Delivered Record Net Sales, Adjusted EBIT

and Adjusted NOPAT for the Third Quarter Fiscal Year 2021

Global Net Sales +20% to US$738.6 Million

for the Third Quarter Fiscal Year 2021

Adjusted NOPAT +59% to US$123.3 Million for

the Third Quarter Fiscal Year 2021

Operating Cash Flow +72% to US$678.4 Million

for the First Nine Months of Fiscal Year 2021

Declares Special Dividend of US$0.70 per

share

Raises Fiscal Year 2021 Adjusted NOPAT

Guidance Range to US$440 Million to US$450 Million

James Hardie Industries plc (ASX:JHX; NYSE:JHX), the

world’s #1 producer and marketer of high-performance fiber cement

and fiber gypsum building solutions announced its third quarter and

first nine months of fiscal year 2021 results, for the periods

ending 31 December 2020.

Third Quarter Fiscal Year 2021 Highlights, Compared to Third

Quarter Fiscal Year 2020 As Applicable:

- Global Net Sales +20% to US$738.6 million

- Adjusted NOPAT +59% to US$123.3 million

- Global Adjusted EBIT +57% to US$167.9 million

- North America Fiber Cement Segment Net Sales +20% and EBIT +39%

in US Dollars, with EBIT margin up 390 basis points to 30.0%

- North America Fiber Cement Segment exteriors volume +19%

- Europe Building Products Segment Net Sales +12% and EBIT +300%

in Euros, with EBIT margin up 740 basis points to 10.2%

- Asia Pacific Fiber Cement Segment Net Sales +9% and EBIT +34%

in Australian Dollars, with EBIT margin up 520 basis points to

28.1%

James Hardie CEO, Dr. Jack Truong, said, “Our business

accelerated considerably during our fiscal third quarter, marking

the seventh consecutive quarter that our global team has delivered

growth above market with strong returns. We delivered strong

organic growth around the world, with each operating region

contributing meaningfully to Global Net Sales up 20% and an even

more impressive 57% increase in Global Adjusted EBIT. The 530 basis

point improvement in our Global EBIT margin to 22.7% was

outstanding, and a testament to our strategy to augment our profit

trajectory in each region, particularly in Europe.

“I am pleased with these record results, underpinned by

excellent execution of our business transformation that we began in

calendar 2019, combined with increasing demand for our

premium-quality James Hardie brand products and solutions. The

transformation we undertook: (i) to unlock capacity and increase

efficiency in our global manufacturing network through LEAN

initiatives and (ii) to better integrate our supply chain with our

customers, continues to deliver consistent market share gains and

the ability to serve our customers seamlessly around the world. We

are firmly on track with our investments in growth to broaden our

portfolio with industry-leading innovations that enhance aesthetic

value for homeowners. Our transformation initiatives will enable us

to expand our market opportunity and allow us to continue to

deliver strong performance.”

Third Quarter Fiscal Year 2021 Results Compared to Third

Quarter Fiscal Year 2020 Results

Global Net Sales of US$738.6 million increased 20%, with Global

Adjusted EBIT growth accelerating to 57%. Global Adjusted NOPAT

increased 59% to US$123.3 million compared to US$77.4 million.

Global Adjusted EBIT margin expanded 530 basis points to 22.7%,

with continued operational improvement across all three operating

regions: North America, Europe and Asia Pacific.

North America Fiber Cement Segment: Delivered 19% exterior

volume growth and 4% interior volume growth driving 20% net sales

growth. LEAN manufacturing initiatives continued to generate

improved performance across the Company’s North American

manufacturing network, helping to deliver 39% EBIT growth at a

30.0% EBIT margin.

Europe Building Products Segment: EBIT increased 300% in Euros,

with EBIT margin improving to 10.2%, reflecting a net sales

increase of 12% in Euros, an improvement in production and

distribution costs driven by LEAN manufacturing savings and the

improved supply chain integration with customers.

Asia Pacific Fiber Cement Segment: EBIT grew 34% in Australian

Dollars at an EBIT margin of 28.1%, driven by a net sales increase

of 9% in Australian Dollars combined with reduced production and

distribution costs. The decision to consolidate Australia and New

Zealand regional production volume into our two Australia based

plants has enabled us to improve our regional cost of

production.

