TIDMPAC

LONDON STOCK EXCHANGE ANNOUNCEMENT

Pacific Assets Trust plc

(the "Company" or the "Trust")

Unaudited Half Year Results For The Six Months Ended 31 July 2021

This announcement is not the Company's Half Year Report. It is an abridged

version of the Company's full Half Year Report for the six months ended 31 July

2021. The full Half Year Report, together with a copy of this announcement,

will shortly be available on the Company's website at www.pacific-assets.co.uk

where up to date information on the Company, including daily NAV, share prices

and fact sheets, can also be found.

The Company's Half Year Report for the six months ended 31 July 2021 has been

submitted to the UK Listing Authority, and will shortly be available for

inspection on the National Storage Mechanism (NSM): https://data.fca.org.uk/#/

nsm/nationalstoragemechanism

For further information please contact: Katherine Manson, Frostrow Capital LLP,

020 3709 8734.

Financial Highlights

Key Statistics

As at As at

31 July 31 January

2021 2021 % change

Share price 336.0p 333.0p 0.9%

Net asset value per share 359.6p 344.1p 4.5%

Discount of share price to net asset value per 6.5% 3.2%

share

Market capitalisation £406.4m £402.8m 0.9%

Shareholders' funds £435.0m £416.2m 4.5%

Six months to One year to

31 July 31 January

2021 2021

Share price (total return)*^ 1.7% 25.8%

Net asset value per share (total return)*^ 5.6% 22.3%

CPI + 6%1 5.1% 6.8%

MSCI All Country Asia ex Japan Index (total (6.6%) 30.7%

return, sterling adjusted)*

Average discount of share price to net asset 7.0% 9.1%

value per share^

Ongoing charges^ 1.1% 1.1%

*Source: Morningstar.

^Alternative Performance Measure (see Glossary).

1UK Consumer Price Index + 6% - the Company's Performance Objective (see

Glossary).

Year ended Year ended

31 January 31 January

Dividends 2021 2020

Dividend per share 2.4p 3.0p

Peer Group Performance

Performance Assessment

Pacific Assets Trust plc exists in a competitive environment and aims to be a

leader in its peer group, defined as being consistently within the top third of

that group measured by net asset value per share total return. The Company is

committed to building a long-term investment record and will assess itself by

reference to its peers on a rolling three to five-year basis. An analysis of

this performance can be found in the Chairman's Statement and the Portfolio

Manager's Review.

Peer Group Net Asset Value per Share Total Return^

1 Year 3 years 5 years

£ Rank £ Rank £ Rank

Pacific Horizon 162.1 1 222.3 1 349.3 1

Schroder Asian Total 126.0 4 144.7 2 207.1 2

Return

Schroder Asia Pacific 123.5 6 133.6 3 192.9 3

Invesco Asia 125.5 5 133.5 4 179.3 5

Asia Dragon 117.8 7 133.0 5 172.9 6

Pacific Assets Trust 126.6 3 131.4 6 166.2 7

JP Morgan Asian 116.3 8 130.9 7 190.2 4

Fidelity Asian Values 140.2 2 126.8 8 152.6 9

iShares MSCI Asia ex Jpn 111.3 9 119.6 9 159.9 8

ETF

Peer Group Average 127.7 141.8 196.7

CPI + 6%1 108.8 125.9 149.1

MSCI AC Asia ex Japan 112.4 122.3 165.8

Source: Morningstar. Figures show the value as at 31 July 2021 of £100 invested

at the start of the period.

^ Alternative Performance Measure (see Glossary).

1 The Company's Performance Objective (see Glossary).

Chairman's Statement

The interim period for the Company closed on 31st July. At that time the news

was dominated by the delayed Tokyo Olympics being held behind closed doors, and

the financial news by a series of regulations and prohibitions affecting

Chinese companies. These are just a reminder of how unpredictable things have

become, neither situation could easily have been anticipated a year or two ago.

Over the six months to 31st July 2021, the net asset value of the Company's

shares rose by 5.6%^ on a total return basis. Such a trend was in line with

most global stock markets which had risen comfortably notwithstanding the

seemingly endless economic disruption by the pandemic. The Company's annualised

net asset value total return per share has been 9.5% over three years and 10.7%

over the last five years. Over these longer periods, it is comfortably ahead of

our Performance Objective, UK CPI plus 6%, which has increased 8.0% and 8.3% on

an annual basis over these periods. We also use a peer group of Asian

investment trusts as a comparator, and while still in the lower half of the

range of returns over three and five years, your Company has shown relative

improvement over the last year. The latest figures are shown above.

Our relative returns over recent years have been affected by the Trust's

reluctance to engage fully in the powerful wave of Chinese investment themes.

