TIDMEUA

RNS Number : 8308M

Eurasia Mining PLC

19 September 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

REGULATION NO. 596/2014 (AS IT FORMS PART OF RETAINED EU LAW AS

DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT 2018) AND IS IN

ACCORDANCE WITH THE COMPANY'S OBLIGATIONS UNDER ARTICLE 7 OF THAT

REGULATION.

19 September 2023

Eurasia Mining plc

("Eurasia" or the "Company")

Interim Results for the six months ended 30 June 2023

Eurasia, the palladium, platinum, rhodium, iridium and gold

mining company, today reports its unaudited interim results and

operational summary for the six months ended 30 June 2023.

A copy of this announcement is also available on Eurasia's

website at:

https://www.eurasiamining.co.uk/investors/news-announcements

For further information, please contact:

Eurasia Mining Plc

Christian Schaffalitzky/ Keith Byrne

+44 (0)207 932 0418

SP Angel Corporate Finance LLP (Nomad and Broker)

Jeff Keating / David Hignell / Adam Cowl

+44 (0)20 3470 0470

Chairman's Statement

Dear Shareholder

The first six months of 2023 saw the Company focused principally

on our plan to sell our Russian assets.

Proposed sale of Russian assets

We have concentrated on this effort since 2020 and can report

that we continue to make progress. Our focus on BRICS

non-sanctioned counterparties continues, with several parties

currently at various stages of their due diligence. Although, as

stated previously, there is no guarantee of a positive outcome to

this activity, the Board remains focused on achieving a successful

conclusion.

West Kytlim

Site preparation work was completed during the first quarter of

2023, but due to the sale process being Eurasia's main priority, no

metal concentrate has been produced at West Kytlim since the end of

2022.

Our key focus at West Kytlim has been on the sale of 2022

concentrate, which is currently held in inventory, with no

restrictions related to its sale as a precious metals bearing high

grade concentrate. The Board expects the concentrates to be sold at

carrying value and we are currently evaluating offers from three

parties who responded to the tender process.

We have started to receive value-added tax refunds (VAT) against

capital expenditure in previous years, which also contributes to

our cash position (see below), in addition to the proposed

concentrate sale.

Monchetundra

The Definitive Feasibility Study ('DFS') at Monchetundra was

approved by the authorities in late June 2023. This allows Eurasia

to present this development and the resulting improvement in value

to potential purchasers. The Company does not believe it is

appropriate to commence construction immediately, as it is expected

that any counterparties to the proposed asset sale may have their

own plans for the development of Monchetundra and can either

proceed with the EPCF contract signed with Sinosteel, or with a

different contractor.

Financial position

The Company's current cash assets at 30 June 2023 including cash

held in bank accounts (GBP0.4 million) and US treasury notes

(GBP1.54 million) totalled GBP1.94 million. The value of unsold

concentrate within Inventories at 30 June 2023 was approximately

GBP3.5 million. In addition, the Company expects to receive VAT

refunds of circa GBP1.5 million.

The Company's cash reserves are held in USD and GBP accounts

outside of Russia and therefore not directly or indirectly exposed

to Rouble foreign exchange gains or losses against other major hard

currencies.

Sanctions

The Board continues to maintain a regular dialogue with the

Company's legal advisers regarding the potential impact of any US,

UK or EU sanctions on the Company, its operations and assets. The

Company remains satisfied that its current operations are not

prohibited under US, UK or EU sanctions rules. Furthermore, the

Group does not engage and has not engaged with any sanctioned

persons, entities or agencies. The Group continues to closely

monitor all regulatory requirements and changes to the laws, rules

and regulations, taking steps whenever necessary to ensure

compliance with new legislation.

Management changes

Following the retirement of James Nieuwenhuys as CEO, the

Company has established an Operations Committee, led by Christian

Schaffalitzky, which oversees the day-to-day project development

activities of the Company, alongside the proposed sale process on

which the full Board is engaged. Eurasia does not intend to make

any further management appointments at this stage.

Litigation

The previously announced litigation case between the Company and

Queeld Investments Limited and Mispare Limited, and Eurasia remains

ongoing. Further developments regarding this case will be announced

as appropriate. The previously announced case filed by Logik

Developments Ltd was settled in July 2023.

