TIDMPAGE

RNS Number : 4238I

PageGroup plc

07 August 2023

7 August 2023

Half Year Results for the Period Ended 30 June 2023

PageGroup plc ("PageGroup"), the specialist professional

recruitment company, announces its unaudited half year results for

the period ended 30 June 2023.

Financial summary Change

(6 months to 30 June 2023) 2023 2022 Change CC*

Revenue GBP1,033.9m GBP977.3m +5.8% +3.6%

------------ ---------- ------- -------

Gross profit GBP526.8m GBP538.9m -2.2% -4.4%

------------ ---------- ------- -------

Operating profit GBP63.9m GBP115.3m -44.6% -47.5%

------------ ---------- ------- -------

Profit before tax GBP63.3m GBP114.5m -44.7%

------------ ---------- -------

Basic earnings per share 13.6p 25.6p -46.9%

------------ ---------- -------

Diluted earnings per share 13.6p 25.5p -46.7%

------------ ---------- -------

Interim dividend per share 5.13p 4.91p

------------ ----------

Special dividend per share 15.87p 26.71p

------------ ----------

H1 Summary

-- Group operating profit of GBP63.9m (H1 2022: GBP115.3m)

-- Conversion rate** decreased to 12.1% (H1 2022: 21.4%)

-- Gross profit per fee earner down 5.8% on H1 2022 to GBP79.7k (H1 2022: GBP82.8k)

-- Total headcount decreased by 448 (5.0%) to 8,572 at the end of June

-- Strong Balance Sheet, with net cash of GBP97.9m (H1 2022: GBP136.2m)

-- Interim dividend up 4.5% to 5.13 pence per share, totalling GBP16.2m

-- Special dividend of 15.87 pence per share, totalling GBP50.0m

-- Outlook unchanged: Full year operating profit expected to be

in line with previous guidance

* in constant currencies

** operating profit as a percentage of gross profit

Commenting, Nicholas Kirk, Chief Executive Officer, said:

"The Group delivered a robust H1 performance against a record

first half in 2022. EMEA delivered the standout result, delivering

record H1 gross profit against a particularly strong comparator

across the region. However, tough market conditions continued in

Asia, the UK and the US. Overall, Group gross profit declined 4.4%

in constant currencies against H1 2022 . We delivered Group

operating profit of GBP63.9m at a conversion rate of 12.1%,

compared with 21.4% in H1 2022.

"The challenging conditions we saw towards the end of 2022

continued into H1 2023, with lower levels of both candidate and

client confidence resulting in delays in decision making and

candidates being more reluctant to accept offers. Reflecting the

uncertain macro-economic conditions, temporary recruitment

outperformed permanent, as clients sought more flexible options. In

line with these conditions, we reduced our fee earner headcount by

558 (-8.0%) in the first half, with reductions in all regions. Our

total headcount of 8,572 is 448 (-5.0%) lower than at the end of

2022. Productivity, measured as gross profit per fee earner,

declined 5.8%, reflecting the reduction in gross profit, although

this was partially offset by the decrease in headcount.

"We are announcing today an interim dividend of 5.13 pence per

share, an increase of 4.5% over 2022. In addition, in line with our

policy of returning surplus capital to shareholders, we are also

announcing a special dividend of 15.87 pence per share (2022: 26.71

pence per share) totalling GBP50.0m. Taking these two dividend

payments together, this amounts to a cash return to shareholders of

GBP66.2m. This is in addition to the 2022 final dividend paid in

June of GBP33.9m, resulting in a total return to shareholders in

2023 of GBP100.1m, or 31.76 pence per share.

"Looking forward, there remains a high level of global

macro-economic and political uncertainty in the majority of our

markets. However, against this backdrop, we continue to see

candidate shortages and good levels of vacancies, as well as

continued high fee rates. We are also seeing the benefits from our

investments in innovation and technology, where Customer Connect is

supporting productivity and enhancing customer experience and Page

Insights is providing real time data to inform business decisions.

We have a highly diversified and adaptable business model, a strong

balance sheet, and our cost base is under continuous review and can

be adjusted rapidly to match market conditions. Given these

fundamental strengths, we believe we will continue to perform well

despite the uncertainty. At this stage of the year, the Board

expects 2023 operating profit to be in line with our previous

guidance."

INTERIM MANAGEMENT REPORT

GROUP RESULTS

GROSS PROFIT GBPm Growth rates

% of Group H1 2023 H1 2022 Reported CC

----------- -------- -------- --------- -------

EMEA 55% 288.4 266.7 +8.1% +4.3%

----------- -------- -------- --------- -------

Americas 17% 89.1 94.2 -5.5% -8.2%

----------- -------- -------- --------- -------

Asia Pacific 16% 83.4 102.0 -18.3% -17.3%

----------- -------- -------- --------- -------

UK 12% 65.9 76.0 -13.2% -13.2%

----------- -------- -------- --------- -------

Total 100% 526.8 538.9 -2.2% -4.4%

----------- -------- -------- --------- -------

Permanent 74% 392.2 422.1 -7.1% -9.1%

----------- -------- -------- --------- -------

Temporary 26% 134.6 116.8 +15.3% +12.5%

----------- -------- -------- --------- -------

Revenue for the six months ended 30 June 2023 increased 5.8% to

GBP1,033.9m (2022: GBP977.3m) and gross profit decreased 2.2% to

GBP526.8m (2022: GBP538.9m). In constant currencies, the Group's

revenue increased 3.6% and gross profit decreased 4.4%. The Group's

revenue mix between permanent and temporary placements was 38:62

(2022: 44:56) and for gross profit was 74:26 (2022: 78:22). Revenue

from temporary placements comprises the salaries of those placed,

together with the margin charged.

Fee earner productivity decreased by 5.8% vs H1 2022 due to

reduced levels of candidate and client confidence resulting in an

increase in time to hire, as well as some reluctance to accept

offers, limiting the number of placements per fee earner.

The Group's organic growth model and profit-based team bonus

ensures costs remain tightly controlled. 77% of first half costs

were employee related, including salaries, bonuses, share-based

long-term incentives, and training and relocation costs.

In total, administrative expenses in the first half increased

9.3% in reported rates to GBP462.9m (2022: GBP423.6m), driven

largely by the higher average headcount in H1 2023 compared to H1

2022 and inflation. In constant currencies, administrative expenses

were up 7.3% and operating profit decreased by 47.5% to GBP63.9m

(2022: GBP115.3m), a decrease of 44.6% at reported rates. The

Group's conversion rate, which represents the ratio of operating

profit to gross profit, was 12.1% (2022: 21.4%) driven by the more

challenging trading conditions in 2023, combined with higher

costs.

