Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

March 09 2022 - 4:19PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

File No. 333-230255

UNITED STATES NATURAL GAS FUND, LP

Supplement dated March 9, 2022

to

Prospectus dated April 28, 2021

This supplement contains information that amends, supplements or modifies

certain information contained in the prospectus of United States Natural Gas Fund, LP (“UNG”) dated April 28, 2021 (the “Prospectus”).

You should carefully read the Prospectus and this supplement before investing.

This supplement should be read in conjunction with the Prospectus. You should also carefully consider the “Risk Factors”

beginning on page 4 of the Prospectus before you decide to invest.

The following risk factor

is added on page 5 of the Prospectus, immediately following the risk factor “Price Volatility May Possibly Cause the Total Loss

of Your Investment.”

Russia’s invasion

of Ukraine, and sanctions brought by the United States and other countries against Russia, have caused disruptions in many business sectors

and have resulted in significant market disruptions and increased volatility in the price of certain commodities, including oil and natural

gas.

On February 24, 2022, Russia

launched a large-scale invasion of Ukraine. The extent and duration of the military action, resulting sanctions and future market disruptions

in the region are impossible to predict, but could be significant and may have a severe adverse effect on the region. Among other things,

the conflict has resulted in increased volatility in the markets for certain securities and commodities, including oil and natural gas,

and other sectors.

The United States and other

countries and certain international organizations have imposed broad-ranging economic sanctions on Russia and certain Russian individuals,

banking entities and corporations as a response to Russia’s invasion of Ukraine. On March 8, 2022, the United States announced

that it would ban imports of oil, natural gas and coal from Russia. The impact of this announcement on commodities and futures prices

is difficult to predict and depends on a number of factors, including whether other countries act in the same manner, but such impact

could be significant.

Actual and threatened responses

to Russia’s invasion, as well as a rapid peaceful resolution to the conflict, may also impact the markets for certain commodities,

such as oil and natural gas, and may have collateral impacts, including increased volatility, and cause disruptions to availability of

certain commodities, commodity and futures prices and the supply chain globally. At this time, the situation is rapidly evolving and may

evolve in a way that could have a negative impact on the fund in the future.

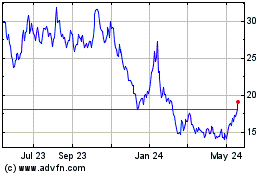

United States Natural Gas (AMEX:UNG)

Historical Stock Chart

From Dec 2024 to Jan 2025

United States Natural Gas (AMEX:UNG)

Historical Stock Chart

From Jan 2024 to Jan 2025