false

0001643988

0001643988

2024-08-07

2024-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): August 7, 2024

Loop

Media, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-41508 |

|

47-3975872 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

2600

West Olive Avenue, Suite 5470

Burbank, CA |

|

91505 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (213) 436-2100

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.0001 par value per share |

|

LPTV |

|

The

NYSE American, LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 7, 2024, Loop Media, Inc. (the “Company”) issued a press release regarding the Company’s financial results

for the quarter ended June 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this

current report on Form 8-K (the “Current Report”) and is incorporated by reference herein.

The

information in this Item 2.02 of this Current Report and Exhibit 99.1 attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Forward-Looking

Statements

This

Current Report, including Exhibit 99.1 furnished herewith, contains forward-looking statements within the meaning of the federal

securities laws. Forward-looking statements typically are identified by use of terms such as “may,” “will,” “should,”

“plan,” “expect,” “anticipate,” “estimate” and similar words, and the opposites of such

words, although some forward-looking statements are expressed differently. Forward-looking statements involve known and unknown risks

and uncertainties that exist in the Company’s operations and business environment, which may be beyond the Company’s control,

and which may cause actual results, performance or achievements to be materially different from future results, performance or achievements

expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that

could be forward- looking statements. For example, forward-looking statements include, without limitation: statements regarding prospects

for additional customers; market forecasts; projections of earnings, revenues, synergies, accretion or other financial information; and

plans, strategies and objectives of management for future operations. The risks and uncertainties referred to above include, but are

not limited to, risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including

its Annual Report on Form 10-K for the year ended September 30, 2023. These risks could cause actual results to differ materially from

those expressed in any forward- looking statements made by, or on behalf of, the Company. Forward-looking statements represent the judgment

of management of the Company regarding future events. Although the Company believes that the expectations reflected in such forward-looking

statements are reasonable at the time that they are made, the Company can give no assurance that such expectations will prove to be correct.

Unless otherwise required by applicable law, the Company assumes no obligation to update any forward-looking statements, and expressly

disclaims any obligation to do so, whether as a result of new information, future events or otherwise.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed

on its behalf by the undersigned, hereunto duly authorized.

| Date:

August 7, 2024 |

LOOP

MEDIA, INC. |

| |

|

|

| |

By: |

/s/

Justis Kao |

| |

|

Justis

Kao, CEO |

Exhibit

99.1

Loop

Media Reports 2024 Fiscal Third Quarter Financial Results

BURBANK,

CA – August 7, 2024 – Loop Media, Inc. (“Loop Media” or “our” or the “Company”) (NYSE

American: LPTV), a leading multichannel streaming CTV platform that provides curated music videos, sports, news, premium entertainment

channels and digital signage for businesses, reports financial and operating results for its 2024 fiscal third quarter ended June 30,

2024.

2024

Fiscal Third Quarter (June 30, 2024) Financial Results

Summary

Fiscal Q3 2024 vs. Fiscal Q3 2023

| |

● |

Revenue

in Q3 was $4.4 million, compared to $5.7 million. |

| |

|

|

| |

● |

Net

loss was $(5.5) million or $(0.07) per share, compared to a loss of $(7.9) million or $(0.14). |

| |

|

|

| |

● |

Adjusted

EBITDA (a non-GAAP financial measure defined below) was $(2.2) million, compared to $(3.7) million. |

| |

|

|

| |

● |

Gross

profit was $0.9 million, compared to $1.8 million. |

| |

|

|

| |

● |

Gross

margin was 20.9%, compared to 31.8%. |

| |

|

|

| |

● |

As

of June 30, 2024, the Company had 30,486 quarterly active units (“QAUs”) operating on its Owned and Operated (“O&O”)

Platform, compared to 34,898 QAUs as of June 30, 2023. |

| |

|

|

| |

● |

As

of June 30, 2024, the Company had approximately 51,000 screens across its Partner Platforms, compared to approximately 37,000 as

of June 30, 2023. |

In

the 2024 fiscal third quarter, revenue decreased approximately 23% to $4.4 million compared to $5.7 million for the same period in fiscal

2023. This decrease was primarily driven by a challenging ad market environment in the second quarter of fiscal year 2024 due to one

of the largest ad demand participants changing their terms of business with ad publishers, including us, which resulted in a material

negative impact on the Company’s ad demand partner revenue.

