Emerging market ETFs have been lagging their developed

counterparts this year and have been among the worst performing

products in the first quarter. This is largely due to a slowdown in

domestic demand in the key emerging markets, a lingering Eurozone

crisis (which can impact exports), and appreciation in the U.S.

dollar.

In fact, these ETFs clearly underperformed the broader U.S.

market funds like SPDR S&P 500 ETF (SPY) and Dow Jones

Industrial Average ETF (DIA), and the world market funds like

iShares MSCI World Index Fund (URTH) by a wide margin in the

quarter. Flows into ETFs offering emerging market exposure have

slowed this year.

Notably, this is the first time in more than a decade when

emerging countries have underperformed during a global rally (read:

A Trio of Top Emerging Market ETFs for 2013).

This is because most of the emerging economies like India,

Brazil and China have been struggling to reinvigorate growth.

Investors should note that worries on the macroeconomic and

political front in India, the property market in China, and

persistent inflation and interest rates hike issues in Brazil are

keeping the emerging market returns in check.

Additionally, most of these nations are commodity-centric

economies that make them highly susceptible to any downtrend in the

global economy. Further, currency declines against the greenback

have hit hard both equity and debt markets in the emerging

economies, adding to woes.

Better Outlook

Despite these weaknesses, emerging markets are expected to grow

substantially compared to the developed world. According to the

International Monetary Fund (IMF), emerging economies would grow

5.9% in 2013 compared to 1.9% for developed countries and 2% for

the U.S.

Also, valuations for emerging market stocks appear cheaper than

the U.S. and developed market stocks, suggesting nice entry points.

As a result, investors could tap this opportunity in the form of a

basket approach with ETFs (read: Emerging Market ETFs to Soar

in 2013?).

While there are several ETFs in the emerging market space, we

have highlighted three of the most popular funds in the segment,

each of which have posted a loss in Q1. However, these funds could

fetch healthy returns considering the attractive valuation of their

stocks and solid growth projections by the IMF, making any of the

following interesting picks for globally-focused investors:

iShares MSCI Emerging Markets ETF

(EEM)

One of the most popular ways to follow emerging markets is

through EEM, a fund that tracks the MSCI Emerging Market

Index, which measures the equity market performance of various

emerging markets.

The fund is widely spread across a large basket of 837

securities and puts little in individual stocks, preventing it from

heavy concentration. It puts just 15.85% in the top 10 holdings,

suggesting minimal company specific risk. Samsung Electronics,

Taiwan semiconductor and China Mobile occupy the top three

positions in the basket.

From a sector perspective, financials take the top spot with

more than one-fourth of the assets, while information technology,

energy and materials round out the next three spots in the basket

(read: Banking ETFs: Laggards or Leaders?).

The product appears rich with AUM of over $45.5 billion and

average daily volume of about 50 million shares. It charges quite a

high annual fee of 66 basis points from investors for the diversity

in its portfolio.

In terms of individual countries, China enjoys the maximum

allocation with a share of 17.46% while South Korea, Brazil and

Taiwan also get double-digit allocation with a share of 14.72%,

12.64% and 10.74%, respectively.

Currently, EEM is trading at P/E of 18.36 times and has a Zacks

ETF Rank #3 or ‘Hold’ rating.

Vanguard FTSE Emerging Markets ETF

(VWO)

VWO is another popular ETF to track the emerging market with the

same index. The fund manages an asset base of $58.4 billion and

trades at a volume of more than 18 million shares a day.

The product holds a great deal of securities, about 1,060, and

has a slight tilt towards one firm – Samsung Electronics – with

4.1% share. It offers a wide diversification across individual

holdings as no other firm makes up more than 2% of VWO. The top 10

holdings combine to make up for 17.8% of the assets.

For sectors, financial gets the maximum allocation closely

followed by energy, technology and basic materials sectors. Among

various nations, China, Brazil, Taiwan and Korea enjoy double-digit

allocation in the fund with respective shares of 18.6%, 13.9%,

10.8% and 10.3% (read: Are China ETFs in Trouble?). The fund

charges a fee of 18 basis points annually.

Currently, the ETF is trading with a P/E of 13.6 times and has a

Zacks Rank #2 or ‘Buy’ rating. This suggests that this product is

expected to outperform over the long haul compared to the other

funds in the sector.

WisdomTree Emerging Markets Equity Income Fund

(DEM)

This fund tracks the WisdomTree Emerging Markets Equity Income

Index, which measures the performance of the highest dividend

yielding stocks selected from the WisdomTree Emerging Markets

Dividend Index (read: 4 Excellent Dividend ETFs for Income and

Stability).

With a total of 237 stocks in its basket, the product is widely

spread across individual securities with just 32.62% of its assets

in top 10 holdings. The top three firms – China Construction Bank,

Gazprom and Banco do Brasil – comprise about 17.43% of the combined

share in the basket.

The fund is heavy on financials, closely followed by energy,

materials and telecommunication services. In terms of country

allocations, Taiwan is at the top (19.62%), followed by China

(16.26%), Russia (12.59%) and Brazil (12.16%).

The product has amassed over $5.5 billion in AUM and trades in

good volume of more than 737,000 shares per day. The ETF charges 63

bps in fees per year from investors.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-EM EQ I (DEM): ETF Research Reports

SPDR-DJ IND AVG (DIA): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS WORLD (URTH): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

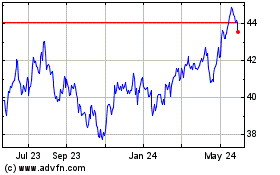

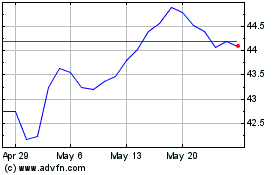

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Dec 2023 to Dec 2024