Outlook

We recognise that, in relation to the potential asset sale, it

may be a source of frustration for shareholders that we cannot

report on specific counterparties, the nature of our discussions,

and the ongoing processes in more detail. This reflects the

regulatory regime and the many confidentiality agreements that

govern this activity. However, although there can be no guarantees,

all the Eurasia Board members are engaged in contributing towards a

successful outcome to this process, and we look forward to

providing our shareholders with further updates as appropriate.

We again thank our shareholders for their continued support.

Christian Schaffalitzky

Chairman

Eurasia Mining PLC

Condensed consolidated statement

of comprehensive income

for the six months ended 30 June

2023

Note 6 months 12 months 6 months

to to to

30 June 31 December 30 June

2023 2022 2022

(unaudited) (audited) (unaudited)

GBP GBP GBP

Sales 4 - 119,525 101,836

Cost of sales - (30,173) (36,197)

------------------------------------------- ----- ------------- ------------- -------------

Gross profit - 89,352 65,639

Administrative costs (1,298,464) (4,618,351) (1,257,924)

Investment income 53,184 61,325 10,070

Finance costs (44,789) (107,697) (49,717)

Other gains 5 272,549 187,592 6,108,902

Other losses 5 (6,361,898) (2,842,309) (1,024,892)

(Loss)/profit before tax (7,379,418) (7,230,088) 3,852,078

------------------------------------------- -----

Income tax expense - - -

------------------------------------------- ----- ------------- ------------- -------------

(Loss)/profit for the period (7,379,418) (7,230,088) 3,852,078

Other comprehensive (loss)/income:

Items that will not be reclassified

subsequently to

profit and loss:

NCI share of foreign exchange differences

on translation of foreign operations 682,020 (61,656) 405,694

Items that will be reclassified

subsequently to

profit and loss:

Parents share of foreign exchange

differences on translation

of foreign operations 1,738,236 (341,762) 945,695

Other comprehensive income/(loss)

for the period, net of tax 2,420,256 (403,418) 1,351,389

------------------------------------------- ----- ------------- ------------- -------------

Total comprehensive (loss)/income

for the period (4,959,162) (7,633,506) 5,203,467

=========================================== ===== ============= ============= =============

(Loss)/profit for the period attributable

to:

Equity holders of the parent (5,638,150) (5,840,245) 2,556,416

Non-controlling interest (1,741,268) (1,389,843) 1,295,662

(7,379,418) (7,230,088) 3,852,078

------------------------------------------- ----- ------------- ------------- -------------

Total comprehensive (loss)/income

for the period attributable to:

Equity holders of the parent (3,899,914) (6,182,007) 3,502,111

Non-controlling interest (1,059,248) (1,451,499) 1,701,356

(4,959,162) (7,633,506) 5,203,467

------------------------------------------- ----- ------------- ------------- -------------

Basic and diluted (loss)/profit

(pence per share) (0.20) (0.21) 0.09

Condensed consolidated statement

of financial position

As at 30 June 2023

Note At 30 At 31 December At 30 June

June

2023 2022 2022

(unaudited) (audited) (unaudited)

GBP GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 6 8,470,553 9,600,231 12,634,691

Assets in the course of construction 538,537 696,026 1,329,132

Intangible assets 7 2,748,361 2,859,368 3,146,073

Investment in financial assets 1,592,143 3,807,925

Investments in joint ventures - - 584,591

Total non-current assets 13,349,594 16,963,550 17,694,487

--------------------------------------- ----- -------------- --------------- --------------

Current assets

Inventories 3,687,482 4,182,382 2,135,082

Trade and other receivables 8 2,684,475 3,171,669 4,124,692

Other financial assets 89,485 - -

Current tax assets 5,967 6,050 10,371

Cash and bank balances 405,875 1,009,908 13,559,308

Total current assets 6,873,284 8,370,009 19,829,453

--------------------------------------- ----- -------------- --------------- --------------

Total assets 20,222,878 25,333,559 37,523,940

======================================= ===== ============== =============== ==============

EQUITY

Capital and reserves

Issued capital 9 61,208,111 61,187,111 61,187,111

Reserves 10 5,330,971 3,580,929 4,868,386

Accumulated losses (44,604,733) (38,954,777) (30,558,116)

--------------------------------------- ----- -------------- --------------- --------------

Equity attributable to equity holders

of the parent 21,934,349 25,813,263 35,497,381

Non-controlling interest (4,460,796) (3,401,548) (248,693)

--------------------------------------- ----- -------------- --------------- --------------