Gross

profit in the 2024 fiscal third quarter was $0.9 million compared to $1.8 million for the same period in fiscal 2023. Gross margin was

20.9% in the 2024 fiscal third quarter compared to 31.8% for the same period in fiscal 2023. The decrease in margin rate was primarily

driven by decreased revenue.

Total

sales, general, and administrative (“SG&A”) expenses (excluding stock-based compensation, depreciation and amortization,

impairment of goodwill and intangible assets, and restructuring costs) in the 2024 fiscal third quarter were $4.1 million, a decrease

of $2.2 million, or 35%, from $6.3 million for the same period in fiscal 2023. This decrease in SG&A expenses was primarily due to

reductions in headcount, marketing costs, and professional and administration fees. As a result of the cost-cutting measures that the

Company has undertaken in fiscal year 2024, the Company has realized a quarter-on-quarter reduction in SG&A expenses of $1.6 million,

or 28%, from $5.7 million in the second quarter ended March 31, 2024, to $4.1 million in the third quarter ended June 30, 2024.

Net

loss in the third quarter of fiscal 2024 was $(5.5) million or $(0.07) per share, compared to a net loss of $(7.9) million or $(0.14)

per share for the same period in fiscal 2023.

Adjusted

EBITDA in the third quarter of fiscal 2024 was $(2.2) million compared to $(3.7) million for the same period in fiscal 2023.

On

June 30, 2024, cash and cash equivalents were $1.5 million compared to $2.2 million on March 31, 2024. The decrease was primarily driven

by use of cash from operations. As of June 30, 2024, the Company had total net debt of $6.2 million compared to $6.0 million as of March

31, 2024, a 3% increase.

For

the third quarter of fiscal 2024, the Company had approximately 81,000 active Loop Players and Partner Screens across the Loop Platform,

which included 30,486 QAUs across the Company’s O&O Platform, a decrease of 13% (or 4,412 QAUs) over the 34,898 QAUs for the

third quarter of fiscal 2023, and a decrease of 7% (or 2,172 QAUs) over the 32,658 QAUs for the second quarter of fiscal 2024, and approximately

51,000 Partner Screens across the Company’s Partner Platforms at the end of the third quarter of fiscal 2024, an increase of 38%

(or approximately 14,000 Partner Screens) over approximately 37,000 Partner Screens at the end of the third quarter of fiscal 2023, and

an increase of approximately 2% (or approximately 1,000 Partner Screens) over approximately 50,000 Partner Screens at the end

of the second quarter of fiscal 2024.

Continued

Cost-Cutting Initiatives

During

the third quarter of fiscal year 2024, the Company continued the cost-cutting review it began earlier in fiscal year 2024, which it believed

would provide the framework for making it more competitive in the CTV for business/DOOH industry and would accelerate its potential

path to break even and achieve operating profitability. These measures have included: (1) discussions with certain third-party content

providers and other licensors with a view to (i) restructuring existing or new license agreements and (ii) eliminating certain fixed

fee content licenses, in each case to more closely align payments to content licensors with revenue associated with such content; (2)

the development and promotion of lower cost channels to reduce or eliminate third-party content license fees, where possible; and (3)

a continued review of existing third-party vendor products and services with a view to eliminating approximately $750,000 in ongoing

yearly costs and expenses beginning in the first quarter of fiscal year 2025.

These

efforts are ongoing and as these initiatives and changes continue to take effect, the Company believes it will see improved margins for

the business. There can be no assurances, however, that the Company will be able to effect all changes that it has identified or that

any such changes will achieve the desired results.

