TIDMNAH

RNS Number : 5962N

NAHL Group PLC

26 September 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310. With the publication of

this announcement, this information is now considered to be in the

public domain.

26 September 2023

NAHL Group plc

("NAHL", the "Company" or the "Group")

Interim Results

Continued reduction in net debt and trading in line with

expectations

NAHL (AIM: NAH), a leading marketing and services business

focused on the UK consumer legal market, announces its interim

results for the six months ended 30 June 2023 (the "Period").

Financial Highlights

-- In line with expectations, revenue increased to GBP21.0m

(H1 2022: GBP20.7m)

-- Cash received from settled claims in the Group's fully integrated

law firm, National Accident Law ("NAL"), increased by 77%

to GBP2.7m during the Period

-- Operating profit decreased by 19% to GBP1.8m reflecting planned

investment in scaling NAL

-- Profit before tax was broadly breakeven, in line with expectations

(H1 2022: GBP0.1m)

-- Net debt further reduced by GBP1.8m to GBP11.5m from GBP13.3m

at 31 December 2022

Operational Highlights

Consumer Legal Services

-- Demonstrated maturity and momentum in Personal Injury business

and continued execution against our strategy of creating

a higher margin, integrated law firm underpinned by a flexible

business model which will drive higher returns in the medium

and long-term

-- NAL settled 178% more claims (1,738) than H1 2022 and almost

as many as all of 2022, demonstrating the rapid scale-up

of operations within the firm

-- 4,555 new enquiries placed into NAL (H1 2022: 4,531)

-- NAL had a book of 10,611 ongoing claims at 30 June 2023,

7% ahead of 30 June 2022

-- Ongoing claims in NAL expected to convert over coming years

into GBP9.9m of future revenue and future gross profit of

GBP8.6m

-- Recently upgraded the value of NAL's ongoing book of claims

mitigating the stagnation in the personal injury market

-- The Group's market-leading brand, National Accident Helpline,

continued to grow market share in a contracting personal

injury claims market, generating 17,559 new enquiries

-- Independent research in March 2023 revealed that the National

Accident Helpline brand continues to be the "first choice

for people who have had an accident and want legal representation"

Critical Care

-- Critical Care went from strength to strength growing the

number of expert witness reports it issued by 15% and

Initial Needs Assessment ("INA") reports by 5%

-- Strong pipeline of new work within the business with the

number of new instructions generated increasing by 2%

in expert witness services

-- Growing demand in the area of medical negligence with

recent data suggesting that the market is 27% larger than

in 2018/19

-- Bush & Co Care Solutions generated revenues of GBP248k,

a 41% increase on H1 2022

-- Critical Care recruited 40 new associates in key specialisms

and now works with 117 case managers and 146 expert witnesses

across the UK

Outlook

-- The Group continues to trade in line and is on track to meet

full year market expectations

-- In Consumer Legal Services, in July and August:

o The division delivered an encouraging 9% growth in

personal injury enquiry numbers compared to last year

o NAL collected GBP1m of cash from settlements, 67% more

than last year. Year to date collections as at 31 August

2023 was GBP3.7m (2022 full year: GBP3.5m)

-- In Critical Care, in July and August:

o The number of expert witness reports issued was 53%

ahead of last year and the number of instructions was

35% ahead

o The number of INA reports issued was 45% lower than

last year and instructions were 15% lower, albeit the

run-rates returned to normal in August after a slow

July

-- The Group remains committed to managing net debt and anticipates

it reducing further this year

James Saralis, CEO of NAHL, commented:

"We are very pleased with the performance of the Group in the

first half of the year both from a financial and operational

perspective. Trading was in line with our expectations and we made

great strides in both of our divisions. In Consumer Legal Services,

NAL settled 1,738 claims in the Period, an increase of 178% against

last year and generated GBP2.7m in cash, a 77% progression on H1

2022. These numbers clearly illustrate the growing maturity of the

firm and are materially contributing to the significant progress we

have made on reducing our net debt. Further, we are pleased our

market leading brand, National Accident Helpline, continues to grow

market share in a stagnated personal injury market.

Our Critical Care division had its strongest year since the

pandemic, growing revenues 9% to GBP7.3m and operating profit by

39% to GBP2.3m. Pleasingly, alongside the top line growth we have

seen margin expansion within the business from 24.5% in H1 2022 to

31.2% during the Period. We continue to see good results from our

business development initiatives and have significantly grown our

team to support the increased workload.

Based on our performance in H1, and early indications in H2, the

Board believes that it will deliver a full year outturn in line

with market expectations."

For further information:

NAHL Group PLC via FTI Consulting

James Saralis (CEO) Tel: +44 (0) 20 3727 1000

Chris Higham (CFO)

Allenby Capital (AIM Nominated Adviser Tel: +44 (0) 20 3328 5656

& Broker)

Jeremy Porter/Vivek Bhardwaj (Corporate

Finance)

Amrit Nahal/Stefano Aquilino (Sales &

Corporate Broking)

FTI Consulting (Financial PR) Tel: +44 (0) 20 3727 1000

Alex Beagley NAHL@fticonsulting.com

Sam Macpherson

Amy Goldup

Notes to Editors

NAHL Group plc (AIM: NAH) is a leader in the Consumer Legal

Services market. The Group provides services and products to

individuals and businesses in the through its two divisions:

-- Consumer Legal Services provides outsourced marketing

services to law firms through National Accident Helpline and claims

processing services to individuals through National Accident Law,

Law Together and Your Law. In addition, it also provides property

searches through Searches UK.

-- Critical Care provides a range of specialist services in the

catastrophic and serious injury market to both claimants and

defendants through Bush & Co.

More information is available at www.nahlgroupplc.co.uk , www.national-accident-helpline.co.uk , www.national-accident-law.co.uk and www.bushco.co.uk .

Use of alternative performance measures

The commentary in the Interim Management Statement includes

alternative performance measures, which are not defined by

International Financial Reporting Standards. Definitions of these

measures can be found in the Strategic Report section of the 2022

Annual Report. The measures provide additional information for

users on underlying business trends and performance.

Interim Management Statement

I am pleased to report NAHL's Interim Results for the six months

ended 30 June 2023.

Overview

NAHL has continued to make good progress with its strategic

priorities in the first half of the year and its results were in

line with the board of Directors' (the "Board") expectations.

The Group has grown revenues in some challenging markets,

further strengthened its balance sheet and continued to carefully

invest to build a more profitable and sustainable business in the

medium-term. We have seen growing evidence of our stated strategy

paying off. Notable examples include a 178% growth in settlements

in our wholly owned law firm, National Accident Law ("NAL"), and a

39% growth in profits in Critical Care, whilst we have

simultaneously reduced the Group's net debt by GBP1.8m in the

Period.