Total equity 17,473,553 22,411,715 35,248,688

--------------------------------------- ----- -------------- --------------- --------------

LIABILITIES

Non-current liabilities

Lease liabilities 11 147,592 181,198 431,973

Provisions 13 173,645 254,218 470,029

Total non-current liabilities 321,237 435,416 902,002

--------------------------------------- ----- -------------- --------------- --------------

Current liabilities

Borrowings - - 50,833

Lease liabilities 11 98,256 167,071 211,397

Trade and other payables 12 2,265,361 2,230,879 1,111,020

Provisions 13 64,471 88,478 -

Total current liabilities 2,428,088 2,486,428 1,373,250

--------------------------------------- ----- -------------- --------------- --------------

Total liabilities 2,749,325 2,921,844 2,275,252

--------------------------------------- ----- -------------- --------------- --------------

Total equity and liabilities 20,222,878 25,333,559 37,523,940

======================================= ===== ============== =============== ==============

Condensed statement of changes in

equity

For the six months ended 30 June

2022

Attributable to owners of the parent

---------------------------------------------------------------------------------

Foreign Total

currency attributable

Share Share Deferred Other translation Accumulated to owners Non-controlling Total

Note capital premium shares reserves reserve losses of parent interest equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January

2022 2,853,560 51,308,068 7,025,483 3,924,026 (1,335) (33,114,532) 31,995,270 (1,950,049) 30,045,221

Transaction

with owners - - - - - - - - -

--------------- ------ ----------- ------------ ----------- ----------- ------------ -------------- ------------- ---------------- ------------

Loss for the period - - - - - 2,556,416 2,556,416 1,295,662 3,852,078

Other

comprehensive

loss

Exchange differences

on translation

of foreign operations - - - - 945,695 - 945,695 405,694 1,351,389

Total comprehensive

income - - - - 945,695 2,556,416 3,502,111 1,701,356 5,203,467

Balance at 30 June

2022 2,853,560 51,308,068 7,025,483 3,924,026 944,360 (30,558,116) 35,497,381 (248,693) 35,248,688

======================= =========== ============ =========== =========== ============ ============== ============= ================ ============

Condensed

statement of

changes

in equity

For the six

months ended

30 June 2023

Attributable to owners of the parent

---------------------------------------------------------------------------------

Foreign Total

currency attributable

Share Share Deferred Other translation Accumulated to owners Non-controlling Total

Note capital premium shares reserves reserve losses of parent interest equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January

2023 2,853,560 51,308,068 7,025,483 3,924,026 (343,097) (38,954,777) 25,813,263 (3,401,548) 22,411,715

Issue of shares under

employee

share option plan 5,000 16,000 11,806 (11,806) - - 21,000

Transaction with

owners 5,000 16,000 - 11,806 - (11,806) - - 21,000

----------------------- ----------- ------------ ----------- ----------- ------------ -------------- ------------- ---------------- -------------

Loss for the period - - - - - (5,638,150) (5,638,150) (1,741,268) (7,379,418)

Other

comprehensive

loss

Exchange differences

on translation

of foreign operations - - - - 1,738,236 - 1,738,236 682,020 2,420,256

Total comprehensive

income - - - - 1,738,236 (5,638,150) (3,899,914) (1,059,248) (4,959,162)

----------- ------------ ----------- ----------- ------------ -------------- ------------- ---------------- -------------

Balance at 30 June

2023 2,858,560 51,324,068 7,025,483 3,935,832 1,395,139 (44,604,733) 21,913,349 (4,460,796) 17,473,553

======================= =========== ============ =========== =========== ============ ============== ============= ================ =============

Condensed consolidated statement

of cash flows

for the six months ended 30 June

2021

6 months 12 months 6 months

to to to

30 June 31 December 30 June

2023 2022 2022

(unaudited) (audited) (unaudited)

GBP GBP GBP

Cash flows from operating activities

(Loss)/profit for the period (7,379,418) (7,230,088) 3,852,078

Adjustments for:

Depreciation and amortisation of

non-current assets 497,628 1,006,210 1,194,452

- Asset value write off to cost

of sales 2,365,988

Gain/(loss) on sale or disposal

of property, plant and equipment - (4,952) (4,219)

Finance costs recognised in profit

or loss 47,548 107,697 49,717

Investment revenue recognised in

profit or loss (53,184) (61,325) (10,070)