OTHER ITEMS

Net interest expense of GBP0.5m was broadly consistent with H1

2022 (GBP0.8m). The effective tax rate for the first half was 31.9%

(H1 2022: 28.8%), with the increase on the prior year due to the

change in the UK tax rate from 19% to 25% from April 2023.

For the six months ended 30 June 2023, basic earnings per share

and diluted earnings per share were both 13.6p, representing a

decrease of 47% on 2022 (2022: basic earnings per share 25.6p;

diluted earnings per share 25.5p).

CASH FLOW

The Group started the year with net cash of GBP131.5m. In H1,

GBP83.7m was generated from operations due to H1 Operating Profit

as well a net outflow of working capital due to the stronger

performance in temporary recruitment. Tax paid was GBP27.3m and net

capital expenditure was GBP11.3m. During the first half, GBP0.8m

was received from exercises of share options (2022: GBP0.3m), GBP

17.5m was spent on the purchase of shares into the Employee Benefit

Trust (2022: GBP14.8m) and dividends of GBP33.9m were paid to

shareholders (2022: GBP32.7m). As a result, the Group had net cash

of GBP97.9m at 30 June 2023 (30 June 2022: GBP136.2m).

CAPITAL ALLOCATION POLICY

It is the Directors' intention to continue to finance the

activities and development of the Group from retained earnings and

to maintain a strong balance sheet position.

The Group's first use of cash is to satisfy operational and

investment requirements, as well as to hedge its liabilities under

the Group's share plans. The level of cash required for this

purpose will vary depending upon the revenue mix of geographies,

permanent and temporary recruitment, and point in the economic

cycle.

Our second use of cash is to make returns to shareholders by way

of an ordinary dividend. Our policy is to grow the ordinary

dividend over the course of the economic cycle in a way that we

believe we can sustain the level of ordinary dividend payment

during downturns, as well as increasing it during more prosperous

times.

Cash generated in excess of these first two priorities will be

returned to shareholders through supplementary returns, using

special dividends and/or share buybacks.

The Board has announced an interim dividend of 5.13 pence per

share, an increase of 4.5% over last year. In addition, in line

with our policy of returning surplus capital to shareholders, the

Group is pleased to announce today a special dividend of 15.87

pence per share (2022: 26.71 pence per share) totalling GBP50.0m.

Taking these two dividend payments together, this amounts to a cash

return to shareholders of GBP66.2m. This is in addition to the 2022

final dividend paid in June of GBP33.9m, meaning a total of

GBP100.1m, or 31.76 pence per share, returned to shareholders in

2023.

The special dividend will be paid, as in previous years, at the

same time as the interim dividend on 13 October 2023 to

shareholders on the register as at 1 September 2023.

During the first half, the Group made purchases of GBP 17.5m of

shares into the Employee Benefit Trust to hedge its exposure under

the Group's share plans (2022: GBP14.8m).

GEOGRAPHICAL ANALYSIS ( All growth rates given below are in

constant currency vs. H1 2022 unless otherwise stated )

EUROPE, MIDDLE EAST AND AFRICA (EMEA)

EMEA GBPm Growth rates

(55 % of Group in H1 2023) H1 2023 H1 2022 Reported CC

-------- -------- --------- -------

Revenue 580.5 523.0 +11.0% +6.9%

-------- -------- --------- -------

Gross Profit 288.4 266.7 +8.1% +4.3%

-------- -------- --------- -------

Operating Profit 47.8 65.3 -26.8% -29.8%

-------- -------- --------- -------

Conversion Rate (%) 16.6% 24.5%

-------- -------- --------- -------

EMEA is the Group's largest region, contributing 55% of Group

first half gross profit. Against 2022, in reported rates, revenue

in the region increased 11.0% to GBP580.5m (2022: GBP523.0m) and

gross profit increased 8.1% to GBP288.4m (2022: GBP266.7m). In

constant currencies, revenue increased 6.9% on the first half of

2022 and gross profit increased by 4.3%.

The region was our strongest performing in H1 2023, delivering

record gross profit against a particularly tough comparator.

Against 2022, gross profit in Michael Page grew 3%, whilst our more

temporary focused Page Personnel business was up 6%. France, 14% of

Group gross profit and around a quarter of the region, delivered

record gross profit against a very tough comparator, up 2% on 2022.

Germany, the Group's second largest market, also delivered a record

first half, up 9%. This was driven by strong performances from both

our Page Personnel and our Technology focused Interim businesses,

which grew 21% and 22%, respectively. Southern Europe grew 3%, with

Italy down 1% and Spain up 1%. Benelux was up 4% for the first

half, with the Netherlands down 1% whilst Belgium grew 15%. The

Middle East and Africa grew 20%, a record H1, driven largely by a

record performance in the UAE.

Productivity for the first half was down 4.3% on the record

levels achieved in H1 2022, with total headcount up 220 (5.8%)

versus Q2 2022. H1 operating profit was GBP47.8m (2022: GBP65.3m)

with a conversion rate of 16.6% (2022: 24.5%). Profitability

decreased on 2022 due the reduction in productivity, combined with

the higher cost base. Headcount across the region decreased by 50

(1.2%) in the first half, to 4,035 at the end of June 2023 (4,085

at 31 December 2022).

THE AMERICAS

Americas GBPm Growth rates

(17% of Group in H1 2023) H1 2023 H1 2022 Reported CC

-------- -------- --------- -------

Revenue 151.0 137.3 +10.0% +8.3%

-------- -------- --------- -------

Gross Profit 89.1 94.2 -5.5% -8.2%

-------- -------- --------- -------

Operating Profit 5.9 13.8 -57.1% -70.9%

-------- -------- --------- -------

Conversion Rate (%) 6.7% 14.7%

-------- -------- --------- -------

In the Americas, representing 17% of Group first half gross

profit, revenue increased 10.0% in reported rates against 2022, to

GBP151.0m (2022: GBP137.3m), while gross profit declined 5.5% to

GBP89.1m (2022: GBP94.2m). In constant currencies against 2022,

revenue increased by 8.3% and gross profit declined 8.2%.

North America declined against 2022, a record comparator, with

the US down 16%. Conditions remained tough throughout the first

half, as uncertainty around market conditions impacted candidate

and client confidence, and we experienced a higher level of

candidate buybacks.

Latin America delivered growth of 4%. Mexico, our largest

country in the region, declined 6% and Brazil declined 11%.

Elsewhere in Latin America, our other five countries in the region

grew 24%, collectively, with Argentina, Colombia and Panama all

delivering record first halves.