This approach owed much to the lack of transparency within Chinese companies,

and the belief that the Chinese Communist Party ("CCP") could still overpower

company management for ideological or political reasons. The CCP being

synonymous with the Government meant that we could never have full confidence

that our shareholders' assets could be secure against a rapid change in

political sentiment. Where the larger Chinese companies are concerned, there

seems to be an unhealthy mixture with geopolitics, so that foreign listings

(notably New York) and special purpose vehicles used to access some (the

Variable Interest Entity structure) have been vulnerable.

All this is now widely understood and possibly discounted as prominent Chinese

shares have fallen substantially, justifying our Portfolio Manager's long held

decision to be underweight Chinese securities. However, the Trust has ventured

modestly into China, more so recently. It is invested in less high profile

companies, particularly in the fields of medicine and diagnostics. We are

encouraged that the euphoria of recent years has been punctured, and that more

opportunities will be provided in China. It is easy to be overwhelmed by the

commentary on the politics and miss the extraordinary creativity and economic

dynamism that is flourishing throughout the country.

Our Portfolio Manager is discriminating in seeking out quality franchises. Some

of these are to be found in China, and many elsewhere, notably in India. One of

the most positive contributors to return in the period has been Marico, an

Indian stock that has been held by the Trust for more than 10 years. At the

same time, in a sometimes volatile market, it is encouraging how many new names

are appearing in the portfolio, that meet the exacting standards we apply.

James Williams

Chairman

25 October 2021

^ Alternative Performance Measure (see Glossary).

Portfolio Manager's Review

Performance overview

The Company's net asset value per share total return over the half year was

5.6%. This compares to an increase in the Company's Performance Objective1 of

5.1% and a 6.6% decrease in the MSCI AC Asia ex Japan Index (measured on a

total return, sterling adjusted basis). These numbers point at a feature of the

year so far, a significant divergence in performance between countries in the

Asia Pacific region. In China, strengthening political headwinds had a chilling

impact on equities whereas, in stark contrast, equities in India proved to be

very popular. Six of the portfolio's largest detractors were companies

operating in China, while seven of the largest positive contributors were from

India. We have found that quality and sustainability transcend borders and

focusing on geography can be distracting. The Trust invests in companies and

not countries, but we do consider headwinds and tailwinds and the sheer size of

this performance differential bears examination.

What detracted from our return?

During the interim period many equities in China became less popular as

political headwinds strengthened against certain areas of the economy.

Companies falling foul of greater government scrutiny appeared to possess three

main characteristics: prominent stewards deemed capable of challenging higher

powers; franchises considered to be misaligned with social development; and

foreign investors facilitated by American Depositary Receipt ("ADR") listings

and/or corporate structures containing variable interest entities. American

listed education companies were sanctioned heavily. Here, it was decreed that

profit from the provision of private tuition was incompatible with social

development. By prohibiting these companies from making profit the government

effectively confiscated the assets. Shareholders lost more than 90% within a

few weeks. Fortunately, our focus on quality companies spared shareholders from

the worst of these tribulations, but political anxieties, particularly in China

and Hong Kong, did have a small negative impact on performance.

The biggest detractor from performance was Vitasoy, one of the largest holdings

in the portfolio. Vitasoy is a plant-based beverage manufacturer that is listed

in Hong Kong and expanding in China. Following an unpredictable debacle,

external to company purview, Vitasoy featured negatively in the national and

international press. This led to a social media outcry, a boycott of their

products by Chinese consumers and ultimately a profit warning. A recent call

with management confirmed their competence and that demand for Vitasoy's

products was rebounding. We are encouraged that the worst of this episode is in

the past and the Trust remains invested in this high-quality franchise.

Five other companies operating in China were also weak, but the cumulative

detraction was less than from Vitasoy alone. These companies were Unicharm

Corporation, Pigeon Corporation, Vinda International, Hualan Biological and AK

Medical. Rising input prices had a marginal short-term impact on manufacturers,

but there were no discernible political headwinds facing any of these

companies, save for the possibility of reduced product pricing at AK Medical.

This written, we are not complacent and we continue to evaluate any challenges

to capital preservation with a sharpened focus on political risk.

Outside China, equities in South East Asia were mostly lacklustre. The

portfolio suffered small performance detractions from Philippine Seven, a

convenience store operator headquartered in Manila; Humanica, a human resources

and accounting specialist in Thailand; and Bank OCBC Nisp in Indonesia. These

companies are particularly sensitive to local lockdown and economic challenges

and their recent weakness is understandable. The Trust remains invested in

these companies as their deep financial resilience, excellent stewardship and

strong franchises mean they are well placed to contribute to future returns as

economies recover.