(Gain)/loss on disposal of investments 18,362 814,158 -

(Loss reversal)/loss recognised

on valuation of inventory (272,549) 2,028,151 1,024,892

Rehabilitation cost recognised in

profit or loss (57,548) 99,725 90,096

Net foreign exchange loss/(profit) 6,343,536 (182,640) (6,104,683)

(855,625) (1,057,076) 92,263

Movements in working capital

Increase in inventories (75,390) (6,166,681) (3,098,450)

Increase in trade and other receivables (71,805) (1,300,887) (1,614,762)

Increase in trade and other payables 392,291 1,716,777 508,844

Cash used in operations (610,529) (6,807,867) (4,112,105)

Net cash used in operating activities (610,529) (6,807,867) (4,112,105)

-------------------------------------------- ------------- -------------- --------------

Cash flows from investing activities

Payments for investment securities - (7,030,548) -

Proceeds from sale of investment

securities 2,284,775 2,835,299 -

Interest received - 11,943 10,070

loan provided to non-related party (143,071) - -

Investment to acquire interest in

joint venture - (354,769) -

Payments for property, plant and

equipment (1,210,627) (7,190,406) (6,221,805)

Payments for other intangible assets (475,540) (1,239,085) (910,258)

Proceeds from disposal of property,

plant and equipment - 4,952 4,219

Net cash generated by/(used in)

investing activities 455,537 (12,962,614) (7,117,774)

-------------------------------------------- ------------- -------------- --------------

Cash flows from financing activities

Repayment of borrowings - (36,232) -

Proceeds from issues of equity shares 21,000 - -

Repayment of lease liability (41,167) (141,528) (24,757)

Interest paid (33,681) (90,446) (41,449)

Net cash used in financing activities (53,848) (268,206) (66,206)

-------------------------------------------- ------------- -------------- --------------

Net decrease in cash and cash equivalents (208,840) (20,038,687) (11,296,085)

Effects of exchange rate changes

on the balance of

cash held in foreign currencies (395,193) (960,912) 2,845,886

Cash and cash equivalents at the

beginning of period 1,009,908 22,009,507 22,009,507

Cash and cash equivalents at the

end of the period 405,875 1,009,908 13,559,308

============================================ ============= ============== ==============

Selected notes to the condensed

consolidated financial statements

for the six months ended 30 June

2023

1. General information

Eurasia Mining plc (the "Company") is a public limited company incorporated

and domiciled in Great Britain with its registered office at International

House, 42 Cromwell Road, London SW7 4EF, United Kingdom and principal

place of business at Clubhouse Bank, 1 Angel Court, EC2R 7HJ. The

Company's shares are listed on AIM, a market of the London Stock

Exchange. The principal activities of the Company and its subsidiaries

(the "Group") are related to the exploration for and development

of platinum group metals, gold and other minerals in Russia.

The financial information set out in these condensed interim consolidated

financial statements (the "Interim Financial Statements") do not

constitute statutory accounts as defined in Section 435 of the Companies

Act 2006. The Group's statutory financial statements for the year

ended 31 December 2022, prepared under International Financial Reporting

Standards (the "IFRS"), have been filed with the Registrar of Companies.

The auditor's report on those financial statements was unqualified.

The report did not contain a statement under Section 498(2) of the

Companies Act 2006.

2. Basis of preparation

The Group prepares consolidated financial statements in accordance

with International Accounting Standards in conformity with the requirements

of the Companies Act 2006. These condensed consolidated interim

financial statements for the period ended 30 June 2023 have been

prepared by applying the recognition and measurement provisions

of IFRS and the accounting policies adopted in the audited accounts

for the year ended 31 December 2022.

These Interim Financial Statements have been prepared under the

historical cost convention.

The accounting policies have been applied consistently throughout

the Group for the purposes of preparation of these condensed consolidated

interim financial statements.

The Interim Financial Statements are presented in Pounds Sterling

(GBP), which is also the functional currency of the parent company.

3. Accounting policies

The Interim Financial Statements have been prepared in accordance

with the accounting policies adopted in the Group's last annual

financial statements for the year ended 31 December 2022.

