TIDMSKG

Smurfit Kappa Group plc

2011 Third Quarter Results

9 November 2011: Smurfit Kappa Group plc ('SKG' or the 'Group')

today announced results for the 3 months and 9 months ending 30

September 2011.

2011 Third Quarter & First Nine Months | Key Financial

Performance Measures

EUR m YTD2011 YTD2010 change Q32011 Q32010 change Q22011 change

Revenue EUR5,538 EUR4,928 12% EUR1,868 EUR1,702 10% EUR1,867 0%

EBITDA EUR771 EUR647 19% EUR264 EUR243 9% EUR264 0%

before

Exceptional

Items

and

Share-based

Payment(1)

EBITDA 13.9% 13.1% - 14.1% 14.3% - 14.2% -

Margin

Operating EUR477 EUR349 36% EUR162 EUR143 13% EUR167 (3%)

Profit

before

Exceptional

Items

Basic EPS 53.5 (0.5) - 22.2 16.9 31% 15.7 41%

(cent)

Pre-exceptional 69.7 25.1 178% 22.2 16.9 31% 31.4 (29%)

EPS (cent)

Free Cash EUR195 EUR59 - EUR117 EUR128 - EUR66 -

Flow(2)

Net Debt EUR2,921 EUR3,123 (6%) EUR3,003 (3%)

Net Debt 2.8x 3.7x - 3.0x -

to

EBITDA

(LTM)

(1) EBITDA before exceptional items and share-based

payment expense is denoted by

EBITDA throughout the remainder of the

management commentary for ease of

reference. A reconciliation of net profit

for the period to EBITDA before

exceptional items and share-based payment

expense is set out on page 27.

(2) Free cash flow is set out on page 8. The

IFRS cash flow is set out on page 15.

Highlights

-- Strong EBITDA of EUR264 million in Q3. Pre-exceptional EPS of 22 cent

-- Net debt reduction of EUR82 million in Q3. Total net debt reduction of

EUR189 million in year-to-date

-- Net debt to EBITDA ratio reduced to 2.8x

-- Re-affirming year-end net debt target of EUR2.85 billion

Performance Review and Outlook

Gary McGann, Smurfit Kappa Group CEO, commented: "We are pleased

to report a strong EBITDA of EUR264 million for the third quarter.

As expected, our free cash flow generation accelerated in the

quarter, delivering further net debt reduction of EUR82 million in

the period, or EUR189 million in the year-to-date. Lower net debt,

combined with continued earnings progress, reduced our net debt to

EBITDA ratio to 2.8x at the end of September 2011.

In the third quarter, box demand continued to grow, albeit at a

slower pace than in the first half, and higher inventory levels

generated some downward pressure on paper prices in Europe. Against

that backdrop, our EBITDA margin of 14.1% primarily highlights the

increasing efficiency of our integrated model, continued box price

recovery, and a sustained strong performance in our Latin American

business. Return on capital employed was 12.5% for the third

quarter, compared to 8.5% in the prior year.

Over the past four years, we have strengthened our business

platform through significant debt paydown and unrelenting cost

reduction actions, which will sustain the delivery of strong cash

flows and improving returns through the cycle. We are committed to

continue building our strong market credentials in the areas of

packaging innovation, customer service and sustainability.

In that context, despite softening demand, we expect to deliver

a full-year 2011 EBITDA performance in line with current market

expectations, and re-affirm our target to reduce net debt to

EUR2.85 billion by the year end."

About Smurfit Kappa Group

Smurfit Kappa Group is a world leader in paper-based packaging

with operations in Europe and Latin America. Smurfit Kappa Group

operates in 21 countries in Europe and is the European leader in

containerboard, solidboard, corrugated and solidboard packaging and

has a key position in several other packaging and paper market

segments, including graphicboard and sack paper. Smurfit Kappa

Group also has a good base in Eastern Europe and operates in 9

countries in Latin America where it is the only pan-regional

operator.

Forward Looking Statements

Some statements in this announcement are forward-looking. They

represent expectations for the Group's business, and involve risks

and uncertainties. These forward-looking statements are based on

current expectations and projections about future events. The Group

believes that current expectations and assumptions with respect to

these forward-looking statements are reasonable. However, because

they involve known and unknown risks, uncertainties and other

factors, which are in some cases beyond the Group's control, actual

results or performance may differ materially from those expressed

or implied by such forward-looking statements.

Contacts

Bertrand Paulet FTI Consulting

Smurfit Kappa Group

Tel: +353 1 202 71 80 Tel: +353 1 663 36 80

E-mail: ir@smurfitkappa.com E-mail:

smurfitkappa@fticonsulting.com

2011 Third Quarter & First Nine Months | Performance

Overview

Following EUR107 million of net debt reduction in the first half

of the year, free cash flow generation accelerated in the third

quarter as anticipated, allowing the Group to deliver a further

EUR82 million of debt paydown in the period. This strong

performance was achieved despite EUR30 million of adverse currency

movements, which primarily resulted from the strengthening of the

US dollar against the euro in the quarter.

Since the Group's IPO in 2007, SKG's net debt has reduced by

approximately EUR630 million, thereby materially improving its

capital structure and financial flexibility. This debt paydown

demonstrates SKG's ability to generate strong cash flows at all

points in the cycle.

Compared to the 2% underlying demand growth experienced in the

first half, SKG's European box shipments increased by 1% in the

third quarter. The somewhat weaker demand environment, combined

with high operating rates through the summer, led to a rise in

recycled containerboard inventories in Europe. At the end of

August, recycled containerboard inventories in the market were

approximately 20% higher than prior year levels. Inventories have

remained generally stable since then, primarily due to a number of

open-market containerboard players taking commercial downtime.

The higher level of inventory generated downward pressure on

European recycled containerboard prices, with indices reporting a

decline of approximately EUR55 per tonne between June and October

2011 (the equivalent of just over 10%). A EUR30 per tonne reduction

in OCC costs in the period was not sufficient to fully offset the

paper price decline, thereby leading to margin compression for

recycled containerboard producers.

In comparison, SKG's EBITDA margin of 14.1% in the third quarter

highlights the earnings stability of the integrated model, and

benefits from the Group's own actions, with a further 2% rise in

box prices, as well as EUR36 million of cost take-out delivered in

the period. SKG's third quarter earnings were negatively impacted

by extended maintenance downtime at the Group's kraftliner mill in

Piteå, Sweden, which reduced its output by approximately 90,000

tonnes.

The Group's margin in the third quarter also reflects a

sustained strong performance in Latin America, resulting in an

EBITDA margin of 19.6% in the period. This outcome primarily

highlights a good performance from SKG's operations in Colombia and

Venezuela, while earnings in Mexico and Argentina eased compared to

the first half run-rate due to weaker local economic

conditions.

Through the cycle, SKG's focus is to generate consistently

strong financial returns. This objective is underpinned by the

Group's integrated business model and disciplined capital

allocation decisions, which together with a unique broad geographic

coverage and superior design capabilities, provides SKG with a

particular ability to support its customers in promoting their

products through innovative and sustainable packaging

solutions.

2011 Third Quarter | Financial Performance

At EUR1,868 million for the third quarter of 2011, revenue was

10% higher than in the third quarter of 2010. However, allowing for

the impact of currency and hyperinflation accounting, as well as

acquisitions, disposals and closures, the underlying increase in

revenue was EUR154 million, the equivalent of approximately 9%.