Looking ahead, the Group started the second half of the year

positively and notwithstanding the difficult macro-economic

environment, we are seeing growing resilience in our businesses.

Accordingly, the Board expects the Group to meet market

expectations for the full year.

Group results

Revenue for the Period was GBP21.0m, which was 1% higher than

the first half of last year (H1 2022: GBP20.7m). Growth primarily

came from the Critical Care division which increased its revenues

by 9%, and whilst revenues in the Consumer Legal Services division

fell slightly, it made good progress in transitioning revenue

generation into our own consumer-focused law firm , NAL, from our

joint venture partnerships. This transitioning of revenue into NAL

will ultimately be more profitable for the Group.

The Group returned an operating profit of GBP1.8m, which was 19%

lower than last year (H1 2022: GBP2.3m). Operating profits in

Critical Care grew by 39%, as the business benefitted from ongoing

investments in people, business development and systems. Within

Consumer Legal Services, operating profit fell by 48% due to a

combination of a change in the mix of personal injury enquiries

generated in the first half, our investment in TV advertising to

enhance the National Accident Helpline brand, and a reduction in

profits from the division's Residential Property businesses. In

this respect, we also disposed of Homeward Legal Limited in the

Period and further details can be found below.

Due to our strategic decision to prioritise enquiry placement

into NAL and our panel, the profit attributable to members'

non-controlling interests in our joint venture LLPs was 30% lower

than last year at GBP1.4m (H1 2022: GBP1.9m).

Borrowing costs on the Group's GBP20.0m revolving credit

facility increased, due to higher UK interest rates. We accrue

interest at a rate of 2.25% over the Sterling Overnight Index

Average (SONIA), and SONIA has been rising in line with the Bank of

England base rate. As a result, and as we anticipated, our

financial expenses grew from GBP0.3m in H1 2022 to GBP0.6m in the

Period.

As planned, profit before tax was broadly breakeven at GBP0.0m

(H1 2022: GBP0.1m) and basic earnings per share on continuing

operations (EPS) were (0.1)p (H1 2022: (0.2)p).

The Group delivered strong growth in cash generation in the

Period, growing free cash flow(2) ("FCF") by 74% from GBP1.0m in H1

2022 to GBP1.8m. Operating cash conversion(3) was very strong at

270% (H1 2022: 152%). Cash generated by our Critical Care division

increased by 94% in the Period as we leveraged the benefits of our

investment in a new finance system and added additional credit

control resource. Consumer Legal Services also increased cash

generation, which included a 77% increase in cash received from

settlements to GBP2.7m (H1 2022: GBP1.5m).

One of the Group's strategic priorities for 2023 was to reduce

net debt whilst balancing investment in both divisions to enable

future growth, and I am pleased to report excellent progress in the

first half. Net debt at 30 June 2023 was GBP11.5m, down 13% from

GBP13.3m at 31 December 2022 and down 20% from GBP14.5m at 30 June

2022.

Consumer Legal Services

In our Consumer Legal Services division, revenue fell by 3% from

GBP14.1m to GBP13.7m in the Period. This was due to a 34% reduction

in revenues from the division's Residential Property businesses,

part of which was disposed of in April 2023. The Personal Injury

business grew its revenues by 4%.

Operating profit for the Period fell by 48% to GBP1.1m (H1 2022:

GBP2.1m). Approximately a quarter of this reduction was due to the

contraction in the Residential Property business, which delivered a

breakeven operating profit in the Period, with the remainder

arising in the Personal Inju ry business.

The division generated GBP3.0m of cash from operations in the

Period (H1 2022: GBP2.7m), and after deduction of drawings paid to

LLP partners both the Personal Injury (GBP0.7m) and Residential

Property (GBP0.2m) businesses were cash generative. Cash conversion

was 274% (H1 2022: 148%), although this measure is before drawings

paid to LLP members.

The personal injury market showed no growth in the Period, and

in fact, external data from the Compensation Recovery Unit ("CRU")

and Official Injury Claim ("OIC") portal shows that the number of

new UK personal injury claims registered in the 12 months to 30

June 2023 fell by 1% compared to 31 December 2022. We continue to

believe that the stagnation we have seen in the market since 2020

is due to three factors. Firstly, there are fewer accidents due to

changes in consumer behaviour that emerged during the COVID-19

pandemic which have now become embedded in working patterns;

secondly, the introduction of the Civil Liability Act 2018, which

reduced compensation levels for customers with low value road

traffic injury claims ("RTAs"); and finally a significant reduction

in victims' appetite to make a claim due to stigma and a lack of

understanding of the process, exacerbated by a reduction in

advertising by law firms since the pandemic.

Our strategy to grow in the personal injury market is to

increase the number of customer enquiries that we attract with our

National Accident Helpline brand and process more of those

enquiries through our own integrated law firm, NAL. By doing this

we will create a higher margin, sustainable business and we can

fund our growth through our agile and scalable placement model.

This is designed to balance the work we place with our panel of

third-party law firms, and joint venture partners for in-year

profit and cash, with the work we process ourselves for greater,

but deferred profit and cash.

In the first half of 2023, we continued to build momentum in

delivering this strategy and made good progress in reducing the

revenues generated in our joint-venture partnerships, in favour of

those generated in NAL, which generate higher returns in the

medium-term.

National Accident Helpline generated 17,559 enquiries in the

Period, which was in line with last year on a like-for-like

basis(1) (H1 2022: 17,630). Within this total, we attracted a

higher mix of RTA enquiries than last year, with RTA making up 25%

of all enquiries, non-RTA 48% and the remaining 27% being

specialist enquiries. Non-RTA comprises employers', public and

occupier liability claims. This mix compares to 22% RTA, 49%

non-RTA and 29% specialist in H1 2022.

In March 2023, independent research revealed that the National

Accident Helpline brand continues to be the "first choice for

people who have had an accident and want legal representation". We

invested GBP0.5m in TV advertising in the first half of the year to

strengthen our brand position, which contributed to a 3% increase

in our overall share of the personal injury market at 30 June 2023,

measured on a trailing 12-month basis. We continue to review the

return on investment generated by our TV advertising and, as part

of our strategic development, we continue to look at new ways of

both engaging with and educating potential customers.

Our website performed well during the Period and the share of

enquiries generated through organic (unpaid) leads grew by 3%

compared to last year.

We placed 4,555 new enquiries into NAL in the Period, which was

slightly more than last year (H1 2022: 4,531), and this cost us

GBP1.4m in marketing spend (H1 2022: GBP1.4m). Many of these

enquiries will not translate into winning claims this year but go

towards building the embedded value of NAL's book of claims, which

will lead to future profits and cash. We estimate that these

enquiries will be worth GBP3.4m in future revenues and cash by the

time they are mature.