4. Revenue

6 months 12 months 6 months

to to to

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Sale of platinum and other metals - 61,075 -

Other revenue - 58,450 101,836

- 119,525 101,836

=================================== ========= ============ =========

5. Other gains and losses

6 months 12 months 6 months

to to to

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Gains

Gain on disposal of property, plant

and equipment - 4,952 4,219

Reversal of loss on revaluation

of stock to net realisable value 272,549 - -

Net foreign exchange gain - 182,640 6,104,683

272,549 187,592 6,108,902

Losses

Impairment of investments (18,362) (814,158) -

Loss on revaluation of stock to

net realisable value - (2,028,151) (1,024,892)

Net foreign exchange loss (6,343,536) - -

(6,361,898) (2,842,309) (1,024,892)

(6,089,349) (2,654,717) 5,084,010

===================================== ============= ============= =============

The majority of the foreign exchange gains and losses are a

result of the revaluation of monetary assets and liabilities in the

subsidiary accounts as a result of movements in the Rouble exchange

rates.

In 2022 the Group took a decision to postpone the sale of

platinum and other metals due to a strong Ruble and low platinum

price. Stock available at 30 June 2023 represents platinum

concentrate ready for refining, which was valued (i) using

methodology set in the refining and sale and purchase agreement

made with local refinery in 2021 and (ii) exchange rate and metal

prices at 30 June 2023.

6. Property, plant and equipment

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Net book value at the beginning

of period 9,600,231 5,061,743 5,061,743

Additions 1,137,353 2,443,927 5,911,509

Transferred from assets under construction 90,499 4,776,644 -

Written off to inventory - (2,365,988) (2,365,988)

Depreciation (497,628) (1,006,210) (1,194,452)

Exchange differences (1,859,902) 690,115 2,855,891

Net book value at the end of period 8,470,553 9,600,231 12,634,691

============================================= ============= ============= =============

7. Intangible assets

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Net book value at the beginning

of period 2,859,368 1,389,029 1,389,029

Additions 475,540 1,239,085 910,258

Exchange differences (586,547) 231,254 846,786

Net book value at the end of period 2,748,361 2,859,368 3,146,073

============================================= ============= ============= =============

Intangible assets represent capitalised costs associated with

Group's exploration, evaluation and development of mineral

resources.

8. Trade and other receivables

30 June 31 December 30 June

2023 2022 2022

Trade receivables - - 78,520

Advances made 677,536 822,280 1,759,183

Prepayments 26,929 135,447 36,681

VAT recoverable 1,496,281 1,942,410 2,123,355

Other receivables 483,729 271,532 126,953

2,684,475 3,171,669 4,124,692

================================ =========== ============ ===========

The fair value of trade and other receivables is not materially

different to the carrying values presented. None of the receivables

are provided as security or past due.

9. Share capital

30 June 31 December 30 June

2023 2022 2022

Issued ordinary shares with a nominal

value of 0.1p:

Number 2,858,559,995 2,853,559,995 2,853,559,995

Nominal value (GBP) 2,853,560 2,853,560 2,853,560

Fully paid ordinary shares carry

one vote per share and carry the

right to dividends.

Issued deferred shares with a nominal

value of 4.9 p:

Number 143,377,203 143,377,203 143,377,203

Nominal value (GBP) 7,025,483 7,025,483 7,025,483

Deferred shares have the following rights and restrictions

attached to them:

- they do not entitle the holders to receive any dividends and

distributions;

- they do not entitle the holders to receive notice or to attend

or vote at General Meetings of the Company; and

- on return of capital on a winding up the holders of the

deferred shares are only entitled to receive the amount paid up on

such shares after the holders of the ordinary shares have received

the sum of 0.1p for each ordinary share held by them and do not

have any other right to participate in the assets of the

Company.

There had been no change in the issued share capital during the

reporting period.

Ordinary shares Number of Share Share

shares capital premium

GBP GBP

Balance at 1 January 2023 2,853,559,995 2,853,560 51,308,068

Exercise of warrants and options 5,000,000 5,000 16,000

Balance at 30 June 2023 2,858,559,995 2,858,560 51,324,068

==================================== =============== =========== ============

Deferred shares Number of Deferred

deferred share

shares capital

GBP

Balance at 1 January and 30 June

2021 143,377,203 7,025,483

==================================== =============== =========== ============

10. Reserves

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Capital redemption reserve 3,539,906 3,539,906 3,539,906

Foreign currency translation reserve 1,395,139 (343,097) 944,360

Equity-based payment reserve 395,926 384,120 384,120

5,330,971 3,580,929 4,868,386

====================================== =========== ============ ===========

The capital redemption reserve was created as a result of a share

capital restructuring in earlier years. There is no policy of regular

transactions affecting the capital redemption reserve.

