Societe Generale: Third quarter 2024 earnings

RESULTS AT 30 SEPTEMBER

2024

Press

release

Paris, 31 October 2024

SOLID BUSINESS PERFORMANCE IN Q3

24,

GROUP NET INCOME OF EUR 1.4

BILLION

Revenues of EUR 6.8

billion, up +10.5% vs. Q3 231, driven

notably by the strong rebound in net interest income in France, in

line with end of year estimate, and by another solid performance of

Global Banking and Investor Solutions, in particular in Equities

and Transaction Banking

Strong positive

jaws, control of operating expenses, down by

-0.8% vs. Q3 23

Cost-to-income ratio at 63.3% in

Q3 24, improved by 7.1 points vs. Q3 23

Stable cost of risk at 27 basis

points in Q3 24

Profitability (ROTE) at

9.6% vs. 3.8% for Q3 23

9M 24 NET INCOME UP 53% VS. 9M

23 AT EUR 3.2 BILLION,

DRIVEN BY THE IMPROVEMENT IN OPERATING

PERFORMANCE

Revenues of EUR 20.2

billion, up +5.3% vs. 9M 23

Stable operating

expenses, +0.1% vs. 9M 23

Cost-to-income ratio at

68.8%, improved by 3.6 percentage points vs. 9M

23

Profitability (ROTE) at

7.1% vs. 5.0% for 9M 23

SOLID CAPITAL AND LIQUIDITY

RATIOS

CET 1 ratio of

13.2%2

at end of Q3 24, around 300 basis

points above the regulatory requirement

Liquidity Coverage Ratio at 152%

at end of Q3 24

Distribution provision of EUR

1.663

per share at end-September

2024

DECISIVE EXECUTION OF THE

STRATEGIC PLAN

Capital build-up ahead of

Capital Markets Day trajectory

Continuous improvement in

efficiency and profitability

Reshaping of the business

portfolio well underway

Slawomir Krupa, the Group’s Chief

Executive Officer, commented:

“We are publishing solid quarterly results that continue to

show strong improvement. It demonstrates that we are executing our

strategic plan which is impacting our results in a positive and

tangible way. Our revenues are up thanks to the solid

performance of our businesses with a strong rebound of the net

interest income in France and another remarkable contribution from

Global Banking and Investor Solutions. Operating expenses are

stable and cost of risk is contained. We are posting a clear

improvement of cost-to-income ratio and profitability, and our

capital ratio continues to strengthen.

For the past year we have been working relentlessly. Our teams

are mobilized and we have made progress in three fundamental areas:

capital build-up, improvement of profitability, and the reshaping

of our business portfolio. We continue to implement our various

strategic initiatives such as BoursoBank’s development, LeasePlan’s

integration within Ayvens and the acceleration of our contribution

to the energy transition. Our goal remains unchanged: a sustainable

performance that will create long-term value.”

-

GROUP CONSOLIDATED RESULTS

|

In EURm |

Q3 24 |

Q3 23 |

Change |

9M 24 |

9M 23 |

Change |

|

Net banking income |

6,837 |

6,189 |

+10.5% |

+11.8%* |

20,167 |

19,147 |

+5.3% |

+6.5%* |

|

Operating expenses |

(4,327) |

(4,360) |

-0.8% |

-0.3%* |

(13,877) |

(13,858) |

+0.1% |

+0.5%* |

|

Gross operating income |

2,511 |

1,829 |

+37.3% |

+41.0%* |

6,290 |

5,289 |

+18.9% |

+22.4%* |

|

Net cost of risk |

(406) |

(316) |

+28.4% |

+30.5%* |

(1,192) |

(664) |

+79.6% |

+81.0%* |

|

Operating income |

2,105 |

1,513 |

+39.1% |

+43.2%* |

5,098 |

4,625 |

+10.2% |

+13.9%* |

|

Net profits or losses from other assets |

21 |

6 |

x 3.5 |

x 3.4* |

(67) |

(92) |

+27.5% |

+27.3%* |

|

Income tax |

(535) |

(624) |

-14.3% |

-12.7%* |

(1,188) |

(1,377) |

-13.7% |

-11.3%* |

|

Net income |

1,591 |

563 |

x 2.8 |

x 3.0* |

3,856 |

2,836 |

+35.9% |

+41.3%* |

|

O.w. non-controlling interests |

224 |

268 |

-16.5% |

-16.1%* |

696 |

774 |

-10.1% |

-11.2%* |

|

Reported Group net income |

1,367 |

295 |

x 4.6 |

x 5.1* |

3,160 |

2,062 |

+53.2% |

+62.2%* |

|

ROE |

8.4% |

0.9% |

|

|

6.2% |

3.6% |

+0.0% |

+0.0%* |

|

ROTE |

9.6% |

3.8% |

|

|

7.1% |

5.0% |

+0.0% |

+0.0%* |

|

Cost to income |

63.3% |

70.4% |

|

|

68.8% |

72.4% |

+0.0% |

+0.0%* |

Societe Generale’s Board of Directors, which met

on 30 October 2024 under the chairmanship of Lorenzo Bini Smaghi,

examined Societe Generale Group’s results for Q3 24 and for the

first nine months of 2024.

Net banking

income

Net banking income stood at EUR 6.8

billion, up by +10.5% vs. Q3 23.

Revenues of French Retail, Private

Banking and Insurance were up by +18.7% vs. Q3 23 and

totalled EUR 2.3 billion in Q3 24. Net interest income continued

its rebound in Q3 24 (+43% excluding PEL/CEL provision vs. Q3 23),

in line with latest estimates, in the context of a still muted loan

environment and the pursuit of increasing interest-bearing

deposits. Assets under management in the Private Banking

and Insurance businesses continued to rise, respectively

recording a growth of +8% and +10% in Q3 24 vs. Q3 23. Last,

BoursoBank continued its controlled client

acquisition, onboarding once again more than 300,000 new clients

over the quarter, reaching close to 6.8 million clients at

end-September 2024. Likewise, assets under administration rose by

over 14% vs. Q3 23. As in Q2 24, BoursoBank posted a positive

contribution to Group net income in Q3 24.

Global Banking and Investor

Solutions registered a +4.9% increase in revenues relative

to Q3 23. Revenues totalled EUR 2.4 billion over the quarter, still

driven by strong dynamics of Global Markets’ and

Global Transaction & Payment Services’

activities, with revenues increasing by a respective +7.6% and

+9.0% in Q3 24 vs. Q3 23. Within Global Markets, revenues of Equity

businesses grew by +10.1%. This is the second best third quarter

ever. Fixed income and Currencies also recorded a

solid performance, with a +6.1% increase in revenues amid a falling

interest rates. Financing and Advisory’s revenues

totalled EUR 843 million, stable vs. Q3 23. The commercial

momentum in the securitisation businesses remained very solid and

the performance of financing activities continued to be good,

albeit slower relative to an elevated Q3 23. Likewise,

Global Transaction & Payment Services’

activities posted an +9.0% increase in revenues vs. Q3 23, driven

by a favourable market environment and sustained commercial

development in the cash management and correspondent banking

activities.

Mobility, International

Retail Banking and Financial Services’ revenues were down

by -5.4% vs. Q3 23 mainly owing to base effects at Ayvens.

