The fourth quarter of 2012 was a mixed bag for the equity

markets. It was a quarter marked by certain domestic as well as

global events which could prove to be game changers in the months

ahead.

Nevertheless, the ETF industry seems to be going strong. A look

at the top 10 asset accumulating ETFs this quarter reveals an

impressive 5.97% increase in terms of total additions to the asset

base over the third quarter of 2012, suggesting that even with some

volatility in the market, demand for ETFs remains strong.

The following table reveals the 10 most popular ETFs in the

final quarter of fiscal year 2012.

Table 1: Top 10 Asset Accumulating ETFs for Q4

12

|

ETF

|

Category

|

Inflow for Q4

|

4th Quarter Returns

|

|

EEM

|

Emerging Market Equities

|

$8.86 billion

|

8.46%

|

|

SPY

|

Broad Market Equities

|

$6.16 billion

|

1.47%

|

|

IVV

|

Broad Market Equities

|

$3.68 billion

|

1.82%

|

|

FXI

|

Emerging Market Equities

|

$2.99 billion

|

10.19%

|

|

GLD

|

Commodities-Gold

|

$1.77 billion

|

-2.88%

|

|

IWD

|

Broad Market Equities

|

$1.42 billion

|

2.13%

|

|

VGK

|

Developed Market Equities

|

$1.12 billion

|

6.89%

|

|

VOO

|

Broad Market Equities

|

$1.14 billion

|

1.59%

|

|

EMB

|

Emerging Market Bonds

|

$1.09 billion

|

1.61%

|

|

VTI

|

Broad Market Equities

|

$1.07 billion

|

2.08%

|

(Source: Indexuniverse.com)

Surprisingly, the iShares MSCI Emerging Market ETF

(EEM) makes it to the list and its Vanguard counterpart

VWO is nowhere to be found within the top 10

names. This could partially be due to Vanguard promising to switch

its index from MSCI to FTSE, but Vanguard did suggest that the fees

would be reduced in the move as well.

Although this would result in a cut in the already competitive

expense ratio of 20 basis points for the Vanguard ETF (especially

compared to the 67 basis points that iShares charges), the index

excludes South Korea. Top names like Samsung and Hyundai will

thereby be missing from the ETF portfolio so this could be part of

the shift to EEM by larger investors (read 2012 Was Forgettable for

These Emerging Market ETFs).

Also, it is worthwhile to point out that other Emerging Market

ETFs have also made it to the top 10 asset accumulating list. The

iShares FTSE China Large Cap ETF (FXI) which

provides a pure play in the Chinese large cap equity space has

gained more than 10% this quarter accumulating almost $3 billion in

its asset base.

The Chinese economy has for long been waiting for a turnaround.

The latest bout of optimism from the Chinese economy comes in the

form of rising industrial production coupled with increased

infrastructure spending by the government and a real estate

recovery. These factors have been the key positives for the Chinese

economy (read Try Small Cap ETFs to Gain from Chinese Domestic

Demand).

Of course, a modest recovery in the global economic space has

surely helped the Chinese large cap companies which are more export

oriented than their mid and small cap counterparts.

Also, the iShares J.P.Morgan Emerging Markets USD Bond

ETF (EMB) gained tremendous popularity this quarter. The

paltry yields from the domestic U.S. fixed income market had forced

yield hungry investors to look beyond the shores of the U.S.

Adding to the flavor of this product is that it eliminates

currency risk by considering only U.S. Dollar denominated

securities in its portfolio. Thus investors could get the actual

returns without worrying about the exchange rate movements.

A number of domestic broad market funds have made it to the top

10 list too. The SPDR S&P 500 ETF (SPY), iShares Core

S&P 500 ETF (IVV) and the Vanguard S&P 500

ETF (VOO) the three S&P 500 ETFs have accumulated

$6.16 billion, $3.68 billion and $1.14 billion respectively.

However, IVV leads in terms of returns by fetching investors 1.82%.

This is followed by VOO returning 1.59% and SPY returning

1.47%.

Beyond the S&P 500 ones, other broad market ETFs tracking

other indexes have featured in this elite list. The iShares

1000 Value ETF (IWD) tracking the Russell 1000 Value Index

and the Vanguard Total Stock Market ETF (VTI)

tracking the MSCI US Broad Market Index have made it to the top 10

list.

The former is a large cap ETF tracking 1000 large cap stocks

from the U.S. equity markets whereas the latter is a total market

ETF which is composed of more than 3300 shares and constitutes of

stocks from the entire spectrum of market capitalization.

The fourth quarter was pretty much the most volatile quarter

this fiscal. Although it seemed that the stock markets would end in

the red this quarter especially post the presidential elections, it

actually rebounded and posted positive returns.

Also, there was lack of clarity over the stock market

performance of individual sectors since the third quarter earnings

season was feeble and so was the forward guidance for the upcoming

quarters by the company management.

This kind of explains the popularity for the broad based funds

as investors seemed to play the wait and see game and ride out

sector specific risk by allocating more to broad market funds.

Lastly, of late, gold has not been experiencing the best of

times. In fact the outlook for Gold remains on the negative side at

least in the near to mid-term (see Gold ETFs: Is the Sell-Off

Overdone?). The SPDR Gold ETF (GLD) is the only

ETF in this list which has posted negative returns for the fourth

quarter in spite of accumulating nearly $1.77 billion.

However, Gold still ended the year on a positive note gaining

for the 12th straight year and on a multi-year high

(read Gold ETFs Make 2012 Another Positive Year). And with the

fundamentals not yet completely bearish for the yellow metal, a

recovery in the longer term definitely seems possible.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

(EEM): ETF Research Reports

(EMB): ETF Research Reports

(FXI): ETF Research Reports

(GLD): ETF Research Reports

(IVV): ETF Research Reports

(IWD): ETF Research Reports

(SPY): ETF Research Reports

(VGK): ETF Research Reports

(VOO): ETF Research Reports

(VTI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

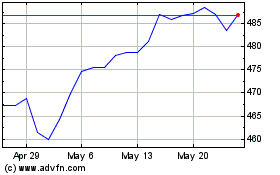

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Mar 2024 to Mar 2025