Since the Group stopped processing the lowest value RTA claims

(so called "tariff-only" official injury claims (OIC) portal

claims) in February last year, our average revenue on RTA claims is

now significantly higher and not materially different to a typical

non-RTA claim, although RTA claims usually settle earlier. In the

first half of the year, the division did not have any placement

options on its panel for RTA enquiries and, hence, all RTA

enquiries were put into NAL which took up almost all the available

capacity. Since then, we have started to distribute some RTA

enquiries to panel firms which provides further flexibility for the

business.

NAL settled 1,738 claims in the Period, which was 178% more than

last year (H1 2022: 626) and almost as many as in whole of 2022,

demonstrating the rapid scale-up of operations within the firm.

These settled claims generated GBP2.7m of cash for NAL, which was

77% more than last year (H1 2022: GBP1.5m) and contributed to the

strong net debt reduction.

At 30 June 2023, NAL had 10,611 ongoing claims (31 December

2022: 10,860; 30 June 2022: 9,884) representing an embedded value

to the business, being the future profits and cash expected to be

generated by processing these cases through to settlement. This

embedded value has not yet been recognised in the financial

statements. At 30 June 2023, after expensing the marketing costs to

generate those claims and processing costs to date, we anticipate

that the ongoing claims will generate future revenue of GBP9.9m and

future gross profits of GBP8.6m. Following recent analysis, we

upgraded the value of our future book of claims by GBP1.6m due to

the higher revenue per claim we are seeing come through. The

increased revenue per claim is helping to offset the reduction in

enquiry volumes seen across the market caused by the factors set

out above.

The division made good use of its flexible placement model

during the Period and benefitted from consistent demand from its

panel of third-party law firms, providing us with good options for

short-term profit and cash generation. We also placed a modest

allocation of enquiries into Law Together LLP, one of our joint

venture partnerships, which performed well in the Period. We do not

intend to place any new enquiries into our other joint venture,

Your Law LLP, which is making good progress in settling its

historical book of claims.

Following investment over several years, the Group's joint

venture partnerships are returning strong levels of cash flow which

is helping us to manage the investment in growing NAL. In the first

six months of the year, they generated GBP2.0m of cash after

deducting our partners' drawings, compared to GBP1.8m last

year.

The division's Residential Property businesses, comprising

Homeward Legal and Searches UK, generated revenues of GBP1.5m (H1

2022: GBP2.4m) and operating profit before shared costs of GBP0.0m

(H1 2022: GBP0.3m). As previously announced, the Group disposed of

Homeward Legal in April 2023, which made a small loss in the

Period. Details of this transaction are presented in note 10 to the

interim results.

Critical Care

Our Critical Care division performed strongly in the Period,

increasing revenues by 9% from GBP6.7m to GBP7.3m, and operating

profit by 39% to GBP2.3m (H1 2022: GBP1.6m). Operating profit

margin expanded from 24.5% last year to 31.2% through a combination

of attracting a more profitable mix of work and by reducing

overheads.

The business generated GBP2.6m of cash from operations in the

Period (H1 2022: GBP1.4m) and cash conversion was strong at 117%

(H1 2022: 83%).

Bush & Co. operates in the catastrophic injury market with

most work arising from injuries suffered in serious RTAs or through

medical negligence. At 30 June 2023, the number of RTA claims

registered with the CRU in the preceding 12 month period has fallen

by 2% compared to the position six months prior. Furthermore, data

issued by the Department for Transport in May 2023 showed that the

number of serious RTAs has returned to its long-term trend of a

slow decline, and in 2022 was estimated to be 3% lower than in

2019. However, data presented by NHS Resolution suggests that the

medical negligence market has been growing steadily since 2019/20,

and in their most recent data, the number of new claims registered

in the financial year 2022/23 had increased by 27% since

2018/19.

Expert witness services had a particularly strong six months,

with revenues 34% higher than last year and the number of expert

witness reports completed and issued to customers in the Period

increased by 15% to 580 reports. The number of new instructions

generated increased by 2%, indicating a strong pipeline of work for

future periods.

In case management services, revenues were 2% lower than last

year. The business delivered 265 initial needs assessments ("INAs")

in the Period, which was 5% more than last year. Whilst instruction

numbers were 6% lower than last year at 268, the mix skewed towards

more complex cases in the Period which convert at a lower rate but

are worth more in future billings. We will continue to monitor this

to understand if it is a new trend. The business is servicing 1,369

ongoing case management clients (H1 2022: 1,284) that generate

recurring revenue.

In the first half of the year, Bush & Co. has been investing

to capitalise on market opportunities and made good progress with a

number of our strategic initiatives.

Firstly, we have grown the number of associates we work with

across a range of specialisms, geographies and case types, further

increasing our capacity and improving our offering. Most recently

we saw this growth across the children and young people clinicians,

paediatric care and midwifery teams that we work with. In the first

six months of the year, we recruited and trained 40 new associates,

comprising of 18 new case managers and 22 new expert witnesses and

we ended the Period working with a total of 117 case managers and

146 expert witnesses.

Secondly, we have continued our investment in growth initiatives

which are currently small but which I believe will generate

significant growth for the business in the coming years.

One of these is Bush & Co Care Solutions, a service that

provides a range of support solutions for clients who directly

employ support workers or care nurses. We have been successfully

leveraging our business development capabilities to grow the number

of care packages we provide and at 30 June 2023, the business was

engaged to deliver 12 ongoing care packages (H1 2022: 2), each

generating recurring revenue for the division. Bush & Co Care

Solutions generated revenues of GBP248k in the first half, which

was 41% more than the same period last year.

We also recruited three new colleagues to our growing team of 10

employed case managers. These colleagues deliver the same

first-class case management service to enhance our client's

rehabilitation as our associates, but through an in-house model

which allows us to better control resource levels. This is

anticipated to lead to margin expansion as the initiative

develops.

These initiatives have been well received by our customers and

end clients and I'm excited to see how they develop over the coming

years. Finally, we have been upgrading our internal systems which

have allowed us to manage increased demand and be more efficient.

In the first half of this year, we reduced our overhead costs as a

proportion of gross profit by 7ppts from 55.6% in 2022 to 47.9%,

despite high inflationary pressures.

Shared Services and other items

The costs of the Group's Shared Services function, including

plc-related costs and Other Items, which comprises share-based

payments and amortisation on business combinations, were both

unchanged from last year. These amounted to GBP0.9m and GBP0.6m in

the Period respectively.

Our people

We employed 288 people at 30 June 2023 which was an increase of

4% from the end of 2022 (December 2022: 278). The growth in staff

primarily arose in the operational teams within NAL and Bush &

Co.

