Press release: Sanofi successfully prices EUR 1.5 billion of bond issue

March 05 2025 - 11:10AM

UK Regulatory

Press release: Sanofi successfully prices EUR 1.5 billion of bond

issue

Sanofi successfully prices EUR 1.5 billion of

bond issue

Paris, March 5, 2025. Sanofi

announces that it has successfully priced its offering of EUR 1.5

billion of notes across 2 tranches:

- €850 million

floating rate notes, due March 2027, bearing interest at 3-month

Euribor plus 0.300%

- €650 million fixed

rate notes, due March 2031, bearing interest at an annual rate of

2.750%.

The notes are being issued off the company's

Euro Medium Term Note Program.

Sanofi intends to use the net proceeds of the

offering for general corporate purposes.

The transaction has been led by Deutsche Bank

and J.P. Morgan as Global Coordinators, and ING, Santander CIB and

Unicredit, all as Joint Lead Managers.

Disclaimer

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. This is neither an advertisement and not a prospectus

for the purposes of Regulation (EU) 2017/1129 of June 14, 2017 (as

amended, the “Prospectus Regulation”), nor a prospectus within the

meaning of Regulation (EU) 2017/1129 as it forms part of domestic

law by virtue of the European Union (Withdrawal) Act 2018 (the “UK

Prospectus Regulation”), and has not been approved, filed or

reviewed by any regulatory authority of the EEA or the United

Kingdom.

The Notes have not been and will not be

registered under the Securities Act and may not be offered or sold

within the United States or to, or for the account or benefit of,

U.S. persons except in certain transactions exempt from the

registration requirements of the Securities Act.

PROHIBITION OF SALES TO EUROPEAN ECONOMIC AREA

("EEA") AND UNITED KINGDOM ("UK") RETAIL INVESTORS – The Notes

are not intended to be offered, sold or otherwise made available to

and should not be offered, sold or otherwise made available to any

retail investor in the EEA and in the UK. For these purposes, a

retail investor means a person who is one (or more) of: (i) a

retail client as defined in point (11) of Article 4(1) of Directive

2014/65/EU ("MiFID II") or in point (8) of Article 2 of Regulation

(EU) No 2017/565 as it forms part of UK domestic law by virtue of

the European Union (Withdrawal) Act 2018 (the "EUWA"); or (ii) a

customer within the meaning of Directive (EU) 2016/97 (as amended

or superseded the "Insurance Mediation Directive") or within the

meaning of the provisions of the Financial Services and Markets Act

2000, as amended (the "FSMA") and any rules or regulations made

under the FSMA which were relied on immediately before exit day to

implement the Insurance Distribution Directive, where that customer

would not qualify as a professional client as defined in point (10)

of Article 4(1) of MiFID II or in point (8) of Article 2(1) of

Regulation (EU) No 600/2014 as it forms part of UK domestic law by

virtue of the EUWA. Consequently no key information document

required by Regulation (EU) No 1286/2014 (as amended, the "PRIIPs

Regulation", including as it forms part of domestic law by virtue

of the EUWA) for offering or selling the Notes or otherwise making

them available to retail investors (as defined above) in the EEA or

in the UK has been or will be prepared and therefore offering or

selling the Notes or otherwise making them available to any such

retail investor in the EEA or in the UK may be unlawful under the

PRIIPS Regulation.

This communication is only being distributed to

and is only directed at (i) persons who are outside the United

Kingdom or (ii) persons in the United Kingdom who have professional

experience in matters related to investments and who are investment

professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

"Order") or (iii) high net worth companies, and

other persons to whom it may lawfully be communicated, falling

within Article 49(2)(a) to (d) of the Order or (iv) persons to whom

an invitation or inducement to engage in investment activity

(within the meaning of section 21 of the Financial Services and

Markets Act 2000) may otherwise lawfully be communicated or cause

to be communicated (all such persons together being referred to as

“relevant persons”). The Notes are only available

to, and any invitation, offer or agreement to subscribe, purchase

or otherwise acquire such Notes will be engaged in only with,

relevant persons. Any person who is not a relevant person should

not act or rely on this document or any of its contents.

Notes have only been offered or sold and will only

be offered or sold, directly or indirectly, in France to qualified

investors (investisseurs qualifiés) as referred to in Article

L.411-2 1° of the French Code monétaire et financier and defined in

Article 2(e) of the Prospectus Regulation, and the Base Prospectus,

any Final Terms or any other offering material relating to the

Notes have only been distributed or caused to be distributed and

will only be distributed or caused to be distributed in France to

such qualified investors.

About Sanofi

We are an innovative global healthcare company, driven by one

purpose: we chase the miracles of science to improve people’s

lives. Our team, across the world, is dedicated to transforming the

practice of medicine by working to turn the impossible into the

possible. We provide potentially life-changing treatment options

and life-saving vaccine protection to millions of people globally,

while putting sustainability and social responsibility at the

center of our ambitions. Sanofi is listed on EURONEXT: SAN and

NASDAQ: SNY

Media Relations

Sandrine Guendoul | + 33 6 25 09 14 25

| sandrine.guendoul@sanofi.com

Evan Berland | +1 215 432 0234 |

evan.berland@sanofi.com

Nicolas Obrist | + 33 6 77 21 27 55 |

nicolas.obrist@sanofi.com

Léo Le Bourhis | + 33 6 75 06 43 81 |

leo.lebourhis@sanofi.com

Victor Rouault | + 33 6 70 93 71 40

| victor.rouault@sanofi.com

Timothy Gilbert | + 1 516 521 2929 |

timothy.gilbert@sanofi.com

Investor Relations

Thomas Kudsk Larsen |+ 44 7545 513 693 |

thomas.larsen@sanofi.com

Alizé Kaisserian | + 33 6 47 04 12 11 |

alize.kaisserian@sanofi.com

Felix Lauscher | + 1 908 612

7239 | felix.lauscher@sanofi.com

Keita Browne | + 1 781 249 1766 |

keita.browne@sanofi.com

Nathalie Pham | + 33 7 85 93 30 17 |

nathalie.pham@sanofi.com

Tarik Elgoutni | + 1 617 710 3587 |

tarik.elgoutni@sanofi.com

Thibaud Châtelet | + 33 6 80 80 89 90 |

thibaud.chatelet@sanofi.com

Yun Li |+ 33 6 84 00 90 72 |

yun.li3@sanofi.com

Sanofi Forward-Looking

Statements

Any statements made in this communication that are not statements

of historical fact, including statements about Sanofi’s beliefs and

expectations are forward-looking statements and should be evaluated

as such. Forward-looking statements include statements that may

relate to Sanofi‘s plans, objectives, strategies, goals, future

events, future revenues or performance, and other information that

is not historical information. Sanofi does not undertake, and

specifically disclaims, any obligation or responsibility to update

or amend any of the information above except as otherwise required

by law.

Additional Information

This communication is neither an offer to purchase nor a

solicitation of any offer to sell any securities, nor shall there

be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

- 2025_03_05_GPR_ Bond issue_ENG

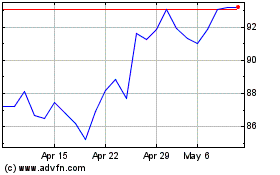

Sanofi (EU:SAN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sanofi (EU:SAN)

Historical Stock Chart

From Mar 2024 to Mar 2025