International Retail Banking recorded a +1.4%

increase in revenues vs. Q3 23 to EUR 1.1 billion, driven by

favourable momentum across all regions. Mobility and

Financial Services’ revenues contracted by -11.4% vs. Q3

23 owing to an unfavourable non-recurring base effect on

Ayvens.

The Corporate Centre recorded

revenues of EUR +54 million in Q3 24. They include the booking of

exceptional proceeds of approximately EUR 0.3

billion4.

Over 9M 24, net banking income increased

by +5.3% vs. 9M 23.

Operating

expenses

Operating expenses came to EUR 4,327

million in Q3 24, down -0.8% vs. Q3 23.

The cost-to-income ratio stood at 63.3%

in Q3 24, a sharp decrease vs. Q3 23 (70.4%) and Q2 24

(68.4%).

Over 9M 24, operating expenses

were stable (+0.1% vs. 9M 23) and the cost-to-income ratio came to

68.8% (vs. 72.4% for 9M 23), which is lower than the 71% target set

for FY 2024.

Cost of

risk

The cost of risk was stable and

contained over the quarter at 27 basis points, i.e., EUR

406 million. This comprises a EUR 400 million provision for

doubtful loans (around 27 basis points) and a provision on

performing loan outstandings for EUR +6 million.

At end-September 2024, the Group’s provisions on

performing loans amounted to EUR 3,122 million, down by a slight

EUR -56 million relative to 30 June 2024 notably as per the

application of IFRS5 accounting standards on activities under

disposal. The EUR -450 million contraction relative to

31 December 2023 is mainly owing to the application of IFRS 5

accounting standards for activities under disposal.

The gross non-performing loan ratio stood at

2.95%5,6 at 30 September 2024,

down vs. end of June 2024 (3.03%). The net coverage ratio on the

Group’s non-performing loans stood at 84%7 at 30

September 2024 (after netting of guarantees and collateral).

Net profits from other

assets

In Q3 24, the Group booked net profit of EUR 21

million driven, on the one hand, by the sale of the headquarters of

KB in the Czech Republic and, on the other hand, by the accounting

impacts mainly owing to the current sale of assets.

Group net

income

Group net income stood at EUR 1,367

million in Q3 24, equating to a Return on Tangible Equity

(ROTE) of 9.6%.

Over 9M 24, Group net income came to EUR

3,160 million, equating to a Return on Tangible Equity

(ROTE) of 7.1%.

2. STRATEGIC PLAN FULLY

ON TRACK

Since announcing its strategic plan in September

2023, the Group has made significant progress in its

implementation, the benefits of which are starting to materialise,

including on financials aspects. Fundamental milestones have

notably been reached in three major areas: capital build-up, the

continuous improvement in efficiency and profitability and the

reshaping of the business portfolio.

Regarding the business portfolio, the Group has

been proactive in recent months, announcing the disposal of several

non-core and non-synergistic assets. These latest divestments not

only contribute to simplifying the Group but will also reinforce

the capital ratio by around 60 basis points, of which around

15 basis points are expected by year-end.

At the same time, the Group is preparing the

future by investing in our core franchises, as demonstrated by the

development of BoursoBank, the integration of LeasePlan in Ayvens,

the creation of Bernstein, the partnership with Brookfield, the

merger of our networks in France and the digitalization of our

networks in the Czech Republic.

The rollout of our ESG roadmap is also

progressing well, particularly on the alignment of our portfolio.

The Group has already reduced by more than 50% its upstream Oil

& Gas exposure at Q2 24 compared to 20198.

Last quarter, the Group reached its EUR 300

billion sustainable finance target set between 2022-2025. Societe

Generale announces today a new sustainable finance target to

facilitate EUR 500 billion over the 2024-2030 period that breaks

down as follows:

- EUR 400 billion in financing and EUR 100 billion in sustainable

bonds9

- EUR 400 billion in environmental activities and EUR 100 billion

in social

A major portion of financing will be for

dedicated transactions in clean energy, sustainable real estate,

low carbon mobility, and other industry and environmental

transition topics.

3. THE

GROUP’S FINANCIAL STRUCTURE

At 30 September 2024, the Group’s Common

Equity Tier 1 ratio stood at 13.2%10, around

300 basis points above the regulatory requirement. Likewise, the

Liquidity Coverage Ratio (LCR) was well ahead of regulatory

requirements at 152% at end-September 2024 (156% on average for the

quarter), and the Net Stable Funding Ratio (NSFR) stood at 116% at

end-September 2024.

All liquidity and solvency ratios are well above

the regulatory requirements.

|

|

30.09.2024 |

31.12.2023 |

Requirements |

|

CET1(1) |

13.2% |

13.1% |

10.22% |

|

CET1 fully loaded |

13.2% |

13.1% |

10.22% |

|

Tier 1 ratio (1) |

15.5% |

15.6% |

12.15% |

|

Total Capital(1) |

18.2% |

18.2% |

14.71% |

|

Leverage ratio (1) |

4.25% |

4.25% |

3.60% |

|

TLAC (% RWA)(1) |

27.8% |

31.9% |

22.29% |

|

TLAC (% leverage)(1) |

7.6% |

8.7% |

6.75% |

|

MREL (% RWA)(1) |

32.2% |

33.7% |

27.56% |

|

MREL (%

leverage)(1) |

8.8% |

9.2% |

6.23% |

|

End of period LCR |

152% |

160% |

>100% |

|

Period average LCR |

156% |

155% |

>100% |

|

NSFR |

116% |

119% |

>100% |

|

In EURbn |

30.09.2024 |

31.12.2023 |

|

Total consolidated balance sheet |

1,580 |

1,554 |

|

Group shareholders’ equity |

67 |

66 |

|

Risk-weighted assets |

392 |

389 |

|

O.w. credit risk |

331 |

326 |

|

Total funded balance sheet |

948 |

970 |

|

Customer loans |

453 |

497 |

|

Customer deposits |

608 |

618 |

At 11 October 2024, the parent company had

issued a total of EUR 38.0 billion in medium/long-term debt, of

which EUR 17.5 billion in vanilla notes. The 2024 long-term vanilla

funding programme is completed. The subsidiaries had issued EUR 4.6

billion. In all, the Group has issued a total of EUR

42.6 billion.

The Group is rated by four rating agencies: (i)

FitchRatings - long-term rating “A-”, stable outlook, senior

preferred debt rating “A”, short-term rating “F1” (ii) Moody’s -

long-term rating (senior preferred debt) “A1”, negative outlook,

short-term rating “P-1” (iii) R&I - long-term rating (senior

preferred debt) “A”, stable outlook; and (iv) S&P Global

Ratings - long-term rating (senior preferred debt) “A”, stable

outlook, short-term rating “A-1”.