Our focus on making NAHL a great place to work was recognised in

July with our best ever results in our annual staff engagement

survey, which returned an overall engagement score of 81% (2022:

79%). This was significantly higher than Gallup's UK average of

10%, and the 72% average of their best-practice organisations.

Summary and outlook

In summary, the results for the first half of 2023 were in line

with the Board's expectations and saw the Group deliver an

operating profit, generate cash and significantly reduce net debt.

Pleasingly, this momentum has continued into the second half of the

year and the Board expects the Group to meet market expectations

for the full year.

In July and August of this year, our Consumer Legal Services

division delivered 9% growth in personal injury enquiry numbers

compared to last year, suggesting continued share growth. Cash from

settlements in NAL has continued to gain momentum, and GBP1.0m was

collected across July and August, 67% more than last year. Year to

date collections as at 31 August 2023 was GBP3.7m (2022 full year:

GBP3.5m).

In Critical Care, the number of expert witness reports issued in

July and August was 53% ahead of last year. The number of INAs

issued was 45% lower than last year due to a slow July but,

pleasingly, numbers returned to normal in August. The business has

continued to benefit from encouraging levels of new instructions,

contributing to a strong pipeline of future work.

Cash generation has remained strong across the Group, and we

will continue to leverage our flexible placement model to drive

short-term cash flow and reduce net debt, given the high interest

rate environment we are operating in.

Finally, I'd like to thank all our people for their hard work

and dedication to our customers during the Period. We are making

good progress in executing our strategy across the Group and are

starting to see the benefits come through in the results.

James Saralis

Chief Executive Officer

26 September 2023

1 Like-for-like enquiry numbers exclude tariff-only road traffic

accident claims, which the Group ceased processing in February

2022.

2 Free cash flow is defined as net cash generated from operating

activities less net cash used in investing activities less payments

made to partner LLP members and less principal element of lease

payments. This measure provides management with an indication of

the amount of cash available for discretionary investing or

financing after removing material non-recurring expenditure that

does not reflect the underlying trading operations.

Unaudited Unaudited 6 months Audited 12 months

6 months ended ended

ended 30 June 31 December 2022

30 June 2022

2023

-------------------------------------------------------------- ---------- ------------------- ------------------

Statutory measure - net cash generated from operating

activities 4.2 3.1 6.0

--------------------------------------------------------------- ---------- ------------------- ------------------

Net cash used in investing activities (excluding disposal of

subsidiary) (0.1) (0.1) (0.3)

--------------------------------------------------------------- ---------- ------------------- ------------------

Principal elements of lease payments (0.2) (0.1) (0.3)

--------------------------------------------------------------- ---------- ------------------- ------------------

Drawings paid to LLP members (2.1) (1.9) (3.2)

--------------------------------------------------------------- ---------- ------------------- ------------------

Net cash used in financing activities (before borrowings) (2.3) (2.0) (3.5)

--------------------------------------------------------------- ---------- ------------------- ------------------

Free Cash Flow 1.8 1.0 2.2

--------------------------------------------------------------- ---------- ------------------- ------------------

3 Operating cash conversion is calculated as cash generated from

operations divided by operating profit. This measure allows

management to monitor the conversion of underlying operating profit

into operating cash.

Unaudited Unaudited 6 months Audited 12 months

6 months ended ended

ended 30 June 31 December 2022

30 June 2022

2023

----------------------------------------------------- ---------- ------------------- ------------------

Statutory measure - cash generation from operations 4.9 3.4 6.8

------------------------------------------------------ ---------- ------------------- ------------------

Statutory measure - operating profit 1.8 2.3 4.8

------------------------------------------------------ ---------- ------------------- ------------------

Operating cash conversion 269.6% 151.5% 142.9%

------------------------------------------------------ ---------- ------------------- ------------------

Consolidated statement of comprehensive income

for the 6 months ended 30 June 2023

Audited

Unaudited Unaudited 12 months

Note 6 months 6 months ended 31

ended 30 ended 30 December 2022

June 2023 June 2022 GBP000

GBP000 GBP000

Revenue 2 20,951 20,732 41,421

Cost of sales (12,021) (11,984) (23,586)

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Gross profit 8,930 8,748 17,835

Administrative expenses (7,110) (6,493) (13,079)

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Operating profit 2 1,820 2,255 4,756

Profit attributable to members' non-controlling interests in

LLPs (1,360) (1,935) (3,554)

Financial income 57 37 80

Financial expense 3 (560) (307) (713)

---------------------------------------------------------------- ------- ----------- ------------ ----------------

(Loss)/Profit before tax (43) 50 569

Taxation 4 (45) (48) (184)

---------------------------------------------------------------- ------- ----------- ------------ ----------------

(Loss)/Profit and total comprehensive income for the period (88) 2 385

---------------------------------------------------------------- ------- ----------- ------------ ----------------

(Loss)/Profit from discontinued operations for the period 10 (49) 75 13

---------------------------------------------------------------- ------- ----------- ------------ ----------------

(Loss)/Profit from continuing operations for the period (39) (73) 372

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Unaudited Unaudited 6 months Audited 12 months

6 months ended ended

ended 30 June 31 December 2022

30 June 2022

Earnings per share (p) - Continuing operations 2023

-------------------------------------------------- ---------- ------------------- ------------------

Basic earnings per share 7 (0.1) (0.2) 0.8

-------------------------------------------------- ---------- ------------------- ------------------

Diluted earnings per share 7 (0.1) (0.2) 0.8

-------------------------------------------------- ---------- ------------------- ------------------

Unaudited Unaudited 6 months Audited 12 months

6 months ended ended

ended 30 June 31 December 2022

30 June 2022

Earnings per share (p) - Discontinued operations 2023

---------------------------------------------------- ---------- ------------------- ------------------

Basic earnings per share 7 (0.1) 0.2 0.0

---------------------------------------------------- ---------- ------------------- ------------------

Diluted earnings per share 7 (0.1) 0.2 0.0

---------------------------------------------------- ---------- ------------------- ------------------

Consolidated statement of financial position

At 30 June 2023

Unaudited as at

Unaudited as at 30 June 30 June Audited

2023 2022 as at 31 December 2022

Note GBP000 GBP000 GBP000

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Non-current assets

Goodwill 55,489 55,489 55,489

Other intangible assets 2,238 3,156 2,714

Property, plant and equipment 365 440 392

Right of use assets 1,883 2,171 2,027

Deferred tax asset 49 23 50

----------------------------------------- ----- ------------------------ ---------------- ------------------------

60,024 61,279 60,672

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Current assets

Trade and other receivables (including

GBP5,174,000 (June 2022: GBP4,692,000;