For the region overall, productivity in H1 decreased 3.6%

compared with H1 2022, with North America down 9% and Latin America

up 7%. Operating profit was GBP5.9m (2022: GBP13.8m), with a

conversion rate of 6.7% (2022: 14.7%). Our conversion rate was down

on H1 2022, due to the lower productivity and higher cost base.

Headcount across the region decreased by 190 (11.3%) in H1, to

1,500 at the end of June 2023 (1,690 at 31 December 2022).

ASIA PACIFIC

Asia Pacific GBPm Growth rates

(16% of Group in H1 2023) H1 2023 H1 2022 Reported CC

-------- -------- --------- -------

Revenue 149.8 159.3 -6.0% -4.7%

-------- -------- --------- -------

Gross Profit 83.4 102.0 -18.3% -17.3%

-------- -------- --------- -------

Operating Profit 4.5 20.9 -78.7% -75.9%

-------- -------- --------- -------

Conversion Rate (%) 5.3% 20.5%

-------- -------- --------- -------

In Asia Pacific, representing 16% of Group first half gross

profit, revenue decreased 6.0% in reported rates to GBP149.8m

(2022: GBP159.3m) and gross profit decreased 18.3% to GBP83.4m

(2022: GBP102.0m), against 2022. In constant currencies, revenue

decreased 4.7% in H1 and gross profit decreased 17.3%.

Gross profit in Greater China declined 37%. In Mainland China,

gross profit was down 42% on 2022, due to the slower than

anticipated recovery following the lifting of COVID restrictions

during H1. Hong Kong declined 28%. South East Asia declined 18%,

with Singapore down 22%, whilst the other five countries in the

region declined 17%, collectively. India grew 3% and delivered a

record H1, against a very strong comparator. Overall, for the first

half, Japan declined 3% and Australia declined 2%.

First half productivity was down 13.6% on 2022, due to the

continued challenging trading conditions across the region. We

delivered GBP4.5m of operating profit (2022: GBP20.9m) at a

conversion rate of 5.3% (2022: 20.5%), significantly behind the

comparative period due to the much tougher trading conditions.

Headcount across the region decreased by 111 in the first half

(6.0%) to 1,731 at the end of June 2023 (1,842 at 31 December

2022).

UNITED KINGDOM

UK GBPm Growth rate

(12% of Group in H1 2023) H1 2023 H1 2022

-------- -------- ------------

Revenue 152.5 157.7 -3.2%

-------- -------- ------------

Gross Profit 65.9 76.0 -13.2%

-------- -------- ------------

Operating Profit 5.7 15.3 -62.9%

-------- -------- ------------

Conversion Rate (%) 8.6% 20.1%

-------- -------- ------------

In the UK, representing 12% of Group first half gross profit,

revenue decreased 3.2% vs. 2022 to GBP152.5m (2022: GBP157.7m) and

gross profit declined 13.2% to GBP65.9m (2022: GBP76.0m).

Gross profit in our Michael Page business was down 17% in the

first half. Page Personnel, which operates at lower salary levels

with a higher degree of temporary recruitment, was down 5%.

First half productivity was down 8.5% on the prior year, with H1

2022 being at record levels. Operating profit was GBP5.7m (2022:

GBP15.3m) and our conversion rate was 8.6% (2022: 20.1%). This

weaker conversion rate was due primarily to the more challenging

trading conditions, combined with a higher cost base than in the

prior year. Headcount was down 97 (6.9%) during the first half to

1,307 at the end of June 2023 (1,404 at 31 December 2022).

KEY PERFORMANCE INDICATORS ("KPIs")

We measure our progress against our strategic objectives using

the following key performance indicators:

KPI Definition, method of calculation and analysis

Gross profit How measured: Gross profit represents revenue less

growth cost of sales and consists of the total placement

fees of permanent candidates, the margin earned on

the placement of temporary candidates and the margin

on advertising income, i.e. it represents net fee

income. The measure used is the increase or decrease

in gross profit as a percentage of the prior year

gross profit.

Why it's important: The growth of gross profit relative

to the previous year is an indicator of the growth

in net fees of the business as a whole. It demonstrates

whether we are in line with our strategy to grow the

business.

How we performed in H1 2023: Trading conditions continued

to be challenging through the first half of 2023 which

resulted in a decline in gross profit of -2.2% vs.

H1 2022 in reported rates and -4.4% in constant currencies.

Relevant strategic objective: Organic growth

--------------------------------------------------------------

Gross profit How measured: Total gross profit from a) geographic

diversification regions outside the UK; and b) disciplines outside

of Accounting and Financial Services, each expressed

as a percentage of total gross profit.

Why it's important: These percentages give an indication

of how the business has diversified its revenue streams

away from its historic concentrations in the UK and

from the Accounting and Financial Services discipline.

How we performed in H1 2023: Geographies: the percentage

outside the UK increased to 87.5% (H1 2022: 85.9%),

due to the strong H1 gross profit growth in EMEA,

whilst all other regions were in decline.

Disciplines: the percentage outside of Accounting

and Financial Services was broadly in line with H1

2022 at 68.2% (H1 2022: 68.8%).

Relevant strategic objective: Diversification

--------------------------------------------------------------

Ratio of gross How measured: Gross profit from each type of placement

profits generated expressed as a percentage of total gross profit.

from permanent

and temporary Why it's important: This ratio helps us to understand

placements where we are in the economic cycle, since the temporary

market tends to be more resilient when the economy

is weak. However, in several of our core strategic

markets, working in a temporary role or as a contractor

or interim employee is not currently normal practice,

for example in Mainland China.

How we performed in H1 2023: 74% of our gross profit

was generated from permanent placements, below the

78% in 2022. Permanent recruitment declined 9.1% in

constant currencies against 2022, whilst temporary

recruitment, grew 12.5%. This reflects the current

economic climate, with clients looking for more flexibility

in their hiring decisions.

Relevant strategic objective: Organic growth

--------------------------------------------------------------

Gross profit How measured: Gross profit for the year divided by

per fee earner the average number of fee earners in the year.

Why it's important: This is a key indicator of productivity.

How we performed in H1 2023: Gross profit per fee

earner of GBP79.7k was down 5.8% vs. 2022 in constant

currencies. Although we continued to see the benefits

of video interviewing reducing time to hire, combined

with the data and technology investments made by the

Group in recent years, trading conditions were significantly

more challenging than in H1 2022.

Relevant strategic objective: Organic growth

--------------------------------------------------------------

Conversion rate How measured: Operating profit (EBIT) as a percentage

of gross profit.

Why it's important: This demonstrates the Group's

effectiveness at controlling the costs and expenses

associated with its normal business operations. It

will be impacted by the level of productivity and

the level of investment for future growth.

