TIDMLTHM

RNS Number : 1274V

Latham(James) PLC

30 November 2023

James Latham plc

("James Latham" or the "Company")

HALF YEARLY RESULTS FOR THE PERIODED 30 SEPTEMBER 2023

Chairman's statement

Unaudited results for the six months trading to 30 September

2023

Revenue for the six months ended 30 September 2023 was

GBP190.9m, down 10.3% on GBP212.8m for the same period last year.

Cost prices on both timber and panels have slowly fallen throughout

the first half of the year but they are now relatively stable and

there are currently few signs of price weakness. Sales volumes have

also remained at similar levels to the same period last year. We

have seen a change in the product mix of our sales, with some of

our customers moving to cheaper alternative products to counter the

effect of high inflation, which is the main reason for the

reduction in revenues.

Gross profit percentage, which includes warehouse costs, for the

six month period ended 30 September 2023 was 16.8% compared with

19.4% in the comparative six months. Increased competition in

weaker market conditions has led to the gross profit percentage

dipping slightly below the long term average of 17.5%.

Overheads have been well controlled during the six months, and

despite the stubbornly high inflation rates, the overheads are

slightly lower than the same period last year.

Operating profit was GBP14.5m, down GBP9m compared with GBP23.5m

profit for the same period last year. This reduction was

anticipated as we return to normal trading conditions after the

exceptional results of the last two years. Profit before tax was

GBP16.4m compared with GBP23.7m for the same period last year. The

tax charge of GBP4.0m represents an effective rate of 24.6%, and

reflects the increase in the UK basic rate of corporation tax.

Earnings per ordinary share were 61.5p compared with 95.6 p for the

same period last year.

As at 30 September 2023 net assets are GBP203.8m (2022:

GBP180.5m). Inventory levels of GBP66.1m have reduced from GBP74.6m

at the same period last year as supply chains have stabilised.

Trade and other receivables are also slightly down with bad debts

remaining at a low figure. Cash and cash equivalents have increased

to GBP66.0m (2022: GBP36.9m) and we continue to take advantage of

additional early settlement discount opportunities with our

suppliers as well as generating improved interest receipts.

There is a surplus in the IAS19 valuation of the pension scheme

at 30 September 2023 of GBP11.2m compared with GBP7.2m in the same

period last year. The triennial valuation at 31 March 2023 has been

completed, and is showing a surplus of GBP10.0m and a funding level

of 118%. This strong position has enabled the trustees to derisk

their investments to reduce the volatility of the IAS19 valuation.

In addition the deficit recovery funding payment of GBP3m a year

will cease from 1 December 2023.

Interim dividend

The Board has declared an increased interim dividend of 7.75p

per Ordinary Share (2022: 7.25p). The dividend is payable on 26

January 2024 to ordinary shareholders on the Company's Register at

close of business on 5 January 2024. The ex-dividend date will be 4

January 2024.

Current and future trading

The second half of 2023/24 has started with similar volumes to

the previous six month period to 30 September 2023, with similar

margins. Cost prices of the majority of our products are stable at

the moment, but we are mindful that the market in continental

Europe is quiet at the moment, with European Panel manufacturers

exporting more product to the UK, where the market is currently

more robust. There remain significant cost pressures on all our

manufacturers, so we expect any further price weakness to be

limited.

Our customers still have reasonable order books, but there are

still indications that some contracts are being postponed rather

than cancelled. We are seeing a continued shift in our market

sectors to more lower value products, where we have gained market

share, and we expect this trend to continue as customers look for

more cost effective solutions.

The strength of our customer base and the diverse markets in

which we operate will help us during the more challenging

macroeconomic climate that we are all facing.

The board anticipates that the results for the year ended 31

March 2024 will be in line with market expectations.

Nick Latham

Chairman

30 November 2023

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended.