At EUR264 million, EBITDA in the third quarter of 2011 was EUR21

million higher than the third quarter of 2010. Allowing for

currency and hyperinflation accounting, and for a modest impact

from acquisitions, disposals and closures, underlying EBITDA

increased year-on-year by EUR13 million, the equivalent of 5%.

Revenue and EBITDA in the third quarter were stable compared to

the second quarter of 2011. However, allowing for the impact of

currency and hyperinflation accounting, underlying revenue and

EBITDA in the third quarter were EUR27 million and EUR7 million

lower respectively.

Earnings per share was 22.2 cent for the quarter to September

2011 (2010: 16.9 cent).

2011 First Nine Months | Financial Performance

Revenue of EUR5,538 million in the first nine months of 2011

represented a 12% increase on the first nine months of 2010.

Allowing for the impact of currency and hyperinflation accounting,

as well as acquisitions, disposals and closures, revenue shows an

underlying year-on-year increase of EUR619 million (13%).

At EUR771 million, EBITDA in the first nine months of 2011 was

EUR124 million, or 19% higher than in the comparable period in

2010. Allowing for the impact of currency and hyperinflation

accounting, as well as acquisitions, disposals and closures,

underlying EBITDA increased by EUR112 million (17%).

Exceptional items in the first nine months of 2011 amounted to

EUR36 million and almost entirely related to the permanent closure

of SKG's Nanterre mill in France in the second quarter. In the

first nine months of 2010, exceptional charges amounted to EUR56

million, approximately EUR40 million of which related to the asset

swap with Mondi in the second quarter, while the balance related to

the currency devaluation and associated hyperinflationary

adjustments in Venezuela, which were booked primarily in quarter

one.

Adjusting for exceptional charges, pre-exceptional EPS was 69.7

cent in the nine months to September 2011 (2010: 25.1 cent).

2011 Third Quarter & First Nine Months | Free Cash Flow

Compared to the EUR59 million reported in the first nine months

of 2010, the Group's free cash flow of EUR195 million in 2011

highlights SKG's continued focus on maximising cash flow generation

for debt paydown. The year-on-year increase in free cash flow

primarily reflected a 19% increase in EBITDA as well as lower cash

interest expense, somewhat offset by higher capital

expenditure.

The working capital move in the first nine months of 2011 was an

outflow of EUR91 million, mainly reflecting improved volumes and

higher raw material and end-product prices. In the third quarter

the Group generated a EUR28 million working capital inflow, as

reflected in the reduction in its working capital to sales ratio

from 9.3% at the half year to 8.9% at the end of September 2011.

Additional working capital inflows are expected in the fourth

quarter.

Capital expenditure of EUR196 million in the first nine months

of 2011 equated to 75% of depreciation, compared to 53% in the

first nine months of 2010. For the full year 2011, SKG's capital

expenditure is expected to increase to approximately 90%.

Cash interest of EUR183 million in the first nine months of 2011

was EUR13 million lower than in the first nine months of 2010,

primarily reflecting a lower average interest cost

year-on-year.

Tax payments of EUR47 million in the first nine months of 2011

were EUR7 million lower than in 2010.

2011 Third Quarter & First Nine Months | Capital

Structure

The Group's net debt reduced by EUR189 million to EUR2,921

million in the first nine months of 2011, mainly reflecting SKG's

positive free cash flow performance of EUR195 million, somewhat

offset by a deferred payment relating to the disposal of SKG's

loss-making Rol Pin operation in 2010. While currency had a

relatively modest impact in the first nine months of the year, in

the third quarter the relative strengthening of the US dollar

against the euro negatively impacted net debt by EUR30 million.

Compared to September 2010, net debt at the end of September

2011 was EUR202 million lower, the equivalent of a 6% reduction. It

is worth bearing in mind that this year-on-year reduction in net

debt was achieved despite a cumulative working capital outflow of

EUR100 million over the period, generally reflecting higher volumes

and prices year-on-year.

The Group's average debt maturity profile is 4.6 years, with no

material maturities before December 2013. In addition, at the end

of September 2011 SKG has EUR692 million of cash on its balance

sheet, as well as committed undrawn credit facilities of

approximately EUR525 million.

At the end of September 2011, the Group's net debt to EBITDA

ratio reduced to 2.8x, its lowest level since the Smurfit Kappa

merger in 2005. The Group's main priority for 2011 continues to be

one of maximising free cash flow generation for further debt

paydown. Reducing net debt levels, combined with strong liquidity,

a good maturity profile and diversified funding sources, provide

SKG with continuously improving financial flexibility.

2011 Third Quarter & First Nine Months | Operating

Efficiency

Commercial offering

In addition to its continued focus on cost efficiency and

operating excellence, SKG's margin performance through the cycle is

strongly linked to its commitment to provide customers with

innovative, sustainable and cost efficient paper-based packaging

solutions. SKG will continue to invest to meet and exceed

customers' requirements.

To support customers and retailers increasing demands for

high-quality printed packaging, in 2011 the Group finalised

investment programmes of over EUR25 million in new printing

equipment. Projects included the installation of state of the art

5-colour printing capacity in the Group's Italian packaging

operations, a new 6-colour flexo folder gluer in its German

operation, as well as offset printing capacity in Belgium and the

Czech Republic. Those investments significantly enhance SKG's

offering to the local value-added packaging markets.

In 2011, SKG also finalised a 3-year modernisation programme in

its corrugated plant in Pruszkow, Poland. This initiative is part

of a broader EUR30 million investment programme for Poland, and

demonstrates the Group's commitment to follow its customers'

developments and grow its market share in Eastern Europe.

The Group's efforts to enhance its innovation and service

capabilities are being recognised by the market. For example, in

September 2011 SKG won two awards from the German print

association, in a competition that included over 300 packaging

designs from 90 different companies. In addition, six SKG companies

across Europe and Latin America have been short-listed for the

annual Pulp & Paper Industry ('PPI') Awards, to be decided in

November, including three in the area of environment and

sustainability.

Overall, the Group is particularly well equipped to provide

industry leading customer service, supported by its unique

geographical footprint, its superior design capabilities and its

broad-based product offering. In 2011, these attributes resulted in

SKG winning significant incremental business from key multinational

Fast Moving Consumer Goods ('FMCG') customers.

Corporate Social Responsibility ('CSR')

In its fourth annual sustainability report, released during the

third quarter of 2011, SKG highlighted its continued progress and

commitment to social and environmental best practices and cited

tangible evidence of this. A number of sustainability awards were

received this year from major customers and institutions.

SKG considers the drive for sustainability to be a key

differentiator in the marketplace.

Cost take-out programme

In 2011, SKG commenced a 2-year initiative, with a target to

generate EUR150 million of cost savings by the end of 2012. This

programme generated EUR75 million of cost savings benefits in the

first nine months of 2011 (including EUR36 million in quarter

three), which partially mitigated the impact of materially higher

input costs year-on-year. The Group is confident of exceeding the

target number by the end of 2012.

Reorganisation of Specialties segment

With effect from 1 September, 2011 the Group transferred its

Specialties businesses into its existing European Packaging

segment. This reorganisation will increase the focus of the Group's

commercial offering, and will create a platform for SKG to become a

"one stop shop" for paper-based packaging solutions.

This initiative will also enhance the Group's overall cost

efficiency, and should contribute to improving the margins of its

solid, graphic and carton board businesses.

From quarter three 2011 onwards, the segmental reporting for the

Group reflects the new organisational structure. Comparative

periods have been re-stated to reflect the new structure.

