false

0000008504

0000008504

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 30, 2024

AGEAGLE

AERIAL SYSTEMS INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-36492 |

|

88-0422242 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 8201

E. 34th Cir N, Suite 1307, Wichita, Kansas |

|

67226 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (620) 325-6363

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

UAVS |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

3.01 |

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On

October 30, 2024, AgEagle Aerial Systems Inc. (the “Company”) received written notice (the “Notice”) from the

NYSE American LLC (the “NYSE American”) stating that it is not in compliance with the continued listing standards set forth

in (i) Section 801(h) of the NYSE American Company Guide (the “Company Guide”) because the Company’s Board of Directors

(the “Board”) is not comprised of at least 50% independent directors (the “Board Composition Requirement”) and

(ii) Section 803B(2)(c) of the Company Guide because the Company’s Audit Committee (the “Audit Committee”) is not comprised

of at least two independent members (“Audit Committee Composition Requirement”). The Notice stated that the Company will

have until the earlier of its next annual meeting or one year from the date of its noncompliance with the Board Composition Requirement

to appoint at least one additional independent director to the Board; provided, however, that if the annual shareholders meeting occurs

no later than 180 days following the event that caused the noncompliance, the Company shall instead have 180 days from such event to

regain compliance with the Board Composition Requirement. The Notice also stated that the Company will have until the earlier of its

next annual meeting or one year from the date of its noncompliance with the Audit Committee Composition Requirement to appoint at least

one additional independent member to the Audit Committee; provided, however, that if the annual shareholders meeting occurs no later

than 75 days following the event that caused the noncompliance, the Company shall instead have 75 days from such event to regain compliance

with the Audit Committee Composition Requirement.

As

a result of the foregoing, the Company has become subject to the procedures and requirements of Section 1009 of the Company Guide, which

could, among other things, result in the initiation of delisting proceedings, unless the Company cures the deficiency in a timely manner.

The

Company intends to regain compliance with the NYSE American’s continued listing standards by undertaking a measure or measures

that are in the best interests of the Company and its shareholders, including, but not limited to, appointing an additional independent

director to the Board and an additional independent member to the Audit Committee.

The

Company’s shares of common stock have not been suspended as a result of the receipt of the Notice and continue to trade on the

NYSE American.

In

accordance with the rules of the NYSE American, the Company issued a press release on November 4, 2024 announcing that it had received

the Notice. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated into this

Item 3.01 by reference.

| Item

5.02 |

Departure

of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers. |

On

November 1, 2024, the board of directors (the “Board”) of the Company appointed Brent Klavon to serve as an independent director

of the Company, effective immediately. Mr. Klavon was also appointed as a member of the Company’s Audit Committee, the Compensation

Committee, and the Nominating and Corporate Governance Committee, effective immediately. Mr. Klavon will be chair of the Compensation

Committee.

Mr.

Klavon has over three decades of aviation and strategic leadership experience. A retired U.S. Navy pilot, he served as a squadron Commanding

Officer, logged over 3,000 flight hours, and was instrumental in the launch of the Navy’s MQ-4C Triton program. Since 2022, Mr.

Klavon has been the Chief Strategy Officer at ANRA Technologies, a leading provider of airspace management and mission management solutions

for uncrewed aircraft systems, where he leads global operations and strategic planning. From 2019-2022, Mr. Klavon was Vice President,

Operations at ANRA Technologies. Mr. Klavon was previously a board member at the Association for Uncrewed Vehicle Systems International

(AUVSI) from 2018-2021. He is well versed in the nexus between policy, regulations, standards, technology, and social acceptance. He

is an FAA certified Commercial Pilot and Remote Pilot. Mr. Klavon earned his undergraduate degree in Logistics, Materials, and Supply

Chain Management from Pennsylvania State University.

Mr.

Klavon will receive compensation for his Board and committee service in accordance with the Company’s outside director compensation

program as previously described in the Company’s filings with the Securities and Exchange Commission, including an annual cash

retainer of $60,000, prorated for any partial years of service.