1 Consumer Price Index ("CPI") + 6%. CPI data is quoted on a one month lag. See

Glossary for further information.

What contributed to our return?

Indian companies contributed positively to performance regardless of their

sector. The strongest contributor was Dr Lal Pathlabs which conducts medical

tests in radiology, pathology and cardiology. The title of their recently

released annual report, "Enabling Healthier Lives", provides a good explanation

for this strength as well as highlighting excellent sustainability credentials.

Dr Lal's supplemented their core franchise expansion with Covid testing

facilities and the value of the equity rose by nearly 60% in local terms.

Despite a pandemic induced boost, the company only tests 20 million patients a

year and we are comfortable that there is significant growth potential for this

franchise as high-quality operators continue to take market share in a

relatively unorganised market.

The second largest contributor was Tube Investments. Tube is expertly stewarded

by Mr Vellayan Subbiah, a descendant of the Murugappa family who founded a

conglomerate spanning 28 businesses across India and beyond over 120 years ago.

The company is currently one of India's leading manufacturers of metal formed

products for automotive, railway, construction and agriculture as well as a

leading manufacturer of bicycles. Since taking the reins in 2017, Velleyan has

improved the balance sheet, returns on capital and free cash flow generation.

This has set the scene for Tube's long-term ambition to evolve into a

high-quality industrial conglomerate capable of reinvesting free cash flow from

existing businesses into new growth engines. This year, we witnessed their

first major move with the acquisition of CG Power, a high-quality motor

franchise that had been severely mismanaged by previous owners. We have spent a

lot of time trying to understand how successful industrial conglomerates have

evolved globally and believe Tube has many of the right credentials for

long-term success.

The third strongest contributor was Marico. Marico is the dominant provider of

hair conditioning and healthy edible oils2 in India and is also present in

Bangladesh, Vietnam and parts of the Middle East and North Africa. Aided by the

pandemic, the company enjoyed a strong year on the back of a consumer

inclination towards better hygiene and healthier eating. After a number of

years of investment, we are now seeing their healthy foods business become a

material contributor to growth and profitability.

Only slightly less substantial, but no less important, other notable

contributors to performance were Cyient, Sundaram Finance and Elgi Equipment,

all from India. Each of these companies enjoyed a rebound in operations and

investor interest following extreme Covid related weakness in 2020. Lastly, a

relatively new investment in Tata Consumer Products performed well as the CEO,

Sunil D'Souza, showed progress removing ineffciencies from this newly created

consumer franchise.

Of course, India was not the only focus and three of the top ten contributors

were from China, South Korea and Hong Kong, namely Silergy, Naver and

Techtronic.

Silergy is listed in Taiwan, but operates in China, and designs analog

semiconductors, mostly for power management and effciency. Global demand for

integrated circuits has continued to be strong with shortages in supply

documented across countries and industries. Additionally, Silergy also benefits

from a localisation trend as China seeks semiconductor manufacturing

independence from foreign suppliers.

Naver is listed in South Korea and started in 2000 as a search engine dedicated

to Korean users. Since then, the group has prudently parlayed prodigious

cash-flows from search advertising revenues into a powerful internet ecosystem

offering financial services, media, commerce and cloud capabilities. The

steward here is Seong-sook Han and we have great admiration for the vibrant,

innovative and differentiated culture she has nurtured. Naver, like all

companies, is imperfect and we have been engaging, with some success, on

certain unwelcome employment practices. During the period Naver benefitted from

the increased need for virtual connectivity making it easier to launch and

develop new services within their expanding eco-system.

The last significant contributor to performance was Techtronic, which is listed

in Hong Kong. Techtronic is one of only three major competitors in the now

consolidated power tool manufacturing industry. During the period Techtronic

continued to benefit from buoyant demand from personal and commercial

construction activities. They also strengthened their industry position as the

marketplace continues to transition to cordless power tool technology, which is

dominated by Techtronic.

2 Marico's domestic market share of coconut oil hair conditioning and super

premium refined edible oils is 61% and 81%. Marico Investor Presentation, May

2021 https://m.marico.com/investorspdf/Investor_Presentation_May_2021.pdf

Transactions

The Trust purchased three new companies in China: Glodon, which provides

digital design and imaging services to the construction industry; Estun

Automation, a manufacturer of industrial automation; and Amoy Diagnostics,

which specialises in the early-stage detection of cancer.

Having sold the Trust's entire holding in Nippon Paint in November 2020, for

reasons of valuation only, with the share price weakening since that time and

with our confidence in the quality of its people, franchise and financials

undiminished, we reinitiated a holding in the period under review.

