MARKET MOVEMENTS:

--Brent crude oil is 0.6% lower at $85.03 a barrel.

--European benchmark gas rises 3.1% to EUR54 a megawatt

hour.

--Gold futures are down 1.1% at $1,845.30 a troy ounce.

--Three-month copper is 1.7% lower at $8,862.50 a metric

ton.

--Wheat futures are 0.1% lower at $7.85 a bushel.

TOP STORY:

Oil Demand to be Driven by Asia This Year as China Reopens, IEA

Says

The International Energy Agency raised its forecasts for oil

demand this year to a record level, as China's reopening fueled a

surge in air travel across Asia, while also adding to its supply

forecast as Russian production remained surprisingly resilient to

Western sanctions.

The Paris-based energy watchdog said in a monthly report that it

expects oil demand to grow to 101.9 million barrels a day this

year--a record level--propelled almost entirely by rising demand in

Asia. The figure is 200,000 barrels a day more than the IEA

forecast last month, which was also a record amount.

That figure means demand is expected to grow by 2 million

barrels a day this year, of which Asian nations will account for

1.4 million barrels a day and China alone will account for 900,000

barrels a day.

OTHER STORIES:

Glencore to Return $7.1 Bln to Shareholders After Record 2022

Earnings

Glencore PLC said Wednesday that it will return $7.1 billion to

shareholders after reporting record 2022 earnings on the back of

significant growth in its marketing and energy divisions.

The Anglo-Swiss commodity mining and trading company declared

distributions of $5.6 billion and a $1.5 billion share-buyback

program.

This follows increased earnings and net debt reducing to $75

million, significantly beating a market consensus of net debt of

around $386 million. However, the net debt figure should imply

total shareholder returns of around $9 billion, leaving the actual

result a significant miss, RBC Capital Markets said in a research

note.

Glencore reported record adjusted earnings before interest,

taxes, depreciation and amortization of $34.06 billion for 2022, up

from $21.32 billion in 2021 and slightly above a market consensus

of $33.94 billion, taken from FactSet and based on 13 analysts'

estimates.

--

Chinese President Xi Jinping Pledges to Boost Consumption,

Investment

Chinese President Xi Jinping has pledged to boost domestic

consumption and investment to anchor economic expectations and

improve business confidence, according to an article published

Wednesday by the ruling Communist Party journal Qiushi.

The government should give priority to the recovery and

expansion of consumption by unleashing the potential of the

domestic market and increasing residents' income, especially low

and middle-income groups, Xi said in a speech dated back in

December during the country's annual key economic work

conference.

Chinese policy makers usually make key economic decisions at

this year-end meeting, including setting growth targets for the

following year. China will unveil its economic targets at an annual

legislative meeting early next month.

--

Fortescue's First-Half Net Profit Fell 15%, Cuts Dividend

Fortescue Metals Group Ltd. on Wednesday reported a 15% fall in

first-half profit and pared its interim dividend as iron-ore prices

fell and production costs increased.

The world's fourth-largest iron-ore producer said it made a net

profit of US$2.37 billion in the six months through December, down

from US$2.78 billion in the year-earlier period. That beat market

expectations of a US$2.34 billion profit, according to 12 analyst

forecasts compiled by Vuma Financial.

Directors declared an interim dividend of 75 Australian cents

(US$0.52) a share, down from 86 Australian cents a year ago.

Underlying earnings before interest, tax, depreciation and

amortization, or Ebitda, declined to US$4.35 billion from US$4.76

billion in the year-earlier period.

MARKET TALKS:

Platinum Supply at Risk Amid South Africa Power Struggles

1043 GMT - Platinum supply remains at risk this year as South

Africa--the globe's largest producer--faces deepening power issues,

putting strain on refiners and miners, Bank of America says in a

note. "Ultimately, the mining sector is heavily dependent on power

availability. No power, no output," BofA says, noting that 90% of

South Africa's power comes from state provider Eskom, which has

implemented load shedding for months now to try and ease the strain

on the grid. As a result, BofA expects South African PGM output to

slip 3.5% this year and platinum to move into deficit. Palladium

remains under less strain due to low auto demand, the U.S. bank

says. Futures Wednesday are down 1.4% to $925 a troy ounce.

