Acumen Pharmaceuticals, Inc. (NASDAQ: ABOS) (“Acumen” or the

“Company”), a clinical-stage biopharmaceutical company developing a

novel therapeutic that targets toxic soluble amyloid beta oligomers

(AβOs) for the treatment of Alzheimer’s disease (AD), today

reported financial results for the full year ended December 31,

2023 and provided a business update.

“2023 was a landmark year for Acumen. We delivered the first

Phase 1 results from an oligomer-targeted antibody for the

treatment of early Alzheimer’s disease, which exceeded

expectations. Beyond favorable safety results, our study confirmed

near-maximal target engagement of abeta oligomers, significant

plaque reduction and impressive improvements in fluid biomarkers

for AD that together give us increased confidence that sabirnetug

may offer a best-in-class therapeutic profile for patients,” said

Daniel O’Connell, Chief Executive Officer of Acumen. “We have

entered 2024 from a position of strength. Our team is laser-focused

on advancing the clinical development of sabirnetug and expects to

initiate our Phase 2 study in the first half of this year. We also

expect to initiate a subcutaneous bioavailability study in

mid-2024, to extend the product profile and offer administration

optionality for patients. We look forward to sharing our progress

with you throughout the year.”

Recent Highlights and Anticipated

Milestones

Sabirnetug (ACU193) Clinical Development

- In March 2024, the Company

presented fluid biomarker and target

engagement analyses from Phase 1 INTERCEPT-AD study in

AD at the International Conference on Alzheimer’s and

Parkinson’s diseases (AD/PD).

- Sabirnetug had an observed dose-dependent trend in the multiple

ascending dose cohorts on CSF levels of p-tau181, total tau,

neurogranin and the Aβ42/Aβ40 ratio, consistent with the downstream

pharmacologic effects of the drug, after just three

administrations. These findings are consistent with sabirnetug’s

proposed mechanism of action and intended target engagement of

AβOs. Additionally, the apparent effect of sabirnetug on downstream

biomarkers such as p-tau181 and neurogranin are consistent with the

hypothesis that oligomers drive the downstream neurodegenerative

process in AD.

- Additionally, Acumen presented a poster detailing its method to

develop the first assay to directly measure target engagement of

AβOs by an immunotherapy (as measured by sabirnetug-AβO complex in

CSF) in the INTERCEPT-AD trial. These data also informed the

development of a pharmacokinetic-pharmacodynamic (PK/PD) model,

which ultimately demonstrated that the highest doses used in

INTERCEPT-AD (60 mg/kg Q4W and 25mg/kg Q2W) approached maximal

target engagement (Emax), as was presented in October 2023.

- The Company expects to

initiate a Phase 2 study, ALTITUDE-AD, in the first half of 2024 to

investigate the clinical efficacy, safety and tolerability of

sabirnetug for the treatment of early Alzheimer’s

disease.

- The Company expects to

initiate a Phase 1 bioavailability study to support a subcutaneous

dosing option of sabirnetug in mid-2024.

Corporate Updates

- In February 2024, the

Company announced the appointment of Dr. James Doherty as President

and Chief Development Officer.

- Dr. Doherty’s responsibilities include oversight of clinical

and nonclinical development, chemistry, manufacturing &

controls and regulatory functions, reporting to Daniel O’Connell,

Chief Executive Officer.

- Dr. Doherty brings decades of neuroscience-focused research and

clinical development expertise to Acumen, from discovery through

drug approval. Prior to joining Acumen, Dr. Doherty served as Chief

Development Officer at Sage Therapeutics, where the team achieved

U.S. Food and Drug Administration approvals of two treatments for

postpartum depression. Previously, he served as Director and Head

of the Neuroscience Department for the Central Nervous System and

Pain Innovative Medicines Unit of AstraZeneca Pharmaceuticals in

Sodertalje, Sweden, where he led the company’s research pipeline

for Alzheimer’s disease and neurodegeneration.