Capital Resources

Record operating cash flow generation of US$678.4 million in the

first nine months was driven by continuous improvement in the

Company’s LEAN manufacturing performance, strong profitable organic

sales growth and the integration of its supply chain with its

customers. Working capital improved by US$198.1 million during the

first nine months of fiscal year 2021. The Company has achieved

global LEAN savings of US$83.4 million over the 21-month period

since inception of LEAN, including US$60.7 million LEAN savings in

North America.

Following the close of the quarter, the Company used its strong

cash position to voluntarily redeem its 4.75% senior unsecured

notes due 2025 with a payment of US$409.5 million in principal and

call premium. As a result of this redemption, the Company reduced

its gross debt balance from US$1,291.6 million, as of 31 December

2020, to US$884.0 million as of 31 January 2021. Following the

repayment, which was funded with cash on hand, the Company has

liquidity of US$675.2 million as of 31 January 2021.

Dr. Truong continued, “We set ambitious goals to achieve a step

change in the cash generated by our businesses across the three

regions and we are exceeding those objectives. We are executing our

plan to rapidly transform James Hardie into a high-performing,

world-class organization. The resulting cash flow is fueling our

strategic investments in capacity expansion, product innovation and

brand building efforts to deliver future organic growth."

Dividend

The Company has declared a special dividend of US$0.70 cents per

share, payable on 30 April 2021, to shareholders of record as of 19

February 2021. The Company intends to resume its ordinary dividend

policy in fiscal year 2022, beginning with a first half fiscal year

2022 dividend to be declared in November 2021.

“We are pleased to announce this special dividend,” said James

Hardie CFO, Jason Miele. “Based on our strong strategic execution

through the pandemic, our confidence in continued strong cash

generation, and in light of the suspension of our ordinary dividend

since May 2020, we believe resuming our return of capital to

shareholders via dividends is appropriate at this time. We have a

solid balance sheet and liquidity position to execute on our

unchanged near-term and longer-term organic growth priorities.”

Outlook and Earning Guidance

Based on the continued, strong momentum in its business and

expectations for continued growth in residential end markets, the

Company is raising its outlook for fiscal year 2021, ending 31

March 2021. Management now expects fiscal year 2021 Adjusted NOPAT

to be between US$440 million and US$450 million, compared to a

prior range of US$380 million and US$420 million. The comparable

prior year Adjusted NOPAT for fiscal year 2020 was US$352.8

million.

James Hardie’s guidance is based on current estimates and

assumptions and is subject to several known and unknown

uncertainties and risks, including those related to the COVID-19

pandemic. James Hardie continues to assess the impacts and the

uncertainties of the COVID-19 pandemic on the geographic locations

in which it operates, as well as its impact on the new construction

and repair and remodel building markets. The COVID-19 pandemic

remains highly volatile and continues to evolve, and the full

impact of the pandemic on the Company’s business and future

financial performance remains uncertain.

Key Financial

Information

Q3 FY21

Q3 FY20

Change

9 Months FY21

9 Months FY20

Change

Group (US$ millions)

Net Sales

$

738.6

$

616.7

20%

$

2,101.7

$

1,933.6

9%

Adjusted EBIT

167.9

107.2

57%

455.9

365.8

25%

Adjusted EBIT Margin

22.7%

17.4%

5.3 pts

21.7%

18.9%

2.8 pts

Adjusted Net Operating Profit

123.3

77.4

59%

333.1

266.2

25%

Operating Cash Flow

678.4

393.4

72%

North America Fiber Cement (US$

millions)

Net Sales

$

518.1

$

430.0

20%

$

1,484.9

$

1,341.9

11%

Adjusted EBIT

155.6

112.3

39%

435.1

350.5

24%

Adjusted EBIT Margin

30.0%

26.1%

3.9 pts

29.3%

26.1%

3.2 pts

Asia Pacific Fiber Cement (A$

millions)

Net Sales

A$

163.3

A$

149.4

9%

A$

472.6

A$

468.0

1%

Adjusted EBIT

45.9

34.2

34%

133.6

109.2

22%

Adjusted EBIT Margin

28.1%

22.9%

5.2 pts

28.4%

23.3%

5.1 pts

Europe Building Products (€

millions)

Net Sales

€

85.3

€

76.5

12%

€

246.0

€

240.9

2%

Adjusted EBIT

8.8

2.2

300%

20.2

14.5

39%

Adjusted EBIT Margin

10.2%

2.8%

7.4 pts

8.4%

6.0%

2.4 pts

Further Information

Readers are referred to the Company’s Condensed Consolidated

Financial Statements and Management’s Analysis of Results for the

third quarter and nine months ended 31 December 2020 for additional

information regarding the Company’s results, including information

regarding income taxes, the asbestos liability and contingent

liabilities.