Justis

Kao, CEO, stated, “Since my recent appointment as CEO, I have focused my attention on those areas of the business where we can

look to increase revenues, leverage the Company’s fixed and variable expenses and improve profitability. As we have already undertaken

significant cost-cutting measures, we will continue to streamline our operations and create further cost efficiencies for the remainder

of this fiscal year and into the next. We are also continuing to work toward the expansion of our subscription offerings to our out-of-home

business clients, including the introduction of a two-tier music video service offering, which will include a “primary tier”

consisting of fewer than ten music video channels provided under a free ad-based service, and a “premium tier” of Loop’s

full library of curated music video channels provided under a subscription service. We have also recently announced a non-music subscription

offering that includes a number of live channels ranging from live sports events (including The NFL Redzone and The NFL Network) to news

and lifestyle offerings, which we believe will continue to support the growth opportunities of our business while further enhancing

the customer experience for our business venue partners.”

Conference

Call

The

Company will conduct a conference call today, August 7, 2024, at 5:00 p.m. Eastern Daylight Time to discuss its financial and operating

results for its 2024 fiscal third quarter ended June 30, 2024.

Loop

Media’s management will host the conference call.

Date:

August 7, 2024

Time:

5:00 p.m. Eastern Time

Participant

registration link: Q3 Link

Below

are the details for those participants who would like to dial in.

Conference

ID: 1588215

Participant

Toll-Free Dial-In Number: 1(800) 715-9871

Participant

International Dial-In Number: 1(646) 307-1963

The

conference call will also be available for replay on the investor relations section of the Company’s website at https://ir.loop.tv/.

About

Loop Media, Inc.

Loop

Media, Inc. (“Loop®”) (NYSE American: LPTV) is a leading connected television (CTV) / streaming / digital

out-of-home TV and digital signage platform optimized for businesses, providing music videos, news, sports, and entertainment channels

through its Loop® TV service. Loop Media is the leading company in the U.S. licensed to stream music videos to businesses

through its proprietary Loop® Player.

Loop®

TV’s digital video content is streamed to millions of viewers in CTV / streaming / digital out of home locations including

bars/restaurants, office buildings, retail businesses, college campuses, airports, among many other venues in the United States, Canada,

Australia and New Zealand.

Loop®

TV is fueled by one of the largest and most important premium short-form entertainment libraries that includes music videos, movie

trailers, branded content, and live performances. Loop Media’s non-music channels cover a wide variety of genres and moods and

include movie trailers, sports highlights, lifestyle and travel videos, viral videos, and more. Loop Media’s streaming services

generate revenue from programmatic and direct advertising, and subscriptions.

To

learn more about Loop Media products and applications, please visit us online at Loop.tv

Follow

us on social:

Instagram:

@loopforbusiness

X

(Twitter): @loopforbusiness

LinkedIn:

https://www.linkedin.com/company/loopforbusiness/

Safe

Harbor Statement and Disclaimer

This

news release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended, including, but not limited to, Loop Media’s expected performance,

ability to compete in the highly competitive markets in which it operates, statements regarding Loop Media’s ability to develop

talent and attract future talent, the success of strategic actions Loop Media is taking, and the impact of strategic transactions. Forward-looking

statements give Loop Media’s current expectations, opinion, belief or forecasts of future events and performance. A statement identified

by the use of forward-looking words including “will,” “may,” “expects,” “projects,” “anticipates,”

“plans,” “believes,” “estimate,” “should,” and certain of the other foregoing statements

may be deemed forward-looking statements. Although Loop Media believes that the expectations reflected in such forward-looking statements

are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be materially

different from those suggested or described in this news release. Investors are cautioned that any forward-looking statements are not

guarantees of future performance and actual results or developments may differ materially from those projected. The forward-looking statements

in this press release are made as of the date hereof. Loop Media takes no obligation to update or correct its own forward-looking statements,

except as required by law, or those prepared by third parties that are not paid for by Loop Media. Loop Media’s Securities and

Exchange Commission filings are available at www.sec.gov.

Non-GAAP

Measures

Loop

Media uses non-GAAP financial measures, including Adjusted EBITDA and quarterly active units or QAUs, as supplemental measures

of the performance of the Company’s business. Use of these financial measures has limitations, and you should not consider

them in isolation or use them as substitutes for analysis of Loop Media’s financial results under generally accepted accounting

principles in the United States of America (“U.S. GAAP”).