2011 Third Quarter & First Nine Months | Performance

Review

Europe

Following the 2% underlying demand growth experienced in the

first half of 2011, demand for SKG's corrugated packaging solutions

grew by 1% year-on-year in the third quarter. While demand growth

in July and August was broadly in line with the first half average,

September volumes were flat compared to September 2010. Overall for

the first nine months of 2011, SKG's underlying corrugated volumes

were 1.6% higher year-on-year.

As is usual within the Group's business, it takes three to six

months to fully pass through higher containerboard prices to box

prices. As a result, box prices continued to recover throughout the

first nine months of 2011. The Group's European box prices in the

third quarter were on average 2% higher compared with the second

quarter, leading to a cumulative 6.5% corrugated price increase

during the first nine months of the year.

Higher box prices, together with the Group's strong focus on

cost efficiency contributed to deliver a European EBITDA margin of

13.6% in the third quarter, despite a generally tougher operating

environment, and the extended downtime relating to the recovery

boiler rebuild at its Piteå kraftliner mill in Sweden.

At industry level, recycled containerboard inventories rose in

August, as most paper producers ran at full capacity during a

seasonally weaker month for box demand. The inventory build did not

reverse in September as a result of somewhat softer demand, in both

domestic and export markets. Higher inventory levels led to a EUR55

per tonne reduction in European recycled containerboard prices, to

an absolute level of EUR440 per tonne in October.

On the cost side, pressure from European buyers combined with

somewhat lower Chinese demand, has led to a EUR30 per tonne

reduction in European OCC prices from June to October. Other

variable costs, however, have remained generally stable throughout

the third quarter.

Although somewhat mitigating the impact of lower paper prices,

the reduction in OCC costs was not sufficient to avoid margin

reduction for recycled containerboard producers in the quarter.

Sustained margin pressure should inevitably lead less-efficient

producers into financial difficulties. In comparison, following the

permanent closure of 10 less efficient containerboard mills since

2005, together with significant investments in its "champion"

mills, SKG is equipped today with an efficient and fully integrated

recycled containerboard system. Its system should allow the Group

to outperform in any operating environment.

On the kraftliner side, in the first eight months of 2011, US

imports into Europe were 33% higher than in the prior year,

although this was somewhat offset by a 7% reduction in imports from

other regions. This led to an increase in net imports of

approximately 170,000 tonnes in the period. Kraftliner inventories

remained relatively stable through the nine months however,

reflecting good demand levels in Europe together with material

maintenance downtime in the summer, mainly at SKG's Piteå mill.

However, lower priced US imports have created downward pressure

on domestic kraftliner prices, which have declined by approximately

EUR50 per tonne since the beginning of 2011, to a level of

approximately EUR590 per tonne in October.

Latin America

In the third quarter, Latin American EBITDA of EUR66 million

represented a 19.6% margin on revenue, slightly below the second

quarter of 19.9%, but higher than the 17.6% reported in the third

quarter of 2010. In the first nine months of 2011, Latin American

EBITDA of EUR177 million represented 23% of the Group's total.

SKG's corrugated volumes in Colombia experienced strong

year-on-year growth of 6% in the first nine months of 2011, a trend

that was sustained through the third quarter. Pricing in the

quarter was relatively stable year-on-year however, highlighting

moderate inflation in the country, a strong currency and aggressive

price action from both domestic and external competitors. Following

extensive maintenance downtime at its Cali mill in March, SKG's

earnings grew sequentially in the second and third quarters.

In the Venezuelan market, SKG's corrugated volumes were 2% lower

year-on-year in the first nine months. Continuing high inflation in

the country was more than offset by SKG's cost take-out and

operating efficiency actions, as well as by increased pricing. In

July, the Venezuelan authorities issued precautionary measures over

a further 7,253 hectares of the Group's forestry land, with a view

to acquiring it and converting its use to food production and

related activities. Discussions are continuing at local level in an

effort to find an optimal solution.

In the first nine months of 2011, SKG's Mexican EBITDA in US

dollar terms was higher than in 2010. Third quarter EBITDA was

lower year-on-year however, reflecting a 4% reduction in volumes

due to a slower economy, and with lower US containerboard export

prices constraining paper and box price initiatives in the Mexican

market.

High inflation continues to prevail in Argentina, which is

increasingly affecting demand. Due to lower consumer spending

power, after a 1% demand growth in the first half, the Group's

corrugated volumes in the country were 8% lower year-on-year in the

third quarter. Increased average prices in 2011 compared to 2010

supported good EBITDA growth in the first nine months in US dollar

terms.

Despite some country-specific challenges from time to time, the

Group believes that the geographic diversity of its business in the

Latin American region, together with the proven ability of its

local management to drive the business, will continue to deliver a

strong performance through the cycle.

Summary Cash

Flow(1)

Summary cash flows for the third quarter and nine

months are set out in the following table.

3 months to 3 months to 9 months to 9 months to

30-Sep-11 30-Sep-10 30-Sep-11 30-Sep-10

EURm EURm EURm EURm

Pre-exceptional 264 243 771 647

EBITDA

Exceptional Items (5) - (5) (16)

Cash interest (61) (63) (183) (196)

expense

Working capital 28 44 (91) (83)

change

Current (1) (7) (7) (21)

provisions

Capital (80) (53) (196) (137)

expenditure

Change in capital 9 (7) (6) (44)

creditors

Sale of fixed 1 1 2 2

assets

Tax paid (25) (22) (47) (54)

Other (13) (8) (43) (39)

Free cash flow 117 128 195 59

Share issues - - 8 3

Sale - - (4) (9)

of businesses

and investments

Purchase - - (1) (46)

of investments

Derivative - (2) (1) (2)

termination

payments

Dividends (1) (1) (4) (4)

Net cash inflow 116 125 193 1

Net - - - (2)

cash

acquired/disposed

Deferred debt (4) (5) (12) (15)

issue

costs amortised

Currency (30) 48 8 (55)

translation

adjustments

Decrease/(increase) 82 168 189 (71)

in net debt

(1) The summary cash flow is prepared on a different basis to the

cash flow statement under IFRS. The principal difference

is that the summary cash flow details movements in net debt

while the IFRS cash flow details movement in cash and

cash equivalents. In addition, the IFRS cash flow has different

sub-headings to those used in the summary cash flow.

A reconciliation of the free cash flow to cash generated

from operations in the IFRS cash flow is set out below.

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Free cash 195 59

flow

Add Cash interest 183 196

back:

Capital expenditure (net of change in capital creditors) 202 181

Tax payments 47 54

Less: Sale of fixed assets (2) (2)

Profit on sale of assets and businesses - non exceptional (7) (11)

Receipt of capital grants (in 'Other') (1) -

Dividends received from associates (in 'Other') (1) (1)

Non-cash lease movement (4) -

Cash generated from 612 476

operations

Capital Resources

The Group's primary sources of liquidity are cash flow from

operations and borrowings under the revolving credit facility. The

Group's primary uses of cash are for debt service and capital

expenditure.

At 30 September 2011 Smurfit Kappa Funding plc had outstanding

EUR217.5 million 7.75% senior subordinated notes due 2015 and

US$200 million 7.75% senior subordinated notes due 2015. In

addition Smurfit Kappa Treasury Funding Limited had outstanding

US$292.3 million 7.50% senior debentures due 2025 and the Group had

outstanding EUR177 million variable funding notes issued under the

new EUR250 million accounts receivable securitisation program

maturing in November 2015.

