Monte dei Paschi Seeks to Unload Bad Loans, Raise Capital

July 27 2016 - 6:40AM

Dow Jones News

MILAN—Italy's Banca Monte dei Paschi di Siena SpA has presented

to the European Central Bank a plan to shed about €10 billion ($11

billion) in nonperforming loans and raise up to €5 billion in fresh

capital, in a bid to stave off a bailout by the Italian government

and draw a line under its longstanding problems.

According to people familiar with the situation, Monte dei

Paschi is seeking approval from the ECB to unload a large chunk of

the bad loans to Atlante, a fund orchestrated by the Italian

government and financed by Italian banks, insurers and pension

funds.

Atlante would take on the worst-performing loans, while MPS

would sell better-quality loans to private investment funds with

the support of a government guarantee aimed at sweetening the

transaction.

With a deal to unload the bad loans in place, Monte dei Paschi

would then raise as much as €5 billion in fresh capital—or five

times its current market capitalization—by the end of the year, the

people said. Italy's Mediobanca SpA and J.P. Morgan would act as

global coordinators for the capital increase.

The plan would avoid a government bailout which, according to

European rules, would first require bondholders to sustain heavy

losses—a scenario the government is keen to avoid given the large

numbers of mom-and-pop investors who have bought the bank's bonds.

Monte dei Paschi has €5 billion in outstanding junior bonds, with

about half believed to be in the hands of Italian households.

An ECB spokeswoman declined to comment.

The bank is hoping for approval for its plan by Friday, when the

European Banking Authority will publish the results of so-called

stress tests of 51 European lenders. Monte dei Paschi is expected

to emerge as the worst performer, a result that could further

pummel shares that have lost 84% of their value in the past year

and complicate any plan to rescue Italy's No. 3 bank.

Monte dei Paschi, which has nearly €50 billion in bad loans, has

been of acute concern in an Italian banking system that has

suffered from poor profitability and huge bad loans.

The bank has been bailed out twice by the government since the

financial crisis and failed ECB stress tests in 2014. Efforts to

bring it back to health have done little to revive Monte dei

Paschi, which still has low profitability and thin capital

buffers.

The government has hoped that a healthier bank would buy the

lender, but no such offers have materialized. Some argue that a

cleaned-up Monte dei Paschi could be more appetizing for a

prospective buyer.

In trading in Milan, Monte dei Paschi's shares were up 3.5%.

Write to Deborah Ball at deborah.ball@wsj.com

(END) Dow Jones Newswires

July 27, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

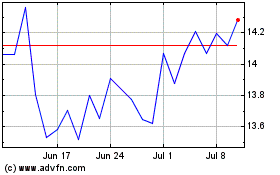

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Dec 2024 to Jan 2025

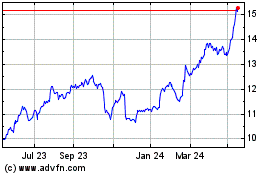

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Jan 2024 to Jan 2025