Arcadis Trading Update Q1 2023

ARCADIS TRADING UPDATE Q1

2023

On track to deliver

on strategic targets

set for 2023

- Net revenue of €940 million, with accelerated organic growth of

12.3%1)

- Operating EBITA of €92 million, operating margin improved to

9.8% (Q1'22: 9.4%)

- Order intake of €1,062 million, creating record net backlog of

€3,192 million, organic backlog growth of 3.9%

(quarter-to-date)

- Successful refinancing through €500 million Eurobond issuance

in Feb’23. Net debt at €1,072 million

- Integration of Arcadis IBI and Arcadis DPS on track, revenue

and cost synergies materializing

Amsterdam, 4 May 2023 – Arcadis (EURONEXT: ARCAD), the

leading global Design & Consultancy organization for natural

and built assets, sees continued growing client demand

across all of its Global Business

Areas, resulting in record Q1 Net Revenue

of €940m with an organic growth

of 12.3%. Operating EBITA margin increased

to

9.8%

(last year:

9.4%).

Peter Oosterveer, CEO Arcadis, comments:

“During the last quarter, we have continued to see strong client

demand for our services. Our Resilience business demonstrated

strong results across the solutions portfolio. Our Places business

has reaped the benefits of our diversification towards industrial

manufacturing, intelligent buildings, and retrofitting, resulting

in a more balanced backlog and solid pipeline. Our Mobility

business increasingly supports clients with electrification and

decarbonization of infrastructure assets. And strong demand for

smart mobility solutions drives growth in our recently established

Intelligence business.

We are pleased to report that the integration of both Arcadis

IBI and Arcadis DPS is progressing well. Our combined capabilities

created significant wins in industrial manufacturing,

pharmaceutical, semiconductor, and energy transition, and we are

building a strong pipeline of additional synergy opportunities,

whilst the expected cost synergies are materializing

simultaneously.

Our strong client relationships, diverse business offering and

continued solid markets provide us with the opportunity to be more

selective in the projects we pursue on, creating a resilient and

balanced portfolio with sustained focus on profitable growth. The

strong demand for our services originates from governments, public

agencies as well as the private sector, despite the ongoing

geopolitical turbulence and economic uncertainties.

It has been both an honor and a privilege to lead Arcadis over

the past six years. We significantly strengthened our focus on

people, prioritized client relationships, while improving

discipline around project selection and delivery. Sustainability

has always been a cornerstone of the organization and we built on

this foundation with a Sustainability Strategy and a Net Zero

commitment, while addressing the growing client demand for

sustainability solutions. We have transformed our operating model,

complemented our capabilities through the acquisitions of last

year, whilst divesting non-core areas. Capitalizing on its talented

diverse teams, Arcadis, under the leadership of my nominated

successor Alan Brookes, is well positioned to retain and attract

talent, bring groundbreaking solutions and services to our clients,

deliver profitable growth, and deliver on its strategic

objectives.”

KEY FIGURES As the acquisitions of the IBI Group formally closed

on 27th of September 2022, and DPS Group on 1st of December 2022,

the Arcadis consolidated financial statements 2023 include IBI and

DPS consolidated data.

| in €

millions |

First quarter |

|

Period ended 31 March 2023 |

2023 |

2022 |

change |

|

Gross revenues |

1,218 |

879 |

39% |

|

Net revenues |

940 |

688 |

37% |

|

Organic growth1) |

12.3% |

5.6% |

|

|

Operating EBITDA2) |

120 |

86 |

40% |

|

Operating EBITDA margin |

12.8% |

12.5% |

|

|

EBITA |

87 |

65 |

33% |

|

EBITA margin |

9.2% |

9.5% |

|

|

Operating EBITA2) |

92 |

64 |

43% |

|

Operating EBITA margin (%) |

9.8% |

9.4% |

|

|

Free Cash Flow (excl. lease liabilities)3) |

-108 |

-51 |

114% |

|

Net Working Capital % |

12.9% |

12.9% |

|

|

Days Sales Outstanding (days) |

70 |

70 |

|

|

Net Debt |

1,072 |

205 |

422% |

|

Order intake (millions) |

1,062 |

785 |

35% |

|

Net revenues in backlog (millions) |

3,192 |

2,349 |

36% |

|

Backlog organic growth (qtd)1) |

3.9% |

4.4% |

|

1) This excludes the impact of currency movements, acquisitions,

divestments, and footprint reductions (such as the Middle East)2)

Excluding acquisition, restructuring and non-operating

integration-related costs3) Free Cash flow: Cash Flow from

Operations corrected for Capex and Lease liabilities

INCOME STATEMENTNet revenues totaled €940 million and increased

organically by 12.3%. Growth was driven by all the GBAs, with

exceptionally strong performance in North America. The currency

impact was 0.5%. The operating EBITA margin improved to 9.8%

(Q1’22: 9.4%).