In India, we purchased four new franchises with strong growth opportunities: CG

Power & Industrial, which has a long history and strong franchise manufacturing

equipment for power generation, transmission and distribution; Cholamandalam

Financial Holdings (a subsidiary of the Murugappa Group), which provides

insurance and investments; Indiamart Intermesh, which digitally connects buyers

and sellers with over 72,000 mostly industrial components and goods; and

lastly, Biocon, which is a contract researcher and manufacturer of

pharmaceuticals.

The Trust sold out of four investments in the period. Two of these were banks:

OCBC in Singapore and Bank of Central Asia in Indonesia. The environment for

banks is challenging with new competitors and a diminished outlook for

profitable loan growth. We also sold Metropolis Healthcare and Indigo Paints.

Both of these were small holdings which we did not want to increase for reasons

of valuation.

Outlook

The Trust invests in companies and not in countries. When constructing the

portfolio we start with a blank sheet of paper and invest in companies with

strong sustainability positioning and high-quality franchises, people and

financials. When evaluating companies, we also consider political and economic

headwinds and tailwinds. These exacerbate weaknesses and magnify qualities.

During the interim period under review, political headwinds in China

strengthened. This exposed the legal or social frailties of many well-known but

lower quality companies. In the future, these political headwinds may wane but

the Trust will not compromise on quality and will continue to invest in the

highest quality stewards, franchises and financials to preserve and grow

shareholders' capital.

Stewart Investors

25 October 2021

Contribution by investment for the six months ended 31 July 2021

Top 10 contributors to and detractors from absolute performance (%)

Top 10 contributors to absolute performance for the 6 months ended 31 July 2021

Contribution to

Company Returns %

Dr Lal Pathlabs 1.23

Tube Investments 1.21

Marico 0.79

Silergy 0.64

Cyient 0.50

Tata Consumer Products 0.49

Sundaram Finance 0.48

NAVER 0.47

Techtronic Industries 0.47

Elgi Equipments 0.45

Top 10 detractors from absolute performance for the 6 months ended 31 July 2021

Contribution to

Company Returns %

Vitasoy International Holdings -1.63

Unicharm Corporation -0.42

Pigeon Corporation -0.37

Vinda International Holdings -0.30

Hualan Biological -0.25

Philippine Seven -0.24

Humanica -0.24

Bank OCBC -0.22

AK Medical Holdings -0.16

Kotak Mahindra Bank -0.14

Source: Stewart Investors.

