Ethereum Trades Inside A Multi-Year Bullish Pennant – Analyst Sees A Breakout Above $4K

February 06 2025 - 3:30PM

NEWSBTC

Ethereum experienced one of the craziest days in its history last

Monday, plunging over 30% in less than 24 hours amid widespread

market panic fueled by U.S. trade war fears. However, within hours,

ETH staged an impressive recovery following President Trump’s

announcement of negotiations with Canada and Mexico to ease tariff

concerns. This sharp rebound has reignited optimism among

investors, with many now closely watching Ethereum’s next move.

Related Reading: Bitcoin Looks Stronger Compared To Altcoins –

Demand Remains Strong As Price Consolidates In A Range Despite the

recent volatility, top analyst Jelle shared a technical analysis

revealing that Ethereum is still trading within a massive bullish

pennant that has been forming since 2021. This long-term structure

suggests that ETH remains in a consolidation phase, building

momentum for a breakout. According to Jelle, once Ethereum

decisively breaks out of this pattern, a massive rally into price

discovery is expected. As the market stabilizes and investors

reassess their positions, ETH remains one of the most closely

watched assets. While short-term price action is unpredictable, the

long-term bullish structure provides strong support for Ethereum’s

growth potential. Traders and analysts alike are now looking for

key technical signals that could confirm a breakout and propel ETH

into new all-time highs. Ethereum Struggles Below Key Supply Levels

Ethereum is currently facing serious selling pressure, struggling

to reclaim the crucial $3,000 mark. Bulls are in trouble as ETH

remains trapped below this level, leading to heightened uncertainty

and volatility in the market. Related Reading: Ethereum Is Testing

Key Support on the ETH/BTC Chart – A Parabolic Move Could Be Next

Every day that Ethereum trades below $3,000 increases the

likelihood of a deeper correction, as traders remain cautious and

sentiment weakens. The inability to gain momentum above this

psychological level has left investors concerned about ETH’s

short-term direction. However, despite the ongoing struggles, top

analyst Jelle shared a technical analysis on X, revealing that

Ethereum is still trading inside a massive bullish pennant.

According to Jelle, ETH has deviated from both the highs and the

lows of the pattern, and now the market is setting its direction to

tag key supply levels. This means that while short-term price

action remains uncertain, Ethereum’s long-term structure suggests

that a breakout could be on the horizon. Jelle believes that once

Ethereum manages to push above the bullish structure, a break above

the $4,000 mark will follow. This breakout would confirm a rally

into price discovery, setting the stage for Ethereum to reach new

all-time highs. While bears remain in control for now, the

long-term bullish formation suggests that ETH could be gearing up

for a major move in the coming months. Price Action Details:

Technical Levels Ethereum is currently trading at $2,820,

still unable to test the critical $3,000 level. Price action

remains weak, as ETH struggles to break above the $2,900 mark,

which has now turned into a short-term supply zone. The failure to

push higher signals that bulls are losing momentum, and the market

remains in a state of uncertainty. If Ethereum loses the $2,800

support level, a deeper correction could unfold, potentially

dragging the price down to the $2,500 region. This would be a

significant setback for bulls, as it would confirm further downside

pressure and could extend the current consolidation phase. On the

other hand, if ETH manages to reclaim the $3,000-$3,100 level in

the coming days, it would signal renewed bullish momentum. A

successful breakout above this range could ignite a massive surge,

pushing Ethereum toward higher supply levels and setting the stage

for a potential run toward $3,500 and beyond. Related Reading:

‘Solana Breakdown Fails’ – Holding $205 Is Crucial To Trigger a

Push Higher For now, Ethereum remains at a crucial juncture, with

price action signaling both risk and opportunity. Traders and

investors are closely watching key resistance and support levels,

as ETH prepares for its next major move. Featured image from

Dall-E, chart from TradingView

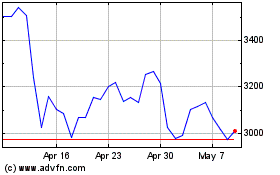

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025