Ethereum Reaches $4,100 For The First Time In Over Three Years, Aiming For $5,000 Next

December 17 2024 - 5:00AM

NEWSBTC

For the first time in over three years, Ethereum (ETH) has reached

the significant price milestone of $4,100. This level has proven to

be a key resistance point for investors, especially as the leading

altcoin struggled to breach it during the bullish momentum

experienced in the first quarter of this year. Poised For Rally If

It Breaks $4,000-$4,100 Resistance? The renewed bullish sentiment

among crypto investors has led analysts to forecast potential new

all-time highs for Ethereum, surpassing its previous record of

$4,878, set in November 2021. For instance, crypto analyst

Justin Bennett noted on social media platform X (formerly Twitter)

that ETH had previously faced technical barriers in surpassing the

$4,000 threshold and acknowledged that Bitcoin has been the focal

point of market attention in December. Related Reading:

MicroStrategy Raises Stakes, Acquires $1.5 Billion In Bitcoin Amid

Positive Market Outlook However, the analyst emphasized that if

ETH’s price can successfully navigate the critical $4,000 to $4,100

range in the short term, it could pave the way for a rally back

toward its all-time high zone, with the potential to reach

mid-$5,000 levels, thereby completing the current bullish channel

for the altcoin. Bennet also suggested that now is the

opportune moment for the ETH price to target a new all-time high as

he believes that the altcoin could see “some of those Bitcoin (BTC)

profits” flow into the Ethereum market soon. Ethereum Price To

Reach $15,937 By May 2025? Adding to this bullish outlook,

market expert VentureFounder shared even more optimistic

predictions, anticipating an extended bullish momentum for ETH over

the next seven months, and projecting it to reach a new all-time

high of $15,937 by May 2025. VentureFounder linked this forecast to

historical patterns, noting that the first quarter following

Bitcoin’s Halving events typically initiates a surge toward new

record highs. He further indicated that Ethereum often enjoys a

year of strong performance after such Halving events, the latest of

which occurred in April of this year. This year has already seen

significant similarities with the past for both Bitcoin and

Ethereum. Prior to Bitcoin’s Halving, the cryptocurrency

experienced a substantial rally, fueled in part by the approval of

spot Bitcoin exchange-traded funds (ETFs) by the US Securities and

Exchange Commission (SEC). Related Reading: The $589 XRP

Dream: Believers Aren’t ‘Delusional’ Enough, Expert Says At the

time, the Bitcoin price reached a new all-time high just above

$70,000 in March, and it has since risen by more than 50% to a new

record of $107,000, despite challenging second and third quarter

price action. Ethereum also experienced significant growth, posting

its strongest first quarter in more than three years, rising from

$2,260 in February to nearly 100% in just 30 days. However, it

remained below the $4,100 threshold until recently, consistent with

Bitcoin’s increasing trajectory. Overall, VentureFounder’s

analysis, together with the price movements of both Ethereum and

Bitcoin this year, gives a solid foundation for believing that ETH

may be poised for significant rises in the coming months if the

experts’ projections and prior patterns hold true. At the

time of writing, ETH is attempting to consolidate at around $4,014.

This level will be crucial for determining whether further upward

momentum will occur in the coming days or if additional tests of

price support are on the horizon. Featured image from DALL-E, chart

from TradingView.com

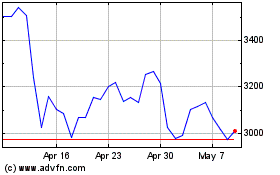

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024