How we performed in H1 2023: Operating profit as

a percentage of gross profit decreased to 12.1% compared

to the prior year (H1 2022: 21.4%), driven by the

reduced productivity and higher cost base.

Relevant strategic objective: Sustainable growth

--------------------------------------------------------------

Basic earnings How measured: Profit for the year attributable to

per share the Group's equity shareholders, divided by the weighted

average number of shares in issue during the year.

Why it's important: This measures the overall profitability

of the Group.

How we performed in H1 2023: Earnings per share (EPS)

in H1 2023 was 13.6p, a decrease of 46.9% on the 2022

EPS of 25.6p. The decline is due to the lower profit

for the period, driven by the more adverse trading

conditions.

Relevant strategic objective: Build for the long-term,

organic growth

--------------------------------------------------------------

Fee-earner headcount How measured: Number of fee-earners and directors

growth involved in revenue-generating activities at the period

end, expressed as the percentage change compared to

the prior year.

Why it's important: Growth in fee-earners is a guide

to our confidence in the business and macro-economic

outlook, as it reflects expectations as to the level

of future demand above the existing capacity within

the business.

How we performed in H1 2023: Net fee earner headcount

decreased by 558 (8.0%) in H1 2023, resulting in 6,385

fee earners at the end of June. We have reduced our

fee earner headcount in all regions, in response to

the more challenging trading conditions.

Relevant strategic objective: Sustainable growth

--------------------------------------------------------------

Net cash How measured: Cash and short-term deposits less bank

overdrafts and loans.

Why it's important: The level of net cash is a key

measure of our success in managing our working capital

and determines our ability to reinvest in the business

and to return cash to shareholders.

How we performed in H1 2023: Net cash at 30 June

2023 was GBP97.9m (H1 2022: GBP136.2m). The 2023 balance

is after the payment of the 2022 final dividend of

GBP33.9m and the purchase of shares into the Employee

Benefit Trust of GBP17.5m (H1 2022: GBP14.8m).

Relevant strategic objective: Build for the long-term

--------------------------------------------------------------

The source of data and calculation methods year-on-year are on a

consistent basis. The movements in KPIs are in line with

expectations. Disclosure for GHG emissions and People KPIs is

provided annually.

PRINCIPAL RISKS AND UNCERTAINTIES

The management of the business and the execution of the Group's

strategy are subject to a number of risks.

The main risks that PageGroup believes could potentially impact

the Group's operating and financial performance for the remainder

of the financial year remain those as set out in the Annual Report

and Accounts for the year ending 31 December 2022 on pages 56 to

64.

TREASURY MANAGEMENT, BANK FACILITIES AND CURRENCY RISK

The Group operates multi-currency cash concentration and

notional cash pools, and an interest enhancement facility. The

Eurozone subsidiaries and the UK-based Group Treasury subsidiary

participate in the cash concentration arrangement. The Group

Treasury subsidiary and UK business utilise the notional cash pool

and the Asia Pacific subsidiaries operate the interest enhancement

facility. The structures facilitate interest compensation for cash

whilst supporting working capital requirements.

The Group maintains a Confidential Invoice Facility with HSBC

whereby the Group has the option to discount receivables in order

to advance cash. The Group also has a Revolving Credit Facility

with BBVA, expiring in December 2027, with a total drawable amount

of GBP80m. Neither of these facilities were in use as at 30 June

2023. These facilities are used on an ad hoc basis to fund any

major Group sterling cash outflows.

The main functional currencies of the Group are Sterling, Euro,

Chinese Renminbi, US Dollar, Singapore Dollar, Hong Kong Dollar and

Australian Dollar. The Group does not have material transactional

currency exposures. The Group is exposed to foreign currency

translation differences in accounting for its overseas operations.

The Group's policy is not to hedge translation exposures.

In certain cases, where the Group gives or receives short-term

loans to and from other Group companies that differ from the

Group's reporting currency, it may use short-dated foreign exchange

swap derivative financial instruments to manage the currency and

interest rate exposure that arises on these loans.

ESG

Our ESG strategy drives purposeful impact today and will

continue to evolve alongside our business. In April 2023, we

published our third sustainability report, highlighting the

progress we've made on our four Sustainability goals over the

course of 2022. This includes:

-- Changing 135,000 lives in 2022

-- Increasing our proportion of women in leadership roles to 43%

-- Decreasing our scope 1 & 2 emissions by 30% vs 2021

-- Increasing net fees from our sustainability business by 120% vs 2021

H1 2023 has delivered continued and strong progress against all

key targets. We have also committed to set a Science-based Target

and are working on our submission to the Science-based Target

Initiative.

We are now well on our way to reaching our sustainability goals,

as we strive to support the transition to a more equitable and

greener society. For further information on our sustainability

efforts, please refer to https://www.page.com/sustainability .

GOING CONCERN

The Board has undertaken a review of the Group's forecasts and

associated risks and sensitivities, in the period from the date of

approval of the interim financial statements to August 2024 (review

period).

The Group had GBP97.9m of cash as at 30 June 2023, with no debt

except for IFRS 16 lease liabilities of GBP103.6m. Debt facilities

relevant to the review period comprise a committed GBP80m RCF

maturing December 2027, an uncommitted UK trade debtor discounting

facility (up to GBP50m depending on debtor levels) and an

uncommitted GBP20m UK bank overdraft facility. None of these

facilities were in use as at 30 June 2023.

Despite the macroeconomic and political uncertainty that

currently exists, and its inherent risk and impact on the business,

based on the analysis performed there are no plausible downside

scenarios that the Board believes would cause a liquidity issue.

Having considered the Group's forecasts, the level of cash

resources available to the business and the Group's borrowing

facilities, the Group's geographical and discipline

diversification, limited concentration risk, as well as the ability

to manage the cost base, the Board has concluded that the Group and

therefore the Company has adequate resource to continue in

operation existence for the period through to August 2024.

CAUTIONARY STATEMENT

This Interim Management Report ("IMR") has been prepared solely

to provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose. This IMR contains certain forward-looking

statements. These statements are made by the directors in good

faith based on the information available to them up to the time of

their approval of this report and such statements should be treated

with caution due to the inherent uncertainties, including both

economic and business risk factors, underlying any such

forward-looking information.

This IMR has been prepared for the Group as a whole and

therefore gives greater emphasis to those matters that are

significant to PageGroup plc and its subsidiary undertakings when

viewed as a whole.