Portfolio Valuation

as at 31 July 2021

Val'n % Total

Company Sector Country £'000 Assets

Hoya Corp Health Care Japan 18,374 4.2%

Tube Investments of India Consumer Discretionary India 17,847 4.1%

Mahindra & Mahindra Consumer Discretionary India 15,597 3.6%

Marico Consumer Staples India 15,257 3.5%

Unicharm Consumer Staples Japan 13,322 3.1%

Techtronic Industries Industrials Hong Kong 12,901 3.0%

Vitasoy International Consumer Staples Hong Kong 12,683 2.9%

Holdings

Voltronic Power Technology Industrials Taiwan 12,080 2.8%

Housing Development Finance Financials India 11,771 2.7%

Corporation

NAVER Communication Services South Korea 11,696 2.7%

Top 10 Investments 141,528 32.6%

Dr Lal Pathlabs Health Care India 10,910 2.5%

Koh Young Technology Information Technology South Korea 9,728 2.2%

Taiwan Semiconductor Information Technology Taiwan 9,144 2.1%

Manufacturing

Tata Consultancy Services Information Technology India 9,098 2.1%

Tata Consumer Products Consumer Staples India 8,994 2.1%

Kotak Mahindra Bank Financials India 8,844 2.0%

Delta Electronics Information Technology Taiwan 8,539 2.0%

Advantech Information Technology Taiwan 8,420 1.9%

Vinda International Consumer Staples China 8,130 1.9%

Silergy Information Technology China 7,823 1.8%

Top 20 Investments 231,158 53.2%

Info Edge Communication Services India 7,260 1.7%

Aavas Financiers Financials India 7,198 1.7%

Chroma Ate Information Technology Taiwan 7,178 1.7%

Dabur India Consumer Staples India 7,140 1.6%

Elgi Equipments Industrials India 7,027 1.6%

Dr. Reddy's Laboratories Health Care India 6,793 1.6%

PT Uni-Charm Indonesia Consumer Staples Indonesia 6,668 1.5%

CG Power & Industrial Industrials India 6,590 1.5%

Solutions

Vitrox Information Technology Malaysia 6,386 1.5%

Tech Mahindra Information Technology India 6,213 1.4%

Top 30 Investments 299,611 69.0%

Godrej Consumer Products Consumer Staples India 6,137 1.4%

Sundaram Finance Financials India 6,056 1.4%

Tata Communications Communication Services India 5,705 1.3%

Philippine Seven Consumer Staples Philippines 5,646 1.3%

Infosys Information Technology India 5,426 1.2%

Bank OCBC NISP Financials Indonesia 5,380 1.2%

Syngene International Health Care India 5,272 1.2%

Hualan Biological Engineering Health Care China 5,241 1.2%

Tokyo Electron Information Technology Japan 5,061 1.2%

PT Selamat Sempurna Consumer Discretionary Indonesia 4,871 1.1%

Top 40 Investments 354,406 81.5%

Marico Bangladesh Consumer Staples Bangladesh 4,744 1.1%

Shenzhen Inovance Technology Industrials China 4,707 1.1%

Mahindra Logistics Industrials India 4,453 1.0%

HDFC Life Insurance Financials India 4,133 1.0%

BRAC Bank Financials Bangladesh 4,107 0.9%

Shanthi Gears Industrials India 4,087 0.9%

Centre Testing International Industrials China 4,079 0.9%

Guangzhou Kingmed Diagnostics Health Care China 3,684 0.8%

Humanica Information Technology Thailand 3,644 0.8%

Glodon Information Technology China 3,031 0.7%

Top 50 Investments 395,075 90.7%

Estun Automation Industrials China 2,848 0.7%

Delta Brac Housing Finance Financials Bangladesh 2,677 0.6%

Cholamandalam Financial Financials India 2,427 0.6%

Holdings

Pigeon Corporation Consumer Staples Japan 2,401 0.6%

MediaTek Information Technology Taiwan 2,223 0.5%

Kasikornbank Financials Thailand 2,180 0.5%

Amoy Diagnostics Health Care China 2,148 0.5%

Biocon Health Care India 2,081 0.5%

Hemas Holdings Industrials Sri Lanka 2,001 0.5%

IndiaMart InterMesh Information Technology India 1,781 0.4%

AK Medical Holdings Health Care China 1,494 0.3%

Pentamaster International Information Technology Malaysia 1,371 0.3%

Cyient Information Technology India 831 0.2%

Nippon Paint Materials Japan 809 0.2%

Square Pharmaceuticals Health Care Bangladesh 156 0.0%

Total Investments 422,503 97.1%

Net current assets / 12,470 2.9%

(liabilities)

Total Shareholders Funds 434,973 100.0%

Financial Statements

Income Statement

for the six months ended 31 July 2021

(Unaudited) (Unaudited)

Six months ended Six months ended

31 July 2021 31 July 2020

Revenue Capital Total £ Revenue Capital Total

£'000 £'000 '000 £'000 £'000 £'000

Gains on investments - 24,349 24,349 - 1,966 1,966

Exchange differences on currency - (463) (463) - (87) (87)

balances

Investment Income 3,094 - 3,094 3,035 - 3,035

Portfolio Management and AIFM (514) (1,542) (2,056) (389) (1,166) (1,555)

fees (note 2)

Other expenses (344) - (344) (288) - (288)

Return before taxation 2,236 22,344 24,580 2,358 713 3,071

Taxation (415) (2,505) (2,920) (301) 1,117 816

Return after taxation 1,821 19,839 21,660 2,057 1,830 3,887

Return per ordinary share (note 3) 1.5p 16.4p 17.9p 1.7p 1.5p 3.2p

The Total column of this statement represents the Company's Income Statement.

The Revenue and Capital columns are supplementary to this and are both prepared

under guidance published by the Association of Investment Companies ("AIC").

All revenue and capital items in the Income Statement derive from continuing

operations.

The Company had no recognised gains or losses other than those declared in the

Income Statement.

All of the return and total comprehensive income for the period is attributable

to the owners of the Company.

Statement of Changes in Equity

for the six months ended 31 July 2021

(Unaudited) (Unaudited)

Six months Six months

ended ended

31 July 2021 31 July 2020

£'000 £'000

Opening shareholders' funds 416,216 345,717

Return for the period 21,660 3,887

Dividends paid (note 4) (2,903) (3,629)

Closing shareholders' funds 434,973 345,975

Statement of Financial Position

as at 31 July 2021

(Unaudited) (Audited)

As at As at

31 July 31 January

2021 2021

£'000 £'000

Fixed assets

Investments (note 5) 422,503 404,714

Current assets

Debtors 3,407 232

Cash and cash equivalents 19,501 17,823

22,908 18,055

Creditors (amounts falling due within one year) (2,718) (1,231)