“Underpinning my decision to join Acumen at this transformative

time in the Alzheimer’s field is the intriguing science behind AβO

toxicity paired with Acumen’s impressive Phase 1 data. Not only

does the data confirm sabirnetug’s selectivity for AβOs in

patients, it also highlights that the drug can actively improve

downstream biomarkers associated with AD, moving the amyloid beta

discussion beyond plaque to focus on amyloid species toxic to

synaptic function,” said Dr. Jim Doherty, President and Chief

Development Officer of Acumen. “I am excited to help the team

thoughtfully interrogate the multiple potential paths toward

sabirnetug’s next-generation differentiation – via greater

efficacy, safety or both – that would be beneficial to

patients as compared to existing AD therapeutics.”

2023 Financial Results

- Cash Balance. As of

December 31, 2023, cash, cash equivalents and marketable securities

totaled $306.1 million, compared to cash, cash equivalents and

marketable securities of $193.4 million as of December 31, 2022.

This increase is due to the net proceeds from the Company’s public

offering of approximately $122 million on July 21, 2023, as well as

approximately $30 million from K2 HealthVentures as part of a debt

financing of up to $50 million announced in November 2023.

Altogether, this runway is now expected to be sufficient to support

current clinical and operational activities into the first half of

2027.

- Research and Development (R&D) Expenses.

R&D expenses in 2023 were $42.3 million, compared to $32.4

million in 2022. The increase in R&D expenses was primarily due

to increased costs related to consulting, personnel and other

costs.

- General and Administrative (G&A) Expenses.

G&A expenses in 2023 were $18.8 million, compared to $12.9

million in 2022. The increase in G&A expenses was primarily due

to increased costs related to personnel, consulting and

legal/patent services.

- Loss from Operations. Losses from operations

in 2023 were $61.1 million, compared to $45.2 million in 2022. This

increase was due to the increased R&D and G&A expenses over

the prior year period.

- Net Loss. Net loss for the year ended December

31, 2023 was $52.4 million, compared to a net loss of $42.9 million

for the year ended December 31, 2022.

Conference Call Details

Acumen will host a conference call and live audio webcast today,

March 26, 2024, at 8:00 a.m. ET.

To participate in the live conference call, please register

using this link. After registration, you will be informed of

the dial-in numbers including PIN. Please register at least one day

in advance.

The webcast audio will be available via this link.

An archived version of the webcast will be available for at

least 30 days in the Investors section of the Company's website at

www.acumenpharm.com.

About Sabirnetug (ACU193)

Sabirnetug (ACU193) is a humanized monoclonal antibody (mAb)

discovered and developed based on its selectivity for soluble AβOs,

which are a highly toxic and pathogenic form of Aβ, relative to Aβ

monomers and amyloid plaques. Soluble AβOs have been observed to be

potent neurotoxins that bind to neurons, inhibit synaptic function

and induce neurodegeneration. By selectively targeting toxic

soluble AβOs, sabirnetug aims to directly address a growing body of

evidence indicating that soluble AβOs are a primary underlying

cause of the neurodegenerative process in Alzheimer’s disease.

Sabirnetug has been granted Fast Track designation for the

treatment of early Alzheimer’s disease by the U.S. Food and Drug

Administration.

About INTERCEPT-AD

INTERCEPT-AD was a Phase 1, U.S.-based, multi-center,

randomized, double-blind, placebo-controlled clinical trial

evaluating the safety and tolerability, and establishing clinical

proof of mechanism, of sabirnetug in patients with early

Alzheimer’s disease (AD). Sixty-five individuals with early AD

(mild cognitive impairment or mild dementia due to AD) enrolled in

this first-in-human study of sabirnetug. The INTERCEPT-AD study

consisted of single-ascending-dose (SAD) and

multiple-ascending-dose (MAD) cohorts and was designed to evaluate

the safety, tolerability, pharmacokinetics (PK), and target

engagement of intravenous doses of sabirnetug. More information can

be found on www.clinicaltrials.gov, NCT identifier

NCT04931459.