We

believe that the presentation of Adjusted EBITDA, provides investors with additional information about our financial results. Adjusted

EBITDA is an important supplemental measure used by our board of directors and management to evaluate our operating performance from

period-to-period on a consistent basis and as a measure for planning and forecasting overall expectations and for evaluating actual results

against such expectations.

Adjusted

EBITDA is not measured in accordance with, or an alternative to, measures prepared in accordance with U.S. GAAP. In addition, this non-GAAP

financial measure is not based on any comprehensive set of accounting rules or principles. As a non-GAAP financial measure, Adjusted

EBITDA has limitations in that it does not reflect all of the amounts associated with our results of operations as determined in accordance

with U.S. GAAP. In particular:

| |

● |

Adjusted

EBITDA does not reflect the amounts we paid in interest expense on our outstanding debt; |

| |

|

|

| |

● |

Adjusted

EBITDA does not reflect the amounts we paid in taxes or other components of our tax provision; |

| |

|

|

| |

● |

Adjusted

EBITDA does not include depreciation expense from fixed assets; |

| |

|

|

| |

● |

Adjusted

EBITDA does not include amortization expense; |

| |

|

|

| |

● |

Adjusted

EBITDA does not include the impact of stock-based compensation; |

| |

|

|

| |

● |

Adjusted

EBITDA does not include the impact of non-recurring expense; |

| |

|

|

| |

● |

Adjusted

EBITDA does not include the impact of restructuring costs; |

| |

|

|

| |

● |

Adjusted

EBITDA does not include the impact of the loss on the extinguishment of debt; |

| |

|

|

| |

● |

Adjusted

EBITDA does not include the impact of employee retention credits; and |

| |

|

|

| |

● |

Adjusted

EBITDA does not include the impact of other income including foreign currency translation adjustments, realized foreign currency

gains/losses and unrealized gains/losses. |

Because

of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures including net income (loss)

and our financial results presented in accordance with U.S. GAAP.

The financial tables below provide a reconciliation

of Adjusted EBITDA to the most nearly comparable measure under U.S. GAAP.

The

Company defines an “active unit” as (i) an ad-supported Loop Player (or DOOH location using Loop Media’s ad-supported

service through its “Loop for Business” application or using a DOOH venue-owned computer screening the Company’s content)

that is online, playing content, and has checked into the Loop analytics system at least once in the 90-day period or (ii) a DOOH location

customer using the Company’s paid subscription service at any time during the 90-day period. The Company uses quarterly active

units, or “QAUs,” to refer to the number of such active units during such period.

Loop

Media Investor Contact

ir@loop.tv

Loop

Media Press Contact

Grant

Genske

grant@loop.tv

LOOP

MEDIA, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

June 30, 2024 | | |

September 30, 2023 | |

| | |

(UNAUDITED) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 1,546,088 | | |

$ | 3,068,696 | |

| Accounts receivable, net | |

| 3,541,592 | | |

| 6,211,815 | |

| Prepaid expenses and other current assets | |

| 443,045 | | |

| 987,605 | |

| Content assets - current | |

| 997,508 | | |

| 2,218,894 | |

| Total current assets | |

| 6,528,233 | | |

| 12,487,010 | |

| Non-current assets | |

| | | |

| | |

| Deposits | |

| 9,954 | | |

| 12,054 | |

| Content assets - non current | |

| 211,661 | | |

| 448,726 | |

| Deferred costs - non current | |

| 503,123 | | |

| 744,408 | |

| Property and equipment, net | |

| 2,507,776 | | |

| 2,711,558 | |

| Operating lease right-of-use assets | |

| 189,650 | | |

| — | |

| Intangible assets, net | |

| 393,556 | | |

| 477,889 | |

| Total non-current assets | |

| 3,815,720 | | |

| 4,394,635 | |

| Total assets | |

$ | 10,343,953 | | |

$ | 16,881,645 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 5,501,995 | | |

