European Banks Take Beating After 'Brexit' Vote

June 24 2016 - 4:20AM

Dow Jones News

European banks took a beating in early trading Friday, with

Barclays PLC down nearly 30% at one point and other investment

banks also suffering from widespread market uncertainty after the

U.K. voted to leave the European Union.

Shares of Switzerland's Credit Suisse Group AG were trading down

13%, and Standard Chartered PLC was down around 8%. Shares in

Germany's biggest bank, Deutsche Bank AG, were down 17% just before

Prime Minister David Cameron began his address Friday morning in

which he said he would step down.

Shares of HSBC PLC, which is seen as less exposed to the EU exit

due to its significant Asian operations, fell by 4.8%.

Spain's Banco Santander SA, which has significant exposure to

the U.K. through its Santander U.K. unit, was also pummeled, with

its share price down 20.8%.

Things looked even worse for Italian banks Friday morning. The

majority of Italian shares failed to start trading at market

opening in Milan, as trades didn't go through because investors

were dumping Italian shares at prices not matching the ones offered

by buyers.

Theoretically based on orders placed in the market, UniCredit

SpA shares were down 36%, Intesa Sanpaolo SpA's were down 23%, and

Mediobanca's were down 50%. A strategist said that at this level of

discrepancy between bid and ask prices the stocks wouldn't manage

to start trading.

"Financial sectors were really expecting a 'remain,'" said

Joseph Dickerson, an equities analyst with Jefferies International.

"We are now entering a long period of uncertainty."

Write to Sara Schaefer Muñ oz at Sara.Munoz@wsj.com, Jenny

Strasburg at jenny.strasburg@wsj.com and Giovanni Legorano at

giovanni.legorano@wsj.com

(END) Dow Jones Newswires

June 24, 2016 05:05 ET (09:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

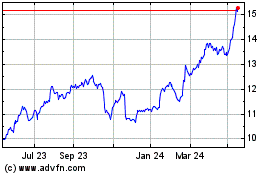

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Dec 2024 to Jan 2025

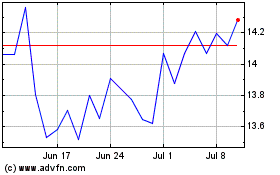

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Jan 2024 to Jan 2025