Commodity Currency's Slide On Concerns Over U.S. Tariffs, Global Trade War

March 10 2025 - 11:25PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Tuesday, amid increasing worries the U.S. is

headed for a recession and concerns over the health of the world

economy following the likely impact of President Donald Trump's

tariffs and trade policies.

Trump declined to rule out the possibility of a recession

following his tariff actions on Mexico, Canada and China. He warned

of imposing sweeping banking sanctions and tariffs in Russia until

there is a ceasefire and peace agreement.

Additionally, the United States raised its tariffs on Chinese

imports from 10% to 20% last week, prompting China to impose

retaliation tariffs of up to 15% on some US agricultural exports on

Monday, also led to the downturn of the investor sentiment.

Moreover, the commodity-linked currencies like the AUD, NZD and

CAD comes under pressure from deepening deflationary concerns in

China.

Crude oil prices fell to six-month lows as worries about global

economic growth and fears of a U.S. recession fueled demand

concerns. West Texas Intermediate Crude oil futures settled lower

by $1.01 or 1.5 percent at $66.03 a barrel, the lowest settlement

since September 10, 2024.

Traders look ahead to the release of some key U.S. economic data

in the coming days. Reports on consumer and producer price

inflation are likely to be in focus along with readings on consumer

sentiment and inflation expectations.

In economic news, Australia's Westpac-Melbourne Institute

Consumer Sentiment Index rose 4 percent in March, reaching 95.9

from 92.2 in February. It is the highest level in three years.

Australia's NAB business confidence index tumbled to negative 1

in February 2025 from an upwardly revised 5 in the prior month,

marking the first negative reading of the year.

In the Asian trading today, the Australian dollar fell to nearly

a 5-year low of 1.7329 against the euro and more than a 7-month low

of 91.83 against the yen, from yesterday's closing quotes of 1.7261

and 92.37, respectively. If the aussie extends its downtrend, it is

likely to find support around 1.75 against the euro and 89.00

against the yen.

Against the U.S. and the Canadian dollars, the aussie dropped to

a 6-day low of 0.6259 and a 4-day low of 0.9041 from Monday's

closing quotes of 0.6280 and 0.9060, respectively. The aussie may

test support near 0.60 against the greenback and 0.88 against the

loonie.

The New Zealand dollar slipped to a 5-year low of 1.9121 against

the euro, a 6-day low of 0.5678 against the U.S. dollar and a

1-week low of 83.31 against the yen, from yesterday's closing

quotes of 1.9034, 0.5695 and 83.76, respectively. If the kiwi

extends its downtrend, it is likely to find support around 1.93

against the euro, 0.55 against the greenback and 82.00 against the

yen.

The kiwi edged down to 1.1037 against the Australian dollar,

from Monday's closing value of 1.1027. The kiwi is likely to find

support around the 1.12 region.

The Canadian dollar fell to more than a 4-year low of 1.5694

against the euro and nearly a 2-year low of 101.50 against the yen,

from yesterday's closing quotes of 1.5638 and 101.95, respectively.

The may test support near 1.58 against the euro and 100.00 against

the yen.

The loonie edged down to 1.4448 against the U.S. dollar, from

Monday's closing value of 1.4427. On the downside, 1.46 is seen as

the next support level for the loonie.

Looking ahead, U.S. NFIB small business optimism for February,

U.S. Redbook report and U.S. WASDE report are due to be released in

the New York session.

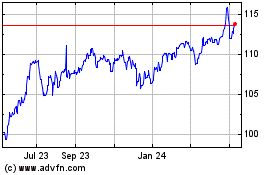

CAD vs Yen (FX:CADJPY)

Forex Chart

From Feb 2025 to Mar 2025

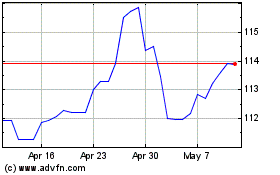

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Mar 2025