Smurfit Kappa Acquisitions had outstanding EUR500 million 7.25%

senior secured notes due 2017 and EUR500 million 7.75% senior

secured notes due 2019. Smurfit Kappa Acquisitions and certain

subsidiaries are also party to a senior credit facility. The senior

credit facility comprises a EUR132 million amortising Tranche A

maturing in 2012, an EUR819 million Tranche B maturing in 2013 and

an EUR817 million Tranche C maturing in 2014. In addition, as at 30

September 2011, the facility includes a EUR525 million revolving

credit facility, none of which was drawn.

The following table provides the range of interest rates as of

30 September 2011 for each of the drawings under the various senior

credit facility term loans.

BORROWING ARRANGEMENT CURRENCY INTEREST RATE

Term Loan A EUR 4.100%

Term Loan B EUR 4.729% - 4.468%

USD 3.371%

Term Loan C EUR 4.979% - 4.715%

USD 3.621%

Borrowings under the revolving credit facility are available to

fund the Group's working capital requirements, capital expenditures

and other general corporate purposes.

Market Risk and Risk Management Policies

The Group is exposed to the impact of interest rate changes and

foreign currency fluctuations due to its investing and funding

activities and its operations in different foreign currencies.

Interest rate risk exposure is managed by achieving an appropriate

balance of fixed and variable rate funding. At 30 September 2011

the Group had fixed an average of 77% of its interest cost on

borrowings over the following twelve months.

Our fixed rate debt comprised mainly EUR500 million 7.25% senior

secured notes due 2017, EUR500 million 7.75% senior secured notes

due 2019, EUR217.5 million 7.75% senior subordinated notes due

2015, US$200 million 7.75% senior subordinated notes due 2015 and

US$292.3 million 7.50% senior debentures due 2025. In addition the

Group also has EUR1,110 million in interest rate swaps with

maturity dates ranging from April 2012 to July 2014.

Our earnings are affected by changes in short-term interest

rates as a result of our floating rate borrowings. If LIBOR

interest rates for these borrowings increase by one percent, our

interest expense would increase, and income before taxes would

decrease, by approximately EUR10 million over the following twelve

months. Interest income on our cash balances would increase by

approximately EUR7 million assuming a one percent increase in

interest rates earned on such balances over the following twelve

months.

The Group uses foreign currency borrowings, currency swaps,

options and forward contracts in the management of its foreign

currency exposures.

Group Income Statement - Nine Months

Unaudited Unaudited

9 months to 30-Sep-11 9 months to 30-Sep-10

Pre-exceptional2011 Exceptional2011 Total2011 Pre-exceptional2010 Exceptional2010 Total2010

EURm EURm EURm EURm EURm EURm

Revenue 5,538 - 5,538 4,928 - 4,928

Cost of sales (3,979) (13) (3,992) (3,556) - (3,556)

Gross profit 1,559 (13) 1,546 1,372 - 1,372

Distribution (416) - (416) (410) - (410)

costs

Administrative (668) - (668) (632) (16) (648)

expenses

Other operating 2 - 2 19 - 19

income

Other operating - (23) (23) - (40) (40)

expenses

Operating 477 (36) 441 349 (56) 293

profit

Finance costs (296) - (296) (333) - (333)

Finance income 72 - 72 92 - 92

Profit on disposal 2 - 2 - - -

of associate

Share 2 - 2 2 - 2

of associates'

profit (after tax)

Profit before 257 (36) 221 110 (56) 54

income tax

Income tax (98) (52)

expense

Profit for the 123 2

financial

period

Attributable

to:

Owners of the 119 (1)

Parent

Non-controlling 4 3

interests

Profit for the 123 2

financial

period

Earnings per

share:

Basic 53.5 (0.5)

earnings/(loss)

per share - cent

Diluted 52.6 (0.5)

earnings/(loss)

per share - cent

Group Income Statement - Third Quarter

Unaudited Unaudited

3 months to 30-Sep-11 3 months to 30-Sep-10

Pre-exceptional2011 Exceptional2011 Total2011 Pre-exceptional2010 Exceptional2010 Total2010

EURm EURm EURm EURm EURm EURm

Revenue 1,868 - 1,868 1,702 - 1,702

Cost of sales (1,342) - (1,342) (1,215) - (1,215)

Gross profit 526 - 526 487 - 487

Distribution (134) - (134) (136) - (136)

costs

Administrative (231) - (231) (213) - (213)

expenses

Other operating 1 - 1 5 - 5

income

Operating 162 - 162 143 - 143

profit

Finance costs (100) - (100) (96) - (96)

Finance income 22 - 22 15 - 15

Share 1 - 1 1 - 1

of associates'

profit (after tax)

Profit before 85 - 85 63 - 63

income tax

Income tax (30) (22)

expense

Profit for the 55 41

financial

period

Attributable

to:

Owners of the 50 37

Parent

Non-controlling 5 4

interests

Profit for the 55 41

financial

period

Earnings per

share:

Basic earnings per 22.2 16.9

share - cent

Diluted earnings 22.0 16.5

per share - cent

Group Statement of Comprehensive Income

Unaudited Unaudited

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Profit for the financial period 123 2

Other comprehensive income:

Foreign currency translation adjustments (53) (62)

Defined benefit pension plans:

- Actuarial loss including payroll tax (13) (98)

- Movement in deferred tax 1 15

Effective portion of changes in fair

value of cash flow hedges:

- Movement out of reserve 16 17

- New fair value adjustments into reserve (10) (27)

- Movement in deferred tax (1) 1

Net change in fair value of available-for-sale - 1

financial assets

Total other comprehensive income (60) (153)

Comprehensive income and expense 63 (151)

for the financial period

Attributable to:

Owners of the Parent 61 (154)

Non-controlling interests 2 3

63 (151)

Group Balance Sheet

Unaudited Unaudited Audited

30-Sep-11 30-Sep-10 31-Dec-10

EURm EURm EURm

ASSETS

Non-current assets

Property, plant and equipment 2,922 2,971 3,008

Goodwill and intangible assets 2,192 2,208 2,209

Available-for-sale financial assets 32 32 32

Investment in associates 14 15 16

Biological assets 90 88 88

Trade and other receivables 6 4 5

Derivative financial instruments - - 2

Deferred income tax assets 91 272 134

5,347 5,590 5,494

Current assets

Inventories 720 631 638

Biological assets 10 10 7

Trade and other receivables 1,406 1,311 1,292

Derivative financial instruments 7 11 8

Restricted cash 11 25 7

Cash and cash equivalents 681 565 495

2,835 2,553 2,447

Non-current assets held for sale - 3 -

Total assets 8,182 8,146 7,941

EQUITY

Capital and reserves attributable

to the owners of the Parent

Equity share capital - - -

Capital and other reserves 2,288 2,289 2,315

Retained earnings (392) (705) (552)

Total equity attributable to 1,896 1,584 1,763

the owners of the Parent

Non-controlling interests 177 173 173

Total equity 2,073 1,757 1,936

LIABILITIES

Non-current liabilities

Borrowings 3,450 3,544 3,470

Employee benefits 584 740 595

Derivative financial instruments 92 118 101

Deferred income tax liabilities 179 309 206

Non-current income tax liabilities 8 15 9

Provisions for liabilities and charges 45 45 49

Capital grants 13 12 14

Other payables 7 5 7

4,378 4,788 4,451

Current liabilities

Borrowings 163 169 142

Trade and other payables 1,466 1,353 1,351

Current income tax liabilities 42 20 5

Derivative financial instruments 33 32 27

Provisions for liabilities and charges 27 27 29

1,731 1,601 1,554

Total liabilities 6,109 6,389 6,005

Total equity and liabilities 8,182 8,146 7,941

Group Statement of Changes in Equity (Unaudited)