4. FRENCH RETAIL, PRIVATE

BANKING AND INSURANCE

|

In EURm |

Q3 24 |

Q3 23 |

Change |

9M 24 |

9M 23 |

Change |

|

Net banking income |

2,254 |

1,900 |

+18.7% |

6,390 |

6,090 |

+4.9% |

|

Net banking income excl. PEL/CEL |

2,259 |

1,895 |

+19.2% |

6,392 |

6,090 |

+5.0% |

|

Operating expenses |

(1,585) |

(1,608) |

-1.4% |

(4,962) |

(5,073) |

-2.2% |

|

Gross operating income |

669 |

292 |

x 2.3 |

1,428 |

1,017 |

+40.5% |

|

Net cost of risk |

(178) |

(144) |

+23.4% |

(597) |

(342) |

+74.7% |

|

Operating income |

491 |

148 |

x 3.3 |

831 |

675 |

+23.1% |

|

Net profits or losses from other assets |

(1) |

0 |

n/s |

7 |

4 |

x 2.1 |

|

Reported Group net income |

368 |

109 |

x 3.4 |

631 |

506 |

+24.8% |

|

RONE |

9.4% |

2.8% |

|

5.4% |

4.4% |

|

|

Cost to income |

70.3% |

84.7% |

|

77.7% |

83.3% |

|

Commercial

activity

SG Network, Private Banking and

Insurance

Average outstanding deposits of the SG Network

amounted to EUR 236 billion in Q3 24, up by +0.6% vs. the previous

quarter (-1% vs. Q3 23), with a continued rise in interest-bearing

deposits and financial savings.

The SG Network’s average loan outstandings

contracted by -5% vs. Q3 23 to EUR 195 billion. Outstanding loans

to corporate and professional clients were stable vs. Q3 23

(excluding government-guaranteed PGE loans), with the share of

medium to long-term loans increasing relative to Q2 24. Home loan

production continued its recovery (2.4x vs. Q3 23 and +15% vs. Q2

24).

The average loan to deposit ratio came to 82.5%

in Q3 24, down by -3.3 percentage points relative to

Q3 23.

Private Banking activities saw

their assets under management11 reach a new record of

EUR 154 billion in Q3 24, up by +8% vs. Q3 23. Net gathering stood

at EUR 5.9 billion in 9M 24, the net asset gathering pace (net new

money divided by AuM) has risen by +5.5% since the start of the

year. Net banking income stood at EUR 368 million over the quarter,

stable vs. Q3 23. Over 9M 24, net banking income came to EUR 1,121

million, a +1% increase vs. 9M 23.

Insurance, which covers

activities in and outside France, posted a very strong commercial

performance. Life insurance outstandings increased sharply by +10%

vs. Q3 23 to reach a record EUR 145 billion at end-September 2024.

The share of unit-linked products remained high at 40%. Gross life

insurance savings inflows amounted to EUR 3.6 billion in Q3 24, up

by +35% vs. Q3 23.

Personal protection and P&C premia were up

by +5% vs. Q3 23.

BoursoBank

BoursoBank registered almost 6.8 million clients

at end-September 2024, a +27% increase vs. Q3 23 (an increase of

around 1.4 million clients year on year). The pace of new client

acquisition (around 310,000 new clients in Q3 24) is fully in line

with the target of 7 million clients by the end of 2024. BoursoBank

can build on an active, loyal and high-quality client base. The

brokerage activity registered two million transactions, up by +18%

vs. Q3 23. Last, proof of the efficiency of the model and of the

very high client satisfaction level, the churn rate has remained

low at around 3% and below the market rate.

Average loan outstandings rose by +4,2% compared

to Q3 23, at EUR 15 billion in Q3 24.

Average outstanding savings including deposits

and financial savings were +13.8% higher vs. Q3 23 at EUR 63

billion. Deposits outstanding totalled EUR 38 billion at Q3 24,

posting another sharp increase of +16.2% vs. Q3 23. Life insurance

outstandings came to EUR 12 billion in Q3 24 and rose by +7.3% vs.

Q3 23 (o/w 47% unit-linked products, a +3.3 percentage points

increase vs. Q3 23). The activity continued to register strong

gross inflows over the quarter (+55% vs. Q3 23, around 53%

unit-linked products).

For the second quarter in a row, BoursoBank

recorded a positive contribution to Group net income in

Q3 24.

Net banking

income

Over the quarter, revenues came

to EUR 2,254 million, up +19% vs. Q3 23 and up +6% vs Q2 24. Net

interest income grew by +43% vs. Q3 23 (excluding PEL/CEL) and +19%

(EUR 169 million) vs. Q2 24. Fee income rose by +5.0% relative

to Q3 23.

Over 9M 24 revenues came to EUR

6,390 million, up by +4.9% vs. 9M 23. Net interest income excluding

PEL/CEL was up by +15.9% vs. 9M 23. Fee income increased by +1.7%

relative to 9M 23.

Operating

expenses

Over the quarter, operating

expenses came to EUR 1,585 million, down -1.4% vs. Q3 23. Operating

expenses for Q3 24 include EUR 12 million in transformation costs.

The cost-to-income ratio stood at 70.3% for Q3 24, improving by

more than +14 percentage points vs. Q3 23.

Over 9M 24, operating expenses

came to EUR 4,962 million (-2.2% vs. 9M 23). The cost-to-income

ratio stood at 77.7% and improved by +5.7 percentage points vs. 9M

23.

Cost of

risk

In Q3 24, the cost of risk

amounted to EUR 178 million or 30 basis points stable on Q2 24

(29 basis points).

Over 9M 24, the cost of risk

totalled EUR 597 million or 34 basis points.

Group net

income

Over the quarter, Group net

income totalled EUR 368 million. RONE stood at 9.4% in Q3 24.

Over 9M 24, Group net income

totalled EUR 631 million. RONE stood at 5.4% in 9M 24.

5. GLOBAL BANKING AND

INVESTOR SOLUTIONS

|

In EUR m |

Q3 24 |

Q3 23 |

Variation |

9M 24 |

9M 23 |

Change |

|

Net banking income |

2,422 |

2,309 |

+4.9% |

+5.2%* |

7,666 |

7,457 |

+2.8% |

+2.8%* |

|

Operating expenses |

(1,494) |

(1,478) |

+1.1% |

+1.3%* |

(4,898) |

(5,187) |

-5.6% |

-5.5%* |

|

Gross operating income |

928 |

831 |

+11.6% |

+12.0%* |

2,768 |

2,270 |

+21.9% |

+21.8%* |

|

Net cost of risk |

(27) |

(14) |

+95.3% |

x 2.0* |

(29) |

8 |

n/s |

n/s |

|

Operating income |

901 |

817 |

+10.2% |

+10.5%* |

2,739 |

2,278 |

+20.2% |

+20.0%* |

|

Reported Group net income |

699 |

645 |

+8.2% |

+8.5%* |

2,160 |

1,814 |

+19.1% |

+18.8%* |

|

RONE |

18.0% |

16.8% |

+0.0% |

+0.0%* |

19.0% |

15.6% |

+0.0% |

+0.0%* |

|

Cost to income |

61.7% |

64.0% |

+0.0% |

+0.0%* |

63.9% |

69.6% |

+0.0% |

+0.0%* |

Net banking

income

Global Banking and Investor

Solutions continued to deliver very strong performances,

posting revenues of EUR 2,422 million, up +4.9% versus Q3 23.

Over 9M 24, revenues climbed by

+2.8% vs. 9M 23 (EUR 7,666 million vs. EUR 7,457 million).

Global Markets and Investor

Services recorded a rise in revenues over the quarter vs.

Q3 23 of +7.6% to EUR 1,579 million. Over 9M 24, revenues totalled

EUR 5,063 million, i.e., a +3.1% increase vs. 9M 23. Growth

was mainly driven by Global Markets which recorded

revenues of EUR 1,410 million in Q3 24, up by +8.6% relative to Q3

23 amid a positive environment that was particularly conducive to

Equities. Over 9M 24, revenues totalled EUR 4,553 million, up by

+4.5% vs. 9M 23.

