AKWEL: NINE-MONTH REVENUE DOWN -5.2%

November 07 2024 - 10:45AM

UK Regulatory

AKWEL: NINE-MONTH REVENUE DOWN -5.2%

Champfromier,

Thursday, November 7, 2024

NINE-MONTH REVENUE DOWN -5.2%

AKWEL (FR0000053027, AKW, PEA-eligible), parts

and systems manufacturer for the automotive and heavy-vehicle

industry, specialist in fluid management, mechanisms and structural

parts for electric vehicles, has recorded, over the first 9 months

of 2024, a published consolidated revenue of €757.7M, down -5.2%

compared to the same period in 2023.

Consolidated revenue (from

January 1 to September 30, 2024)

|

in €m — unaudited |

2024 |

2023 |

Variation |

PCC variation (1) |

|

1st quarter |

263.5 |

274.6 |

-4.0% |

-3.3% |

|

2nd quarter |

265.3 |

271.2 |

-2.2% |

-2.2% |

|

3rd quarter |

228.9 |

253.1 |

-9.6% |

-9.2% |

|

Nine-month total |

757.7 |

799.0 |

-5.2% |

-4.8% |

(1) At constant

scope and exchange rates.

DECREASE OF -9.6% IN THIRD-QUARTER

REVENUE

The downward trend observed since the beginning

of the 2024 financial year was confirmed and reinforced in the

third quarter for AKWEL, with consolidated revenue of €228.9M, down

by -9.6% as reported and -9.2% at constant scope and exchange

rates. The positive impact of foreign exchange rates amounted to an

increase of €0.8M this quarter, due almost entirely to the US

dollar. In the first 9 months of 2024, revenue at constant scope

and exchange rates decreased by -4.8%.

ANALYSIS OF REVENUE

DISTRIBUTION

The geographical distribution of revenue by

production area as at September 30, 2024 is broken down as follows,

and points to a sharper decline in France than in the rest of the

world:

-

France: €187.7M (-16.4%)

-

Europe (excluding France) and Africa: €221.6M (-1.6%)

-

North America: €227.8M (-0.6%)

-

Asia and the Middle East (including Türkiye): €118.3M (+1.6%)

-

South America: €2.5M (-34.5%)

Revenue for Products and Functions fell by -6.5%

to €722.9M in the first nine months. By product line, the most

significant changes were the 4.6% growth in the Air line, the

decline in Mechanisms (-6.8%), Fuel (-4.3%) and Cooling (-1.0%)

activities, and the more significant decline in Decontamination

(-21.3%), with the gradual end of production of SCR tanks scheduled

for 2025. Tools revenue represents €25.0M over 9 months

(+22.9%).

NET CASH POSITION OF

€140.5M

Consolidated net cash excluding the impact of

lease liabilities amounted to €140.5M on October 31, 2024, an

increase of €25.4M compared to June 30, taking into account an

investment envelope of €8.8M this quarter.

OUTLOOK FOR THE FULL YEAR

Performance in the third quarter and current

developments in the global automotive market are consistent with an

expected decline in revenue for 2024, with the decline in SCR

series activity before the planned production shutdown in 2025

(excluding SCR spare parts activity) adding to a difficult market

situation.

Next press release: 2024 annual revenue, February 6,

2025, after markets close.

|

An independent family business, trading on Euronext Paris,

AKWEL is a parts and systems manufacturer for the automotive and

heavy-vehicle industry, and a specialist in fluid management,

mechanisms and structural parts for electric vehicles. The Group

achieves this with their first-rate industrial and technological

know-how in mastering the application and processing of materials

(plastic, rubber, metal) and mechatronic integration.

Operating in 20 countries across 5 continents, AKWEL employs

9,600 people worldwide.

Euronext Paris — Sub-fund B — ISIN: FR0000053027 — Reuters:

AKW.PA — Bloomberg: AKW:FP

|

|

Contacts

AKWEL

Benoit Coutier — Financial Director — Tel.: +33 (0)4 50 56 98

68

EKNO — Public Relations

Jean-Marc Atlan — jean-marc.atlan@ekno.fr — Tel: +33 (0)6 07 37 20

44

CALYPTUS — Investor

Relations

Mathieu Calleux — akwel@calyptus.net — Tel.: +33 (0)1 53 65 68

68

- 2024-11-07_AKWEL_TO-Q3 2024_EN

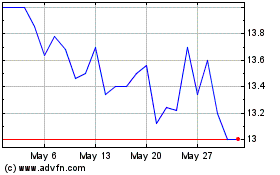

Mgi Coutier (EU:AKW)

Historical Stock Chart

From Nov 2024 to Dec 2024

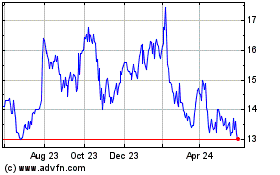

Mgi Coutier (EU:AKW)

Historical Stock Chart

From Dec 2023 to Dec 2024