ORDER INTAKE & BACKLOGBacklog at the end of the quarter

stood at €3,192 million (Q1’22: €2,349 million), with strong

business momentum leading to an order intake of €1,062 million (up

35% year on year) for the quarter. Organic backlog growth was 3.9%

quarter-to-date, with a positive contribution of all GBAs and with

very few project cancellations.

BALANCE SHEET & CASH FLOWDays Sales Outstanding (DSO)

stood at 70 days (Q1'22: 70 days) and net working

capital as a percentage of annualized gross revenues at 12.9%

(Q1'22: 12.9%), in line with last year’s performance.

The negative free cash flow generation during the quarter of

€108 million reflects a year-on-year increase in line with our

usual seasonal networking capital pattern applied to a

significantly larger business volume and investments in net working

capital from the very strong revenue growth.Net debt increased

slightly to €1,072 million, with deleveraging on track. The bridge

loan of €750 million was partly refinanced by a successful €500

million inaugural Eurobond issuance. The senior unsecured fixed

rate notes have an annual coupon of 4.875%, are due 2028, and an

investment grade rating of BBB- from Standard &

Poor’s. INTEGRATION OF ARCADIS IBI AND ARCADIS DPSThe

integration of Arcadis IBI and Arcadis DPS is on track with revenue

and cost synergies materializing. The Architecture and Urbanism

business unit is up and running as part of the Places GBA and sees

strong momentum as it launches its first commercial events. The

Intelligence GBA management team is set up and works closely with

the Integration team to set a fit-for-purpose organization,

consolidating the various organizations, and fostering innovation.

Finally, Arcadis DPS is progressively embedded in the Places GBA,

creating additional strengths in the industrial manufacturing area.

Various revenue synergy opportunities were converted into order

intake during the quarter, and we are progressing as planned on

extracting the expected cost synergies.

PERFORMANCE BY GLOBAL BUSINESS AREAS

RESILIENCE

| (35% of net

revenues) |

|

|

|

| in €

millions |

First quarter |

|

Period ended 31 March 2023 |

2023 |

2022 |

change |

|

Net revenues |

332 |

281 |

18% |

|

Organic growth1) |

13.0% |

6.9% |

|

|

Order intake (millions) |

423 |

338 |

25% |

|

Net revenues in backlog (millions) |

980 |

850 |

15% |

|

Backlog organic growth (qtd)1) |

10.0% |

7.2% |

|

1) This excludes the impact of currency movements, acquisitions,

divestments, and footprint reductions (such as the Middle East)

Solid revenue and backlog growth in the quarter was driven by

all regions. We continue to see strong client demand in

environmental restoration, with our leading position in PFAS.

Clients increasingly look for our support in adopting renewable

energy, in order to meet their Net-Zero ambitions. Clients’ demand

continues to be strong for our enviro-social permitting solutions

to deal with the issues in delivering their capital programs due to

higher energy costs and sticky processes. Collaboration with

Arcadis IBI results in cross selling to their client base. Strong

market demands force us to set the right priorities.

PLACES

| (41% of net

revenues) |

|

|

|

| in €

millions |

First quarter |

|

Period ended 31 March 2023 |

2023 |

2022 |

change |

|

Net revenues |

388 |

228 |

70% |

|

Organic growth1) |

8.7% |

1.1% |

|

|

Order intake (millions) |

407 |

259 |

57% |

|

Net revenues in backlog (millions) |

1,555 |

976 |

59% |

|

Backlog organic growth (qtd)1) |

1.3% |

3.3% |

|

1) This excludes the impact of currency movements, acquisitions,

divestments, and footprint reductions (such as the Middle East)

Revenue growth in the quarter was driven by a strong performance

in North America and Europe, being key markets after the strategic

repositioning last year. Good backlog growth in North America

and Europe was partly offset by China and softer market conditions

in the UK. We are successfully pressing ahead with the integration

of Arcadis IBI and Arcadis DPS and have identified

substantial synergy opportunities in the pipeline, while already

securing a number of wins. Demand for sustainable and intelligent

buildings and industrial manufacturing facilities continues with

vast addressable markets and clients following federal and private

funding.