$ | 4,978,920 | |

| Accrued liabilities | |

| 1,866,161 | | |

| 3,546,338 | |

| Accrued royalties and revenue share | |

| 7,829,892 | | |

| 4,930,329 | |

| License content liabilities - current | |

| 708,567 | | |

| 489,157 | |

| Equipment financing liability, current | |

| 131,348 | | |

| — | |

| Deferred Income | |

| 26,278 | | |

| — | |

| Lease liability, current | |

| 67,689 | | |

| — | |

| Revolving line of credit - current | |

| 2,175,456 | | |

| 2,985,298 | |

| Non-revolving line of credit, current | |

| 1,000,000 | | |

| | |

| Non-revolving line of credit - related party, current | |

| 1,329,750 | | |

| 2,124,720 | |

| Total current liabilities | |

| 20,637,136 | | |

| 19,054,762 | |

| Non-current liabilities | |

| | | |

| | |

| License content liabilities - non current | |

| 129,000 | | |

| 208,000 | |

| Equipment financing liability, non-current | |

| 229,846 | | |

| — | |

| Lease liability, non-current | |

| 121,961 | | |

| — | |

| Revolving line of credit - related party, non-current | |

| 1,679,226 | | |

| — | |

| Non-revolving line of credit, non-current | |

| — | | |

| 475,523 | |

| Non-revolving line of credit - related party, non-current | |

| — | | |

| 1,959,693 | |

| Total non-current liabilities | |

| 2,160,033 | | |

| 2,643,216 | |

| Total liabilities | |

| 22,797,169 | | |

| 21,697,978 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| — | | |

| — | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Common Stock, $0.0001 par value, 150,000,000 shares authorized, 71,173,736 and 65,620,151 shares issued and outstanding as of March 31, 2024 and September 30, 2023, respectively | |

| 7,904 | | |

| 6,562 | |

| Additional paid in capital | |

| 134,132,075 | | |

| 123,462,648 | |

| Accumulated deficit | |

| (146,593,195 | ) | |

| (128,285,543 | ) |

| Total stockholders’ equity | |

| (12,453,216 | ) | |

| (4,816,333 | ) |

| Total liabilities and stockholders’ equity | |

$ | 10,343,953 | | |

$ | 16,881,645 | |

LOOP

MEDIA, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

Three months ended June 30, | | |

Nine months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 4,350,570 | | |

$ | 5,734,976 | | |

$ | 18,524,289 | | |

$ | 25,954,038 | |

| Cost of revenue | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue - Advertising and Legacy and other revenue | |

| 2,641,779 | | |

| 3,132,568 | | |

| 11,214,512 | | |

| 14,767,807 | |

| Cost of revenue - depreciation and amortization | |

| 798,434 | | |

| 779,165 | | |

| 2,356,717 | | |

| 2,091,876 | |

| Total cost of revenue | |

| 3,440,213 | | |

| 3,911,733 | | |

| 13,571,229 | | |

| 16,859,683 | |

| Gross profit | |

| 910,357 | | |

| 1,823,243 | | |

| 4,953,060 | | |

| 9,094,355 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Sales, general and administrative | |

| 4,116,186 | | |

| 6,284,514 | | |

| 16,022,857 | | |

| 22,011,961 | |

| Stock-based compensation | |

| 931,571 | | |

| 2,592,369 | | |

| 3,371,933 | | |

| 6,858,983 | |

| Depreciation and amortization | |

| 422,882 | | |

| 295,008 | | |

| 1,217,955 | | |

| 717,733 | |

| Restructuring costs | |

| 220,053 | | |

| 146,672 | | |

| 220,053 | | |

| 146,672 | |

| Total operating expenses | |

| 5,690,692 | | |

| 9,318,563 | | |

| 20,832,798 | | |

| 29,735,349 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (4,780,335 | ) | |

| (7,495,320 | ) | |

| (15,879,738 | ) | |

| (20,640,994 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (670,981 | ) | |