Capital and other reserves

Equity share capital Share premium Reverse acquisition reserve Available-for-salereserve Cash flow hedging reserve Foreign currency translation reserve Reserve for share-based payment Retained earnings Totalequityattributableto Non-controllinginterests Total equity

theowners ofthe Parent

EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm

At 1 January 2011 - 1,937 575 - (45) (216) 64 (552) 1,763 173 1,936

Shares issued - 8 - - - - - - 8 - 8

Total comprehensive - - - - 5 (51) - 107 61 2 63

income and expense

Hyperinflation adjustment - - - - - - - 53 53 6 59

Share-based payment - - - - - - 11 - 11 - 11

Dividends paid to non-controlling - - - - - - - - - (4) (4)

interests

At 30 September 2011 - 1,945 575 - (40) (267) 75 (392) 1,896 177 2,073

At 1 January 2010 - 1,928 575 - (44) (174) 60 (669) 1,676 179 1,855

Shares issued - 3 - - - - - - 3 - 3

Total comprehensive - - - 1 (9) (62) - (84) (154) 3 (151)

income and expense

Hyperinflation adjustment - - - - - - - 47 47 5 52

Share-based payment - - - - - - 3 - 3 - 3

Dividends paid to non-controlling - - - - - - - - - (4) (4)

interests

Purchase of non-controlling - - - - - - - - - (1) (1)

interests

Other movements - - - - - 8 - 1 9 (9) -

At 30 September 2010 - 1,931 575 1 (53) (228) 63 (705) 1,584 173 1,757

Group Cash Flow Statement

Unaudited Unaudited

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Cash flows from operating activities

Profit for the financial period 123 2

Adjustment for

Income tax expense 98 52

(Profit)/loss on sale of (5) 23

assets and businesses

Amortisation of capital grants (2) (1)

Impairment of property, plant and equipment 13 -

Equity settled share-based 11 3

payment transactions

Amortisation of intangible assets 22 34

Share of associates' profit (after tax) (2) (2)

Profit on disposal of associates (2) -

Depreciation charge 248 248

Net finance costs 224 241

Change in inventories (91) (71)

Change in biological assets 13 13

Change in trade and other receivables (137) (207)

Change in trade and other payables 135 195

Change in provisions 2 (19)

Change in employee benefits (40) (40)

Foreign currency translation adjustment 1 1

Other 1 4

Cash generated from operations 612 476

Interest paid (172) (181)

Income taxes paid:

Irish corporation tax paid - (5)

Overseas corporation tax (net (47) (49)

of tax refunds) paid

Net cash inflow from operating activities 393 241

Cash flows from investing activities

Interest received 5 3

Mondi asset swap - (56)

Purchase of property, plant and equipment (198) (176)

and biological assets

Purchase of intangible assets (3) (5)

Receipt of capital grants 1 -

(Increase)/decrease in restricted cash (4) 18

Disposal of property, plant and equipment 9 13

Disposal of associates 4 -

Dividends received from associates 1 1

Purchase of subsidiaries and (1) (1)

non-controlling interests

Deferred consideration (8) -

Net cash outflow from investing activities (194) (203)

Cash flow from financing activities

Proceeds from issue of new ordinary shares 8 3

Decrease in interest-bearing borrowings (11) (57)

Repayment of finance lease liabilities (7) (10)

Derivative termination payments (1) (2)

Deferred debt issue costs - (1)

Dividends paid to non-controlling interests (4) (4)

Net cash outflow from financing activities (15) (71)

Increase/(decrease) in cash 184 (33)

and cash equivalents

Reconciliation of opening to closing

cash and cash equivalents

Cash and cash equivalents at 1 January 481 587

Currency translation adjustment (3) (13)

Increase/(decrease) in cash 184 (33)

and cash equivalents

Cash and cash equivalents at 30 September 662 541

1.General Information

Smurfit Kappa Group plc ('SKG plc') ('the Company') ('the

Parent') and its subsidiaries (together the 'Group') manufacture,

distribute and sell containerboard, corrugated containers and other

paper-based packaging products such as solidboard and graphicboard.

The Company is a public limited company incorporated and tax

resident in Ireland. The address of its registered office is Beech

Hill, Clonskeagh, Dublin 4, Ireland.

2.Basis of Preparation

The annual consolidated financial statements of SKG plc are

prepared in accordance with International Financial Reporting

Standards ('IFRS') as adopted by the European Union ('EU'),

International Financial Reporting Interpretations Committee

('IFRIC') interpretations as adopted by the EU, and with those

parts of the Companies Acts applicable to companies reporting under

IFRS. IFRS is comprised of standards and interpretations approved

by the International Accounting Standards Board ('IASB') and

International Accounting Standards and interpretations approved by

the predecessor International Accounting Standards Committee that

have been subsequently approved by the IASB and remain in

effect.

The financial information presented in this report has been

prepared to comply with the requirement to publish an 'Interim

management statement' during the second six months of the financial

year, in accordance with the Transparency Regulations. The

Transparency Regulations do not require Interim management

statements to be prepared in accordance with International

Accounting Standard 34 - 'Interim Financial Information' ('IAS

34'). Accordingly the Group has not prepared this financial

information in accordance with IAS 34.

The financial information has been prepared in accordance with

the Group's accounting policies. Full details of the accounting

policies adopted by the Group are contained in the financial

statements included in the Group's Annual Report for the year ended

31 December 2010 which is available on the Group's website

www.smurfitkappa.com. The accounting policies and methods of

computation and presentation adopted in the preparation of the

Group financial information are consistent with those described and

applied in the Annual Report for the financial year ended 31

December 2010.

The following new standards, amendments and interpretations

became effective in 2011, however, they either do not have an

effect on the Group financial statements or they are not currently

relevant for the Group:

-- Classification of Rights Issues (Amendment to IAS 32)

-- IAS 24, Related Party Disclosure (Revised)

-- Amendments to IFRIC 14, Prepayments of a Minimum Funding Requirement

-- IFRIC 19, Extinguishing Financial Liabilities with Equity

Instruments

In addition, a number of annual improvements to IFRSs are

effective for 2011, however, none of these had or is expected to

have a material effect on the Group financial statements.

The condensed interim Group financial information includes all

adjustments that management considers necessary for a fair

presentation of such financial information. All such adjustments

are of a normal recurring nature. Some tables in this interim

statement may not add correctly due to rounding. The Group's

auditors have not audited or reviewed the interim Group financial

information contained in this report.

The condensed interim Group financial information presented does

not constitute full group accounts within the meaning of Regulation

40(1) of the European Communities (Companies: Group Accounts)

Regulations, 1992 of Ireland insofar as such group accounts would

have to comply with all of the disclosure and other requirements of

those Regulations. Full Group accounts for the year ended 31

December 2010 have been filed with the Irish Registrar of

Companies. The audit report on those Group accounts was

unqualified.

3.Segmental Analyses

With effect from 1 September, 2011 the Group reorganised the way

in which its European businesses are managed. As part of this

reorganisation for commercial reasons, the businesses which

previously formed part of the Specialties segment were

operationally merged with the Europe segment (formally known as

Packaging Europe) and are now managed on a combined basis to make

decisions about the allocation of resources and in assessing

performance. After this date, the Group ceased to produce financial

information for Specialties as the financial information of all of

its plants is now combined with the other Europe segment

plants.

