Asian Shares Stronger With Nikkei at 10-Month High

November 24 2016 - 10:00PM

Dow Jones News

Asian share markets were broadly higher early Friday, with

Japan's Nikkei leading after the yen hit a fresh eight-month low

against the dollar, helping boost the competitiveness of the

country's exports.

The Nikkei Stock Average rose 0.8% to fresh 10-month high.

Elsewhere in the region, Australia's S&P/ASX 200 was up 0.5%,

Hong Kong's Hang Seng Index added 0.2%, while the Shanghai

Composite Index was down 0.8%.

The U.S. dollar-yen currency pair rose further on Friday, amid

subdued trading volumes over the U.S. Thanksgiving holiday.

Expectations of higher inflation in the U.S. under the Donald Trump

administration are driving the greenback's broad strength, noted

Seiichi Tanaka, head of foreign exchange spot trading at Mizuho

Bank.

A weaker yen makes Japanese exports competitive and increases

the value of overseas profits when they are repatriated. Among key

export stocks, Nissan Motor surged 4.9% and Honda Motor gained 4%.

Electronics giant Sony added 0.5%, while videogame maker Nintendo

rose 0.9%.

Also, latest consumer price data in Japan showed deflation there

was slowing. The core consumer price index there fell 0.4% from a

year earlier in October, adjusted for fresh food and energy prices,

according to data released Friday. The reading marked the eighth

consecutive monthly decline, but was smaller than the 0.5% drop in

the previous month.

Meanwhile, strength in global commodity prices is helping drive

share gains in Australia. On Thursday, copper prices hit a 17-month

high as bullish expectations for manufacturing spending outweighed

the impact of the U.S. dollar hitting multi-year highs.

Among key resource shares in Australia, BHP Billiton rose 2.7%,

while Rio Tinto added 1.8%, and Fortescue Metals Group added

0.3%.

"There is strong momentum in copper, coal and other

commodities," said Castor Pang, head of research at Core

Pacific-Yamaichi International, noting that the surge in prices has

been due to speculation. "It seems that investors believe there may

be very strong demand from the U.S."

Expectations that a deal to cut global oil output will be

finalized next week continued to help drive energy stock prices,

with Woodside Petroleum and Santos Ltd. in Australia adding 1.6%

and 0.7%, respectively. In Japan, shares of Inpex Corp. rose

0.4%.

Brent, the international crude oil benchmark, was down 0.1% in

Asian trade but was hovering around $49 a barrel, ahead of the

meeting of the Organization of the Petroleum Exporting Countries

next week. Iraq has indicated that it would be taking part in any

agreement to freeze production.

Still, gains in Asian markets were capped by reduced volumes and

a lack of trading cues, with U.S. markets shut for Thanksgiving.

"Whenever there are holidays in the U.S., trading is expected to be

thin (in Asia)," said Alex Furber, a senior client services

executive at CMC Markets.

In South Korea, the Kospi was mostly flat, last up 0.05%. The

market's underperformance came as consumer confidence in the

country fell to the lowest in more than seven years in November, a

Bank of Korea survey showed Friday.

The market will also be watching for the release of key Asia

data later Friday, including Malaysian consumer prices and

Singapore industrial production data, both for October, while

Taiwan will release third-quarter final economic output data.

--Kosaku Narioka, Takashi Nakamichi, Kwanwoo Jun and Katherine

Dunn contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

November 24, 2016 22:45 ET (03:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

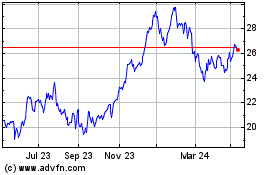

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2024 to Jan 2025

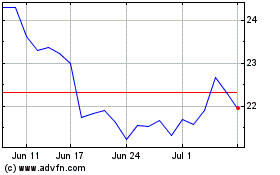

Fortescue (ASX:FMG)

Historical Stock Chart

From Jan 2024 to Jan 2025