For further information please visit www.lathamtimber.co.uk or

contact:

James Latham plc Tel: 01442 849 100

Nick Latham, Chairman

David Dunmow, Finance Director

SP Angel Corporate Finance LLP

Matthew Johnson / Charlie Bouverat (Corporate Tel: 0203 470 0470

Finance)

Abigail Wayne (Corporate Broking)

JAMES LATHAM PLC

CONSOLIDATED INCOME STATEMENT

For the six months to 30 September 2023

Six months Six months Year to

to 30 Sept. to 30 Sept. 31 March

2023 unaudited 2022 unaudited 2023 audited

GBP000 GBP000 GBP000

Revenue 190,882 212,797 408,370

Cost of sales (including warehouse costs) (158,832) (171,443) (328,361)

Gross profit 32,050 41,354 80,009

Selling and distribution costs (12,033) (12,147) (24,214)

Administrative expenses (5,558) (5,680) (12,097)

Operating profit 14,459 23,527 43,698

Finance income 2,063 231 1,071

Finance costs (126) (98) (258)

Profit before tax 16,396 23,660 44,511

Tax expense (4,030) (4,606) (8,593)

Profit after tax attributable to owners

of the parent company 12,366 19,054 35,918

Earnings per ordinary share (basic) 61.5p 95.6p 179.5p

Earnings per ordinary share (diluted) 61.4p 95.2p 179.2p

============================================== ================ ================ ==============

All results relate to continuing operations.

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

For the six months to 30 September 2023

Six months Six months Year to

to 30 Sept. to 30 Sept. 31 March

2023 unaudited 2022 unaudited 2023 audited

GBP000 GBP000 GBP000

---------------------------------------------- ---------------- ---------------- --------------

Profit after tax 12,366 19,054 35,918

Other Comprehensive income

Actuarial gains on defined benefit pension

scheme 1,982 3,242 1,407

Deferred tax relating to components of other

comprehensive income (495) (1,080) (632)

Foreign translation (charge)/credit (64) 492 233

---------------------------------------------- ---------------- ---------------- --------------

Other comprehensive income for the period,

net of tax 1,423 2,654 1,008

---------------------------------------------- ---------------- ---------------- --------------

Total comprehensive income, attributable

to owners of the parent company 13,789 21,708 36,926

============================================== ================ ================ ==============

JAMES LATHAM PLC

CONSOLIDATED BALANCE SHEET

At 30 September 2023

As at As at 30 As at 31

30 Sept. Sept. 2022 March 2023

2023 unaudited unaudited audited

GBP000 GBP000 GBP000

ASSETS

Non-current assets

Goodwill 1,181 1,363 1,193

Intangible assets 1,236 1,403 1,319

Property, plant and equipment 37,841 37,278 37,440

Right-of-use-asset 5,438 3,995 5,817

Retirement benefit surplus 11,212 7,318 7,221

Deferred tax asset 53 134 -

Total non-current assets 56,961 51,491 52,990

Current assets

Inventories 66,052 74,588 67,489

Trade and other receivables 64,220 69,380 66,782

Cash and cash equivalents 65,958 36,939 62,609

Tax receivable 13 - 490

Total current assets 196,243 180,907 197,370

Total assets 253,204 232,398 250,360

------------------------------------------- ---------------- ------------ ------------

Current liabilities

Lease liabilities 879 1,429 879

Trade and other payables 35,013 40,471 41,066

Current tax payable - 268 -

------------------------------------------- ---------------- ------------ ------------

Total current liabilities 35,892 42,168 41,945

Non-current liabilities

Interest bearing loans and borrowings 587 592 592

Lease liabilities 4,806 2,753 5,130

Deferred tax liabilities 8,124 6,369 7,118

------------------------------------------- ---------------- ------------ ------------

Total non-current liabilities 13,517 9,714 12,840

Total liabilities 49,409 51,882 54,785

Net assets 203,795 180,516 195,575

=========================================== ================ ============ ============