As a result, the Group has now two segments on the basis of

which performance is assessed and resources are allocated: 1)

Europe and 2) Latin America and segmental information is presented

below on this basis. Prior year segmental information has been

restated to conform to the current year segment presentation.

The Europe segment is highly integrated. It includes a system of

mills and plants that produces a full line of containerboard that

is converted into corrugated containers. It also includes the

bag-in-box and solidboard businesses. The Latin America segment

comprises all forestry, paper, corrugated and folding carton

activities in a number of Latin American countries. Inter segment

revenue is not material. No operating segments have been aggregated

for disclosure purposes.

Segment disclosures are based on operating segments identified

under IFRS 8. Segment profit is measured based on earnings before

interest, tax, depreciation, amortisation, exceptional items and

share-based payment expense (EBITDA before exceptional items).

Segmental assets consist primarily of property, plant and

equipment, biological assets, goodwill and intangible assets,

inventories, trade and other receivables, deferred income tax

assets and cash and cash equivalents.

9 months to 30-Sep-11 9 months to 30-Sep-10

Europe LatinAmerica Total Europe LatinAmerica Total

EURm EURm EURm EURm EURm EURm

Revenue

and

Results

Revenue 4,594 944 5,538 4,105 823 4,928

EBITDA 618 177 795 523 141 664

before

exceptional

items

Segment (23) - (23) (40) (16) (56)

exceptional

items

EBITDA 595 177 772 483 125 608

after

exceptional

items

Unallocated (24) (17)

centre

costs

Share-based (11) (3)

payment

expense

Depreciation (261) (261)

and

depletion

(net)

Amortisation (22) (34)

Impairment (13) -

of assets

Finance (296) (333)

costs

Finance 72 92

income

Profit on 2 -

disposal

of

associate

Share 2 2

of

associates'

profit

(after

tax)

Profit 221 54

before

income tax

Income tax (98) (52)

expense

Profit for 123 2

the

financial

period

Assets

Segment 6,071 1,377 7,448 6,063 1,243 7,306

assets

Investment 1 13 14 2 13 15

in

associates

Group 720 825

centre

assets

Total 8,182 8,146

assets

3 months to 30-Sep-11 3 months to 30-Sep-10

Europe LatinAmerica Total Europe LatinAmerica Total

EURm EURm EURm EURm EURm EURm

Revenue

and

Results

Revenue 1,530 338 1,868 1,425 277 1,702

EBITDA 208 66 274 203 48 251

before

exceptional

items

Segment - - - - - -

exceptional

items

EBITDA 208 66 274 203 48 251

after

exceptional

items

Unallocated (10) (8)

centre

costs

Share-based (7) (1)

payment

expense

Depreciation (87) (88)

and

depletion

(net)

Amortisation (8) (11)

Finance (100) (96)

costs

Finance 22 15

income

Share 1 1

of

associates'

profit

(after

tax)

Profit 85 63

before

income tax

Income tax (30) (22)

expense

Profit for 55 41

the

financial

period

4.Exceptional Items

9 months to 9 months to

The following items are regarded 30-Sep-11 30-Sep-10

as exceptional in nature:

EURm EURm

Impairment loss on property, (13) -

plant and equipment

Reorganisation and restructuring costs (23) -

Currency trading loss on Venezuelan - (16)

Bolivar devaluation

Mondi asset swap - (40)

Total exceptional items (36) (56)

In June, SKG closed its recycled containerboard mill in

Nanterre, France. This resulted in an impairment loss on property,

plant and equipment of EUR13 million and reorganisation and

restructuring costs of EUR22 million. The remaining EUR1 million of

reorganisation and restructuring costs relates to the continuing

rationalisation of the Group's corrugated operations in

Ireland.

In 2010 a currency translation loss of EUR16 million arose from

the effect of the retranslation of the US dollar denominated net

payables of the Venezuelan operations following the devaluation of

the Bolivar Fuerte in January 2010.

During the second quarter of 2010 an asset swap agreement was

completed with Mondi. As a result of this, three corrugated plants

in the UK were acquired and the Group's paper sacks plants (other

than the Polish plant which was sold separately in December 2010)

were disposed. The transaction generated an exceptional loss of

EUR40 million.

5.Finance Costs and Income

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Finance costs

Interest payable on bank loans and overdrafts 101 113

Interest payable on finance leases 1 2

and hire purchase contracts

Interest payable on other borrowings 98 99

Unwinding discount element of provisions 1 -

Foreign currency translation loss on debt 6 34

Fair value loss on derivatives 5 -

not designated as hedges

Interest cost on employee 75 75

benefit plan liabilities

Net monetary loss - hyperinflation 9 10

Total finance cost 296 333

Finance income

Other interest receivable (5) (3)

Foreign currency translation gain on debt (8) (5)

Fair value gain on derivatives (2) (31)

not designated as hedges

Expected return on employee (57) (53)

benefit plan assets

Total finance income (72) (92)

Net finance cost 224 241

6.Income Tax Expense

Income tax expense recognised in the Group Income Statement

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Current taxation:

Europe 31 30

Latin America 56 27

87 57

Deferred taxation 11 (5)

Income tax expense 98 52

Current tax is analysed as follows:

Ireland 3 3

Foreign 84 54

87 57

Income tax recognised in the Group

Statement of Comprehensive Income

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Arising on actuarial gains/losses (1) (15)

on defined benefit plans

Arising on qualifying derivative 1 (1)

cash flow hedges

- (16)

The current taxation expense for Latin America includes a EUR23

million tax expense arising from the implementation of additional

temporary taxes in Colombia on 1 January, which although payable

over the next four years, was required to be expensed in quarter

one 2011.

7.Employee Post Retirement Schemes - Defined Benefit Expense

The table below sets out the components of the defined benefit

expense for the period:

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Current service cost 20 27

Past service cost 2 -

Gain on settlements and curtailments - (1)

22 26

Expected return on plan assets (57) (53)

Interest cost on plan liabilities 75 75

Net financial expense 18 22

Defined benefit expense 40 48

Included in cost of sales, distribution costs and administrative

expenses is a defined benefit expense of EUR22 million for the

first nine months of 2011 (2010: EUR26 million). Expected Return on

Plan Assets of EUR57 million (2010: EUR53 million) is included in

Finance Income and Interest Cost on Plan Liabilities of EUR75

million (2010: EUR75 million) is included in Finance Costs in the

Group Income Statement.

The amounts recognised in the Group Balance Sheet were as

follows:

30-Sep-11 31-Dec-10

EURm EURm

Present value of funded or partially (1,571) (1,548)

funded obligations

Fair value of plan assets 1,390 1,357

Deficit in funded or partially funded plans (181) (191)

Present value of wholly unfunded obligations (403) (404)

Net employee benefit liabilities (584) (595)

The employee benefits provision has decreased from EUR595

million at 31 December 2010 to EUR584 million at 30 September

2011.

8.Earnings Per Share

Basic

Basic earnings per share is calculated by dividing the profit or

loss attributable to the owners of the Parent by the weighted

average number of ordinary shares in issue during the period.

3 months to 3 months to 9 months to 9 months to

30-Sep-11 30-Sep-10 30-Sep-11 30-Sep-10

EURm EURm EURm EURm

Profit/(loss) 50 37 119 (1)

attributable

to

the owners of

the Parent

Weighted average 222 218 221 218

number

of ordinary

shares in issue

(million)

Basic earnings/(loss) 22.2 16.9 53.5 (0.5)

per share - cent

Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares which comprise

convertible shares issued under the management equity plans.