| (962,718 | ) | |

| (2,402,444 | ) | |

| (2,889,745 | ) |

| Employee retention credits | |

| — | | |

| 648,543 | | |

| | | |

| 648,543 | |

| Loss on extinguishment of debt | |

| | | |

| | | |

| (25,424 | ) | |

| — | |

| Other expense | |

| 34 | | |

| (65,643 | ) | |

| 289 | | |

| (68,267 | ) |

| Total other income (expense) | |

| (670,947 | ) | |

| (379,818 | ) | |

| (2,427,579 | ) | |

| (2,309,469 | ) |

| Loss before income taxes | |

| (5,451,282 | ) | |

| (7,875,138 | ) | |

| (18,307,317 | ) | |

| (22,950,463 | ) |

| Income tax (expense)/benefit | |

| (335 | ) | |

| (394 | ) | |

| (335 | ) | |

| (1,624 | ) |

| Net loss | |

$ | (5,451,617 | ) | |

$ | (7,875,532 | ) | |

$ | (18,307,652 | ) | |

$ | (22,952,087 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per common share | |

$ | (0.07 | ) | |

$ | (0.14 | ) | |

$ | (0.26 | ) | |

$ | (0.41 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of basic and diluted common shares outstanding | |

| 75,146,980 | | |

| 56,604,812 | | |

| 70,966,475 | | |

| 56,455,743 | |

LOOP

MEDIA, INC.

ADJUSTED

EBITDA RECONCILIATION

| | |

Three months ended June 30, | | |

Nine months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| GAAP net loss | |

$ | (5,451,617 | ) | |

$ | (7,875,532 | ) | |

$ | (18,307,652 | ) | |

$ | (22,952,087 | ) |

| Adjustments to reconcile to Adjusted EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 670,981 | | |

| 962,718 | | |

| 2,402,444 | | |

| 2,889,745 | |

| Depreciation and amortization expense* | |

| 1,221,316 | | |

| 1,074,173 | | |

| 3,574,672 | | |

| 2,809,609 | |

| Income tax expense (benefit) | |

| 335 | | |

| 394 | | |

| 335 | | |

| 1,624 | |

| Stock-based compensation** | |

| 931,571 | | |

| 2,592,369 | | |

| 3,371,933 | | |

| 6,858,983 | |

| Non-recurring expense | |

| 159,425 | | |

| 62,615 | | |

| 437,838 | | |

| 62,615 | |

| Restructuring costs | |

| 220,053 | | |

| 146,672 | | |

| 220,053 | | |

| 146,672 | |

| Loss on extinguishment of debt | |

| | | |

| | | |

| 25,424 | | |

| | |

| Employee retention credits | |

| | | |

| (648,543 | ) | |

| | | |

| (648,543 | ) |

| Other expense | |

| (34 | ) | |

| 3,028 | | |

| (289 | ) | |

| 5,652 | |

| Adjusted EBITDA | |

$ | (2,247,970 | ) | |

$ | (3,682,106 | ) | |

$ | (8,275,242 | ) | |

$ | (10,825,730 | ) |

*

Includes amortization of content assets and for cost of revenue and operating expenses and ATM facility.

**

Includes options, Restricted Stock Units (“RSUs”) and warrants.

v3.24.2.u1

Cover

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity File Number |

001-41508

|

| Entity Registrant Name |

Loop

Media, Inc.

|

| Entity Central Index Key |

0001643988

|

| Entity Tax Identification Number |

47-3975872

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2600

West Olive Avenue

|

| Entity Address, Address Line Two |

Suite 5470

|

| Entity Address, City or Town |

Burbank

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91505

|

| City Area Code |

(213)

|

| Local Phone Number |

436-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.0001 par value per share

|

| Trading Symbol |

LPTV

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

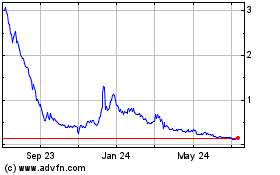

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Nov 2024 to Dec 2024

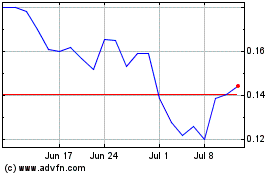

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Dec 2023 to Dec 2024