MARKET COMMENT: S&P/ASX 200 Flat Amid Mixed Offshore Data

March 10 2013 - 7:27PM

Dow Jones News

2356 GMT [Dow Jones] Australia's S&P/ASX 200 is flat in

mixed trading Monday as disappointing Chinese economic data

released over the weekend is offsetting Friday's

stronger-than-expected U.S. jobs data. BHP (BHP.AU), Rio Tinto

(RIO.AU) and Fortescue (FMG.AU) are down 1.0%-1.8%, while ANZ

(ANZ.AU), NAB (NAB.AU), Woodside (WPL.AU), News Corp (NWS.AU),

Macquarie (MQG.AU) and Coca-Cola Amatil (CCL.AU) are up 0.7%-2.7%.

CSR (CSR.AU) falls 4.0% after slashing annual profit guidance

following a review of its Viridian glass business. "It's too early

to assume a weakening trend in China's domestic economy," says CMC

Markets chief market analyst Ric Spooner. "While retail sales

growth was weaker than expected, the impact of the New Year means

it's prudent not to assume it's a definite indication of a trend

towards lower growth. However, investors will not be inclined to

ignore these figures altogether. Lower figures in months to come

would frank an outlook for softening domestic spending growth in

response to higher food prices in China." He says the S&P/ASX

200 would need a clear move above last week's high at 5135.7 to

indicate that the uptrend is resuming, and a break of technical

support around 5045 would indicate that a much awaited correction

is underway. Holidays in Victoria state are making for a quiet

start to the week. (david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

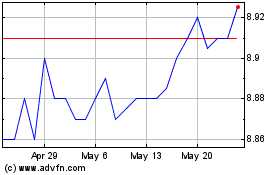

CSR (ASX:CSR)

Historical Stock Chart

From Nov 2024 to Dec 2024

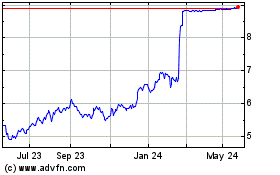

CSR (ASX:CSR)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about CSR Limited (Australian Stock Exchange): 0 recent articles

More CSR Ltd News Articles