December 2022:

GBP5,312,000) due in more than one

year) 5 30,890 33,058 32,886

Cash and cash equivalents 2,422 1,974 2,654

33,312 35,032 35,540

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Total assets 93,336 96,311 96,212

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Current liabilities

Trade and other payables 6 (15,896) (16,096) (15,847)

Lease liabilities (238) (258) (263)

Member capital and current accounts (3,763) (4,232) (4,487)

Current tax liability (110) (74) (162)

(20,007) (20,660) (20,759)

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Non-current liabilities

Lease liabilities (1,600) (1,885) (1,724)

Other interest-bearing loans and

borrowings (13,954) (16,424) (15,939)

Deferred tax liability (367) (546) (470)

----------------------------------------- ----- ------------------------ ---------------- ------------------------

(15,921) (18,855) (18,133)

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Total liabilities (35,928) (39,515) (38,892)

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Net assets 57,408 56,796 57,320

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Equity

Share capital 117 116 116

Share option reserve 4,803 4,487 4,628

Share premium 14,595 14,595 14,595

Merger reserve (66,928) (66,928) (66,928)

Retained earnings 104,821 104,526 104,909

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Capital and reserves attributable to the

owners of NAHL Group plc 57,408 56,796 57,320

----------------------------------------- ----- ------------------------ ---------------- ------------------------

Consolidated statement of changes in equity

for the 6 months ended 30 June 2023

Share

Share option Share Merger Retained Total

capital reserve premium reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Balance at 1 January 2023 116 4,628 14,595 (66,928) 104,909 57,320

Total comprehensive income for the period

Loss for the period - - - - (88) (88)

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Total comprehensive income - - - - (88) (88)

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Transactions with owners, recorded directly in equity

Issue of share capital 1 - - - - 1

Share-based payments - 175 - - - 175

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Total transactions with owners recorded directly in

equity 1 175 - - - 176

--------- --------- --------- --------- ---------- --------

Balance at 30 June 2023 117 4,803 14,595 (66,928) 104,821 57,408

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Balance at 1 January 2022 116 4,312 14,595 (66,928) 104,524 56,619

Total comprehensive income for the period

Profit for the period - - - - 2 2

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Total comprehensive income - - - - 2 2

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Transactions with owners, recorded directly in

equity

Share-based payments - 175 - - - 175

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Total transactions with owners recorded directly in

equity - 175 - - - 175

--------- --------- --------- --------- ---------- --------

Balance at 30 June 2022 116 4,487 14,595 (66,928) 104,526 56,796

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Balance at 1 January 2022 116 4,312 14,595 (66,928) 104,524 56,619

Total comprehensive income for the year

Profit for the year - - - - 385 385

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Total comprehensive income - - - - 385 385

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Transactions with owners, recorded directly in

equity

Share-based payments - 316 - - - 316

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Total transactions with owners recorded directly in

equity - 316 - - - 316

--------- --------- --------- --------- ---------- --------

Balance at 31 December 2022 116 4,628 14,595 (66,928) 104,909 57,320

---------------------------------------------------- --------- --------- --------- --------- ---------- --------

Consolidated cash flow statement

for the 6 months ended 30 June 2023

Audited

Unaudited 6 months ended Unaudited 6 12 months ended 31 December

30 June 2023 months ended 2022

Note GBP000 30 June 2022 GBP000 GBP000

---------------------------- ------ --------------------------- --------------------- ----------------------------

Cash flows from operating

activities

(Loss)/Profit for the period (88) 2 385

Adjustments for:

Profit attributable to members'

non-controlling interests in LLPs 1,360 1,935 3,554

Property, plant and equipment

depreciation 69 91 168

Right of use asset depreciation 144 145 288

Amortisation of intangible assets 586 624 1,186

Financial income (57) (36) (80)

Financial expense 560 307 713

Share-based payments 175 175 316

Taxation 45 48 184

------------------------------------ --------------------------- --------------------- ----------------------------

2,794 3,291 6,714

Decrease in trade and other

receivables 1,896 240 448

Increase/(Decrease) in trade and

other payables 218 (115) (364)

Cash generation from operations 4,908 3,416 6,798

Interest paid (520) (267) (627)

Tax paid (201) (14) (165)

------------------------------------ --------------------------- --------------------- ----------------------------

Net cash generated from operating

activities 4,187 3,135 6,006

------------------------------------ --------------------------- --------------------- ----------------------------

Cash flows from investing

activities

Acquisition of property, plant and

equipment (42) (54) (83)

Acquisition of intangible assets (110) (79) (199)

Interest received 20 6 13

Disposal of subsidiary (30) - -

Net cash used in investing

activities (162) (127) (269)

------------------------------------ --------------------------- --------------------- ----------------------------

Cash flows from financing

activities

Repayment of borrowings (2,000) (1,500) (2,000)

Issue of share capital 1 - -

Principal element of lease payments (174) (80) (264)

Drawings paid to LLP members (2,084) (1,912) (3,277)

------------------------------------ --------------------------- --------------------- ----------------------------

Net cash used in financing

activities (4,257) (3,492) (5,541)

------------------------------------ --------------------------- --------------------- ----------------------------

Net (decrease)/increase in cash

and cash equivalents (232) (484) 196

Cash and cash equivalents at

beginning of period 2,654 2,458 2,458

Cash and cash equivalents at end of

period 2,422 1,974 2,654

------------------------------------ --------------------------- --------------------- ----------------------------

Notes to the financial statements

1. Accounting policies

General Information

The half year results for the current and comparative period to

30 June have not been audited or reviewed by auditors pursuant to

the Auditing Practices Board guidance of Review of Interim

Financial Information.

These half year results do not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2022 were

approved by the Board of Directors on 21 March 2023 and delivered

to the Registrar of Companies. The report of the auditors on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under Section 498 of

the Companies Act 2006.

In preparing the half year results, the Board has considered the

Group's ability to continue as a going concern. This assessment

included a review of management's financial forecasts, covering a

range of potential scenarios. The going concern assessment focuses

on two key areas being the ability of the Group to meet its debts

as they fall due and being able to operate within its banking

facility. The Group has access to a GBP20.0m revolving credit

facility ('RCF') with its bankers. In all of the scenarios the

Group has modelled it would have sufficient liquidity within its

current RCF to meet its liabilities as they fall due and would not

need to access additional funding.

The condensed set of financial statements was approved by the

Board of Directors on 25 September 2023.

Basis of preparation

Profit or loss and other comprehensive income of subsidiaries

acquired or disposed of during the year are recognised from the

effective date of acquisition, or up to the effective date of

disposal, as applicable.