Capital and reserves

Issued capital 5,040 5,040 5,040

Share-based payment reserve 152 438 124

Own shares - (708) -

Capital reserve 398 398 398

Retained earnings 198,205 175,348 190,013

------------------------------------------- ---------------- ------------ ------------

Total equity attributable to shareholders

of the parent company 203,795 180,516 195,575

=========================================== ================ ============ ============

JAMES LATHAM PLC

CONSOLIDATED CASH FLOW STATEMENT

For the six months to 30 September 2023

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2023 unaudited 2022 unaudited 2023 audited

GBP000 GBP000 GBP000

-------------------------------------------------- ---------------- ---------------- --------------

Net cash flow from operating activities

Cash generated from operations 13,197 11,744 43,864

Interest paid (25) (26) (53)

Income tax paid (3,094) (4,043) (7,498)

Net cash inflow from operating activities 10,078 7,675 36,313

-------------------------------------------------- ---------------- ---------------- --------------

Cash flows from investing activities

Interest received and similar income 1,697 127 822

Purchase of property, plant and equipment (2,233) (1,782) (3,304)

Proceeds from sale of property, plant and

equipment 27 56 72

Net cash outflow from investing activities (509) (1,599) (2,410)

-------------------------------------------------- ---------------- ---------------- --------------

Cash flows before financing activities

Lease liability payments (425) (787) (1,499)

Equity dividends paid (5,789) (5,380) (6,825)

Purchase of own shares (6) - -

Cash outflow from financing activities (6,220) (6,167) (8,324)

-------------------------------------------------- ---------------- ---------------- --------------

Increase/(decrease) in cash and cash equivalents

for the period 3,349 (91) 25,579

==================================================

Cash and cash equivalents at beginning

of the period 62,609 37,030 37,030

Cash and cash equivalents at end of the

period 65,958 36,939 62,609

================================================== ================ ================ ==============

JAMES LATHAM PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to owners of the

parent company

Share-based

Issued payment Own Capital Retained Total

capital reserve shares reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

As at 1 April 2022 (audited) 5,040 387 (873) 398 159,019 163,971

Profit for the period - - - - 19,054 19,054

Other comprehensive income:

Actuarial gain on defined

benefit

pension scheme - - - - 3,242 3,242

Deferred tax relating to

components

of other comprehensive income - - - - (1,080) (1,080)

Foreign translation credit - - - - 492 492

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total comprehensive income for

the period - - - - 21,708 21,708

Transaction with owners:

Dividends - - - - (5,379) (5,379)

Deferred tax on share options - (37) - - - (37)

Change in investment in ESOP

shares - - 165 - - 165

Share-based payment expense - 88 - - - 88

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - 51 165 - (5,379) (5,163)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 30 September 2022

(unaudited) 5,040 438 (708) 398 175,348 180,516

Profit for the period - - - - 16,864 16,864

Other comprehensive income:

Actuarial loss on defined

benefit

pension scheme - - - - (1,835) (1,835)

Deferred tax relating to

components

of other comprehensive income - - - - 448 448

Foreign translation charge - - - - (259) (259)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total comprehensive income for

the period - - - - 15,218 15,218

Transactions with owners:

Dividends - - - - (1,446) (1,446)

Exercise of options - (386) 1,397 - 369 1,380

Deferred tax on share options - (22) - - - (22)

Transfer to retained earnings - - (524) - 524 -

Change in investment in ESOP

shares - - (165) - - (165)

Share-based payment expense - 94 - - - 94

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - (314) 708 - (553) (159)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 31 March 2023

(audited) 5,040 124 - 398 190,013 195,575

Profit for the period - - - - 12,366 12,366

Other comprehensive income:

Actuarial gain on defined

benefit

pension scheme - - - - 1,982 1,982

Deferred tax relating to

components

of other comprehensive income - - - - (495) (495)

Foreign translation charge - - - - (64) (64)

Total comprehensive income for

the period - - - - 13,789 13,789

Transactions with owners:

Dividends - - - - (5,789) (5,789)

