Critical Metals PLC Enters into Offtake Agreement (0478P)

October 09 2023 - 1:00AM

UK Regulatory

TIDMCRTM

RNS Number : 0478P

Critical Metals PLC

09 October 2023

Critical Metals plc / EPIC: CRTM / Market: Main Market

9 October 2023

Critical Metals plc

("Critical Metals" or the "Company")

Enters into Offtake Agreement with OM Metal & Resources

S.A.R.L.

Critical Metals plc ( or the "Seller"), a mining investment

company established to acquire mining opportunities in the critical

and strategic metals sector, is pleased to announce that it has

entered into an offtake agreement (the "Agreement") with OM Metal

& Resources S.A.R.L ("OM Metal" or the "Buyer") for the sale of

a minimum of 20,000 tonnes of copper oxide ore from the Company's

flagship Project - the Molulu copper/cobalt project ("Molulu") in

the Democratic Republic of Congo ("DRC").

The Agreement is valid from 4 October 2023 to 31 December 2023

and can be renewed on mutual agreement from both parties. During

the contract, and where possible, Critical Metals will provide the

Buyer with copper ore with an average minimum acid soluble copper

grade of 1.5%.

As a general guidance for the ore sales price, using an LME

copper price of US$8000 and an acid soluble copper grade of 3%, the

gross price received for the sale of copper ore would be US$91.20

per tonne.

The Buyer has already taken delivery of the first load of copper

ore last week and has a fleet of ten trucks, each with the capacity

to transport 40 tonnes of ore.

Russell Fryer, CEO of Critical Metals commented:

"In the last few months, we have experienced significant

interest from seven different buyers of our product. We are

delighted to announce our offtake agreement with OM Metal &

Resources, making Critical Metals the first western and London

Stock Exchange listed company to produce and sell copper ore in the

DRC since Glencore and Ivanhoe. This momentous achievement will

provide us with short term cashflow and allows us to fast track our

progress at Molulu.

"We are sticking to our first phase production target of

producing 10,000 tonnes of oxide ore per month and this partnership

allows for the production at Molulu to be monetised quickly.

Furthermore, with the current diamond drilling programmes that are

underway at the Molulu oxide and sulphide zones, our confidence in

the large potential of Molulu continues to grow."

Analysis, pricing, and payment of copper oxide ore

Weighing, moisture determination, sampling, and analysis shall

be carried out after the delivery of five trucks of ore to OM

Metal's factory. Critical Metals will send a designated

representative to supervise this process to ensure accuracy.

The sales price used will be based on the closing daily LME

copper price on the delivery date of the 5(th) truck. Once the

invoice is sent to the Buyer, the Buyer will make the payment of

all the invoices received for current week, in the following week,

minus a transportation cost.

**ENDS**

For further information on the Company please visit

www.criticalmetals.co.uk or contact:

Critical Metals plc

Russell Fryer, CEO Tel: +44 (0)20 7236 1177

Peterhouse Capital Limited

Corporate Broker

Lucy William / Charles Goodfellow Tel: +44 (0)20 7469 0936 / +44

(0)20 7220 9797

St Brides Partners Ltd

Financial PR

Catherine Leftley /Ana Ribeiro/Isabelle Tel: +44 (0)20 7236 1177

Morris

About Critical Metals

Critical Metals PLC has acquired a controlling 100% stake in

Madini Occidental Limited, which holds an indirect 70% interest in

the Molulu copper/cobalt project, a producing asset in the Katangan

Copperbelt in the Democratic Republic of Congo.

The Company will continue to identify future assets that are in

line with its stated acquisition objective of low CAPEX and OPEX

brown-field projects with near-term production and cash-flow,

whilst concentrating on minerals that have strategic importance to

future economic growth thereby generating significant value for

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGREAPEXEESDFFA

(END) Dow Jones Newswires

October 09, 2023 02:00 ET (06:00 GMT)

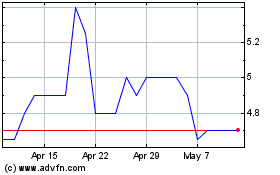

Critical Metals (LSE:CRTM)

Historical Stock Chart

From Apr 2024 to May 2024

Critical Metals (LSE:CRTM)

Historical Stock Chart

From May 2023 to May 2024