The foreign currency translation reserve represents exchange differences

relating to the translation from the functional currencies of the

Group's foreign subsidiaries into GBP.

The equity-based payments reserve represents a reserve arisen on

(i) the grant of share options to employees under the employee share

option plan and (ii) on issue of warrants under terms of professional

service agreements.

11. Lease liabilities

The Group leases certain of its plant and equipment. The average

lease term is 4.5 years, expiring in 2025. The Group has option

to purchase the equipment for a nominal amount at the maturity of

the finance lease. The Group's obligation under finance leases are

secured by the lessor's title to the leased assets.

Interest rates underlying all obligations under finance leases are

fixed at respective contract dates ranging from 21.9% to 23.5% per

annum.

Minimum lease payments 30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Less than one year 179,418 224,700 315,252

Between one and five years 103,334 202,820 496,817

More than five years - - -

--------------------------------

282,753 427,520 812,069

Less future finance charges (36,905) (79,251) (168,699)

--------------------------------- ---------- ------------ -----------

Present value of minimum lease

payments 245,848 348,269 643,370

================================= ========== ============ ===========

Present value of minimum lease 30 June 31 December 30 June

payments

2023 2022 2022

GBP GBP GBP

Less than one year 147,592 167,071 211,397

Between one and five years 98,256 181,198 431,973

More than five years - - -

Present value of minimum lease

payments 245,848 348,269 643,370

================================= ========== ============ ===========

12. Trade and other payables

30 June 31 December 30 June

2023 2022 2022

Trade payables 802,525 270,214 615,115

Accruals 1,326,107 1,825,269 56,826

Social security and other taxes 45,523 46,460 167,392

Other payables 91,206 88,936 271,687

2,265,361 2,230,879 1,111,020

================================== =========== ============ ==========

The fair value of trade and other payables is not materially

different to the carrying values presented. The above listed

payables were all unsecured.

13. Provision

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Long term provision:

Environment rehabilitation 470,029 254,218 470,029

------------------------------------------ ----------- ------------ -----------

Short term provision:

Environment rehabilitation - 88,478 -

----------------------------------------- ----------- ------------ -----------

470,029 342,696 470,029

========================================= =========== ============ ===========

Six month 12 month Six month

Movement in provision to to to

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

At 1 January 342,696 200,762 200,762

Recognised in the period - 54,612 79,541

Utilised in the period - - -

Reduction resulting from re-measurement

or settlement without cost (57,548) 45,446 10,555

Unwinding of discount and effect

of changes in the discount rate 13,867 17,251 8,268

Exchange difference (60,899) 24,625 170,903

At the end of the period 238,116 342,696 470,029

========================================== =========== ============ ===========

Provision is made for the cost of restoration and environmental

rehabilitation of the land disturbed by the West Kytlim mining

operations, based on the estimated future costs using information

available at the reporting date.

The provision is discounted using a risk-free discount rate of

from 6.6% to 6.88% (2020: 3.87% to 5.08%) depending on the

commitment terms, attributed to the Russian Federal Bonds.

Provision is estimated based on the sub-areas within general

West Kytlim mining licence the company has carried down its

operations on by the end of the reporting period. Timing is

stipulated by the forestry permits issued at the pre-mining stage

for each of sub-areas. Actual costs in respect of the long-term

provision recognised by 30 June 2023 will be incurred within

2023-2025.

14. Commitments

At the time of the award of the Monchetundra mining license a royalty

payment was calculated by the Russian Federal Reserves Commission.

20% of this payment was paid in December of 2018 and the remaining

80%, or Rub16.68 mln (approximately GBP150,000) to be paid by November

2023.

During 2020 the Group entered into several lease agreements to lease

mining plant and equipment. As at 30 June 2023 the average lease

term was 2 years and present value of minimum lease payments GBP245,848

(2022: GBP643,370).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDCDSBDGXI

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

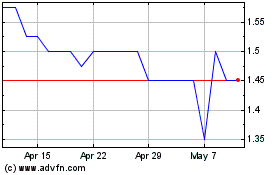

Eurasia Mining (LSE:EUA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Eurasia Mining (LSE:EUA)

Historical Stock Chart

From Jan 2024 to Jan 2025