Management Briefing for

Analysts, Investors and Media

James Hardie will conduct a teleconference and audio webcast for

analysts, investors and media on Tuesday 9 February 2021, 9:00am

Sydney, Australia time (Monday 8 February 2021, 5:00pm New York

City, USA time). Analysts, investors and media can access the

management briefing via the following:

- Live Webcast:

https://ir.jameshardie.com.au/jh/results_briefings.jsp

- Live Teleconference Registration:

https://s1.c-conf.com/DiamondPass/10011981-js86fj.html All

participants wishing to join the teleconference will need to

pre-register by navigating to

https://s1.cconf.com/DiamondPass/10011981-js86fj.html Once

registered, you will receive a calendar invite withdial-in numbers

and a unique PIN which will be required to join the call.

- Webcast Replay: Will be available two hours after the Live

Webcast concludes at

https://ir.jameshardie.com.au/jh/results_briefings.jsp

Use of Non-GAAP Financial Information;

Australian Equivalent Terminology

This Media Release includes financial measures that are not

considered a measure of financial performance under generally

accepted accounting principles in the United States (GAAP), such as

Adjusted net operating profit and Adjusted EBIT. These non-GAAP

financial measures should not be considered to be more meaningful

than the equivalent GAAP measure. Management has included such

measures to provide investors with an alternative method for

assessing its operating results in a manner that is focused on the

performance of its ongoing operations and excludes the impact of

certain legacy items, such as asbestos adjustments. Additionally,

management uses such non-GAAP financial measures for the same

purposes. However, these non-GAAP financial measures are not

prepared in accordance with GAAP, may not be reported by all of the

Company’s competitors and may not be directly comparable to

similarly titled measures of the Company’s competitors due to

potential differences in the exact method of calculation. The

Company is unable to forecast the comparable US GAAP financial

measure for future periods due to, amongst other factors,

uncertainty regarding the impact of actuarial estimates on

asbestos-related assets and liabilities in future periods. For

additional information regarding the non-GAAP financial measures

presented in this Media Release, including a reconciliation of each

non-GAAP financial measure to the equivalent GAAP measure, see the

section titled “Non-GAAP Financial Measures” included in the

Company’s Management’s Analysis of Results for the third quarter

ended 31 December 2020.

In addition, this Media Release includes financial measures and

descriptions that are considered to not be in accordance with GAAP,

but which are consistent with financial measures reported by

Australian companies, such as operating profit, EBIT and EBIT

margin. Since the Company prepares its Consolidated Financial

Statements in accordance with GAAP, the Company provides investors

with a table and definitions presenting cross-references between

each GAAP financial measure used in the Company’s Consolidated

Financial Statements to the equivalent non-GAAP financial measure

used in this Media Release. See the sections titled “Non-GAAP

Financial Measures” included in the Company’s Management’s Analysis

of Results for the third quarter ended 31 December 2020.

Forward-Looking

Statements

This Media Release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of James Hardie to be materially

different from those expressed or implied in this release,

including, among others, the risks and uncertainties set forth in

Section 3 “Risk Factors” in James Hardie’s Annual Report on Form

20-F for the year ended 31 March 2020; changes in general economic,

political, governmental and business conditions globally and in the

countries in which James Hardie does business; changes in interest

rates; changes in inflation rates; changes in exchange rates; the

level of construction generally; changes in cement demand and

prices; changes in raw material and energy prices; changes in

business strategy and various other factors. Should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described herein. James Hardie assumes no obligation to

update or correct the information contained in this Media Release

except as required by law.

This media release has been authorized by the James Hardie Board

of Directors.

James Hardie Industries plc is a limited liability company

incorporated in Ireland with its registered office at Europa House,

2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20,

Ireland

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210208005898/en/

Investor/Media/Analyst Enquiries: Anna Collins +61 2 8845

3356 media@jameshardie.com.au

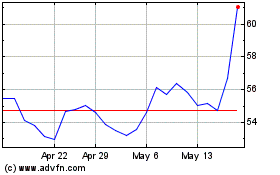

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Apr 2024 to May 2024

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From May 2023 to May 2024