Bitcoin Exchange Reserves Surge: Are Traders Preparing For A Major Market Shift?

December 27 2024 - 9:00PM

NEWSBTC

Bitcoin has recently shown signs of potential market shifts as key

metrics reflect changing investor behavior. This is evident in

Bitcoin reserves on spot exchanges, which had been in a steady

decline for weeks, now seeing a notable uptick with an inflow

exceeding 20,000 BTC, according to CryptoQuant analyst IT Tech.

Simultaneously, netflows across all exchanges turned positive,

registering an increase of 15,800 BTC. These shifts mark a reversal

from the consistent outflow trend observed in previous weeks,

suggesting that traders may be preparing for increased activity on

exchanges. Related Reading: Bitcoin Coinbase Premium Giving

Potential Buy Signal, Quant Says Detailing The Increasing Exchange

Reserves and Positive Netflows When Bitcoin reserves rise on

exchanges, it typically signals an intent to trade or sell,

introducing the possibility of selling pressure. Similarly,

positive net flows indicate that the volume of Bitcoin moving onto

exchanges is outpacing the volume being withdrawn. Historically,

such patterns have often been associated with periods of increased

market volatility. While the long-term accumulation trend remains

intact, these new inflows highlight a short-term shift in

sentiment, suggesting that investors may be positioning themselves

for profit-taking or preparing for potential price corrections. IT

Tech wrote: If reserves and netflows continue to rise, we could see

increased volatility and potential downward pressure on Bitcoin’s

price in the near term. This reversal highlights the importance of

monitoring exchange activity for early signs of changing market

sentiment. Another Bitcoin Metric Signalling Growing Buying

Pressure While there have been signs of looming price action,

another CryptoQuant analyst Burak Kesmeci has highlighted an

opposite key observation: Bitcoin Taker Buy Volume on Binance has

surged to $8.3 billion. This metric tracks the total volume of buy

transactions executed by “takers” on Binance—market participants

who purchase BTC at current market prices using existing liquidity.

An increase in Taker Buy Volume is generally interpreted as a sign

of heightened investor interest and growing buying pressure.

Binance Bitcoin Taker Buy Volume Reaches $8.3 Billion! “We have

observed that the Binance Taker Buy Volume has formed higher lows.

This indicates that investor interest is increasing and buying

pressure is strengthening.” – By @burak_kesmeci Link

👇https://t.co/axZopFuK0v pic.twitter.com/POtTGvcxrY —

CryptoQuant.com (@cryptoquant_com) December 26, 2024 Kesmeci noted

that over the past 60 days, Binance Taker Buy Volume has

consistently formed higher lows. This trend indicates persistent

buying activity despite occasional market corrections. Related

Reading: BTC price is moving upwards on the 2-hour chart. Source:

BTC/USDT on TradingView.com The sustained increase in Taker Buy

Volume suggests that demand remains strong, potentially driving

Bitcoin prices upward in the near term. Kesmeci stated: Although

the market may be overheated and experiencing corrections, the

continued rise in taker buy volume suggests that we may see a price

increase in Bitcoin in the coming days. Featured image created with

DALL-E, Chart from TradingView

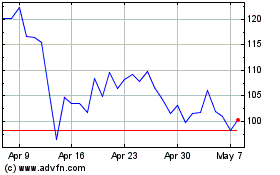

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

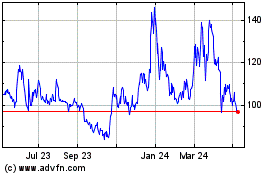

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024