Net current assets 20,190 16,824

Non-current liabilities

Provisions (note 6) (7,720) (5,322)

Net assets 434,973 416,216

Capital and reserves

Share capital 15,120 15,120

Share premium account 8,811 8,811

Capital redemption reserve 1,648 1,648

Special reserve 14,572 14,572

Capital reserve 389,114 369,275

Revenue reserve 5,708 6,790

Equity shareholders' funds 434,973 416,216

Net asset value per ordinary share (note 7) 359.6p 344.1p

Notes to the Financial Statements

1. Basis of preparation

The condensed Financial Statements for the six months to 31 July 2021 comprise

the statements set out above including the related notes below. They have been

prepared in accordance with FRS 104 'Interim Financial Reporting' and the

principles of the AIC's Statement of Recommended Practice issued in October

2019 and updated in April 2021, using the same accounting policies as set out

in the Company's Annual Report and Financial Statements for the year ended 31

January 2021.

Fair value

Under FRS 102 and FRS 104 investments have been classified using the following

fair value hierarchy:

Level 1 - Quoted prices in active markets.

Level 2 - Inputs other than quoted prices included within Level 1 that are

observable (i.e. developed using market data), either directly or indirectly.

Level 3 - Inputs are unobservable (i.e. for which market data is unavailable).

All of the Company's investments fall into Level 1 for the periods reported.

2. Portfolio Management and AIFM fees*

(Unaudited) (Unaudited)

Six months ended Six months ended

31 July 2021 31 July 2020

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Portfolio management fee - 456 1,369 1,825 344 1,032 1,376

Stewart Investors

AIFM fee - Frostrow 58 173 231 45 134 179

514 1,542 2,056 389 1,166 1,555

* Please refer to the most recent annual report for more details of the

management fee structure.

3. Return per ordinary share

The total return per ordinary share is based on the return attributable to

shareholders of £21,660,000 (six months ended 31 July 2020: return of £

3,887,000) and on 120,958,386 shares (six months ended 31 July 2020:

120,958,386 shares), being the weighted average number of shares in issue.

The revenue return per ordinary share is calculated by dividing the revenue

return attributable to shareholders of £1,821,000 (six months ended 31 July

2020: £2,057,000) by the weighted average number of shares in issue as above.

The capital return per ordinary share is calculated by dividing the capital

return attributable to shareholders of £19,839,000 (six months ended 31 July

2020: return of £1,830,000) by the weighted average number of shares in issue

as above.

4. Dividends

(Unaudited) (Unaudited)

Six months Six months

ended ended

31 July 2021 31 July 2020

Amounts recognised as distributions in the period:

Previous year's final dividend of 2.4p (2020: interim 2,903 3,629

dividend of 3.0p)

5. Investments

Six months to Year to

31 July 31 July 31 January

2021 2020 2021

Investments

Cost at start of period 267,140 222,736 222,736

Investment holding gains at start of 137,574 86,781 86,781

period

Valuation at start of period 404,714 309,517 309,517

Purchases at cost 37,762 63,520 110,858

Disposal proceeds (44,322) (41,245) (92,887)

Gains on investments 24,349 1,966 77,226

Valuation at end of period 422,503 333,758 404,714

Cost at end of period 275,584 252,451 267,140

Investment holding gains at end of period 146,919 81,307 137,574

Valuation at end of period 422,503 333,758 404,714

The Company received £44,322,000 (period to 31 July 2020: £41,245,000; year to

31 January 2021: £92,887,000) from investments sold in the period. The book

cost of these investments when they were purchased was £29,318,000 (period to

31 July 2020: £33,805,000; year to 31 January 2021: £66,454,000). These

investments have been revalued over time and until they were sold any

unrealised gains/losses were included in the fair value of the investments.

During the period the Company incurred transaction costs on purchases of £

63,000 (period to 31 July 2020: £76,000; year to 31 January 2021: £156,000) and

transaction costs on sales of £116,000 (period to 31 July 2020: £89,000; year

to 31 January 2021: £231,000).

6. Provisions

The provision at 31 July 2021 of £7,720,000 (31 January 2021: £5,322,000)

relates to a potential deferred tax liability for Indian capital gains tax that

may arise on the Company's Indian investments should they be sold in the

future, based on the net unrealised taxable capital gain at the period end and

on enacted Indian tax rates. The amount of any future tax amounts payable may

differ from this provision, depending on the value and timing of any future

sales of such investments and future Indian tax rates.

The capital tax charge shown in the Income Statement primarily results from the

movements on this provision.

