Cemig's Board OKs Plan To Issue BRL6.5 Billion Debt To Finance Acquisitions

December 16 2011 - 4:26AM

Dow Jones News

The board of Companhia Energetica de Minas Gerais (CIG), or

Cemig, Brazil's third-biggest power utility, authorized the company

to issue up to 6.5 billion Brazilian reais ($3.5 billion) in

promissory notes to finance acquisitions, the company said in a

statement late Thursday.

The notes will mature in 360 days and the company is proposing

to pay an interest rate of 6% over the local interbank rate.

Banco Bradesco BBI, BTG Pactual, Banco Itau BBA, HSBC and Banco

Votorantim will coordinate the deal.

The company said the proceeds will be used to finance

acquisitions.

Earlier this year, Cemig presented a proposal for the

acquisition of a 21.35% stockholding interest in Portuguese

electric company Energias de Portugal (EDPFY), or EDP.

The three other bidders for the EDP stake are German utility

E.ON AG (EOAN.XE), China's Three Gorges Corp., and Brazil's

Centrais Eletricas Brasileiras SA (EBR), or Eletrobras.

-By Rogerio Jelmayer, Dow Jones Newswires; +55 11 3544 7071;

rogerio.jelmayer@dowjones.com

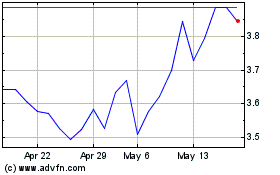

EDP (EU:EDP)

Historical Stock Chart

From Jul 2024 to Aug 2024

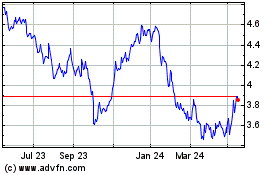

EDP (EU:EDP)

Historical Stock Chart

From Aug 2023 to Aug 2024

Real-Time news about EDP SA (Euronext): 0 recent articles

More EDP News Articles