MOBILITY

| (21% of net

revenues) |

|

|

|

| in €

millions |

First quarter |

|

Period ended 31 March 2023 |

2023 |

2022 |

change |

|

Net revenues |

200 |

179 |

12% |

|

Organic growth1) |

15.3% |

9.4% |

|

|

Order intake (millions) |

211 |

187 |

13% |

|

Net revenues in backlog (millions) |

545 |

524 |

4% |

|

Backlog organic growth (qtd)1) |

1.8% |

1.7% |

|

1) This excludes the impact of currency movements, acquisitions,

divestments, and footprint reductions (such as the Middle East)

Continued very strong revenue growth for Mobility in the

quarter, driven by US, Australia, and the UK. Growing demand for

digital solutions focused on solving mobility challenges. The

demand for electrification and decarbonization solutions continues

to dominate requirements from clients. High revenue visibility for

the remainder of the year. Order intake is typically lumpy, as

projects are more sizeable compared to the remainder of the

portfolio. Collaboration with Arcadis IBI and Intelligence drives

enhanced positioning in the market.

INTELLIGENCE

| (2% of net

revenues) |

|

| in €

millions |

First

quarter |

|

Period ended 31 March 2023 |

2023 |

|

Net revenues |

21 |

|

Order intake (millions) |

21 |

|

Net revenues in backlog (millions) |

111 |

Good performance across regions, especially in North America and

the UK. Project extensions with existing clients and securing work

for new clients are driving revenues. Collaboration across GBAs

triggered synergy wins for Key Clients, such as numerous state

Departments of Transportation, looking to Travel, Traffic &

Transit solutions. In addition, these clients will be benefitting

from first grants of the US SMART (Strengthening Mobility and

Revolutionizing Transportation) stimulus program.

FINANCIAL CALENDAR

- 12 May 2023 – Annual General Meeting

- 27 July 2023 – Q2 & HY 2023 Results

- 26 October 2023 – Q3 2023 Trading Update

INVESTOR RELATIONS Christine Disch | +31 (0)6 1537 6020 |

christine.disch@arcadis.com

CORPORATE COMMUNICATIONS Tanno Massar | +31 (0)6 1158 9121

| tanno.massar@arcadis.com

ANALYST WEBCASTArcadis will host an analyst webcast today at

14.00 hours CET. The webcast can be accessed via the Investor

Relations section on the company’s website at:

https://www.arcadis.com/en/investors/investor-calendar/2023/trading-update-q1-2023

ABOUT ARCADISArcadis is a leading global Design &

Consultancy organization for natural and built assets. Applying our

deep market sector insights and collective design, consultancy,

engineering, project and management services we work in partnership

with our clients to deliver exceptional and sustainable outcomes

throughout the lifecycle of their natural and built assets. We are

36,000 people, active in over 70 countries that generate €4.0

billion in revenues. We support UN-Habitat with knowledge

and expertise to improve the quality of life in rapidly

growing cities around the world. www.arcadis.com.

REGULATED INFORMATIONThis press release contains information

that qualifies or may qualify as inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

FORWARD LOOKING STATEMENTSStatements included in this press

release that are not historical facts (including any statements

concerning investment objectives, other plans and objectives of

management for future operations or economic performance, or

assumptions or forecasts related thereto) are forward-looking

statements. These statements are only predictions and are not

guarantees. Actual events or the results of our operations could

differ materially from those expressed or implied in the

forward-looking statements. Forward-looking statements are

typically identified by the use of terms such as “may”, “will”,

“should”, “expect”, “could”, “intend”, “plan”, “anticipate”,

“estimate”, “believe”, “continue”, “predict”, “potential” or the

negative of such terms and other comparable terminology. The

forward-looking statements are based upon our current expectations,

plans, estimates, assumptions and beliefs that involve numerous

risks and uncertainties. Assumptions relating to the foregoing

involve judgments with respect to, among other things, future

economic, competitive and market conditions and future business

decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond our control. Although we

believe that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, our actual results

and performance could differ materially from those set forth in the

forward-looking statements.

- Arcadis Q1 2023 Trading Update

- Arcadis Q1 2023 results presentation

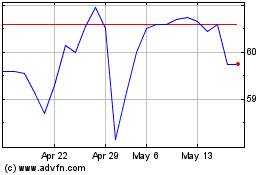

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Feb 2024 to Feb 2025