There

is no family relationship between Mr. Klavon and any other executive officer or director of the Company. There are no transactions in

which Mr. Klavon has an interest requiring disclosure under Item 404(a) of Regulation S-K. There is no arrangement or understanding between

Mr. Klavon and any other persons pursuant to which he was selected as a director.

| Item

9.01. | Financial Statements

and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

November 4, 2024 |

AGEAGLE

AERIAL SYSTEMS INC. |

| |

|

|

| |

By: |

/s/

William Irby |

| |

Name: |

William

Irby |

| |

Title: |

Chief

Executive Officer |

Exhibit 99.1

AgEagle

Aerial Systems Receives Non-Compliance Notice from NYSE American

WICHITA,

Kan., November 4, 2024 – AgEagle Aerial Systems Inc. (NYSE: UAVS) a leading provider of best-in-class unmanned aerial systems (UAS),

sensors and software solutions for customers worldwide in the commercial and government verticals, announces that on October 30, 2024,

the Company received written notice (the “Notice”) from the NYSE American LLC (the “NYSE American”) stating that

it is not in compliance with the continued listing standards set forth in (i) Section 801(h) of the NYSE American Company Guide (the

“Company Guide”) because the Company’s Board of Directors (the “Board”) is not comprised of at least 50%

independent directors (the “Board Composition Requirement”) and (ii) Section 803B(2)(c) of the Company Guide because the

Company’s Audit Committee (the “Audit Committee”) is not comprised of at least two independent members (“Audit

Committee Composition Requirement”). The Notice stated that the Company will have until the earlier of its next annual meeting

or one year from the date of its noncompliance with the Board Composition Requirement to appoint at least one additional independent

director to the Board; provided, however, that if the annual shareholders meeting occurs no later than 180 days following the event that

caused the noncompliance, the Company shall instead have 180 days from such event to regain compliance with the Board Composition Requirement.

The Notice also stated that the Company will have until the earlier of its next annual meeting or one year from the date of its noncompliance

with the Audit Committee Composition Requirement to appoint at least one additional independent member to the Audit Committee; provided,

however, that if the annual shareholders meeting occurs no later than 75 days following the event that caused the noncompliance, the

Company shall instead have 75 days from such event to regain compliance with the Audit Committee Composition Requirement.

As

a result of the foregoing, the Company has become subject to the procedures and requirements of Section 1009 of the Company Guide, which

could, among other things, result in the initiation of delisting proceedings, unless the Company cures the deficiency in a timely manner.

The

Company must submit a plan (the “Plan”) by November 5, 2024 to the NYSE American outlining actions it has taken or will take

to regain compliance with the continued listing standards.

The

Company intends to regain compliance with the NYSE American’s continued listing standards by undertaking a measure or measures

that are in the best interests of the Company and its shareholders, including, but not limited to, appointing an additional independent

director to the Board and an additional independent member to the Audit Committee.

The

Company’s shares of common stock have not been suspended as a result of the receipt of the Notice and continue to trade on the

NYSE American.

About

AgEagle Aerial Systems Inc.

Through

its three centers of excellence, AgEagle is actively engaged in designing and delivering best-in-class flight hardware, sensors and software

that solve important problems for its customers. Founded in 2010, AgEagle was originally formed to pioneer proprietary, professional-grade,

fixed-winged drones and aerial imagery-based data collection and analytics solutions for the agriculture industry. Today, AgEagle is

a leading provider of full stack UAS, sensors and software solutions for customers worldwide in the energy, construction, agriculture,

and government verticals. For additional information, please visit our website at www.ageagle.com.

Forward-Looking

Statements

Certain

statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. All statements, other than statements of historical fact, contained in this press release are forward-looking

statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,”

“believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,”

“seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“suggest,” “target,” “aim,” “should,” “will,” “would,” or the

negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on AgEagle’s current expectations and are subject to inherent uncertainties, risks and assumptions that are

difficult to predict, including risks related to the timing and ability to regain compliance with the NYSE American Listing Standards.

the timing and fulfilment of current and future orders relating to AgEagle’s products, the success of new programs, the ability

to implement a new strategic plan and the success of a new strategic plan. Further, certain forward-looking statements are based on assumptions

as to future events that may not prove to be accurate. For a further discussion of risks and uncertainties that could cause actual results

to differ from those expressed in these forward-looking statements, as well as risks relating to the business of AgEagle in general,

see the risk disclosures in the Annual Report on Form 10-K of AgEagle for the year ended December 31, 2023, and in subsequent reports

on Forms 10-Q and 8-K and other filings made with the SEC by AgEagle. All such forward-looking statements speak only as of the date they

are made, and AgEagle undertakes no obligation to update or revise these statements, whether as a result of new information, future events

or otherwise.

AgEagle Aerial Systems Contacts

Investor Relations:

Email:

UAVS@ageagle.com

Media:

Email:

media@ageagle.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

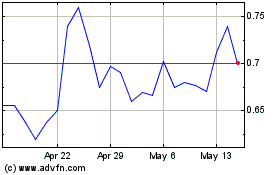

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Nov 2024 to Dec 2024

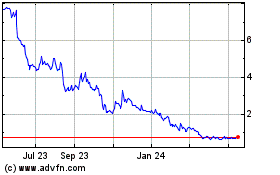

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Dec 2023 to Dec 2024