Exercise of options - (8) - - 8 -

Deferred tax on share options - (1) - - - (1)

Change in investment in ESOP

shares - - - 184 184

Share-based payment expense - 37 - - - 37

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Total transactions with owners - 28 - - (5,597) (5,569)

--------------------------------- ------------ ---------------- ----------- ----------- ------------- ----------

Balance at 30 September 2023

(unaudited) 5,040 152 - 398 198,205 203,795

================================= ============ ================ =========== =========== ============= ==========

JAMES LATHAM PLC

NOTES TO THE HALF YEARLY REPORT

1. The results presented in this report are unaudited and they have

been prepared in accordance with the recognition and measurement principles

of International Accounting Standards in conformity with the requirements

of the Companies Act 2006 and on the basis of the accounting policies

expected to be used in the financial statements for the year ending

31 March 2024. The half yearly report does not include all the disclosures

that would be required for full compliance with IFRS. The figures

for the year ended 31 March 2023 are extracted from the statutory

accounts of the group for that period.

2. The directors propose an interim dividend of 7.75p per ordinary

share which will absorb GBP1,560,000 (2022: 7.25p absorbing GBP1,445,000),

payable on 26 January 2024 to shareholders on the Company's Register

at the close of business on 5 January 2024. The ex-dividend date is

4 January 2024.

3. This half yearly report does not constitute statutory financial

accounts within the meaning of section 434 of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2023 were filed

with the Registrar of Companies. The audit report on those financial

statements was not qualified and did not contain a reference to any

matters to which the auditor drew attention by way of emphasis without

qualifying the report and did not contain a statement under section

498 (2) or (3) of the Companies Act 2006. The half yearly report has

not been audited by the Company's auditor.

4. Earnings per ordinary share is calculated by dividing the net profit

for the period attributable to ordinary shareholders by the weighted

average number of ordinary shares outstanding during the period.

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2023 unaudited 2022 unaudited 2023 audited

GBP000 GBP000 GBP000

Net profit attributable to ordinary shareholders 12,366 19,054 35,918

Number '000 Number '000 Number

'000

Weighted average share capital 20,123 19,926 20,009

Add: diluted effect of share capital options

issued 24 95 31

Weighted average share capital for diluted

earnings per ordinary share calculation 20,147 20,021 20,040

---------------- ---------------- --------------

5. Net cash flow from operating activities

Six months Six months Year to

to 30 Sept to 30 Sept 31 March

2023 unaudited 2022 unaudited 2023 audited

GBP000 GBP000 GBP000

Profit before tax 16,396 23,660 44,511

Adjustment for finance income and expenditure (1,937) (133) (813)

Depreciation and amortisation 2,272 2,091 4,173

Impairment - - 179

Loss/(profit) on disposal of property,

plant and equipment 7 (51) (46)

Decrease/(increase) in inventories 1,437 (358) 6,741

Decrease/(increase) in receivables 2,562 (1,048) 1,550

Decrease in payables (5,934) (9,652) (8,167)

Retirement benefits non cash amounts (1,643) (2,853) (4,446)

Share-based payments non cash amounts 37 88 182

Cash generated from operations 13,197 11,744 43,864

---------------- ---------------- --------------

6. Copies of this statement will be posted on our website, www.lathamtimber.co.uk/investors

A copy can be emailed or posted upon application to the Company Secretary,

James Latham plc, Unit C2, Breakspear Park, Breakspear Way, Hempstead,

Herts, HP2 4TZ, or by email to plc@lathams.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEIFWUEDSEIF

(END) Dow Jones Newswires

November 30, 2023 02:00 ET (07:00 GMT)

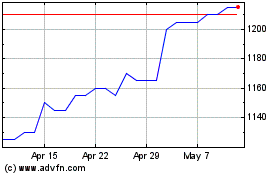

Latham (james) (LSE:LTHM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Latham (james) (LSE:LTHM)

Historical Stock Chart

From Feb 2024 to Feb 2025