3 months to 3 months to 9 months to 9 months to

30-Sep-11 30-Sep-10 30-Sep-11 30-Sep-10

EURm EURm EURm EURm

Profit/(loss) 50 37 119 (1)

attributable

to

the owners of

the Parent

Weighted average 222 218 221 218

number

of ordinary

shares in issue

(million)

Potential dilutive 2 4 4 4

ordinary

shares assumed

Diluted weighted 224 222 225 222

average

ordinary shares

Diluted 22.0 16.5 52.6 (0.5)

earnings/(loss)

per share - cent

9.Property, Plant and Equipment

Land andbuildings Plant andequipment Total

EURm EURm EURm

Nine months ended 30

September 2011

Opening net book amount 1,128 1,880 3,008

Reclassification 6 (9) (3)

Additions 2 178 180

Impairment losses - (13) (13)

recognised in

the Group Income

Statement

Depreciation charge (36) (212) (248)

for the period

Retirements and (1) (1) (2)

disposals

Hyperinflation 15 17 32

adjustment

Foreign currency (11) (21) (32)

translation

adjustment

At 30 September 2011 1,103 1,819 2,922

Year ended 31 December

2010

Opening net book amount 1,151 1,915 3,066

Reclassification 25 (25) -

Additions 5 249 254

Acquisitions 10 21 31

Depreciation charge (50) (293) (343)

for the year

Retirements and (11) (7) (18)

disposals

Hyperinflation 16 18 34

adjustment

Foreign currency (18) 2 (16)

translation

adjustment

At 31 December 2010 1,128 1,880 3,008

10.Share-based Payment

Share-based payment expense recognised in the Group Income

Statement

9 months to 9 months to

30-Sep-11 30-Sep-10

EURm EURm

Charge arising from fair value 3 3

calculated at grant date

Charge arising from deferred annual bonus plan 8 -

11 3

In March 2007 upon the IPO becoming effective, all of the then

class A, E, F and H convertible shares and 80% of the class B

convertible shares vested and were converted into D convertible

shares. The class C, class G and 20% of the class B convertible

shares did not vest and were re-designated as A1, A2 and A3

convertible shares.

The A1, A2 and A3 convertible shares vested on the first, second

and third anniversaries respectively of the IPO. The D convertible

shares resulting from these conversions are convertible on a

one-to-one basis into ordinary shares, at the instance of the

holder, upon the payment by the holder of the agreed conversion

price. The life of the D convertible shares arising from the

vesting of these new classes of convertible share ends on 20 March

2014.

In March 2007, SKG plc adopted the 2007 Share Incentive Plan

(the '2007 SIP'). The 2007 SIP was amended in May 2009. Incentive

awards under the 2007 SIP are in the form of new class B and new

class C convertible shares issued in equal proportions to

participants at a nominal value of EUR0.001 per share. On

satisfaction of specified performance criteria the new class B and

new class C convertible shares will automatically convert on a

one-to-one basis into D convertible shares. The D convertibles may

be converted by the holder into ordinary shares upon payment of the

agreed conversion price. The conversion price for each D

convertible share is the average market value of an ordinary share

for the three dealing days immediately prior to the date that the

participant was invited to subscribe less the nominal subscription

price. Each award has a life of ten years from the date of issuance

of the new class B and new class C convertible shares. The

performance period for the new class B and new class C convertible

shares is three financial years. The awards made in 2007 and 2008

lapsed in March 2010 and March 2011 respectively and ceased to be

capable of conversion to D convertible shares.

The new class B and new class C convertible shares issued during

and from 2009 are subject to a performance condition based on the

Company's total shareholder return over the three-year period

relative to the total shareholder return of a peer group of

companies ('TSR Condition'). Under that condition, 30% of the new

class B and class C convertible shares will convert into D

convertible shares if the Company's total shareholder return is at

the median performance level and 100% will convert if the Company's

total shareholder return is at or greater than the upper quartile

of the peer group. A sliding scale will apply for performance

between the median and upper quartiles. However, notwithstanding

that the TSR condition applicable to any such award may have been

satisfied, the Compensation Committee retains an overriding

discretion to disallow the vesting of the award, in full or in

part, if, in its opinion the Company's underlying financial

performance or total shareholder return (or both) has been

unsatisfactory during the performance period.

The plans provide for equity settlement only, no cash settlement

alternative is available.

A combined summary of the activity under the 2002 Plan, as

amended, and the 2007 SIP, as amended for the period from 1 January

2011 to 30 September 2011 is presented below.

Number ofconvertible shares000's

At 1 January 2011 14,947

Forfeited in the period (89)

Lapsed in the period (2,266)

Exercised in the period (1,796)

At 30 September 2011 10,796

At 30 September 2011, 5,867,163 shares were exercisable and were

convertible to ordinary shares. The weighted average exercise price

for all shares exercisable at 30 September 2011 was EUR4.60.

The weighted average exercise price for shares outstanding under

the 2002 Plan, as amended, at 30 September 2011 was EUR4.60. The

weighted average remaining contractual life of the awards issued

under the 2002 Plan, as amended, at 30 September 2011 was 1.4

years.

The weighted average exercise price for shares outstanding under

the 2007 SIP, as amended, at 30 September 2011 was EUR5.44. The

weighted average remaining contractual life of the awards issued

under the 2007 SIP, as amended, at 30 September 2011 was 8.2

years.

Deferred Annual Bonus Plan

In May 2011, the SKG plc Annual General Meeting approved the

adoption of the SKG plc 2011 Deferred Annual Bonus Plan ('DABP')

which replaces the existing long-term incentive plan, the 2007

SIP.

The size of award to each participant under the DABP will be

subject to the level of annual bonus earned by a participant in any

year. As part of the revised executive compensation arrangements,

the maximum annual bonus potential for participants in the DABP has

been increased from 100% to 150% of salary. The actual bonus paid

in any financial year will be based on the achievement of clearly

defined annual financial targets for some of the Group's Key

Performance Indicators ('KPI') being EBITDA(1), Return on Capital

Employed ('ROCE') and Free Cash Flow ('FCF'), together with targets

for health and safety and a comparison of the Group's financial

performance compared to that of a peer group.

The proposed structure of the new plan is that 50% of any annual

bonus earned for a financial year will be deferred into SKG plc

shares (Deferred Shares) to be granted in the form of a Deferred

Share Award. The Deferred Shares will vest (i.e. become

unconditional) after a three year holding period based on

continuity of employment.

At the same time as the grant of a Deferred Share Award, a

Matching Share Award can be granted up to the level of the Deferred

Share Award. Following a three year performance period, the

Matching Shares may vest up to a maximum of 3 times the level of

the Matching Share Award. Matching Awards will vest provided the

Committee consider that Company's ROCE and Total Shareholder Return

('TSR') are competitive against the constituents of a comparator

group of international paper and packaging companies over that

performance period. The actual number of Matching Shares that will

vest under the Matching Awards will be dependent on the achievement

of the Company's FCF(2) and ROCE targets measured over the same

three year performance period on an inter-conditional basis.

The actual performance targets assigned to the Matching Awards

will be set by the Compensation Committee on the granting of awards

at the start of each three year cycle. The Company will lodge the

actual targets with the Company's auditors prior to the grant of

any awards under the DABP.