Page House

Bourne Business Park

200 Dashwood Lang Road

Addlestone

Weybridge

Surrey

KT15 2NX

By order of the Board,

Nicholas Kirk Kelvin Stagg

Chief Executive Officer Chief Financial Officer

4 August 2023 4 August 2023

PageGroup will host a conference call, with on-line slide

presentation, for analysts and investors at 8.30am on 7 August

2023, the details of which are below.

Link:

https://www.investis-live.com/pagegroup/64b938709b8a600d00c5206e/paau

Please use the following dial-in number to join the

conference:

United Kingdom (Local) 020 4587 0498

All other locations +44 20 4587 0498

Please quote participant access code 51 80 95 to gain access to

the call.

A presentation and recording to accompany the call will be

posted on the PageGroup website during the course of the morning of

7 August 2023 at:

https://www.page.com/presentations/year/2023

Enquiries:

PageGroup +44 (0)20 3077 8425

Nicholas Kirk, Chief Executive Officer

Kelvin Stagg, Chief Financial Officer

FTI Consulting +44 (0)20 3727 1340

Richard Mountain / Susanne Yule

INDEPENT REVIEW REPORT TO PAGEGROUP PLC

Conclusion

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2023 which comprises the Condensed

Consolidated Income Statement, the Condensed Consolidated Statement

of Comprehensive Income, the Condensed Consolidated Balance Sheet,

the Condensed Consolidated Statement of Changes in Equity, the

Condensed Consolidated Statement of Cash Flows and the related

notes 1 to 13. We have read the other information contained in the

half yearly financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34 and the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements 2410 (UK) "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" (ISRE) issued by the Financial Reporting Council. A review

of interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures. A

review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis of Conclusion

section of this report, nothing has come to our attention to

suggest that management have inappropriately adopted the going

concern basis of accounting or that management have identified

material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with this ISRE, however future events or conditions may

cause the entity to cease to continue as a going concern.

Responsibilities of the directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statements in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK) "Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Financial

Reporting Council. To the fullest extent permitted by law, we do

not accept or assume responsibility to anyone other than the

company, for our work, for this report, or for the conclusions we

have formed.

Ernst & Young LLP

London

4th August 2023

Condensed Consolidated Income Statement

For the six months ended 30 June 2023

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Revenue 3 1,033,886 977,257 1,990,287

Cost of sales (507,095) (438,354) (913,993)

Gross profit 3 526,791 538,903 1,076,294

Administrative expenses (462,934) (423,586) (880,215)

---------- ---------- ------------

Operating profit 3 63,857 115,317 196,079

Financial income 4 829 392 1,104

Financial expenses 4 (1,378) (1,212) (2,817)

Profit before tax 3 63,308 114,497 194,366

Income tax expense 5 (20,176) (33,000) (55,354)

---------- ---------- ------------

Profit for the period 43,132 81,497 139,012

---------- ---------- ------------

Attributable to:

Owners of the parent 43,132 81,497 139,012

---------- ---------- ------------

Earnings per share

Basic earnings per share (pence) 8 13.6 25.6 43.7

Diluted earnings per share (pence) 8 13.6 25.5 43.5

---------- ---------- ------------

The above results all relate to continuing operations

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit for the period 43,132 81,497 139,012

Other comprehensive (loss)/income for

the period

Items that may subsequently be reclassified

to profit and loss:

Currency translation differences (13,997) 10,968 15,441

Total comprehensive income for the period 29,135 92,465 154,453

---------- ---------- ------------

Attributable to:

Owners of the parent 29,135 92,465 154,453

---------- ---------- ------------

Condensed Consolidated Balance Sheet

As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 9 37,665 33,251 36,123

Right-of-use assets 93,395 93,188 100,996

Intangible assets - Goodwill and

other intangible 1,859 2,036 1,955

- Computer software 33,880 42,740 38,045

Deferred tax assets 20,421 19,941 18,641

Other receivables 10 12,890 12,989 13,224

200,110 204,145 208,984

---------- ---------- ------------

Current assets

Trade and other receivables 10 411,725 441,274 437,247

Current tax receivable 21,095 22,048 17,233

Cash and cash equivalents 13 97,939 136,227 131,480

530,759 599,549 585,960

---------- ---------- ------------

Total assets 3 730,869 803,694 794,944

---------- ---------- ------------

Current liabilities

Trade and other payables 11 (258,308) (256,958) (289,108)

Provisions 12 (3,737) (2,236) (2,772)

Lease liabilities (32,984) (29,746) (31,268)

Current tax payable (15,457) (32,785) (18,050)

(310,486) (321,725) (341,198)

---------- ---------- ------------

Net current assets 220,273 277,824 244,762

---------- ---------- ------------

Non-current liabilities

Other payables 11 (8,455) (13,883) (14,951)

Lease liabilities (70,643) (71,878) (78,564)

Deferred tax liabilities (2,619) (1,475) (1,345)

Provisions 12 (4,812) (7,443) (6,683)

(86,529) (94,679) (101,543)

---------- ---------- ------------

Total liabilities 3 (397,015) (416,404) (442,741)

---------- ---------- ------------

Net assets 333,854 387,290 352,203

---------- ---------- ------------

Capital and reserves

Called-up share capital 3,286 3,286 3,286

Share premium 99,564 99,564 99,564

Capital redemption reserve 932 932 932

Reserve for shares held in the employee

benefit trust (73,123) (56,875) (56,626)

Currency translation reserve 18,341 27,865 32,338

Retained earnings 284,854 312,518 272,709

Total equity 333,854 387,290 352,203

---------- ---------- ------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Reserve

for

shares

held in

Called-up Capital the Currency

share Share redemption employee translation Retained Total

benefit

capital premium reserve trust reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January 2022 3,286 99,564 932 (47,338) 16,897 266,764 340,105

---------- -------- ----------- --------- ------------ ---------- ----------

Currency translation differences - - - - 10,968 - 10,968

---------- -------- ----------- --------- ------------ ---------- ----------

Net income recognised directly in

equity - - - - 10,968 - 10,968

Profit for the six months ended 30

June 2022 - - - - - 81,497 81,497

Total comprehensive income for the

period - - - - 10,968 81,497 92,465

---------- -------- ----------- --------- ------------ ---------- ----------

Purchase of shares held in the

employee

benefit trust - - - (14,837) - - (14,837)

Exercise of share plans - - - - - 276 276

Reserve transfer when shares held

in the employee benefit trust vest - - - 5,300 - (5,300) -

Credit in respect of share schemes - - - - - 2,922 2,922

Debit in respect of tax on share

schemes - - - - - (901) (901)

Dividends - - - - - (32,740) (32,740)

---------- -------- ----------- --------- ------------ ---------- ----------

- - - (9,537) - (35,743) (45,280)

