2nd UPDATE: Italy Telco Regulator Urges Common Broadband Plan

July 06 2010 - 10:12AM

Dow Jones News

Italy's telecommunications regulator Tuesday urged operators to

work together to develop a fast fiber-based network, warning that

failure to do so could be costly for the country's economic growth

and competitiveness as Italy lags the rest of Europe in broadband

penetration.

In the regulator's annual speech to parliament, AGCOM Chairman

Corrado Calabro said two separate plans--one from Italy's largest

telecoms operator Telecom Italia SpA (TI) and another from a group

of its competitors--need to converge under one nationwide plan,

guided by the Italian government and with clear rules set by the

regulator.

"We need a common, nationwide project that avoids costly

duplication on civil infrastructure and allows Italy to make the

leap forward it needs," Calabro said, adding that broadband

investment may be a successful "exit strategy" out of one of

Italy's worst recessions in recent years.

Calabro will also attempt to boost Italy's coffers through

auctioning new mobile spectrum for the country's fourth generation

mobile network, following in the footsteps of Germany, the

Netherlands and the U.K.

4G technology will allow customers to receive and upload data

faster on their mobile devices spurring a new wave of services such

as high-definition mobile video.

The German auction netted EUR4.38 billion for the government in

May and Calabro said the Italian proceeds may be used for

much-needed broadband investment.

A recent study by Italy's business lobby Confindustria showed

that high-speed broadband technology could help save up to EUR10

billion a year on the country's energy bills alone, Calabro said,

while also reminding operators that the European digital agenda

sets a 2020 deadline to bring an ultra-fast broadband connection to

50% of the region's families by 2020.

Recent European data show broadband penetration in Italy stands

at 20.6% of the country's population, against a European Union

average of 24.8%, he noted.

Telecom Italia recently dismissed calls to join a rival

broadband project and said it will push ahead with its own plans to

offer 100 megabits per second broadband to 50% of the Italian

population by 2018, and to invest EUR7 billion in its fixed-line

network upgrade in the next three years.

In the rival plan, Fastweb SpA (FWB.MI), Vodafone Group PLC

(VOD), Wind SpA and Tiscali SpA (TIS.MI) aim to invest a combined

EUR2.5 billion to bring broadband to Italy's 15 largest cities in

the next five years.

AGCOM has repeatedly pushed for more coordination between

Telecom Italia and the alternative operators on a project that aims

to include the country's main operators as industrial partners and

could involve public funds, possibly provided by state lender Cassa

Depositi e Prestiti.

Responding to the regulator's call, Telecom Italia CEO Franco

Bernabe said Tuesday the group is open to any project that spreads

the cost of investment in fiber, while stressing that its plans are

in line with EU guidelines.

Vodafone Italia CEO Paolo Bertoluzzo, meanwhile, said the

alternative operators' plan is "concrete" and open to all. He said

it is up to the regulator to set clear rules to encourage the

switch from the old copper network to a new fiber one.

Calabro Tuesday also urged rapid action on wireless broadband in

Italy, saying the current mobile network risks collapsing due to

the rising popularity of smartphones and the increase in data

traffic.

Telecom Italia's CEO, however, dismissed the warning.

"There is no such risk in Italy," Bernabe said, adding that

Telecom Italia, like other operators, is already addressing such

concerns by upgrading mobile network infrastructure.

-By Giada Zampano, Dow Jones Newswires, +39 06 69766925;

giada.zampano@dowjones.com

(Carlo Renda, with MF-Dow Jones, contributed to this report)

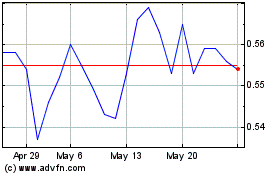

Tessellis (BIT:TSL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Tessellis (BIT:TSL)

Historical Stock Chart

From Mar 2024 to Mar 2025