ECOSLOPS – 2021 TURNOVER AND SIGNIFICANT EVENTS

January 31 2022 - 11:11AM

ECOSLOPS – 2021 TURNOVER AND SIGNIFICANT EVENTS

Paris, 22 January 2022

-

Turnover more than doubled to €12.4m

-

Sale of the first Scarabox® unit

confirmed

-

Production start-up of the Marseille unit

-

Multiple development opportunities identified for 2022 and

beyond

2021 marks a decisive inflection in the

development of Ecoslops with a turnover of €12.4m, which has more

than doubled compared to 2020.

|

Turnover in M€ * |

2020 |

2021 |

Var . M€ |

Var. % |

|

Refined products – Sines |

3,77 |

6,30 |

+2,53 |

+67% |

|

Refined products – Marseille |

- |

0,22 |

+0,22 |

n/a |

|

Industrial equipments – Scarabox® |

- |

3,73 |

+3,73 |

n/a |

|

Port services & others |

1,98 |

2,18 |

+0,20 |

+10% |

|

Total |

5,75 |

12,43 |

+6,68 |

+116% |

|

Turnover in M€ * |

H1 |

Vs 2020 % |

H2 |

Vs 2020 % |

|

Refined products – Sines |

2,02 |

-4% |

4,28 |

+157% |

|

Refined products – Marseille |

- |

|

0,22 |

n/a |

|

Industrial equipments – Scarabox® |

- |

|

3,73 |

n/a |

|

Port services & others |

1,07 |

+18% |

1,11 |

+3% |

|

Total |

3,09 |

+3% |

9,34 |

+241% |

* : unaudited figures

Sines unit in Portugal

After a year 2020 strongly affected by the sharp

drop in oil prices and the slowdown of industrial activity in

Europe (both linked to the Covid crisis), the recovery of our

activity was gradual in the first half of the year after two first

months of 2021 penalized by the wait for the renewal and extension

of the operating permit (finally obtained on 25 February, 2021).

Since then, the Sines unit has made a rapid return to normal with

an annual production volume of 21,960 tons (including a historical

production of 13,889 tons in the second semester). Refined Products

turnover for 2021 amounts to €6.3m, up 67% compared to 2020, with a

volume effect of +1% and a price effect of +66% (of which +58%

linked to the rise in oil prices and +8% linked to the improvement

in the product mix). In 2022, the company expects production to

exceed 25,000 tons, representing revenues of around €10m (including

port services) based on current prices.

Marseille unit

The completion and commissioning of the

Marseille unit (owned 75% by Ecoslops and 25% by TotalEnergies) was

finalized in the first half of the year and allowed the unit to be

launched on 2 July 2021, in the presence of Patrick Pouyanné, CEO

of the TotalEnergies group. The following months were used to carry

out all the operational and safety tests and also allowed the

Ecoslops Provence and TotalEnergies teams to get acquainted with

the unit and with the logistics and customs operations as well. The

fourth quarter saw the start of the unit's ramp-up with the

production of 1,500 tons of refined products. After the product

approval phase by new customers, a little more than 500 tons have

been sold in 2021, representing a turnover of €0.22m. In 2022, as

for the launch of Sines, the company expects to produce around

10,000 tons, representing a turnover of around €4m based on current

prices.

Scarabox®

Designed, developed and built with its own

funds, the first Scarabox® unit was sold in March 2021 to the

Cameroonian company Valtech Energy, which belongs to the SCIN

group. The latter has waived the condition precedent linked to its

financing in December 2021 thanks to the granting of a credit by

Société Générale Cameroun, its partner bank. This will lead to the

delivery of the unit in the first quarter of 2022. As of 31

December 2021, the construction of the unit was 93% complete,

corresponding to a turnover of €3.73m. On this new market, Ecoslops

is a real industrial and financial partner of Valtech Energy for

this innovative project of waste oil treatment, with a technical

assistance contract for a period of 8 years and an acquisition of

17% of the capital of Valtech Energy in January 2022.

The announcement of the sale of the first

Scarabox® unit in Cameroon has allowed the company to build up a

portfolio of opportunities in many developing countries. The

company is very confident in its ability to convince new customers

this year. This new activity, complementary to the units owned by

the company (Sines, Marseille currently), has very strong assets

and arguments in a market where no innovation has been achieved in

the last 30 years and where environmental mindset has grown

strongly in recent years, especially in developing countries. To

meet this need, Ecoslops has signed a technical and commercial

partnership with Greenflow in order to combine their offers in a

common commercial approach and to accelerate sales.

Other projects

In 2021, the Group continued to work on the

Singapore, Antwerp and Suez Canal projects. Even though the

commercial process was slowed down by the health crisis and the

intemperate closure of borders from one country to another, the

second half of the year saw a return to normal in terms of travel

and meetings with decision makers. Ecoslops' ambition is to sign

one of these three projects in 2022.

In order to accelerate its development, Ecoslops

signed a strategic partnership agreement last October with Mercuria

Energy Group, one of the world leaders in bunkering (with its

subsidiary Minerva) and in energy trading, in the Asia-Pacific and

Middle East regions.

Cash position

As of 31 December 2021, the Group had available

cash of €6.3m compared to €8.0m as of 31 December 2020. Gross debt

amounted to €27.8m compared to €27.5m at 31 December 2020. It

should be noted that the cash position as of 31 December 2021

does not include the cash receipts related to the sale of the

Scarabox®, of which €2.4m are expected in early February 2022.

Corporate Social Responsibility

As a player in the circular economy, Ecoslops

attaches major importance to societal issues, in addition to

environmental ones. In this context, the Group published its second

sustainable development report on 10 May 2021 and has signed the

United Nations' Women's Empowerment Principles (WEPs).

The Group's vocation to contribute to

sustainable development is illustrated by the progression of its

ESG rating within the Gaïa panel. The company has confirmed its

performance, particularly in the category of companies with a

turnover of less than €150m, and is now ranked 12th/140 (compared

to 12th/78 in the previous campaign).

Next appointment

Publication of the 2021 annual results on 12

April 2022 after market close

ABOUT ECOSLOPSEcoslops is listed on Euronext Growth in ParisCode

ISIN : FR0011490648 - Ticker : ALESA / PEA-PME eligibleInvestor

Relations : ir@ecoslops.com - 01 83 64 47 43Ecoslops is the

cleantech that brings oil into the circular economy thanks to an

innovative technology allowing the company to upgrade oil residues

and used lub oil into new fuels and light bitumen. The solution

proposed by Ecoslops is based on a unique micro-refining industrial

process that transforms these residues into commercial products

that meet international standards. Ecoslops offers an economic and

more ecological solution to port infrastructure, waste collectors

and ship-owners through its processing plants.

- PR31jan2021_2021_ECOSLOPS_TURNOVER

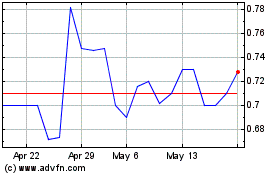

Ecoslops (EU:ALESA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ecoslops (EU:ALESA)

Historical Stock Chart

From Jan 2024 to Jan 2025