Emerging market investments, once a favorite investing destination,

has mostly seen a pathetic 2013 thanks to the taper talk by the

Federal Reserve. The fears deepened again when the Fed finally

decided on a modest tapering (worth $10 billion per month) starting

in January 2014.

Domestic capacity constraints, falling currencies, higher

inflation, and the expected cease of cheap dollar on the ‘QE Taper’

weighed on emerging markets this year. Most of the emerging markets

funds closed out 2013 in the red with top ETFs like

Vanguard FTSE Emerging

Markets ETF (VWO),

iShares MSCI Emerging

Markets Index Fund (EEM),

WisdomTree Emerging Markets

High-Yielding Equity Fund (DEM) shedding more-or-less 10%.

If these were not enough,

Goldman Sachs’ (GS) warning

on emerging market investing was another nail in the coffin. In a

recent report, the bank forecasted "the strong possibility of

significant underperformance and heightened volatility over the

next five to 10 years”.

This investment banking firm also suggested investors with

‘moderate’ risk tolerance to cut down their emerging market

holdings by one-third i.e.; from 9% to 6% of the overall portfolio

(read: 2 Worst Performing Emerging Markets ETFs This Year).

Behind Goldman’s Skepticism

In its 59-page report, Goldman argued that emerging market

outperformance from 2003 to 2007 was due to some specific economic

tailwinds which are unlikely to resurface. Rather than holding the

Fed taper talk solely responsible for the recent underperformance,

Goldman pointed to the structural problems in those nations.

As per Goldman, the downside in investors’ perception about

emerging markets has been noticed due to high volatility as well as

the lower-than-expected growth rate and the subsequent returns.

“The over-involvement of governments in their economies, increasing

reliance on commodities and unfavorable demographic trends” of some

big nations are crippling growth (read: Emerging Markets =

Imploding Markets?).

This global investment bank now expects only "low single-digit"

returns out of emerging market debt in 2014 with profits and losses

around 10%. The banking giant predicts "high single-digit" returns

for stocks, with gains or losses of approximately 20%.

Our Take

Though worries are definitely building up on emerging markets in

next year’s taper-stricken environment, investors should note that

the emerging markets have already taken much of the taper shock in

stride. In fact, broader emerging funds like EEM, VWO and DEM have

gained, though marginally, in the last five days following the

announcement of modest tapering.

In such a situation, investors should be extra careful before

investing in those countries. While picking nations, the only

criterion should be better inherent strength rather than too much

of a dependence on foreign capital (read: 3 Emerging Markets ETFs

in Focus on Improved Data).

Secondly, though the Fed will scale back the QE program, the bulk

of the stimulus ($75 billion a month) still remains in place. The

Fed Chairman, Ben Bernanke commented that the bond buying program

will be curtailed in phases in 2014 if improvement in the labor

market is in accordance with their expectation and might be

completed by late 2014 (read: Fed Tapers Bond Purchases: 3 ETFs in

Focus on the News).

Thus, we believe that there is still time before one gets too

bearish on emerging nations. Investors having a strong stomach for

risks might consider buying some selective emerging market

products.

We have highlighted three options below. The trio has a great Zacks

ETF Rank of ‘2’ (Buy) and could be interesting picks at least for

the near term.

Vanguard FTSE Emerging Markets ETF (VWO) in

Focus

This ETF is the most popular and the largest fund in the emerging

market space and manages a huge asset base of $46.0 billion. With

annual fees of 18 basis points it is also one of the cheapest

within its category. China and Taiwan comprise about one-fourth of

the total holdings.

The product holds a basket of 922 stocks, with the concentration

level in the top 10 holdings at 16.7%. VWO has shot up 10.23% in

the past 6-month period.

Core MSCI Emerging Markets ETF (IEMG) in

Focus

IEMG looks to track the MSCI Emerging Markets Investable Market

Index which is a capitalization-weighted index. In its 1,750-stock

portfolio, the top 10 holdings account for 14.6% thus calling for

low concentration risks. So far, the fund has generated AUM of $3.2

billion. China, South Korea and Taiwan account for around 45% of

the total assets.

The ETF also charges only 18 bps in fees a year. The fund lost 6.3%

in YTD frame (as of December 24) while it gained 10.7% in the last

6-month period.

S&P Emerging Markets Low Volatility

Portfolio (EELV) in Focus

This ETF – tracking the S&P BMI Emerging Markets Low Volatility

Index – invests about $222.5 million of assets in 202 securities

from emerging markets. The Index comprises the 200 least volatile

stocks of the S&P Emerging BMI Plus LargeMid Cap Index over the

past 12 months.

Taiwan takes up the top spot with 26.73% of exposure while the top

10 holdings make up about 10% of the fund. Notably, Taiwan is a

relatively well-placed nation in the emerging markets pack.

Two Taiwan-focusedfunds

iShares MSCI Taiwan Index Fund

(EWT) and

First Trust Taiwan AlphaDEX Fund

(FTW) delivered positive returns in 2013. The fund added 6.09%

in the past 6 months. EELV is also a cheaper fund, charging 0.29% a

year in expenses.

Bottom Line

Emerging markets may face significant issues in 2014, but investors

should note that stock markets in developed countries hovering at

lofty levels leaves little room for material upside. What remains

undervalued now are the emerging markets.

Yes, concerns over China are looming large with a web of credit

issues. Brazil has problems of slower growth and heightened

inflation. Thailand, though having better fundamentals, is

grappling with political disruptions.

Also, in 2014, we are most likely to see a stronger dollar against

a basket of major currencies leading to huge capital outflows which

in turn will pose another round of threats to the current account

deficit balance of nations like Indonesia and India (read: Surprise

Rate Hike Puts Indonesia ETFs in Focus).

That said, we suggest investors consider some export-oriented

emerging nations which will grow from higher export demand from

developed nations as well as safeguard themselves from depreciating

currencies. These might be the picks to look at this year, and

could outperform their counterparts in this rocky space over the

next 12 months.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7

Best Stocks for the Next 30 Days. Click to get this free

report >>

WISDMTR-EM EQ I (DEM): ETF Research Reports

PWRSH-SP EM LVP (EELV): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-CR MS EM (IEMG): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

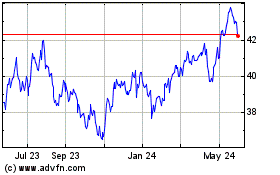

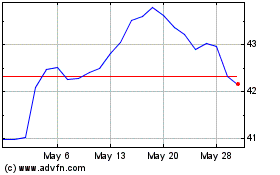

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Feb 2025 to Mar 2025

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Mar 2024 to Mar 2025