The Equities business again

delivered a solid performance, recording revenues of EUR 880

million in Q3 24, up by a strong +10.1% vs. Q3 23, notably on

the back of a very good performance from derivatives amid

favourable market conditions. This is the second best third quarter

ever. Over 9M 24, revenues increased sharply by +12.9% relative to

9M 23 to EUR 2,739 million.

Fixed Income and Currencies

registered a +6.1% increase in revenues to EUR 530 million in Q3

24, notably owing to robust demand for rates and forex flow

activities, particularly from US clients. Over 9M 24, revenues

decreased by -6.0% to EUR 1,814 million.

Securities Services’ revenues

were up +0.6% versus Q3 23 at EUR 169 million, but increased by

+9.9% excluding the impact of equity participations. The business

continued to reap the benefit of a positive fee generation trend

and robust momentum in private market and fund distribution. Over

9M 24, revenues were down by -8.2%, but rose by +2.1% excluding

equity participations. Assets under Custody and Assets under

Administration amounted to EUR 4,975 billion and EUR 614 billion,

respectively.

The Financing and Advisory

business posted revenues of EUR 843 million, stable versus Q3 23.

Over 9M 24, revenues totalled EUR 2,602 million, up by +2.3% vs. 9M

23.

The Global Banking and Advisory

business posted a -3.2% decline in revenues relative to Q3 23.

Securitised products again delivered a solid performance and

momentum was strong in the distribution activity. Financing

activities posted a good performance, albeit down on the high

baseline in Q3 23. Investment banking activities turned in

resilient performances. Over 9M 24, revenues dipped slightly by

-0.3% relative to 9M 23.

Global Transaction & Payment

Services again delivered a very robust performance

compared with Q3 23, posting an +9.0% increase in revenues,

driven by strong momentum in cash management and the correspondent

banking activities. Over 9M 24, revenues grew by +10.1%.

Operating

expenses

Operating expenses came to EUR 1,494

million over the quarter and included EUR 21 million in

transformation costs. Operating expenses rose by +1.1% compared

with Q3 23, equating to a cost-to-income ratio of 61.7% in Q3

24.

Over 9M 24, operating expenses

decreased by -5.6% compared with 9M 23 and the cost-to-income ratio

came to 63.9%.

Cost of

risk

Over the quarter, the cost of

risk was low at EUR 27 million, or 7 basis points vs. 3 basis

points in Q3 23.

Over 9M 24, the cost of risk

was EUR 29 million, or 2 basis points.

Group net

income

Group net income increased by +8.2% vs. Q3 23 to

EUR 699 million. Over 9M 24, Group net income rose

sharply by +19.1% to EUR 2,160 million.

Global Banking and Investor Solutions reported

high RONE of 18.0% for the quarter and

RONE of 19.0% for 9M 24.

6. MOBILITY,

INTERNATIONAL RETAIL BANKING AND FINANCIAL SERVICES

|

In EURm |

Q3 24 |

Q3 23 |

Change |

|

9M 24 |

9M 23 |

Change |

|

Net banking income |

2,108 |

2,228 |

-5.4% |

-2.8%* |

|

6,403 |

6,491 |

-1.4% |

+1.8%* |

|

Operating expenses |

(1,221) |

(1,239) |

-1.4% |

+0.3%* |

|

(3,832) |

(3,479) |

+10.2% |

+12.7%* |

|

Gross operating income |

887 |

989 |

-10.4% |

-6.6%* |

|

2,570 |

3,013 |

-14.7% |

-10.9%* |

|

Net cost of risk |

(201) |

(175) |

+14.9% |

+18.1%* |

|

(572) |

(349) |

+63.7% |

+65.9%* |

|

Operating income |

685 |

814 |

-15.8% |

-12.0%* |

|

1,998 |

2,663 |

-25.0% |

-21.2%* |

|

Net profits or losses from other assets |

94 |

1 |

x 77.0 |

x 76.7* |

|

98 |

0 |

x 375.7 |

x 304.1 |

|

Non-controlling interests |

223 |

237 |

-6.1% |

-3.6%* |

|

623 |

674 |

-7.6% |

-7.8%* |

|

Reported Group net income |

367 |

377 |

-2.4% |

+3.1%* |

|

956 |

1,325 |

-27.8% |

-22.1%* |

|

RONE |

14.1% |

14.9% |

|

|

|

12.2% |

18.6% |

|

|

|

Cost to income |

57.9% |

55.6% |

|

|

|

59.9% |

53.6% |

|

|

(122)()

Commercial

activity

International Retail

Banking

International Retail Banking1

posted robust commercial momentum in Q3 24, with an increase in

loan outstandings of +4.2%* vs. Q3 23 (+1.8%, outstandings of EUR

68 billion in Q3 24) and growth of +4.1%* vs. Q3 23 (+1.2%,

outstandings of EUR 83 billion in Q3 24).

Activity in Europe was solid

across client segments for both entities. Loan outstandings

increased by +6.0%* vs. Q3 23 (+3.1% at current perimeter and

exchange rates, outstandings of EUR 43 billion in Q3 24), driven by

home loans and medium and long-term corporate loans in a lower

rates environment. Deposit outstandings increased by +4.6%* vs. Q3

23 (+1.9% at current perimeter and exchange rates, outstandings of

EUR 55 billion in Q3 24), mainly on interest-bearing products.

In Africa, Mediterranean Basin and

French Overseas Territories, loan outstandings totalled

EUR 25 billion in Q3 24 (+1.2%* vs. Q3 23, stable at

current perimeter and exchange rates) on back of a +5.6%* rise vs.

Q3 23 in sub-Saharan Africa (stable vs. Q3 23 at current perimeter

and exchange rates). Deposit outstandings totalled EUR 27 billion

at Q3 24. They increased by +3.0%* vs. Q3 23 (stable at current

perimeter and exchange rates) across all client segments in

Africa.

Mobility and Financial

Services

Overall, Mobility and Financial

Services maintained a good commercial performance.

Ayvens’ earning assets totalled EUR 53.1 billion

at end-September 2024, a +5.8% increase vs.

end-September 2023.

The Consumer Finance business

posted loans outstanding of EUR 23 billion for Q3 24, down -4.5%

vs. Q3 23 in a still uncertain environment.

Equipment Finance posted

outstandings of EUR 15 billion in Q3 24, the same level as in Q3

23.

Net banking

income

Over the quarter,

Mobility, International Retail Banking and

Financial Services’ revenues totalled EUR 2,108 million, a

decrease of -2.8%* vs. Q3 23 (-5.4% at current perimeter and

exchange rates).

Over 9M 24, revenues came to

EUR 6,403 million, up slightly by +1.8%* vs. 9M 23 (-1.4% at

current perimeter and exchange rates).

International Retail Banking

recorded a solid performance over the quarter, with a net banking

income of EUR 1,058 million, up by +5.1%* vs. Q3 23 (+1.4% at

current perimeter and exchange rates). Over 9M 24, revenues

totalled EUR 3,131 million, a +4.0%* increase vs. 9M 23 (stable at

current perimeter and exchange rates).