Statement of compliance

The half year results for the current and comparative period to

30 June have been prepared in accordance with IAS 34 Interim

Financial Reporting applied in conformity with the requirements of

the Companies Act 2006 and the AIM Rules of UK companies. They do

not include all of the information required for full annual

financial statements and should be read in conjunction with the

financial statements of the Group for the year ended 31 December

2022, which have been prepared in accordance with International

Financial Reporting Standards ("IFRS") in conformity with the

requirements of the Companies Act 2006.

New and amended standards adopted by the Group

There are no new or amended standards applicable for the current

reporting period.

Use of judgements and estimates

The preparation of financial statements in conformity with IFRS

requires management to make judgements and estimates that affect

the application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. Actual results may differ

from these estimates. Estimates and underlying assumptions are

reviewed on an ongoing basis. Revisions to accounting estimates are

recognised in the year in which the estimates are revised and in

any future years affected.

In preparing the condensed set of financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were of the same type as those that applied to the financial

statements for the year ended 31 December 2022.

Significant accounting policies

The accounting policies used in the preparation of these interim

financial statements for the 6 months ended 30 June 2023 are the

accounting policies as applied to the Group's financial statements

for the year ended 31 December 2022.

Financial assets and liabilities

The Group's principal financial instruments comprise cash and

cash equivalents, trade and other receivables, trade and other

payables

and interest-bearing borrowings.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value. Subsequent to initial recognition, trade and other

receivables are stated at amortised cost using the effective

interest method, less any impairment losses calculated in line with

IFRS 9.

Trade and other payables

Trade and other payables are recognised initially at fair value.

Subsequent to initial recognition, trade and other payables are

stated at

amortised cost using the effective interest method.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances. Cash and cash

equivalents are repayable on demand and are recognised at their

carrying amount.

Interest-bearing borrowings

Interest-bearing borrowings are recognised initially at fair

value less attributable transaction costs. Subsequent to initial

recognition,

interest-bearing borrowings are stated at amortised cost using

the effective interest method, less any impairment losses.

Recoverable disbursements and disbursements payable

Disbursement payables represent the balance of disbursements

incurred in the processing of personal injury claims. These

disbursements will ultimately be billed on settlement of a case or

recovered from insurance if a case should fail and so the

recoverable disbursements represents the value of disbursements

still to be billed. Disbursement payables and receivables are

recognised initially at fair value and subsequent to initial

recognition, are stated at amortised cost using the effective

interest method.

Member capital and current accounts

Member capital and current accounts represent the balances owed

to non-controlling members' in the LLPs. These consist of any

capital advances and unpaid allocated profits as at the period end.

Members capital and current accounts are classified as financial

liabilities and are recognised initially at fair value. Subsequent

to initial recognition, members capital and current accounts are

stated at amortised cost using the effective interest method.

2. Operating segments

Geographic information

All revenue and assets of the Group are based in the UK.

Operating segments

The activities of the Group are managed by the Board, which is

deemed to be the Chief Operating Decision Maker (CODM). The CODM

has identified the following segments for the purpose of

performance assessment and resource allocation decisions. These

segments are split along product lines and are consistent with the

prior year.

Consumer Legal Services - Revenue is split along 3 separate

streams being: a) Panel - revenue from the provision of personal

injury and conveyancing enquiries to the Panel Law Firms, based on

a cost plus margin model b) Products - consisting of commissions

received from providers for the sale of additional products by them

to the Panel Law Firms, surveys and the provision of conveyancing

searches and c) Processing - in the case of our ABSs and

self-processing operations, revenue receivable from clients for the

provision of legal services.

Critical Care - Revenue from the provision of expert witness

reports and case management support within the medico-legal

framework for multi-track cases.

Shared Services - Costs that are incurred in managing Group

activities or not specifically related to a product.

Other items - Other items represent share-based payment charges

and amortisation charges on intangible assets recognised as part of

business combinations.

Consumer Critical Care Shared Other items Eliminations(2) Total

Legal Services GBP000 services GBP000

GBP000 GBP000 GBP000

GBP000

6 months ended 30 June

2023

Revenue 13,688 7,263 - - - 20,951

Depreciation and

amortisation (127) (82) (177) (413) - (799)

Operating profit/(loss) 1,099 2,266 (924) (621) - 1,820

Profit attributable to

members'

non-controlling

interests in LLPs (1,360) - - - - (1,360)

Financial income 52 - 5 - - 57

Financial expenses - (1) (559) - - (560)

(Loss)/profit before tax (209) 2,265 (1,478) (621) - (43)

Trade receivables 2,840 5,617 - - - 8,457

Total assets(1) 27,086 6,874 76,882 - (17,506) 93,336

Segment liabilities(1) (16,912) (1,564) (3,021) - - (21,497)

Capital expenditure

(including intangibles) (36) (116) - - - (152)

------------------------- --------------- -------------- --------------- ------------ ---------------- ---------

6 months ended 30 June

2022

Revenue 14,061 6,671 - - - 20,732

Depreciation and

amortisation (129) (116) (179) (436) - (860)

Operating profit/(loss) 2,108 1,634 (876) (611) - 2,255

Profit attributable to

members'

non-controlling

interests in LLPs (1,935) - - - - (1,935)

Financial income 35 - 2 - - 37

Financial expenses - (3) (304) - - (307)

Profit/(loss) before tax 208 1,631 (1,178) (611) - 50

Trade receivables 2,726 5,567 - - - 8,293

Total assets(1) 29,106 6,585 78,126 - (17,506) 96,311

Segment liabilities(1) (15,824) (1,438) (5,208) - - (22,470)

Capital expenditure

(including intangibles) (59) (74) - - - (133)

------------------------- --------------- -------------- --------------- ------------ ---------------- ---------

12 months ended 31

December 2022

Revenue 28,264 13,157 - - - 41,421

Depreciation and

amortisation (257) (201) (358) (826) - (1,642)

Operating profit/(loss) 4,179 3,434 (1,715) (1,142) - 4,756

Profit attributable to

non-controlling

interest members in

LLPs (3,554) - - - - (3,554)

Financial income 77 - 3 - - 80

Financial expenses - (5) (708) - - (713)

Profit/(loss) before tax 702 3,429 (2,420) (1,142) - 569

Trade receivables 2,632 5,610 - - - 8,242

Total assets(1) 29,222 6,780 77,716 - (17,506) 96,212

Segment liabilities(1) (17,874) (1,258) (3,189) - - (22,321)

Capital expenditure

(including intangibles) (95) (187) - - - (282)

------------------------- --------------- -------------- --------------- ------------ ---------------- ---------

1. Total assets and segment liabilities exclude intercompany

loan balances as these are not included in the segment results

reviewed by the Chief Operating Decision Maker.

