2022 half-year results

Slight business growth

- H1 revenue: €371.1 million, up

2.2% (-1.3% at CER1); sustained momentum in Asia and activity in

the United States impacted by labor market tensions affecting a

production site

Profitability maintained

- H1 EBITDA2: €50.5 million; margin of 13.9% of revenue

(excluding extraordinary expenses for optimization of the

operational structure and changes in the sales model in China)

2022 objectives confirmed

- Expected revenue growth of between

2% and 4% on a like-for-like basis and at constant exchange

rates

- 2022 EBITDA margin at least

identical to the 2021 EBITDA margin (14.4% excluding extraordinary

costs for optimization of the operational structure and changes in

the sales model in China)

1 At constant exchange rates: the exchange rate impact was

eliminated by recalculating sales for the period on the basis of

the exchange rates used for the previous fiscal year.

2 EBITDA: Operating income before net amortization,

depreciation, and provisions.

Villepinte, Wednesday, September 21,

2022: Guerbet (FR0000032526), a global

specialist in contrast agents and solutions for medical imaging, is

announcing its consolidated results for the first half of 2022.

Revenue totaled €371.1 million, up 2.2%

from June 30, 2021. This includes a positive forex effect of

€12.8 million, almost half of which (€6 million) was due

to the dollar’s strength against the euro.

Excluding forex effects and on a like-for-like

basis, first-half revenue was down -1.3% at €358.3 million. It

was up +0.5% in the first quarter and down -3.1% in the second

quarter due to a largely unfavorable base effect (sales had jumped

+25.1% in the second quarter of 2021 in a context of post-lockdown

improvements).

Good momentum across all sectors and

geographic areas, excluding the Raleigh effect

In the Americas, reported sales

were up +6.4% (down -3.7% at CER). Demand remained strong, with

activity at the industrial site in Raleigh (North Carolina)

hampered in the first half of the year by recruitment difficulties

affecting the production of Optiray® and Dotarem®. The measures put

in place in recent months have paid off and are now significantly

limiting the impact of these difficulties.

In Asia, activity increased

7.7% (4.2% at CER), driven by the introduction of direct

distribution in China in the second quarter.

In EMEA, reported sales were

down -3.2% (-2.6% at CER) with stable volumes overall, accompanied

by continued price erosion.

Diagnostic Imaging revenue in

the first half grew 2.1% at current exchange rates (-1.3% at

CER).

- In MRI, H1 revenue increased +2.5% to €121.3 million

(-0.5% at CER).

- X-ray revenue totaled €206.8 million, up

1.9% (-1.8% at CER) thanks to volumes and prices that remained

strong for Xenetix® and despite the decline in Optiray® sales due

to production constraints at the Raleigh site.

In Interventional Imaging,

reported sales were up 2.5%. At CER, sales were down -1.6%. The

implementation of a worldwide Lipiodol® sales contract led to a

decline in revenue from this activity in the first quarter (-9.7%)

due to one-off price effects. The recovery was very pronounced in

the second quarter (+7.3%). For the first half as a whole, there

was double-digit growth in micro-catheters (+21.5%).

Resilient first-half

results

|

In millions of euros,Consolidated

financial statements (IFRS) |

H1 2021Reported |

H1 2022Reported |

|

Revenue |

363.1 |

371.1 |

|

EBITDA2% of revenue |

62.317.1% |

50.513.6% |

|

Operating income% of revenue |

34.89.6% |

16.94.6% |

|

Net income% of revenue |

23.46.4% |

3.30.9% |

|

Net debt |

249.3 |

251.5 |

2 EBITDA: Operating income before net

amortization, depreciation, and provisions.

The 2022 half-year financial statements,

approved by the Board of Directors on Wednesday, September 21,

2022, underwent a limited review by the statutory auditors. The

statutory auditors' report is being prepared.

EBITDA margin in line with

expectations

As a reminder, the exceptional budgetary

measures put in place at the height of the COVID crisis led to the

Group’s EBITDA ratio of 17.1% at the end of June 2021. During the

second half of 2021, the Group relaunched its sales and marketing

investments to boost activity and accelerate the strategy’s

implementation, resulting in an EBITDA/revenue ratio of 14.4% at

the end of 2021.

In an environment of inflation and labor market

tensions, the Group managed to preserve its profitability by

continuing its efforts to optimize production and structural costs.

This discipline enabled it to limit the impact of rising costs of

raw materials and other supplies (iodine in particular). The

increase in payroll costs remained contained (+3.3%) despite

intense recruitment pressure in the US. Excluding extraordinary

costs related to the optimization of the Group’s operating

structure and the change in the sales model in China (direct

distribution), the EBITDA/revenue ratio was 13.9%, in line with the

Group’s expectations at the end of this first half of the year. The

reported margin was 13.6%.

As of June 30, operating income totaled

€16.9 million. This includes an increase in depreciation and

amortization as well as provisions related to quality disputes with

component suppliers.

Net income for the first half amounted to

€3.3 million. Financial expenses fell sharply to

€1.2 million (versus €4.4 million in the first half of

2021). The tax expense increased to €11.2 million (compared

with €5.1 million previously) after the Group analyzed the tax

risks across all its subsidiaries and booked an additional

€9.5 million provision in its consolidated accounts in

compliance with IFRIC 23.