Europe recorded revenues of EUR

506 million in Q3 24, an increase for both entities (+3.0%* vs.

Q3 23, stable at current perimeter and exchange rates).

The Africa, Mediterranean Basin and

French Overseas Territories region continued to post

robust commercial momentum with revenues of EUR 552 million in Q3

24. These increased by +7.2%* vs. Q3 23 (+2.8% at current perimeter

and exchange rates), driven by a significant rise in net interest

income in Africa (+10.5%* vs. Q3 23).

In Q3 24, Mobility and Financial

Services’ revenues decreased by -11.4% vs. Q3 23 to EUR

1,049 million. Over the first nine months of 2024, they

contracted by -2.9% to EUR 3,271 million.

Ayvens’ net banking income

stood at EUR 732 million, a decrease of -14,8% in Q3 24 vs. Q3 23

and of

-4,0% restated from non-recurring items13. The amount of

underlying margins was stable vs. Q3 23 at around EUR 690

million1. The average used car sale result per vehicle

(UCS) continued to normalise but remained at a high level of

EUR 1,4201 per unit in Q3 24 vs. EUR

1,4801 in Q2 24.

Consumer Finance activities,

down by -3.5% vs. Q3 23, have stabilised since Q2 24 with the

business posting net banking income of EUR 218 million in Q3 24.

Equipment Finance revenues were also stable vs. Q3

23 (EUR 99 million in Q3 24).

Operating

expenses

Over the quarter, operating

expenses were stable (+0.3%* vs. Q3 23, -1.4%) at EUR 1,221 million

and included EUR 29 million in transformation costs. The

cost-to-income ratio came to 57.9% in Q3 24.

Over 9M 24, operating expenses

totalled EUR 3,832 million, up +12.7%* vs. 9M 23 (+10.2% at current

perimeter and exchange rates). They include around EUR 148 million

of transformation charges.

In a context of a strong transformation,

International Retail Banking costs rose by +3.4%*

vs. Q3 23 (stable at current perimeter and exchange rates, EUR 567

million in Q3 24), notably due to the impact of a new banking tax

in Romania which entered into force in January 2024.

The Mobility and Financial

Services business recorded a decrease in operating

expenses compared to Q3 23 (-2.4% vs. Q3 23, EUR 654 million in Q3

24).

Cost of

risk

Over the quarter, the cost of

risk normalised at 48 basis points (or EUR 201 million).

Over 9M 24, the cost of risk

stood at 45 basis points vs. 32 basis points in 9M 23.

Group net

income

Over the quarter, Group net

income came to EUR 367 million, down -2.4% vs. Q3 23. RONE stood at

14.1% in Q3 24. RONE was 21.4% for International Retail Banking

(positive impact on Group net income of around EUR 40 million

related to the sale of KB head office premises), and 9.2% in

Mobility and Financial Services in Q3 24.

Over 9M 24, Group net income

came to EUR 956 million, down by -27.8% vs. 9M 23. RONE stood at

12.2% for 9M 24. RONE was 16.4% in International Retail Banking,

and 9.5% in Mobility and Financial Services in 9M 24.

7. CORPORATE

CENTRE

|

In EURm |

Q3 24 |

Q3 23 |

Change |

9M 24 |

9M 23 |

Change |

|

Net banking income |

54 |

(249) |

n/s |

n/s |

(291) |

(891) |

+67.3% |

+67.8%* |

|

Operating expenses |

(27) |

(35) |

-22.8% |

-25.8%* |

(185) |

(119) |

+55.2% |

+48.2%* |

|

Gross operating income |

27 |

(283) |

n/s |

n/s |

(476) |

(1,010) |

+52.9% |

+54.2%* |

|

Net cost of risk |

1 |

17 |

+95.9% |

+95.9%* |

6 |

19 |

+70.6% |

+70.6%* |

|

Net profits or losses from other assets |

(73) |

4 |

n/s |

n/s |

(172) |

(96) |

-78.9% |

-79.1%* |

|

Income tax |

(26) |

(214) |

-87.7% |

-87.5%* |

118 |

(85) |

n/s |

n/s |

|

Reported Group net income |

(67) |

(836) |

+92.0% |

+92.2%* |

(587) |

(1,582) |

+62.9% |

+63.7%* |

The Corporate Centre includes:

- the property management of the

Group’s head office,

- the Group’s equity portfolio,

- the Treasury function for the

Group,

- certain costs related to

cross-functional projects, as well as several costs incurred by the

Group that are not re-invoiced to the businesses.

Net banking

income

Over the quarter, the

Corporate Centre’s net banking income totalled EUR +54

million vs. EUR -249 million in Q3 23. It

includes the booking of exceptional proceeds received of

approximately EUR 0.3 billion14.

Operating

expenses

Over the quarter,

operating expenses totalled EUR 27 million vs. EUR

35 million in Q3 23.

Net losses from other

assets

Pursuant notably to the application of IFRS 5,

the Group booked in Q3 24 various impacts from ongoing disposals of

assets.

Group net

income

Over the quarter, the

Corporate Centre’s Group net income totalled EUR -67

million vs. EUR -836 million in Q3 23.

8. 2024 AND 2025

FINANCIAL CALENDAR

2024 and 2025 Financial communication calendar

|

February 6th, 2025 Fourth quarter and full year 2024

results

April 30th, 2025 First quarter 2025 results

May 20th, 2025 2024 Combined General Meeting |

The Alternative Performance Measures, notably the notions

of net banking income for the pillars, operating expenses, cost of

risk in basis points, ROE, ROTE, RONE, net assets and tangible net

assets are presented in the methodology notes, as are the

principles for the presentation of prudential ratios.

This document contains forward-looking statements relating to the

targets and strategies of the Societe Generale Group.

These forward-looking statements are based on a series of

assumptions, both general and specific, in particular the

application of accounting principles and methods in accordance with

IFRS (International Financial Reporting Standards) as adopted in

the European Union, as well as the application of existing

prudential regulations.

These forward-looking statements have also been developed from

scenarios based on a number of economic assumptions in the context

of a given competitive and regulatory environment. The Group may be

unable to:

- anticipate all the risks, uncertainties or other factors likely

to affect its business and to appraise their potential

consequences;

- evaluate the extent to which the occurrence of a risk or a

combination of risks could cause actual results to differ

materially from those provided in this document and the related

presentation.

Therefore, although Societe Generale believes that these statements

are based on reasonable assumptions, these forward-looking

statements are subject to numerous risks and uncertainties,

including matters not yet known to it or its management or not

currently considered material, and there can be no assurance that

anticipated events will occur or that the objectives set out will

actually be achieved. Important factors that could cause actual

results to differ materially from the results anticipated in the

forward-looking statements include, among others, overall trends in

general economic activity and in Societe Generale’s markets in

particular, regulatory and prudential changes, and the success of

Societe Generale’s strategic, operating and financial

initiatives.

More detailed information on the potential risks that could affect

Societe Generale’s financial results can be found in the section

“Risk Factors” in our Universal Registration Document filed with

the French Autorité des Marchés Financiers (which is available on

https://investors.societegenerale.com/en).