2. Eliminations represents the difference between the cost of

subsidiary investments included in the total assets figure for each

segment and the value of goodwill arising on consolidation.

3. Financial expense

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2023 June 2022 December 2022

GBP000 GBP000 GBP000

Interest on bank loans 520 267 628

Amortisation of facility

arrangement fees 15 14 29

Interest on lease

liabilities 25 26 56

Total 560 307 713

---------------------------- ---------------------------- ---------------------------- ----------------------------

Interest on bank loans consists of interest incurred in respect

of a revolving credit facility of GBP20m which is due to terminate

on 31 December 2024. Interest is payable at 2.25% above SONIA per

annum. There have been no changes to the terms of the revolving

credit facility agreement since the year ended 31 December 2022 and

details of the amounts outstanding in respect of this facility are

given in Note 9.

4. Taxation

Unaudited 6 months ended 30 Unaudited 6 months Audited 12 months ended 31

June 2023 ended 30 June 2022 December 2022

GBP000 GBP000 GBP000

Current tax expense

Current tax on income for the

year 148 127 352

Adjustments in respect of

prior years - - 14

Total current tax 148 127 366

Deferred tax credit

Origination and reversal of

timing differences (103) (79) (182)

------------------------------- ------------------------------- -------------------- ------------------------------

Total deferred tax (103) (79) (182)

------------------------------- ------------------------------- -------------------- ------------------------------

Total expense in statement of

comprehensive income 45 48 184

------------------------------- ------------------------------- -------------------- ------------------------------

Total tax charge 45 48 184

------------------------------- ------------------------------- -------------------- ------------------------------

Reconciliation of effective tax rate:

Unaudited 6 months ended 30 Unaudited 6 months Audited 12 months ended 31

June 2023 ended 30 June 2022 December 2022

GBP000 GBP000 GBP000

(Loss)/Profit for the period (88) 2 385

Total tax expense 45 48 184

(Loss)/Profit before taxation (43) 50 569

Tax using the UK corporation

tax rate of 19.0%/25.0% (June

2022: 19.0%, December

2022:19.0%) 10 10 108

Non-deductible expenses 35 38 68

Adjustments in respect of

prior years - - 14

Short term timing differences

for which no deferred tax is

recognised - - (6)

------------------------------- ------------------------------- -------------------- ------------------------------

Total tax charge 45 48 184

------------------------------- ------------------------------- -------------------- ------------------------------

The Group's tax charge of GBP45,000 (June 2022: GBP48,000,

December 2022: GBP184,000) represents an effective tax rate of

104.7% (June 2022: 96.5%, December 2022: 32.3%). The effective tax

rate is higher than the standard corporation tax rate of 25.0% for

the reasons as set out above.

5. Trade and other receivables

Unaudited 6 months ended 30 Unaudited 6 months Audited 12 months ended 31

June 2023 ended 30 June 2022 December 2022

GBP000 GBP000 GBP000

Trade receivables: receivable

in less than one year 7,138 7,711 7,077

Trade receivables: receivable

in more than one year 1,319 820 1,165

Accrued income: receivable in

less than one year 9,925 11,356 11,137

Accrued income: receivable in

more than one year 3,855 3,872 4,147

Other receivables 103 14 26

Prepayments 781 934 954

Recoverable disbursements 7,769 8,351 8,380

------------------------------- ------------------------------- -------------------- ------------------------------

Total 30,890 33,058 32,886

------------------------------- ------------------------------- -------------------- ------------------------------

A provision against trade receivables and accrued income of

GBP464,000 (June 2022: GBP467,000, December 2022: GBP612,000) is

included in the figures above.

Trade receivables and accrued income receivable in greater than

one year are classified as current assets as the Group's working

capital cycle is considered to be up to 36 months as extended

credit terms are offered as part of some commercial agreements.

6. Trade and other payables

Unaudited Unaudited Audited 12 months ended 31 December 2022

6 months ended 30 6 months GBP000

June 2023 ended 30

GBP000 June 2022

GBP000

Trade payables 1,662 1,434 1,689

Disbursements payable 5,813 7,388 6,620

Other taxation and social security 1,763 1,299 1,231

Other payables, accruals and deferred

revenue 6,201 5,518 5,850

Customer deposits 457 457 457

----------------------------------------- ------------------- ----------- -----------------------------------------

Total 15,896 16,096 15,847

----------------------------------------- ------------------- ----------- -----------------------------------------

7. Earnings per share

The calculation of basic earnings per share at 30 June 2023 is

based on a loss attributable to ordinary shareholders of the parent

company of GBP88,000 (June 2022: profit of GBP2,000, December 2022:

profit of GBP385,000) and a weighted average number of Ordinary

Shares outstanding of 46,450,977 (June 2022: 46,325,222, December

2022: 46,325,222).

(Loss)/profit attributable to ordinary shareholders

Unaudited Unaudited Audited

6 months ended 30 June 2023 6 months ended 30 June 2022 12 months ended

GBP000 GBP000 31 December 2022

GBP000

(Loss)/profit for the period

from continuing operations (49) (73) 372

(Loss)/profit for the period

from discontinued operations (39) 75 13

--------------------------------- ------------------------------ ------------------------------ -------------------

(Loss)/profit for the period

attributable to the

shareholders (88) 2 385

--------------------------------- ------------------------------ ------------------------------ -------------------

Weighted average number of Ordinary Shares

Unaudited 6 months ended Unaudited 6 months ended 30 Audited 12

30 June 2023 June 2022 months ended

Number 31 December 2022

-------------------------------- --------------------------- ------------------------------- -------------------

Issued Ordinary Shares at start

of period 46,325,222 46,325,222 46,325,222

--------------------------------- --------------------------- ------------------------------- -------------------

Weighted average number of

Ordinary Shares at end of

period 46,450,977 46,325,222 46,325,222

--------------------------------- --------------------------- ------------------------------- -------------------

Basic earnings per share (p)

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12

June 2023 June 2022 months ended

31 December 2022

Group (p) - continuing

operations (0.1) (0.2) 0.8

Group (p) - discontinued

operations (0.1) 0.2 0.0

-------------------------------- ------------------------------- ------------------------------- ------------------

Group (p) - total (0.2) 0.0 0.8

-------------------------------- ------------------------------- ------------------------------- ------------------

The Company operates a share-based payment schemes to reward

employees. In line with IAS 33, as the Group has a negative

earnings per share at 30 June 2023, it is assumed there are no

dilutive shares. As at 30 December 2022 and 30 June 2022, there

were potentially dilutive shares options under the Group's share

option schemes. The total number of options available for these

schemes included in the diluted earnings per share calculation as

at 30 June 2022 was 2,329,951 and as at 30 Dec 2022 was 2,329,951.