Balance at 30 June 2022 3,286 99,564 932 (56,875) 27,865 312,518 387,290

---------- -------- ----------- --------- ------------ ---------- ----------

Currency translation differences - - - - 4,473 - 4,473

---------- -------- ----------- --------- ------------ ---------- ----------

Net income recognised directly in

equity - - - - 4,473 - 4,473

Profit for the six months ended 31

December 2022 - - - - - 57,515 57,515

Total comprehensive income for the

period - - - - 4,473 57,515 61,988

---------- -------- ----------- --------- ------------ ---------- ----------

Purchase of shares held in the

employee

benefit trust - - - (1) - - (1)

Exercise of share plans - - - - - 171 171

Reserve transfer when shares held

in the employee benefit trust vest - - - 250 - (250) -

Credit in respect of share schemes - - - - - 3,067 3,067

Credit in respect of tax on share

schemes - - - - - 195 195

Dividends - - - - - (100,507) (100,507)

- - - 249 - (97,324) (97,075)

---------- -------- ----------- --------- ------------ ---------- ----------

Balance at 31 December 2022 3,286 99,564 932 (56,626) 32,338 272,709 352,203

---------- -------- ----------- --------- ------------ ---------- ----------

Balance at 1 January 2023 3,286 99,564 932 (56,626) 32,338 272,709 352,203

---------- -------- ----------- --------- ------------ ---------- ----------

Currency translation differences - - - - (13,997) - (13,997)

---------- -------- ----------- --------- ------------ ---------- ----------

Net expense recognised directly in

equity - - - - (13,997) - (13,997)

Profit for the six months ended 30

June 2023 - - - - - 43,132 43,132

---------- -------- ----------- --------- ------------ ---------- ----------

Total comprehensive (expense)/income

for the period - - - - (13,997) 43,132 29,135

---------- -------- ----------- --------- ------------ ---------- ----------

Purchase of shares held in employee

benefit trust - - - (17,529) - - (17,529)

Exercise of share plans - - - - - 759 759

Reserve transfer when shares held

in the employee benefit trust vest - - - 1,032 - (1,032) -

Credit in respect of share schemes - - - - - 2,462 2,462

Credit in respect of tax on share

schemes - - - - - 713 713

Dividends - - - - - (33,889) (33,889)

- - - (16,497) - (30,987) (47,484)

---------- -------- ----------- --------- ------------ ---------- ----------

Balance at 30 June 2023 3,286 99,564 932 (73,123) 18,341 284,854 333,854

---------- -------- ----------- --------- ------------ ---------- ----------

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Note

Profit before tax 63,308 114,497 194,366

Depreciation, amortisation charges

and expense of computer software 31,913 33,519 60,592

Loss on sale of property, plant

and equipment 144 43 4,398

Share scheme charges 2,468 2,923 5,989

Net finance costs 549 820 1,713

---------- ---------- ------------

Operating cash flow before changes

in working capital 98,382 151,802 267,058

Decrease/(increase) in receivables 13,375 (71,612) (61,509)

(Decrease)/increase in payables (28,045) 12,309 40,821

---------- ---------- ------------

Cash generated from operations 83,712 92,499 246,370

Income tax paid (27,337) (30,023) (61,598)

---------- ---------- ------------

Net cash from operating activities 56,375 62,476 184,772

---------- ---------- ------------

Cash flows from investing activities

Purchases of property, plant and

equipment (9,530) (12,723) (21,982)

Purchases and capitalisation of

intangible assets (1,848) (6,558) (9,693)

Proceeds from the sale of property,

plant and equipment, and computer

software 85 336 2,080

Interest received 829 392 1,104

---------- ---------- ------------

Net cash used in investing activities (10,464) (18,553) (28,491)

---------- ---------- ------------

Cash flows from financing activities

Dividends paid (33,889) (32,740) (133,247)

Interest paid (266) (527) (1,213)

Lease liability repayment (18,779) (17,047) (35,896)

Issue of own shares for the exercise

of options 759 276 447

Purchase of shares into the employee

benefit trust (17,529) (14,837) (14,838)

Net cash used in financing activities (69,704) (64,875) (184,747)

---------- ---------- ------------

Net decrease in cash and cash

equivalents (23,793) (20,952) (28,466)

Cash and cash equivalents at the

beginning of the period 131,480 153,983 153,983

Exchange (loss)/gain on cash and

cash equivalents (9,748) 3,196 5,963

Cash and cash equivalents at the

end of the period 13 97,939 136,227 131,480

---------- ---------- ------------

Notes to the condensed set of interim results

For the six months ended 30 June 2023

1. General information

The information for the year ended 31 December 2022 does not

constitute statutory accounts as defined in section 435 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditors

reported on those accounts: their report was unqualified, did not

draw attention to any matters by way of emphasis and did not

contain a statement under section 498(2) or (3) of the Companies

Act 2006.

The unaudited interim condensed consolidated financial

statements of PageGroup plc and its subsidiaries (collectively, the

Group) for the six months ended 30 June 2023 were authorised for

issue in accordance with a resolution of the directors on 4 August

2023.

2. Accounting policies

Basis of preparation

The unaudited interim condensed consolidated financial

statements for the six months ended 30 June 2023 have been prepared

in accordance with UK adopted IAS 34 'Interim financial reporting'

and with the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority.

The unaudited interim condensed consolidated financial

statements do not constitute the Group's statutory financial

statements. The Group's most recent statutory financial statements,

which comprise the annual report and audited financial statements

for the year ended 31 December 2022, were approved by the directors

on 9 March 2023. The interim condensed consolidated financial

statements should be read in conjunction with the Annual Report and

Accounts for the year ended 31 December 2022, which have been

prepared in accordance with UK-adopted international accounting

standards ("IFRSs").

Going concern

The Board has undertaken a review of the Group's forecasts and

associated risks and sensitivities, in the period from the date of

approval of the interim financial statements to August 2024 (review

period).

The Group had GBP97.9m of cash as at 30 June 2023, with no debt

except for IFRS 16 lease liabilities of GBP103.6m. Debt facilities

relevant to the review period comprise a committed GBP80m RCF

maturing December 2027, an uncommitted UK trade debtor discounting

facility (up to GBP50m depending on debtor levels) and an

uncommitted GBP20m UK bank overdraft facility. None of these

facilities were in use as at 30 June 2023.

Despite the macroeconomic and political uncertainty that

currently exists, and its inherent risk and impact on the business,

based on the analysis performed there are no plausible downside

scenarios that the Board believes would cause a liquidity issue.