Investors are advised to take into account factors of uncertainty

and risk likely to impact the operations of the Group when

considering the information contained in such forward-looking

statements. Other than as required by applicable law, Societe

Generale does not undertake any obligation to update or revise any

forward-looking information or statements. Unless otherwise

specified, the sources for the business rankings and market

positions are internal. |

9. APPENDIX 1: FINANCIAL

DATA

GROUP NET INCOME BY CORE

BUSINESS

|

In EURm |

Q3 24 |

Q3 23 |

Variation |

9M 24 |

9M 23 |

Variation |

|

French Retail, Private Banking and Insurance |

368 |

109 |

x 3.4 |

631 |

506 |

+24.8% |

|

Global Banking and Investor Solutions |

699 |

645 |

+8.2% |

2,160 |

1,814 |

+19.1% |

|

Mobility, International Retail Banking & Financial

Services |

367 |

377 |

-2.4% |

956 |

1,325 |

-27.8% |

|

Core Businesses |

1,434 |

1,131 |

+26.7% |

3,747 |

3,644 |

+2.8% |

|

Corporate Centre |

(67) |

(836) |

+92.0% |

(587) |

(1,582) |

+62.9% |

|

Group |

1,367 |

295 |

x 4.6 |

3,160 |

2,062 |

+53.2% |

MAIN EXCEPTIONAL

ITEMS

|

In EURm |

Q3 24 |

Q3 23 |

9M 24 |

9M 23 |

|

Net Banking Income - Total exceptional items |

287 |

0 |

287 |

(240) |

|

One-off legacy items - Corporate Centre |

0 |

0 |

0 |

(240) |

|

Exceptional proceeds received - Corporate Centre |

287 |

0 |

287 |

0 |

|

|

|

|

|

|

|

Operating expenses - Total one-off items and transformation

charges |

(62) |

(145) |

(538) |

(662) |

|

Transformation charges |

(62) |

(145) |

(538) |

(627) |

|

Of which French Retail, Private Banking and Insurance |

(12) |

(46) |

(139) |

(330) |

|

Of which Global Banking & Investor Solutions |

(21) |

(41) |

(204) |

(102) |

|

Of which Mobility, International Retail Banking & Financial

Services |

(29) |

(58) |

(148) |

(195) |

|

Of which Corporate Centre |

0 |

0 |

(47) |

0 |

|

One-off items |

0 |

0 |

0 |

(35) |

|

Of which French Retail, Private Banking and Insurance |

0 |

0 |

0 |

60 |

|

Of which Global Banking & Investor Solutions |

0 |

0 |

0 |

(95) |

|

|

|

|

|

|

|

Other one-off items - Total |

13 |

(625) |

13 |

(704) |

|

Net profits or losses from other assets |

13 |

(17) |

13 |

(96) |

|

Of which Mobility, International Retail Banking and Financial

Services |

86 |

0 |

86 |

0 |

|

Of which Corporate Centre |

(73) |

(17) |

(73) |

(96) |

|

Goodwill impairment - Corporate Centre |

0 |

(338) |

0 |

(338) |

|

Provision of Deferred Tax Assets - Corporate Centre |

0 |

(270) |

0 |

(270) |

CONSOLIDATED BALANCE

SHEET

|

In EUR m |

|

30.09.2024 |

31.12.2023 |

|

Cash, due from central banks |

|

199,140 |

223,048 |

|

Financial assets at fair value through profit or loss |

|

528,259 |

495,882 |

|

Hedging derivatives |

|

8,265 |

10,585 |

|

Financial assets at fair value through other comprehensive

income |

|

93,795 |

90,894 |

|

Securities at amortised cost |

|

29,908 |

28,147 |

|

Due from banks at amortised cost |

|

87,153 |

77,879 |

|

Customer loans at amortised cost |

|

446,576 |

485,449 |

|

Revaluation differences on portfolios hedged against interest rate

risk |

|

(330) |

(433) |

|

Insurance and reinsurance contracts assets |

|

438 |

459 |

|

Tax assets |

|

4,535 |

4,717 |

|

Other assets |

|

75,523 |

69,765 |

|

Non-current assets held for sale |

|

39,940 |

1,763 |

|

Investments accounted for using the equity method |

|

384 |

227 |

|

Tangible and intangible fixed assets |

|

60,970 |

60,714 |

|

Goodwill |

|

5,031 |

4,949 |

|

Total |

|

1,579,587 |

1,554,045 |

|

In EUR m |

|

30.09.2024 |

31.12.2023 |

|

Due to central banks |

|

10,134 |

9,718 |

|

Financial liabilities at fair value through profit or loss |

|

391,788 |

375,584 |

|

Hedging derivatives |

|

14,621 |

18,708 |

|

Debt securities issued |

|

162,997 |

160,506 |

|

Due to banks |

|

105,320 |

117,847 |

|

Customer deposits |

|

526,100 |

541,677 |

Revaluation differences on portfolios hedged

against interest rate risk |

|

(5,074) |

(5,857) |

|

Tax liabilities |

|

2,516 |

2,402 |

|

Other liabilities |

|

93,909 |

93,658 |

|

Non-current liabilities held for sale |

|

29,802 |

1,703 |

|

Insurance contracts related liabilities |

|

150,295 |

141,723 |

|

Provisions |

|

3,954 |

4,235 |

|

Subordinated debts |

|

15,985 |

15,894 |

|

Total liabilities |

|

1,502,347 |

1,477,798 |

|

Shareholder's equity |

|

- |

- |

|

Shareholders' equity, Group share |

|

- |

- |

|

Issued common stocks and capital reserves |

|

21,166 |

21,186 |

|

Other equity instruments |

|

8,918 |

8,924 |

|

Retained earnings |

|

34,074 |

32,891 |

|

Net income |

|

3,160 |

2,493 |

|

Sub-total |

|

67,318 |

65,494 |

|

Unrealised or deferred capital gains and losses |

|

128 |

481 |

|

Sub-total equity, Group share |

|

67,446 |

65,975 |

|

Non-controlling interests |

|

9,794 |

10,272 |

|

Total equity |

|

77,240 |

76,247 |

|

Total |

|

1,579,587 |

1,554,045 |

10. APPENDIX 2:

METHODOLOGY

1 –The financial information presented

for the third quarter and nine-month 2024 was examined by the Board

of Directors on October

30th, 2024

and has been prepared in accordance with IFRS as adopted in the

European Union and applicable at that date. This information has

not been audited.

2 - Net banking income

The pillars’ net banking income is defined on

page 42 of Societe Generale’s 2024 Universal Registration Document.

The terms “Revenues” or “Net Banking Income” are used

interchangeably. They provide a normalised measure of each pillar’s

net banking income taking into account the normative capital

mobilised for its activity.

3 - Operating expenses

Operating expenses correspond to the “Operating

Expenses” as presented in note 5 to the Group’s consolidated

financial statements as at December 31st, 2023. The term

“costs” is also used to refer to Operating Expenses. The

Cost/Income Ratio is defined on page 42 of Societe Generale’s 2024

Universal Registration Document.