7. Net asset value per ordinary share

The net asset value per ordinary share is based on the net assets attributable

to shareholders of £434,973,000 (31 January 2021: £416,216,000) and on

120,958,386 shares in issue (31 January 2021: 120,958,386).

8. 2021 accounts

These are not statutory accounts in terms of Section 434 of the Companies Act

2006 and are unaudited. Statutory accounts for the year to 31 January 2021,

which received an unqualified audit report, have been lodged with the Registrar

of Companies. No statutory accounts in respect of any period after 31 January

2021 have been reported on by an auditor or delivered to the Registrar of

Companies.

Earnings for the first six months should not be taken as a guide to the results

for the full year.

Interim Management Report

Principal Risks and Uncertainties

The Company's principal area of risk relates to its investment activity and

strategy, including currency risk in respect of the markets in which it

invests. Other risks faced by the Company include financial, shareholder

relations and operational risks (including cyber-crime, corporate governance,

accounting, legal, regulatory and political risks). These risks, and the way in

which they are managed, are described in more detail under the heading Risk

Management within the Strategic Report in the Company's Annual Report for the

year ended 31 January 2021. The Company's principal risks and uncertainties

have not changed materially since the date of that report and are not expected

to change materially for the remaining six months of the Company's financial

year.

The Board, the AIFM and the Portfolio Manager continually consider emerging

risks and monitor, amongst other things, the potential for the Company's

portfolio to be a?ected by the Covid-19 pandemic and geopolitical risks.

Related Party Transactions

During the first six months of the current financial year no material

transactions with related parties have taken place which have affected the

financial position or the performance of the Company during the period.

Going Concern

The Directors believe, having considered the Company's investment objective,

risk management policies, capital management policies and procedures, and the

nature of the portfolio and its expenditure projections, that the Company has

adequate resources, an appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the foreseeable

future. For these reasons, they consider it appropriate to continue to adopt

the going concern basis in preparing the financial statements. In reviewing the

position as at the date of this report, the Board has considered the guidance

on this matter issued by the Financial Reporting Council.

Directors' Responsibilities

The Board confirms that, to the best of the Directors' knowledge:

i. the condensed set of financial statements contained within the Half Year

Report has been prepared in accordance with Financial Reporting Standard

104 (Interim Financial Reporting); and

ii. the interim management report includes a fair review of the information

required by:

a. DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six

months of the financial year and their impact on the condensed set of

financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year; and

b. DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially affected

the financial position or performance of the entity during that period;

and any changes in the related party transactions described in the last

annual report that could do so.

This Half Year Report has not been audited or reviewed by an auditor.

This Half Year Report contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the information

available to them up to the date of this report and such statements should be

treated with caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking information.

For and on behalf of the Board

James Williams

Chairman

25 October 2021

Frostrow Capital LLP

Company Secretary

Glossary of Terms

AIFMD

The Alternative Investment Fund Managers Directive (the "Directive") is a

European Union Directive that entered into force on 22 July 2013. The

Directive, which was retained in UK law following the withdrawal of the UK from

the European Union, regulates fund managers that manage alternative investment

funds (including investment trusts).

Where an entity falls within the scope of the Directive, it must appoint a

single Alternative Investment Fund Manager ("AIFM"). The core functions of an

AIFM are portfolio and risk management. An AIFM can delegate one but not both

of these functions. The entity must also appoint an independent depositary

whose duties include the following: the safeguarding and verification of

ownership of assets; the monitoring of cashflows; and ensuring that appropriate

valuations are applied to the entity's assets

Alternative Performance Measures ("APMs")

Measures that are not specifically defined under International Financial

Reporting Standards, but which the Board of Directors views as particularly

relevant for investment trust companies and which it uses to assess the

Company's performance. Definitions of the terms used and the basis of

calculation are set out in this Glossary and the APMs are indicated with a

caret (^).

Average Discount

The average share price for the period divided by the average net asset value

for the period and expressed as a percentage (%).

Six months to Year to

31 July 31 January

2021 2021

pence pence

Average share price for the period 330.0 268.1

Average net asset value for the period 354.9 294.9

Average Discount 7.0% 9.1%

Net Asset Value Per Share

The value of the Company's assets, principally investments made in other

companies and cash held in the Company's bank accounts, minus any liabilities

and divided by the number of shares in issue. The net asset value is often

expressed in pence per share and it may also be described as 'shareholders'

funds' per share. The net asset value per share is unlikely to be the same as

the share price, which is the price at which the Company's shares can be bought

or sold by an investor. The share price is determined by the relationship

between the demand for and supply of the shares.

