TIDMECR

ECR MINERALS plc

("ECR" or the "Company")

ISSUE OF EQUITY

LONDON: 14 SEPTEMBER 2016 - The directors of ECR Minerals plc

(the "Board") announce the issue of 2,415,537,133 new ordinary

shares in the Company of 0.001 pence ("Ordinary Shares") to settle

the following liabilities of the Company.

a) 414,538,378 Ordinary Shares at a price of 0.0069375 pence per

share to satisfy the second tranche of Consideration Shares (as

that term is defined in the Company's announcement dated 3 March

2016), pursuant to the acquisition by the Company's subsidiary

Mercator Gold Australia Pty Ltd of 100% ownership of the Avoca and

Bailieston gold projects in Victoria, Australia.

b) 110,185,512 Ordinary Shares at a price of 0.00635 pence per

share in settlement of unpaid salary and consulting fees due to a

former employee and certain former consultants.

c) 316,010,093 Ordinary Shares at a price of 0.00635 pence per

share in settlement of US$26,663 of fees due to Cosme Maria Beccar

Varela, who provides legal and administrative services in relation

to the Company's activities in Argentina. These fees are for

services provided in 2014, 2015 and 2016.

d) 1,574,803,150 Ordinary Shares at a price of 0.00635 pence per

share in settlement of GBP100,000 in unpaid salary due to Stephen

Clayson, a former director and the former CEO of the Company. This

amount is legally due to Mr Clayson, and arises from unpaid salary

accrued during 2014 and 2015. The amount was included in the

Company's 2015 audited financial statements and has been reported

to HMRC.

Items c) and d) constitute related party transactions under the

AIM Rules for Companies, by virtue of Stephen Clayson having been a

director of ECR within the preceding twelve months, and by virtue

of Cosme Maria Beccar Varela being a director of Ochre Mining SA, a

subsidiary of ECR. The current directors of ECR consider, having

consulted with Cairn Financial Advisers LLP, the Company's

nominated adviser, that the terms of these related party

transactions are fair and reasonable insofar as ECR shareholders

are concerned.

Settlement of the items above will substantially reduce ECR's

outstanding liabilities, and settlement of these items in Ordinary

Shares rather than cash enables the Company to preserve working

capital for other purposes.

Admission of Subscription Shares to AIM

Pursuant to this announcement, application has been made for a

total of 2,415,537,133 Ordinary Shares ("New Ordinary Shares") to

be admitted to trading on AIM ("Admission"), which is expected to

occur on or around 20 September 2016. Following Admission of the

New Ordinary Shares and the Subscription Shares (as such term is

defined in the Company's announcement of 6 September 2016), ECR's

issued ordinary share capital will comprise 25,845,287,953 Ordinary

Shares. This number represents the total voting rights in the

Company and following Admission may be used by shareholders as the

denominator for the calculation by which they can determine if they

are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure and Transparency Rules. The new Ordinary Shares will

rank pari passu in all respects with the Ordinary Shares of the

Company currently traded on AIM.

Following Admission, and the admission to trading on AIM of the

Subscription Shares referred to in the Company's announcement dated

6 September 2016, Stephen Clayson will be beneficially interested

in 1,642,426,928 Ordinary Shares, equating to approximately 6.35%

of the Company's issued Ordinary Share capital.

Market Abuse Regulations (EU) No. 596/2014

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via Regulatory Information Service

("RIS"), this inside information is now considered to be in the

public domain.

ABOUT ECR

ECR is a mineral exploration and development company. ECR's

wholly owned Australian subsidiary Mercator Gold Australia has

acquired 100% ownership of the Avoca and Bailieston gold projects

in Victoria, Australia. ECR has earned a 25% interest in the

Danglay epithermal gold project, an advanced exploration project

located in a prolific gold and copper mining district in the north

of the Philippines. An NI43-101 technical report was completed in

respect of the Danglay project in December 2015, and is available

for download from ECR's website.

ECR's wholly owned subsidiary Ochre Mining has a 100% interest

in the SLM gold project in La Rioja, Argentina. Exploration at SLM

has focused on identifying small tonnage mesothermal gold deposits

which may be suitable for relatively near term production.

FOR FURTHER INFORMATION, PLEASE CONTACT:

ECR Minerals plc Tel: +44 (0)20 7929 1010

William (Bill) Howell, Non-Executive Chairman

Craig Brown, Director & CEO

Richard (Dick) Watts, Non-Executive

Technical Director

Email: info@ecrminerals.com

Website: www.ecrminerals.com

Cairn Financial Advisers LLP Tel: +44 (0)20 7148 7900

Nominated Adviser

Emma Earl / Jo Turner

Optiva Securities Ltd Tel: +44 (0)203 137 1902

Joint Broker

Christian Dennis

Vicarage Capital Ltd Tel: +44 (0)20 3651 2910

Joint Broker

Rupert Williams / Jeremy Woodgate

Blytheweigh Tel: +44 (0)20 7138 3204

Public Relations

Tim Blythe / Camilla Horsfall

FORWARD LOOKING STATEMENTS

This announcement may include forward looking statements. Such

statements may be subject to a number of known and unknown risks,

uncertainties and other factors that could cause actual results or

events to differ materially from current expectations. There can be

no assurance that such statements will prove to be accurate and

therefore actual results and future events could differ materially

from those anticipated in such statements. Accordingly, readers

should not place undue reliance on forward looking statements. Any

forward looking statements contained herein speak only as of the

date hereof (unless stated otherwise) and, except as may be

required by applicable laws or regulations (including the AIM Rules

for Companies), the Company disclaims any obligation to update or

modify such forward looking statements as a result of new

information, future events or for any other reason.

View source version on businesswire.com:

http://www.businesswire.com/news/home/20160914005924/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

September 14, 2016 11:27 ET (15:27 GMT)

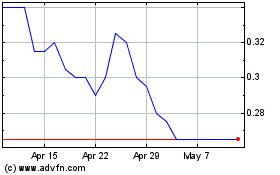

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From Apr 2024 to May 2024

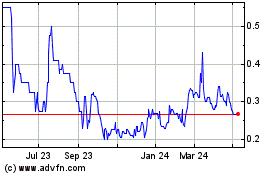

Ecr Minerals (LSE:ECR)

Historical Stock Chart

From May 2023 to May 2024