There are no other diluting items.

Diluted earnings per share (p)

Unaudited 6 months ended Unaudited 6 months Audited 12

30 June 2023 ended months

30 June 2022 ended

31 December 2022

Group (p) - continuing operations (0.1) (0.2) 0.8

Group (p) - discontinued operations (0.1) 0.2 0.0

------------------------------------- ------------------------- ------------------- ------------------

Group (p) - total (0.2) 0.0 0.8

------------------------------------- ------------------------- ------------------- ------------------

8. Dividends

No dividends were paid in 2022 and the Directors have

recommended an interim dividend in respect of 2023 of nil p (2022:

interim dividend of nil p).

9. Net debt

Net debt comprises cash and cash equivalents and secured bank

loans. Secured bank loans consist of a revolving credit facility of

GBP20m which is due to terminate on 31 December 2024. Repayments

are made periodically depending on the level of free cash flow

generated by the Group. Interest is payable at 2.25% above SONIA

per annum. There have been no changes to the terms of the revolving

credit facility agreement since the year ended 31 December

2022.

Unaudited Unaudited Audited

as at 30 as at 30 as at 31 December 2022

June 2023 June 2022 GBP000

GBP000 GBP000

--------------------------------------------- ----------- ----------- ------------------------

Cash and cash equivalents 2,422 1,974 2,654

Other interest-bearing loans and loan notes (13,954) (16,424) (15,939)

Net debt (11,532) (14,450) (13,285)

--------------------------------------------- ----------- ----------- ------------------------

Lease liabilities (1,838) (2,143) (1,987)

--------------------------------------------- ----------- ----------- ------------------------

Set out below is a reconciliation of movements in net debt

during the period.

Unaudited Unaudited Audited

as at 30 as at 30 as at 31 December 2022

June 2023 June 2022 GBP000

GBP000 GBP000

------------------------------------------------------------------ ----------- ----------- ------------------------

Net (decrease)/increase in cash and cash equivalents (232) (484) 196

Net decrease from repayment of debt and debt financing 2,000 1,500 2,000

------------------------------------------------------------------ ----------- ----------- ------------------------

Movement in net borrowings resulting from cash flows 1,768 1,016 2,196

Non-cash movements - net release of prepaid loan arrangement fees (15) (14) (29)

Net debt at beginning of period (13,285) (15,452) (15,452)

------------------------------------------------------------------ ----------- ----------- ------------------------

Net debt at end of period (11,532) (14,450) (13,285)

------------------------------------------------------------------ ----------- ----------- ------------------------

Set out below is a reconciliation of movements in lease

liabilities during the period.

Unaudited Unaudited Audited

as at 30 as at 30 as at 31 December 2022

June 2023 June 2022 GBP000

GBP000 GBP000

------------------------------------------------------------ ----------- ----------- ------------------------

Net outflow from decrease in lease liabilities 174 80 264

Movement in net borrowings resulting from cash flows 174 80 264

Non-cash movements arising from initial recognition of new

lease liabilities, revisions and interest charges (25) (28) (56)

Lease liabilities at beginning of the period (1,987) (2,195) (2,195)

------------------------------------------------------------ ----------- ----------- ------------------------

Lease liabilities at end of period (1,838) (2,143) (1,987)

------------------------------------------------------------ ----------- ----------- ------------------------

10. Discontinued Operations

On 25 April 2023, the Group announced the sale of its wholly

owned subsidiary Homeward Legal Limited. Homeward Legal utilises

online marketing to target homebuyers and sellers in England and

Wales to generate leads and instructions which it then passes to

panel law firms and surveyors in the conveyancing sector for a

fixed cost. The subsidiary is considered to be non-core to the

Group's principal operations.

Consideration for the sale was finalised at GBP117,000 which was

equivalent to the net asset value of Homeward Legal at the date of

sale. The Group incurred legal and consultancy costs amounting to

GBP55,000 in respect of the sale. The consideration is payable in

two annual instalments and additionally, the Group is entitled to

receive contingent consideration in each of the two years following

completion, contingent upon Homeward Legal achieving certain

performance milestones. The contingent consideration will be based

on a share of profits and trade debtors recovered above certain

amounts. The Board believes that the contingent consideration will

not be material and has estimated the fair value as nil.

At the date of disposal, the carrying amounts of Homeward

Legal's net assets were as follows:

GBP000

------------------------------- -------

Property, plant and equipment -

Deferred tax asset 1

Trade and other receivables 255

Cash and cash equivalents 30

------------------------------- -------

Total assets 286

------------------------------- -------

Trade and other creditors (169)

------------------------------- -------

Total liabilities (169)

------------------------------- -------

Net assets 117

------------------------------- -------

The gain on disposal is calculated as:

GBP000

---------------------------------------- -------

Consideration received or receivable:

Cash 117

Fair value of contingent consideration -

Total disposal consideration 117

Carrying amount of net assets sold (117)

---------------------------------------- -------

Gain on sale before income tax -

---------------------------------------- -------

Income tax expense on gain -

---------------------------------------- -------

Gain on sale after income tax -

---------------------------------------- -------

The results of these discontinued operations are included in the

2023 interim results up to the date of disposal, and are presented

as follows:

Consolidated statement of comprehensive income:

Unaudited Unaudited Audited

as at 30 as at 30 as at 31 December 2022

June 2023 June 2022 GBP000

GBP000 GBP000

------------------------------------------------------------------ ----------- ----------- ------------------------

Revenue 269 651 1,196

Expenses (318) (576) (1,183)

------------------------------------------------------------------ ----------- ----------- ------------------------

(Loss)/profit before taxation (49) 75 13

------------------------------------------------------------------ ----------- ----------- ------------------------

Taxation - - -

------------------------------------------------------------------ ----------- ----------- ------------------------

(Loss)/profit after taxation attributable to owners of the parent

company (49) 75 13

------------------------------------------------------------------ ----------- ----------- ------------------------

Consolidated cash flow statement:

Unaudited Unaudited Audited

as at 30 as at 30 as at 31 December 2022

June 2023 June 2022 GBP000

GBP000 GBP000

-------------------------------------- ----------- ----------- ------------------------

Cash flows from operating activities 23 187 41

Cash flows from investing activities - - -

Cash flows from financing activities - - -

Net cash inflow 23 187 41

-------------------------------------- ----------- ----------- ------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAENSAFEDEAA

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

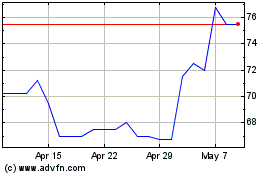

Nahl (LSE:NAH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nahl (LSE:NAH)

Historical Stock Chart

From Feb 2024 to Feb 2025