Having considered the Group's forecasts, the level of cash

resources available to the business and the Group's borrowing

facilities, the Group's geographical and discipline

diversification, limited concentration risk, as well as the ability

to manage the cost base, the Board has concluded that the Group and

therefore the Company has adequate resource to continue in

operation existence for the period through to August 2024.

New accounting standards, interpretations and amendments adopted

by the Group

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 31 December

2022. The Group has not early adopted any standard, interpretation

or amendment that has been issued but is not yet effective.

The IASB published on 23 May 2023 International Tax Reform -

Pillar Two Model Rules (Amendments to IAS 12) which was adopted by

the UKEB on 19th July 2023. Page Group has applied the mandatory

temporary exception to the accounting for deferred taxes arising

from the jurisdictional implementation of the Pillar Two model

rules to our FY23 Interim reporting.

3. Segment reporting

All revenues disclosed are derived from external customers.

The accounting policies of the reportable segments are the same

as the Group's accounting policies. Segment operating profit

represents the profit earned by each segment including allocation

of central administration costs. This is the measure reported to

the Group's Board, the chief operating decision maker, for the

purpose of resource allocation and assessment of segment

performance.

(a) Revenue, gross profit and operating profit by reportable segment

Revenue Gross Profit

---------------------------------- ---------------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 580,539 522,981 1,069,346 288,400 266,683 538,488

Asia Pacific 149,842 159,329 318,359 83,416 102,046 195,276

Americas 150,971 137,302 282,942 89,047 94,188 193,397

United Kingdom 152,534 157,645 319,640 65,928 75,986 149,133

1,033,886 977,257 1,990,287 526,791 538,903 1,076,294

---------- -------- ------------ ------------ ----------- ------------

Operating Profit

---------------------------------------

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

EMEA 47,818 65,283 122,079

Asia Pacific 4,458 20,952 35,244

Americas 5,927 13,822 17,885

United Kingdom 5,654 15,260 20,871

------------ ----------- ------------

Operating profit 63,857 115,317 196,079

Financial expense (549) (820) (1,713)

Profit before

tax 63,308 114,497 194,366

------------ ----------- ------------

The above analysis by destination is not materially different to

analysis by origin.

The analysis below is of the carrying amount of reportable

segment assets, liabilities and non-current assets. Segment assets

and liabilities include items directly attributable to a segment as

well as those that can be allocated on a reasonable basis. The

individual reportable segments exclude current income tax assets

and liabilities. Intangible Assets include computer software,

goodwill and other intangibles.

(b) Segment assets, liabilities and non-current assets by reportable segment

Total Assets Total Liabilities

----------------------------------------------- --------------------------------------

Six months ended Year ended Six months ended Year ended

30

30 June June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 320,385 315,833 338,251 249,084 210,853 248,585

Asia Pacific 108,769 142,008 128,299 62,871 64,930 69,995

Americas 109,488 115,299 116,647 51,310 47,642 60,635

United Kingdom 171,132 208,506 194,514 18,293 60,194 45,476

------------ ------------ -------------- -------- -------- ----------------

Segment

assets/liabilities 709,774 781,646 777,711 381,558 383,619 424,691

Income tax 21,095 22,048 17,233 15,457 32,785 18,050

730,869 803,694 794,944 397,015 416,404 442,741

------------ ------------ -------------- -------- -------- ----------------

Property, Plant & Equipment Intangible Assets

----------------------------------------------- --------------------------------------

Six months ended Year ended Six months ended Year ended

30

30 June June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 15,092 12,730 14,072 2,122 2,197 2,296

Asia Pacific 5,041 6,383 6,194 58 172 110

Americas 6,899 7,542 7,378 4 6 5

United Kingdom 10,633 6,596 8,479 33,555 42,401 37,589

37,665 33,251 36,123 35,739 44,776 40,000

------------ ------------ -------------- -------- -------- ----------------

Right-of-use Assets Lease Liabilities

------------------------------------- ---------------------------------------

Six months ended Year ended Six months ended Year ended

30

30 June June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 60,292 52,621 61,760 66,967 56,130 65,136

Asia Pacific 15,110 16,493 17,415 15,715 17,509 20,042

Americas 10,026 10,072 11,950 12,676 12,943 14,434

United Kingdom 7,967 14,002 9,871 8,269 15,042 10,220

93,395 93,188 100,996 103,627 101,624 109,832

--------- -------- -------------- -------- -------- ------------

The below analyses in notes (c) and (d) relates to the

requirement of IFRS 15 to disclose disaggregated revenue

streams.

(c) Revenue and gross profit generated from permanent and temporary placements

Revenue Gross Profit

------------------------------------- ---------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Permanent 395,569 426,975 832,014 392,202 422,133 826,321

Temporary 638,317 550,282 1,158,273 134,589 116,770 249,973

1,033,886 977,257 1,990,287 526,791 538,903 1,076,294

------------ --------- ------------ --------- -------- ------------

(d) Revenue generated from permanent and temporary placements by reportable segment

Permanent Temporary

------------------------------------ ---------------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

EMEA 199,879 192,132 380,002 380,660 330,849 689,344

Asia Pacific 70,690 89,854 170,029 79,152 69,475 148,330

Americas 78,073 84,974 170,970 72,898 52,328 111,972

United Kingdom 46,927 60,015 111,013 105,607 97,630 208,627

395,569 426,975 832,014 638,317 550,282 1,158,273

-------- -------- -------------- -------- -------- ------------

The below analyses in notes (e) revenue and gross profit by

discipline (being the professions of candidates placed) and (f)

revenue and gross profit by strategic market have been included as

additional disclosure over and above the requirements of IFRS 8

"Operating Segments".

(e) Revenue and gross profit by discipline

Revenue Gross Profit

---------------------------------- ---------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Accounting

and Financial

Services 367,273 354,229 720,783 167,433 168,391 343,659

Legal, Technology,

HR, Secretarial

and Other 352,448 321,332 667,543 162,281 167,871 334,772

Engineering,

Property &

Construction,

Procurement

& Supply Chain 217,835 199,154 400,959 127,689 126,735 251,686

Marketing,

Sales and Retail 96,330 102,542 201,002 69,388 75,906 146,177

1,033,886 977,257 1,990,287 526,791 538,903 1,076,294

---------- -------- ------------ --------- -------- ------------

(f) Revenue and gross profit by strategic market

Revenue Gross Profit

---------------------------------- ---------------------------------

Six months ended Year ended Six months ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2023 2022 2022 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Large, Proven

markets 524,692 505,917 1,015,599 241,961 245,429 483,627

Large, High

Potential markets 359,314 334,214 688,925 194,274 208,007 417,296

Small and Medium,

High Margin

markets 149,880 137,126 285,763 90,556 85,467 175,371

1,033,886 977,257 1,990,287 526,791 538,903 1,076,294

---------- -------- ------------ --------- -------- ------------

4. Financial income / (expenses)

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Financial income

Bank interest receivable 829 392 1,104

--------- -------- ------------

Financial expenses

Bank interest payable (266) (527) (1,213)

Interest on lease liabilities (1,112) (685) (1,604)

(1,378) (1,212) (2,817)

--------- -------- ------------

5. Income tax expense

Taxation for the six month period is charged at 31.9% (six

months ended 30 June 2022: 28.8%; year ended 31 December 2022:

28.5%), representing the best estimate of the average annual

effective tax rate expected for the full year together with known

prior year adjustments applied to the pre-tax income for the six

month period.