Net Asset Value Per Share Total Return^

The theoretical total return on shareholders' funds per share, reflecting the

change in net asset value assuming that dividends paid to shareholders were

reinvested at net asset value at the time the shares were quoted ex-dividend. A

way of measuring investment management performance of investment trusts which

is not affected by movements in the share price.

Six months to Year to

31 July 31 January

2021 2021

NAV Total Return pence pence

Opening net asset value per share 344.1 285.8

Increase in net asset value 17.9 61.3

Dividend paid (2.4) (3.0)

Closing Net Asset Value 359.6 344.1

% increase in net asset value 5.2% 21.4%

Impact of reinvested dividends 0.4% 0.9%

Net Asset Value Per Share Total Return 5.6% 22.3%

Ongoing Charges^

Ongoing charges are calculated by taking the Company's annualised operating

expenses excluding finance costs, taxation and exceptional items, and

expressing them as a percentage of the average daily net asset value of the

Company over the period. The costs of buying and selling investments are

excluded, as are interest costs, taxation, costs of buying back or issuing

shares and other non-recurring costs. These items are excluded because if

included, they could distort the understanding of the Company's performance for

the period and the comparability between periods.

Six months to Year to

31 July 31 January

2021 2021

£'000 £'000

Total Operating Expenses 2,400 4,010

Average Net Assets 429,540 356,104

Ongoing Charges* 1.1% 1.1%

* Annualised

Performance Objective

The Company's performance objective is to provide shareholders with a net asset

value per share total return in excess of the UK Consumer Price Index ("CPI")

plus 6 per cent. (calculated on an annual basis) measured over three to five

years. The Consumer Price Index is published by the UK Office for National

Statistics and represents inflation. The additional 6% is a fixed element to

represent what the Board considers to be a reasonable premium on investors'

capital which investing in the faster-growing Asian economies ought to provide

over time.

Company Net

Asset Value

Per Share

Total Return CPI + 6%

(annualised) (annualised)

(%) (%)

One year to 31 July 2021 26.6 8.3

Three years to 31 July 2021 9.5 8.0

Five years to 31 July 2021 10.7 8.3

Share Price Discount (or Premium) to the Net Asset Value Per Share^

A description of the difference between the share price and the net asset value

per share. The size of the discount or premium is calculated by subtracting the

share price from the net asset value per share and is usually expressed as a

percentage (%) of the net asset value per share. If the share price is higher

than the net asset value per share the result is a premium. If the share price

is lower than the net asset value per share, the shares are trading at a

discount.

Share Price Total Return^

Share price total return to a shareholder, on a last traded price to a last

traded price basis, assuming that all dividends received were reinvested,

without transaction costs, into the shares of the Company at the time the

shares were quoted ex-dividend.

Six months to Year to

31 July 31 January

2021 2021

Share Price Total Return pence pence

Opening share price 333.0 268.0

Increase in share price 5.4 68.0

Dividend Paid (2.4) (3.0)

Closing share price 336.0 333.0

% increase in share price 1.6% 25.4%

Impact of reinvested dividends 0.1% 0.4%

Share Price Total Return 1.7% 25.8%

MSCI Disclaimer

The MSCI information may only be used for your internal use, may not be

reproduced or redisseminated in any form and may not be used as a basis for or

a component of any financial instruments or products or indices. None of the

MSCI information is intended to constitute investment advice or a

recommendation to make (or refrain from making) any kind of investment decision

and may not be relied on as such. Historical data and analysis should not be

taken as an indication or guarantee of any future performance analysis,

forecast or prediction. The MSCI information is provided on an "as is" basis

and the user of this information assumes the entire risk of any use made of

this information. MSCI, each of its a?liates and each other person involved in

or related to compiling, computing or creating any MSCI information

(collectively, the "MSCI Parties") expressly disclaims all warranties

(including, without limitation, any warranties of originality, accuracy,

completeness, timeliness, non-infringement, merchantability and fitness for a

particular purpose) with respect to this information. Without limiting any of

the foregoing, in no event shall any MSCI Party have any liability for any

direct, indirect, special, incidental, punitive, consequential (including,

without limitation lost profits) or any other damages. (www.msci.com)

A member of the Association of Investment Companies

Pacific Assets Trust plc

Address for correspondence - 25 Southampton Buildings, London WC2A 1AL

www.pacific-assets.co.uk

END

(END) Dow Jones Newswires

October 26, 2021 02:00 ET (06:00 GMT)

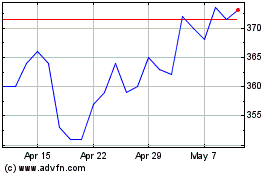

Pacific Assets (LSE:PAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pacific Assets (LSE:PAC)

Historical Stock Chart

From Jul 2023 to Jul 2024