In June 2011, conditional Matching Share Awards totalling

654,814 SKG plc shares were awarded to eligible employees which

gives a potential maximum of 1,964,442 SKG plc shares that may vest

based on the achievement of the relevant performance targets for

the three-year period ending on 31 December 2013.

(1) Earnings before exceptional items, share-based payment expense, net

finance costs, tax, depreciation and intangible asset amortisation.

(2) In calculating FCF, capital expenditure will be set at a minimum

of 90% of depreciation for the 3 year performance cycle.

11.Analysis of Net Debt

30-Sep-11 31-Dec-10

EURm EURm

Senior credit facility

Revolving credit facility(1)- interest at relevant (7) (8)

interbank rate + 2.75% on RCF1 and +3% on RCF2(8)

Tranche A term loan(2a)--interest at relevant 132 164

interbank rate + 2.75%(8)

Tranche B term loan(2b)--interest at relevant 819 816

interbank rate + 3.125%(8)

Tranche C term loan(2c)--interest at relevant 817 814

interbank rate + 3.375%(8)

Yankee bonds (including accrued interest)(3) 221 219

Bank loans and overdrafts 74 75

Cash (692) (502)

2015 receivables securitisation 174 149

variable funding notes(4)

2015 cash pay subordinated notes 362 370

(including accrued interest)(5)

2017 senior secured notes (including 498 488

accrued interest)(6)

2019 senior secured notes (including 501 490

accrued interest)(7)

Net debt before finance leases 2,899 3,075

Finance leases 15 26

Net debt including leases 2,914 3,101

Balance of revolving credit facility 7 9

reclassified to debtors

Net debt after reclassification 2,921 3,110

(1) Revolving credit facility ('RCF') of EUR525 million

split into RCF1 and RCF2 of EUR152

million and EUR373 million (available under

the senior credit facility) to be

repaid in full in 2012 and 2013 respectively.

(Revolver loans - nil, drawn under

ancillary facilities and facilities supported

by letters of credit - nil)

(2a) Tranche A term loan due to be repaid

in certain instalments up to 2012

(2b) Tranche B term loan due to be repaid in full in 2013

(2c) Tranche C term loan due to be repaid in full in 2014

(3) US$292.3 million 7.50% senior debentures due 2025

(4) Receivables securitisation variable

funding notes due November 2015

(5) EUR217.5 million 7.75% senior subordinated notes due 2015 and

US$200 million 7.75% senior subordinated notes due 2015

(6) EUR500 million 7.25% senior secured notes due 2017

(7) EUR500 million 7.75% senior secured notes due 2019

(8) The margins applicable to the senior credit

facility are determined as follows:

Debt/EBITDA ratio Tranche A and RCF1 Tranche B Tranche C RCF2

Greater than 4.0 : 1 3.25% 3.375% 3.625% 3.50%

4.0 : 1 or less but 3.00% 3.125% 3.375% 3.25%

morethan 3.5 : 1

3.5 : 1 or less but 2.75% 3.125% 3.375% 3.00%

morethan 3.0 : 1

3.0 : 1 or less 2.50% 3.125% 3.375% 2.75%

12.Venezuela

Hyperinflation

As discussed more fully in the 2010 annual report, Venezuela

became hyperinflationary during 2009 when its cumulative inflation

rate for the past three years exceeded 100%. As a result, the Group

applied the hyperinflationary accounting requirements of IAS 29 to

its Venezuelan operations at 31 December 2009 and for all

subsequent accounting periods.

The index used to reflect current values is derived from a

combination of Banco Central de Venezuela's National Consumer Price

Index from its initial publication in December 2007 and the

Consumer Price Index for the metropolitan area of Caracas for

earlier periods. The level of and movement in the price index at

September 2011 and 2010 are as follows:

30-Sep-11 30-Sep-10

Index at period end 250.9 198.4

Movement in period 20.5% 21.2%

As a result of the entries recorded in respect of

hyperinflationary accounting under IFRS, the Group Income Statement

for the first nine months of 2011 is impacted as follows: Revenue

EUR34 million increase (2010: EUR6 million increase),

pre-exceptional EBITDA EUR3 million increase (2010: EUR4 million

decrease) and profit after taxation EUR24 million decrease (2010:

EUR25 million decrease). In the first nine months of 2011, a net

monetary loss of EUR9 million (2010: EUR10 million loss) was

recorded in the Group Income Statement. The impact on our net

assets and our total equity is an increase of EUR32 million (2010:

EUR28 million increase).

Devaluation

The Venezuelan government announced the devaluation of its

currency, the Bolivar Fuerte ('VEF'), on 8 January 2010. The

official exchange rate generally applicable to SKG was changed from

VEF 2.15 per US dollar to VEF 4.3 per US dollar. For the first nine

months of 2010 a loss of EUR16 million arose from the effect of

retranslation of the US dollar denominated net payables of its

Venezuelan operations and associated hyperinflationary adjustments,

which is included within operating profit. In addition, the Group

recorded a reduction in net assets of EUR223 million in relation to

these operations, which is reflected in the Group Statement of

Comprehensive Income as part of foreign currency translation

adjustments.

Supplemental Financial Information

EBITDA before exceptional items and share-based payment expense

is denoted by EBITDA in the following schedules for ease of

reference.

Reconciliation of Profit to EBITDA

3 months to 3 months to 9 months to 9 months to

30-Sep-11 30-Sep-10 30-Sep-11 30-Sep-10

EURm EURm EURm EURm

Profit for the 55 41 123 2

financial

period

Income tax 30 22 98 52

expense

Impairment loss - - 13 -

on property,

plant

and equipment

Reorganisation - - 23 -

and

restructuring

costs

Currency trading - - - 16

loss on

Bolivar

devaluation

Mondi asset swap - - - 40

Profit on - - (2) -

disposal

of associate

Share (1) (1) (2) (2)

of associates'

operating

profit (after

tax)

Net finance costs 78 81 224 241

Share-based 7 1 11 3

payment

expense

Depreciation, 95 99 283 295

depletion

(net)

and amortisation

EBITDA 264 243 771 647

Supplemental Historical Financial Information

EURm Q3, 2010 Q4, 2010 FY, 2010 Q1, 2011 Q2, 2011 Q3, 2011

Group and 2,761 2,833 10,769 2,956 3,124 3,109

third

party

revenue

Third 1,702 1,749 6,677 1,803 1,867 1,868

party

revenue

EBITDA 243 257 904 243 264 264

EBITDA 14.3% 14.7% 13.5% 13.5% 14.2% 14.1%

margin

Operating 143 115 409 147 132 162

profit

Profit 63 49 103 78 58 85

before

tax

Free cash 128 23 82 12 66 117

flow

Basic 16.9 23.3 22.9 15.6 15.7 22.2

earnings

per

share -

cent

Weighted 218 219 219 221 222 222

average

number

of

sharesused

in

EPS

calculation

(million)

Net debt 3,123 3,110 3,110 3,061 3,003 2,921

Net debt 3.75 3.44 3.44 3.18 2.98 2.84

to

EBITDA

(LTM)

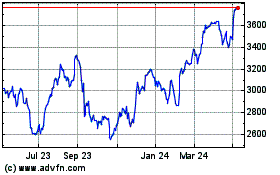

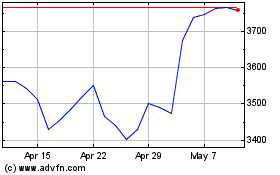

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jul 2023 to Jul 2024