6. Dividends

Six months ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Amounts recognised as distributions to equity

holders in the period:

Final dividend for the year ended 31 December

2022 of 10.76p per ordinary share (2021:

10.30p) 33,889 32,740 32,740

Interim dividend for the period ended 30

June 2022 of 4.91p per ordinary share (2021:

4.70p) - - 15,607

Special dividend for the year ended 31 December

2022 of 26.71p per ordinary share (2021:

0p) - - 84,900

33,889 32,740 133,247

--------- -------- --------------

Amounts proposed as distributions to equity

holders in the period:

Proposed interim dividend for the period

ended 30 June 2023 of 5.13p per ordinary

share (2022: 4.91p) 16,161 15,607

--------- -------- --------------

Proposed special dividend for the year ended

31 December 2023 of 15.87p per ordinary share

(2022: 26.71p) 50,000 84,900

--------- -------- --------------

Proposed final dividend for the year ended

31 December 2022 of 10.76p per ordinary share - - 34,207

--------- -------- --------------

The proposed interim and special dividends have not been

approved by the Board at 30 June 2023 and therefore have not been

included as a liability. The comparative interim and special

dividends at 30 June 2022 were also not recognised as a liability

in the prior period.

The proposed interim dividend of 5.13p (2022: 4.91p) per

ordinary share and special dividend of 15.87p (2022: 26.71p) per

ordinary share will be paid on 13 October 2023 to shareholders on

the register at the close of business on 1 September 2023.

7. Share-based payments

In accordance with IFRS 2 "Share-based Payment", a charge of

GBP2.6m has been recognised for share options and other share-based

payment arrangements (including social charges) (30 June 2022:

GBP2.1m, 31 December 2022 : GBP6.0m).

8. Earnings per ordinary share

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months ended Year ended

30 June 30 June 31 December

Earnings 2023 2022 2022

Earnings for basic and diluted earnings per

share (GBP'000) 43,132 81,497 139,012

--------- -------- ------------

Number of shares

Weighted average number of shares used for

basic earnings per share ('000) 316,436 318,473 318,166

Dilution effect of share plans ('000) 1,494 843 1,204

Diluted weighted average number of shares

used for diluted earnings per share ('000) 317,930 319,316 319,370

--------- -------- ------------

Basic earnings per share (pence) 13.6 25.6 43.7

Diluted earnings per share (pence) 13.6 25.5 43.5

The above results all relate to continuing operations.

9. Property, plant and equipment

Acquisitions

During the period ended 30 June 2023 the Group acquired

property, plant and equipment with a cost of GBP9.5 m (30 June

2022: GBP12.7m).

10. Trade and other receivables

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current

Trade receivables 272,047 306,557 320,794

Less allowance for expected credit losses (12,429) (12,361) (12,960)

--------- --------- ------------

Net trade receivables 259,618 294,196 307,834

Other receivables 7,149 4,658 21,535

Accrued income (net of revenue reversals) 112,278 112,994 88,951

Prepayments 32,680 29,426 18,927

411,725 441,274 437,247

--------- --------- ------------

Non-current

Other receivables 12,890 12,989 13,224

--------- --------- ------------

11. Trade and other payables

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current

Trade payables 3,192 5,023 11,101

Other tax and social security 50,593 45,368 61,079

Other payables 17,676 35,847 36,629

Accruals 186,847 170,720 180,299

258,308 256,958 289,108

-------- -------- ------------

Non-current

Accruals 8,455 13,883 14,529

Other tax and social security - - 422

8,455 13,883 14,951

-------- -------- ------------

12. Provisions

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Dilapidations 6,528 7,212 7,128

NI on share schemes 694 954 844

Other 1,327 1,513 1,483

8,549 9,679 9,455

-------- -------- ------------

Current 3,737 2,236 2,772

Non-Current 4,812 7,443 6,683

8,549 9,679 9,455

-------- -------- ------------

13. Cash and cash equivalents

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 97,939 136,227 131,480

Short-term deposits - - -

-------- -------- ------------

Cash and cash equivalents 97,939 136,227 131,480

Cash and cash equivalents in the statement

of cash flows 97,939 136,227 131,480

-------- -------- ------------

The Group operates multi-currency cash concentration and

notional cash pools, and an interest enhancement facility. The

Eurozone subsidiaries and the UK-based Group Treasury subsidiary

participate in the cash concentration arrangement, the Group

Treasury subsidiary retains the notional cash pool and the Asia

Pacific subsidiaries operate the interest enhancement facility. The

structures facilitate interest compensation of cash whilst

supporting working capital requirements.

PageGroup maintains a Confidential Invoice Facility with HSBC

whereby the Group has the option to discount facilities in order to

advance cash on its receivables. The facility is used only ad hoc

in case the Group needs to fund any major GBP cash outflow.

RESPONSIBILITY STATEMENT

The Directors confirm that to the best of their knowledge:-

a) the condensed set of interim financial statements has been

prepared in accordance with UK adopted IAS 34 "Interim Financial

Reporting"

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

On behalf of the Board

N Kirk K Stagg

Chief Executive Officer Chief Financial Officer

4 August 2023

Copies of the condensed interim financial statements are now

available and can be downloaded from the Company's website:

https://www.page.com/presentations/year/2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKQBQFBKDKFK

(END) Dow Jones Newswires

August 07, 2023 02:00 ET (06:00 GMT)

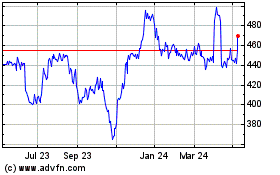

Pagegroup (LSE:PAGE)

Historical Stock Chart

From Apr 2024 to May 2024

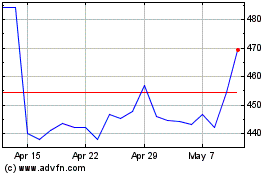

Pagegroup (LSE:PAGE)

Historical Stock Chart

From May 2023 to May 2024