(yusuf.khan@wsj.com)

--

Malaysian Palm Oil Prices Fall, Could Trade Sideways in Near

Term

1004 GMT - Malaysian crude palm oil prices closed a tad lower on

Wednesday. The commodity could continue to trade sideways amid

muted demand, as most importing countries have already stocked up

on vegetable oils, UOB Kay Hian analysts Leow Huey Chuen and

Jacquelyn Yow write in a note. While production in February is

likely to remain low due to widespread floods in Malaysia, a lack

of strong demand could mean that prices of the commodity would

likely struggle to find direction, they add. The benchmark Bursa

Malaysia Derivatives Exchange contract for April delivery closed

MYR21 lower at MYR3,935 a metric ton. (yiwei.wong@wsj.com)

--

Oil Falls on US Demand Worries

0845 GMT - Oil prices tumble as data suggests a sharp build in

U.S. crude oil inventories. Brent crude oil falls 1.1% to $84.61 a

barrel while WTI sheds 1.2% to $78.10 a barrel. American Petroleum

Institute figures reportedly showed a 10.5 million barrel build in

U.S. crude stocks in the week through Feb. 10. Signs of weak U.S.

demand are undermining optimism surrounding China's growing

appetite for crude oil. "We expect oil and gas demand to increase

in China but are a bit more cautious than most...Still, the wild

card remains U.S. demand and whether the biggest major

oil-consuming economy slips into the recession abyss," says Stephen

Innes, managing partner at SPI Asset Management in a note.

(william.horner@wsj.com)

--

Metal Prices Slip as Dollar Strengthens

0844 GMT - Metal prices are moving lower in early trading, with

a rising dollar once again acting as a headwind for commodity

prices. Three-month copper is down 1.5% to $8,884 a metric ton

while aluminum is 0.4% lower at $2397.50 a ton. Gold meanwhile is

down 1% to $1,846.20 a troy ounce--a 10-week low. Deutsche Bank is

now pricing in two more 25 basis-point rate hikes from the Federal

Reserve amid strong employment and warm inflation data recently.

"These all support our base case for a recession rather than a soft

landing," DB analyst Jim Reid says in a note, adding that a more

hawkish approach from the Fed is still likely.

(yusuf.khan@wsj.com)

--

Glencore 2022 Earnings Seen as Solid Despite Working Capital

Drag

0747 GMT - Glencore has reported a solid set of 2022 results

with Ebitda rising 60% to a record $34.1 billion largely on the

back of coal, Citi says. The commodity mining and trading company's

working capital has been a drag for free cash flow given continued

build in the second half, but that has been partially offset by

higher earnings in its marketing business, Citi analysts say in a

research note. "We believe that markets are likely to look through

the working capital build in the context of stronger EBIT in

marketing," the U.S. bank says. Citi retains its buy rating and 700

pence target price on the stock. Shares closed Tuesday at 515.9

pence. (joseph.hoppe@wsj.com)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

February 15, 2023 06:39 ET (11:39 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

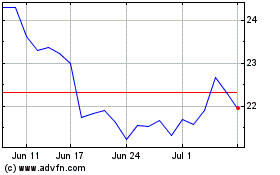

Fortescue (ASX:FMG)

Historical Stock Chart

From Jan 2025 to Feb 2025

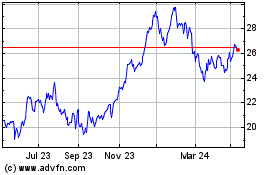

Fortescue (ASX:FMG)

Historical Stock Chart

From Feb 2024 to Feb 2025