SimplyBiz Group PLC (The) Pre-Close Trading Statement (8407M)

January 26 2021 - 1:00AM

UK Regulatory

TIDMSBIZ

RNS Number : 8407M

SimplyBiz Group PLC (The)

26 January 2021

26 January 2021

The SimplyBiz Group plc

("SimplyBiz" or the " Group ")

Pre-close trading statement for year ended 31(st) December 2020

and notice of full year results

Resilient Trading, Resilient Results

SimplyBiz (AIM: SBIZ), a leading independent provider of Fintech

and Support Services to financial advisers and financial

institutions in the UK, today issues a pre-close trading update for

the twelve months ended 31(st) December 2020.

Highlights

-- Resilient revenues - GBP61m (2019: GBP63m)

-- Strong adjusted EBITDA margin* - 28.3% (2019: 28.3%)

-- Robust cash flow conversion** - expected to exceed 65% (2019: 46%)

-- Net debt reduced - to GBP19.5m (31 December 2019: GBP27.0m)

-- Net debt to adjusted EBITDA ratio - comfortable at 1.1x (2019: 1.5x)

-- Adjusted EPS - marginally above 11.0 pence per share***

Dividend

The Board intends to recommend a final dividend of no less than

2p per share.

Outlook

The Board remains confident of the resilient ongoing

profitability, growth prospects and strong cash generation of its

core business.

Notice of Full Year Results

The Group intends to publish its Full Year Results statement on

16(th) March 2021.

Matt Timmins, Joint CEO of The SimplyBiz Group plc, said:

"We are delighted to have delivered a resilient trading

performance in a challenging year, demonstrating the robust nature

of our core revenues and an ongoing improvement in the quality of

our underlying earnings, offsetting an expected reduction of

valuation income in the period.

"Throughout 2020 we have continued to accelerate our digital

strategy, grown our core customer base, and delivered exciting new

services which will further improve our quality of earnings,

margins and cash generation in the future."

"We are confident that the Group is in a strong position and is

moving forward with agility and pace."

* Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share option charges and operating

exceptional costs.

** Free cash flow conversion is calculated as adjusted EBITDA,

less working capital movements, lease payments, CAPEX, development

expenditure, corporation tax paid and interest, as a percentage of

Adjusted EBITDA.

*** EPS guidance provided on 23(rd) July 2020.

For further information please contact:

The SimplyBiz Group plc via Instinctif Partners

Matt Timmins (Joint Chief Executive Officer)

Neil Stevens (Joint Chief Executive Officer)

Zeus Capital (Nominated Adviser and Joint Broker) +44 (0) 20

3829 5000

Martin Green

Dan Bate

Pippa Hamnett

Liberum (Joint Broker) +44 (0) 20 3100 2222

Cameron Duncan

James Greenwood

Ed Phillips

Instinctif Partners (Financial PR) +44 (0)79 6778 9383

Mark Walter SimplyBiz@instinctif.com

Lewis Hill

Notes to Editors

The SimplyBiz Group provides essential support services, software

and data that enable professional financial advisers, financial

intermediaries and product providers to deliver better outcomes

for their customers. The SimplyBiz Group supports over 3,000

intermediary firms with regulatory and business support in addition

to 1,900 customer firms of its fintech platform, while providing

essential distribution support to over 400 financial institutions.

The Company's understanding of the changing regulatory landscape

and deep insights into the needs of customers, advisers and

product providers enables it to add unique value to the retail

financial services sector. For more information, please visit:

www.simplybizgroup.co.uk/ .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDXGDBSXDDGBU

(END) Dow Jones Newswires

January 26, 2021 02:00 ET (07:00 GMT)

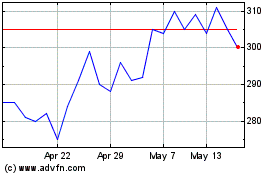

Fintel (LSE:FNTL)

Historical Stock Chart

From Apr 2024 to May 2024

Fintel (LSE:FNTL)

Historical Stock Chart

From May 2023 to May 2024