Santos Receives US$10.37 Billion Bid From Harbour Energy -- Update

April 02 2018 - 7:38PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Private-equity firm Harbour Energy Ltd.

has launched a fresh US$10.37 billion takeover bid for Santos Ltd.

(STO.AU), which it plans to grow through investment in its existing

assets and by snapping up further natural-gas assets in Australia

and internationally.

The proposed deal is the fourth offer Harbour has made since

August to grab Santos, which owns vast oil-and-gas acreage in

Australia and is a partner in liquefied natural gas ventures

stretching from Australia's far north to Papua New Guinea.

Harbour--formed by EIG Global Energy Partners to buy controlling

or near-controlling stakes in energy assets globally--said Tuesday

it was offering US$4.98 a share for Santos, a 28% premium to the

last closing price for the shares before the Easter long weekend in

Australia.

The proposal tops earlier offers beginning last year and as

recent as two days before the most recent bid was received by

Santos just ahead of Easter, the Australian company said. Santos

said it had entered a confidentiality agreement with Harbour to

allow its suitor to go through its books, and that a board

committee had been set up to consider the approach.

Linda Cook, chief executive of Harbour, said Santos has a

leading natural-gas business in Australia and interests in three

operating LNG projects, two in Australia and one in Papua New

Guinea, as well as an experienced management team.

Harbour's aim would be to use Santos's core assets as a platform

for growth in Australia and throughout Asia, it said. Its strategy

doesn't rely on job cuts and the energy investor said it has no

plans to relocate Santos's headquarters from Adelaide.

The bid would comprise cash and a special dividend of US$0.28 a

share, although the U.S. energy investor said it also would offer

an option for Santos's shareholders to accept unlisted shares in a

new private company, up to a maximum 20% stake. The offer of stock

is aimed in part at Chinese natural-gas distributor ENN Group Co.

and private-equity firm Hony Capital, which last year raised their

stake in Santos to a collective 15.1% and agreed to act in concert

as investors when it came to voting and other decisions.

Harbour's interest comes as the rebound in oil prices and a

strong outlook for natural-gas demand across the Asia-Pacific

region has encouraged companies to scout for deals in Australia. In

recent months, Woodside Petroleum Ltd. (WPL.AU) agreed to buy out

Exxon Mobil Corp. (XOM) from a jointly owned undeveloped

natural-gas field off Australia's west coast, Japan's Mitsui &

Co. (8031.TO) topped offers from two other companies to secure an

agreed deal to buy oil-and-gas producer AWE (AWE.AU) for about

US$460 million, and smaller Australian producer Beach Energy Ltd.

(BPT.AU) finalized a US$1.59 billion acquisition of a basket of

oil-and-gas assets from Origin Energy Ltd. (ORG.AU).

In late 2015, Santos rejected as too low a A$7.14 billion

approach from Scepter Partners, a Bermuda-based private-equity firm

backed by sovereign investors and wealthy members of Asian and

Gulf-based ruling families. Since then, under industry veteran

Kevin Gallagher who took over as chief executive and managing

director in early 2016, the company has tied Santos's future to the

GLNG gas-export operation in east Australia that counts Total SA

(TOT) among its partners, the Exxon Mobil Corp.-led (XOM) PNG LNG

operation in Papua New Guinea, the Darwin LNG project in northern

Australia and assets including in the Cooper Basin straddling South

Australia and Queensland states.

In February, Santos continued to hold off paying a dividend but

raised the prospect of returning capital to shareholders if it

could hit a debt-cutting target ahead of schedule. It narrowed its

loss in 2017 to US$360 million and slashed net debt by another 22%

to US$2.73 billion, on track to reducing it to US$2 billion in net

debt by the end of 2019.

Harbour is managed by EIG, which has invested more than US$25

billion in about 320 companies in a portfolio across 36 countries.

Late last year, Harbour closed a US$3 billion acquisition of a

package of Royal Dutch Shell PLC's (RDSB) producing oil-and-gas

assets in the U.K. North Sea.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 02, 2018 20:23 ET (00:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

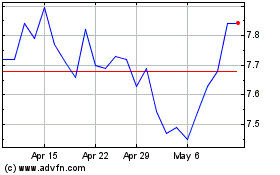

Santos (ASX:STO)

Historical Stock Chart

From Jan 2025 to Feb 2025

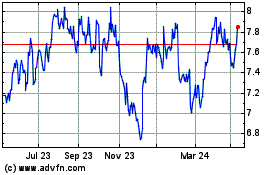

Santos (ASX:STO)

Historical Stock Chart

From Feb 2024 to Feb 2025