4 - Cost of risk in basis points,

coverage ratio for doubtful outstandings

The cost of risk is defined on pages 43 and 770

of Societe Generale’s 2024 Universal Registration Document. This

indicator makes it possible to assess the level of risk of each of

the pillars as a percentage of balance sheet loan commitments,

including operating leases.

|

In EURm |

|

Q3 24 |

Q3 23 |

9M 24 |

9M 23 |

French Retail, Private Banking and Insurance

|

Net Cost Of Risk |

178 |

144 |

597 |

342 |

|

Gross loan Outstandings |

234,420 |

243,740 |

236,286 |

248,757 |

|

Cost of Risk in bp |

30 |

24 |

34 |

18 |

Global Banking and Investor Solutions

|

Net Cost Of Risk |

27 |

14 |

29 |

(8) |

|

Gross loan Outstandings |

163,160 |

167,057 |

163,482 |

170,165 |

|

Cost of Risk in bp |

7 |

3 |

2 |

(1) |

Mobility, International Retail Banking & Financial

Services

|

Net Cost Of Risk |

201 |

175 |

572 |

349 |

|

Gross loan Outstandings |

168,182 |

162,873 |

167,680 |

145,227 |

|

Cost of Risk in bp |

48 |

43 |

45 |

32 |

Corporate Centre

|

Net Cost Of Risk |

(1) |

(17) |

(6) |

(19) |

|

Gross loan Outstandings |

25,121 |

22,681 |

24,356 |

19,364 |

|

Cost of Risk in bp |

(1) |

(31) |

(3) |

(13) |

Societe Generale Group

|

Net Cost Of Risk |

406 |

316 |

1,192 |

664 |

|

Gross loan Outstandings |

590,882 |

596,350 |

591,804 |

583,512 |

|

Cost of Risk in bp |

27 |

21 |

27 |

15 |

The gross coverage ratio for doubtful

outstandings is calculated as the ratio of provisions

recognised in respect of the credit risk to gross outstandings

identified as in default within the meaning of the regulations,

without taking account of any guarantees provided. This coverage

ratio measures the maximum residual risk associated with

outstandings in default (“doubtful”).

5 - ROE, ROTE, RONE

The notions of ROE (Return on Equity) and ROTE

(Return on Tangible Equity), as well as their calculation

methodology, are specified on pages 43 and 44 of Societe Generale’s

2024 Universal Registration Document. This measure makes it

possible to assess Societe Generale’s return on equity and return

on tangible equity.

RONE (Return on Normative Equity) determines the return on average

normative equity allocated to the Group’s businesses, according to

the principles presented on page 44 of Societe Generale’s 2024

Universal Registration Document.

Group net income used for the ratio numerator is the accounting

Group net income adjusted for “Interest paid and payable to holders

if deeply subordinated notes and undated subordinated notes, issue

premium amortisation”. For ROTE, income is also restated for

goodwill impairment.

Details of the corrections made to the accounting equity in order

to calculate ROE and ROTE for the period are given in the table

below:

ROTE calculation: calculation

methodology

|

End of period (in EURm) |

Q3 24 |

Q3 23 |

9M 24 |

9M 23 |

|

Shareholders' equity Group share |

67,446 |

68,077 |

67,446 |

68,077 |

|

Deeply subordinated and undated subordinated notes |

(8,955) |

(11,054) |

(8,955) |

(11,054) |

|

Interest payable to holders of deeply & undated subordinated

notes, issue premium amortisation(1) |

(45) |

(102) |

(45) |

(102) |

|

OCI excluding conversion reserves |

560 |

853 |

560 |

853 |

|

Distribution provision(2) |

(1,319) |

(1,059) |

(1,319) |

(1,059) |

|

Distribution N-1 to be paid |

- |

- |

- |

- |

|

ROE equity end-of-period |

57,687 |

56,715 |

57,687 |

56,715 |

|

Average ROE equity |

57,368 |

56,572 |

56,896 |

56,326 |

|

Average Goodwill(3) |

(4,160) |

(4,279) |

(4,079) |

(3,991) |

|

Average Intangible Assets |

(2,906) |

(3,390) |

(2,933) |

(3,128) |

|

Average ROTE equity |

50,302 |

48,903 |

49,884 |

49,207 |

|

|

|

|

|

|

|

Group net Income |

1,367 |

295 |

3,160 |

2,063 |

|

Interest paid and payable to holders of deeply subordinated notes

and undated subordinated notes, issue premium amortisation |

(165) |

(165) |

(521) |

(544) |

|

Cancellation of goodwill impairment |

- |

338 |

- |

338 |

|

Adjusted Group net Income |

1,202 |

468 |

2,639 |

1,858 |

|

ROTE |

9.6% |

3.8% |

7.1% |

5.0% |

151617

RONE calculation: Average capital

allocated to Core Businesses (in EURm)

|

In EURm |

Q3 24 |

Q3 23 |

Change |

9M 24 |

9M 23 |

Change |

|

French Retail , Private Banking and Insurance |

15,695 |

15,564 |

+0.8% |

15,602 |

15,457 |

+0.9% |

|

Global Banking and Investor Solutions |

15,490 |

15,324 |

+1.1% |

15,149 |

15,485 |

-2.2% |

|

Mobility, International Retail Banking & Financial

Services |

10,433 |

10,136 |

+2.9% |

10,425 |

9,505 |

+9.7% |

|

Core Businesses |

41,618 |

41,024 |

+1.4% |

41,177 |

40,448 |

+1.8% |

|

Corporate Center |

15,750 |

15,548 |

+1.3% |

15,719 |

15,878 |

-1.0% |

|

Group |

57,368 |

56,572 |

+1.4% |

56,896 |

56,326 |

+1.0% |

6 - Net assets and tangible net

assets

Net assets and tangible net assets are defined

in the methodology, page 45 of the Group’s 2024 Universal

Registration Document. The items used to calculate them are

presented below:

1819

|

End of period (in EURm) |

9M 24 |

H1 24 |

2023 |

|

Shareholders' equity Group share |

67,446 |

66,829 |

65,975 |

|

Deeply subordinated and undated subordinated notes |

(8,955) |

(9,747) |

(9,095) |

|

Interest of deeply & undated subordinated notes, issue premium

amortisation(1) |

(45) |

(19) |

(21) |

|

Book value of own shares in trading portfolio |

97 |

96 |

36 |

|

Net Asset Value |

58,543 |

57,159 |

56,895 |

|

Goodwill(2) |

(4,178) |

(4,143) |

(4,008) |

|

Intangible Assets |

(2,895) |

(2,917) |

(2,954) |

|

Net Tangible Asset Value |

51,471 |

50,099 |

49,933 |

|

|

|

|

|

|

Number of shares used to calculate

NAPS(3) |

796,498 |

787,442 |

796,244 |

|

Net Asset Value per Share |

73.5 |

72.6 |

71.5 |

|

Net Tangible Asset Value per Share |

64.6 |

63.6 |

62.7 |

7 - Calculation of Earnings Per Share

(EPS)

The EPS published by Societe Generale is

calculated according to the rules defined by the IAS 33 standard

(see page 44 of Societe Generale’s 2024 Universal Registration

Document). The corrections made to Group net income in order to

calculate EPS correspond to the restatements carried out for the

calculation of ROE and ROTE.