As of June 30, 2022, equity totaled

€429 million, compared with €405 million on Friday,

December 31, 2021. The decrease in cash (-€56 million, at

€60 million) reflects the €25 million repayment of the

installment loan obtained in 2019 and the increase in WCR fueled by

the establishment of precautionary stocks and stocks of EluciremTM

to prepare for its launch in 2023. This did not prevent a further

improvement in the debt ratio, with a net debt/equity ratio of 0.59

as of June 30, 2022, compared with 0.64 a year earlier.

2022 outlook and guidance

During the first half of the year, the Group

made industrial, commercial, and operational investments on several

fronts in order to prepare for the future, thus contributing to an

unprecedented renewal of its product portfolio in all

divisions.

- In Diagnostic Imaging, the production chains

are on track for the sale of EluciremTM, expected by 2023, after

reviews by the FDA and the EMA1.

- In Interventional Imaging, the significant

expansion of the portfolio of SeQure® and DraKon™ microcatheters

(addition of 20 models, representing a total of 38 products) and

the launch of a new line of Axessio™ guidewires allow Guerbet to

now offer a complete platform of solutions to the interventional

radiology community.

- In Artificial Intelligence (AI), the Group is

preparing to launch its first solution in 2023 to help diagnose

prostate cancer.

Guerbet believes that it can meet its ambitious

revenue growth objective of 2% to 4% on a like-for-like basis and

at constant exchange rates for the full 2022 fiscal year, on the

back of solid activity in the first two months of the third quarter

and a continuous improvement in production rates at the Raleigh

site. The Group also reiterates its operating profitability

forecast for the full 2022 fiscal year of an EBITDA/revenue ratio

at least identical to the 2021 ratio (14.4%), excluding

extraordinary costs for optimizing the Group’s operating plan and

shifting to direct distribution in China.

1 EluciremTM (gadopiclenol) is under review in Europe by the EMA

(European Medicines Agency) and in the US by the FDA (Food and Drug

Administration)

Upcoming events:

Publication of Q3 2022

revenueThursday, October 20, 2022, after

trading

About Guerbet

At Guerbet, we build lasting relationships so

that we enable people to live better. That is our purpose. We are a

global leader in medical imaging, offering a comprehensive range of

pharmaceutical products, medical devices, and digital and AI

solutions for diagnostic and interventional imaging. As pioneers in

contrast products for 95 years, with more than 2,700 employees

worldwide, we continuously innovate and devote 8% to 10% of our

revenue to research and development in five centers in France,

Israel, and the United States. Guerbet (GBT) is listed on Euronext

Paris (segment B – mid caps) and generated €732 million in revenue

in 2021. For more information, please visit www.guerbet.com.

Forward-looking statements

Certain information contained in this press release does not

reflect historical data but constitutes forward-looking statements.

These forward-looking statements are based on estimates, forecasts,

and assumptions, including but not limited to assumptions about the

current and future strategy of the Group and the economic

environment in which the Group operates. They involve known and

unknown risks, uncertainties, and other factors that may result in

a significant difference between the Group’s actual performance and

results and those presented explicitly or implicitly by these

forward-looking statements.

These forward-looking statements are valid only

as of the date of this press release, and the Group expressly

disclaims any obligation or commitment to publish an update or

revision of the forward-looking statements contained in this press

release to reflect changes in their underlying assumptions, events,

conditions, or circumstances. The forward-looking statements

contained in this press release are for illustrative purposes only.

Forward-looking statements and information are not guarantees of

future performance and are subject to risks and uncertainties that

are difficult to predict and are generally beyond the Group’s

control.

These risks and uncertainties include but are

not limited to the uncertainties inherent in research and

development, future clinical data and analyses (including after a

marketing authorization is granted), decisions by regulatory

authorities (such as the US Food and Drug Administration or the

European Medicines Agency) regarding whether and when to approve

any application for a drug, process, or biological product filed

for any such product candidates, and their decisions regarding

labeling and other factors that may affect the availability or

commercial potential of such product candidates. A detailed

description of the risks and uncertainties related to the Group’s

activities can be found in Chapter 4.9 “Risk factors” of the

Group’s Universal Registration Document filed with the AMF (French

financial markets authority) under number D-22-0242 on Tuesday,

April 5, 2022, available on the Group’s website

(www.guerbet.com).

Contacts :

Guerbet

Jérôme Estampes, Chief Financial Officer +

33 (0)1 45 91 50 00 /

jerome.estampes@guerbet.comClaire Lauvernier, Communications

Director +33 (0)6 79 52 11 88 /

claire.lauvernier@guerbet.com

Actifin

Benjamin Lehari, Financial Communications +

33 (0)1 56 88 11 25 /

blehari@actifin.frJennifer Jullia, Press

+33 (0)1 56 88 11 19 /

jjullia@actifin.fr

- Guerbet CP RS 2022 Final VA

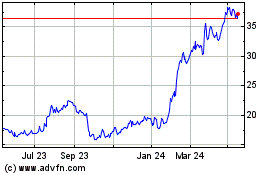

Guerbet (EU:GBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

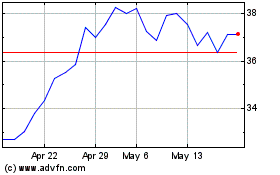

Guerbet (EU:GBT)

Historical Stock Chart

From Nov 2023 to Nov 2024