The calculation of Earnings Per Share is described in the following

table:

|

Average number of shares (thousands) |

9M 24 |

H1 24 |

2023 |

|

Existing shares |

802,314 |

802,980 |

818,008 |

|

Deductions |

|

|

|

|

Shares allocated to cover stock option plans and free shares

awarded to staff |

4,548 |

4,791 |

6,802 |

|

Other own shares and treasury shares |

2,930 |

3,907 |

11,891 |

|

Number of shares used to calculate

EPS(4) |

794,836 |

794,282 |

799,315 |

|

Group net Income (in EUR m) |

3,160 |

1,793 |

2,493 |

|

Interest on deeply subordinated notes and undated subordinated

notes (in EUR m) |

(521) |

(356) |

(759) |

|

Adjusted Group net income (in EUR m) |

2,638 |

1,437 |

1,735 |

|

EPS (in EUR) |

3.32 |

1.81 |

2.17 |

20

8 - The Societe Generale Group’s Common Equity Tier 1

capital is calculated in accordance with applicable

CRR2/CRD5 rules. The fully loaded solvency ratios are presented pro

forma for current earnings, net of dividends, for the current

financial year, unless specified otherwise. When there is reference

to phased-in ratios, these do not include the earnings for the

current financial year, unless specified otherwise. The leverage

ratio is also calculated according to applicable CRR2/CRD5 rules

including the phased-in following the same rationale as solvency

ratios.

9 – Funded balance sheet, loan to

deposit ratio

The funded balance sheet is

based on the Group financial statements. It is obtained in two

steps:

- A first step aiming at reclassifying

the items of the financial statements into aggregates allowing for

a more economic reading of the balance sheet. Main

reclassifications:

Insurance: grouping of the accounting items

related to insurance within a single aggregate in both assets and

liabilities.

Customer loans: include outstanding loans with customers (net of

provisions and write-downs, including net lease financing

outstanding and transactions at fair value through profit and

loss); excludes financial assets reclassified under loans and

receivables in accordance with the conditions stipulated by IFRS 9

(these positions have been reclassified in their original

lines).

Wholesale funding: Includes interbank liabilities and debt

securities issued. Financing transactions have been allocated to

medium/long-term resources and short-term resources based on the

maturity of outstanding, more or less than one year.

Reclassification under customer deposits of the share of issues

placed by French Retail Banking networks (recorded in

medium/long-term financing), and certain transactions carried out

with counterparties equivalent to customer deposits (previously

included in short term financing).

Deduction from customer deposits and reintegration into short-term

financing of certain transactions equivalent to market

resources.

- A second step aiming at excluding

the contribution of insurance subsidiaries, and netting

derivatives, repurchase agreements, securities borrowing/lending,

accruals and “due to central banks”.

The Group loan/deposit ratio is

determined as the division of the customer loans by customer

deposits as presented in the funded balance sheet.

NB (1) The sum of values contained in the tables

and analyses may differ slightly from the total reported due to

rounding rules.

(2) All the information on the results for the period (notably:

press release, downloadable data, presentation slides and

supplement) is available on Societe Generale’s website

www.societegenerale.com in the “Investor” section.

Societe Generale

Societe Generale is a top tier European Bank with

more than 126,000 employees serving about 25 million clients in 65

countries across the world. We have been supporting the development

of our economies for nearly 160 years, providing our corporate,

institutional, and individual clients with a wide array of

value-added advisory and financial solutions. Our long-lasting and

trusted relationships with the clients, our cutting-edge expertise,

our unique innovation, our ESG capabilities and leading franchises

are part of our DNA and serve our most essential objective - to

deliver sustainable value creation for all our stakeholders.

The Group runs three complementary sets of businesses, embedding

ESG offerings for all its clients:

- French Retail,

Private Banking and Insurance, with leading retail bank SG

and insurance franchise, premium private banking services, and the

leading digital bank BoursoBank.

- Global Banking

and Investor Solutions, a top tier wholesale bank offering

tailored-made solutions with distinctive global leadership in

equity derivatives, structured finance and ESG.

- Mobility,

International Retail Banking and Financial Services,

comprising well-established universal banks (in Czech Republic,

Romania and several African countries), Ayvens (the new ALD I

LeasePlan brand), a global player in sustainable mobility, as well

as specialized financing activities.

Committed to building together with its clients a

better and sustainable future, Societe Generale aims to be a

leading partner in the environmental transition and sustainability

overall. The Group is included in the principal socially

responsible investment indices: DJSI (Europe), FTSE4Good (Global

and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity

and Inclusion Index, Euronext Vigeo (Europe and Eurozone), STOXX

Global ESG Leaders indexes, and the MSCI Low Carbon Leaders Index

(World and Europe).

For more information, you can follow us on

Twitter/X @societegenerale or visit our website

societegenerale.com. or visit our website societegenerale.com.

Asterisks* in the document refer to data at

constant perimeter and exchange rates

1 +5.8% excluding exceptional proceeds recorded in Corporate Centre

(~EUR 0.3bn)

2 Including IFRS 9 phasing, proforma including Q3 24 results

3 Based on a pay-out ratio of 50% of the Group net income, at the

high-end of the 40%-50% pay-out ratio, as per regulation, restated

from non-cash items and after deduction of interest on deeply

subordinated notes and undated subordinated notes

4 As stated in Q2 24 results press release

5 Ratio calculated according to European Banking Authority (EBA)

methodology published on 16 July 2019

6 Ratio excluding loans outstanding of companies

currently being disposed of in compliance with IFRS 5

7 Ratio of S3 provisions, guarantees and collaterals

over gross outstanding non-performing loans

8 Target: -80% upstream exposure reduction by 2030 vs. 2019, with

an intermediary step in 2025 at -50% vs. 2019

9 Only the Societe Generale participation is taken into account

10 Including IFRS 9 phasing, proforma including Q3 24 results

11 France and International, including Switzerland and United

Kingdom

1 Including entities reported under IFRS 5

1 Excluding non-recurring items on either margins or UCS (mainly

linked to fleet revaluation at EUR 114m in Q3 23 vs EUR 0m in Q3

24, the net impact related to prospective depreciation and Purchase

Price Allocation for ~EUR 35m vs. Q3 23, hyperinflation in Turkey

at EUR 46m in Q3 23 vs. EUR 10m in Q3 24 and MtM of derivatives at

EUR -82m in Q3 23 vs. EUR -55m in Q3 24)

14 As stated in Q2 24 results press release

15 Interest net of tax

16 The dividend to be paid is calculated based on a pay-out ratio

of 50%, restated from non-cash items and after deduction of

interest on deeply subordinated notes and on undated subordinated

notes

17 Excluding goodwill arising from non-controlling interests

18 Interest net of tax

19 Excluding goodwill arising from non-controlling interests

20 The number of shares considered is the number of ordinary shares

outstanding at end of period, excluding treasury shares and

buybacks, but including the trading shares held by the Group

(expressed in thousand of shares)

4 The number of shares considered is the average number of ordinary

shares outstanding during the period, excluding treasury shares and

buybacks, but including the trading shares held by the Group.

-

Societe-Generale-Q3-2024-Financial-Results-Press-release-en

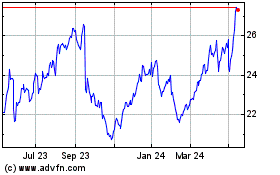

Societe Generale (EU:GLE)

Historical Stock Chart

From Nov 2024 to Dec 2024

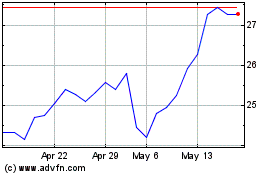

Societe Generale (EU:GLE)

Historical Stock Chart

From Dec 2023 to Dec 2024