About Acumen Pharmaceuticals, Inc.

Acumen, headquartered in Charlottesville, VA, with additional

offices in Indianapolis, IN and Newton, MA, is a clinical-stage

biopharmaceutical company developing a novel therapeutic that

targets toxic soluble amyloid beta oligomers (AβOs) for the

treatment of Alzheimer’s disease (AD). Acumen’s scientific founders

pioneered research on AβOs, which a growing body of evidence

indicates are early and persistent triggers of Alzheimer’s disease

pathology. Acumen is currently focused on advancing its

investigational product candidate, sabirnetug (ACU193), a humanized

monoclonal antibody that selectively targets toxic soluble AβOs,

following positive results in INTERCEPT-AD, a Phase 1 clinical

trial involving early Alzheimer’s disease patients. For more

information, visit www.acumenpharm.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of

1995. Any statement describing Acumen’s goals, expectations,

financial or other projections, intentions or beliefs is a

forward-looking statement and should be considered an at-risk

statement. Words such as “believes,” “expects,” “anticipates,”

“could,” “should,” “would,” “seeks,” “aims,” “plans,” “potential,”

“will,” “milestone” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words.

Forward-looking statements include statements concerning Acumen’s

business, and Acumen’s ability to achieve its strategic and

financial goals, including its projected use of cash, cash

equivalents and marketable securities and the expected sufficiency

of its cash resources into the first half of 2027, the therapeutic

potential of Acumen’s product candidate, sabirnetug (ACU193),

including against other antibodies, the anticipated timeline for

initiating a Phase 2 clinical trial of sabirnetug and a Phase 1

trial to support a subcutaneous dosing option of sabirnetug, and

the expected use of proceeds from a credit facility. These

statements are based upon the current beliefs and expectations of

Acumen management, and are subject to certain factors, risks and

uncertainties, particularly those inherent in the process of

discovering, developing and commercializing safe and effective

human therapeutics. Such risks may be amplified by the impacts of

geopolitical events and macroeconomic conditions, such as rising

inflation and interest rates, supply disruptions and uncertainty of

credit and financial markets. These and other risks concerning

Acumen’s programs are described in additional detail in Acumen’s

filings with the Securities and Exchange Commission (“SEC”),

including in Acumen’s most recent Annual Report on Form 10-K, and

in subsequent filings with the SEC. Copies of these and other

documents are available from Acumen. Additional information will be

made available in other filings that Acumen makes from time to time

with the SEC. These forward-looking statements speak only as of the

date hereof, and Acumen expressly disclaims any obligation to

update or revise any forward-looking statement, except as otherwise

required by law, whether, as a result of new information, future

events or otherwise.

CONTACTS:

Investors: Alex Braunabraun@acumenpharm.com

Media: AcumenPR@westwicke.com

| Acumen

Pharmaceuticals, Inc. |

| Balance

Sheets |

| (in

thousands, except share and per share data) |

|

|

|

|

|

| |

December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

ASSETS |

|

|

|

| Current

assets |

|

|

|

|

Cash and cash equivalents |

$ |

66,886 |

|

|

$ |

130,101 |

|

|

Marketable securities, short-term |

|

176,636 |

|

|

|

47,504 |

|

|

Prepaid expenses and other current assets |

|

3,093 |

|

|

|

2,724 |

|

| Total

current assets |

|

246,615 |

|

|

|

180,329 |

|

| Marketable

securities, long-term |

|

62,553 |

|

|

|

15,837 |

|

| Restricted

cash |

|

233 |

|

|

|

- |

|

| Property and

equipment, net |

|

122 |

|

|

|

165 |

|

| Right-of-use

asset |

|

381 |

|

|

|

105 |

|

| Other

assets |

|

221 |

|

|

|

151 |

|

| Total

assets |

$ |

310,125 |

|

|

$ |

196,587 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities |

|

|

|

|

Accounts payable |

$ |

1,379 |

|

|

$ |

1,640 |

|

|

Accrued clinical trial expenses |

|

4,387 |

|

|

|

2,717 |

|

|

Accrued expenses and other current liabilities |

|

6,339 |

|

|

|

3,350 |

|

|

Finance lease liability, short-term |

|

756 |

|

|

|

- |

|

|

Operating lease liability, short-term |

|

110 |

|

|

|

105 |

|

| Total

current liabilities |

|

12,971 |

|

|

|

7,812 |

|

| Operating

lease liability, long-term |

|

284 |

|

|

|

- |

|

| Debt,

long-term |

|

29,897 |

|

|

|

- |

|

| Total

liabilities |

|

43,152 |

|

|

|

7,812 |

|

| Commitments

and contingencies |

|

|

|

|

Stockholders' equity |

|

|

|

|

Preferred stock, $0.0001 par value; 10,000,000 shares authorized

and no shares issued and outstanding as of December 31, 2023 and

2022 |

|

- |

|

|

|

- |

|

|

Common stock, $0.0001 par value; 300,000,000 shares authorized as

of December 31, 2023 and 2022; 57,910,461 and 41,025,062 shares

issued and outstanding as of December 31, 2023 and 2022,

respectively |

|

6 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

489,453 |

|

|

|

359,949 |

|

|

Accumulated deficit |

|

(222,798 |

) |

|

|

(170,427 |

) |

|

Accumulated other comprehensive income (loss) |

|

312 |

|

|

|

(751 |

) |

| Total

stockholders' equity |

|

266,973 |

|

|

|

188,775 |

|

| Total

liabilities and stockholders' equity |

$ |

310,125 |

|

|

$ |

196,587 |

|

| |

|

|

|

| |

|

|

|

| Statements

of Operations and Comprehensive Loss |

| (in

thousands, except share and per share data) |

| |

|

|

|

|

|

| |

|

|

|

| |

Year Ended December 31, |

| |

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

| |

|

|

|

| Operating

expenses |

|

|

|

|

Research and development |

$ |

42,318 |

|

|

$ |

32,361 |

|

|

General and administrative |

|

18,820 |

|

|

|

12,876 |

|

| Total

operating expenses |

|

61,138 |

|

|

|

45,237 |

|

| Loss from

operations |

|

(61,138 |

) |

|

|

(45,237 |

) |

| Other income

(expense) |

|

|

|

|

Interest income |

|

10,791 |

|

|

|

2,392 |

|

|

Change in fair value of embedded derivatives |

|

(1,360 |

) |

|

|

- |

|

|

Interest expense |

|

(581 |

) |

|

|

- |

|

|

Other expense, net |

|

(83 |

) |

|

|

(11 |

) |

| Total other

income |

|

8,767 |

|

|

|

2,381 |

|

| Net

loss |

|

(52,371 |

) |

|

|

(42,856 |

) |

| Other

comprehensive gain (loss) |

|

|

|

|

Unrealized gain (loss) on marketable securities |

|

1,063 |

|

|

|

(520 |

) |

|

Comprehensive loss |

$ |

(51,308 |

) |

|

$ |

(43,376 |

) |

| Net loss per

common share, basic and diluted |

$ |

(1.08 |

) |

|

$ |

(1.06 |

) |

|

Weighted-average shares outstanding, basic and diluted |

|

48,609,383 |

|

|

|

40,601,936 |

|

| |

|

|

|

| |

|

|

|

| Statements

of Cash Flows |

| (in

thousands) |

| |

| |

|

|

|

| |

|

|

|

| |

Year Ended December 31, |

| |

|

2023 |

|

|

|

2022 |

|

| Cash

flows from operating activities |

|

| Net

loss |

$ |

(52,371 |

) |

|

$ |

(42,856 |

) |

| Adjustments

to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation |

|

61 |

|

|

|

32 |

|

|

Stock-based compensation expense |

|

6,145 |

|

|

|

3,061 |

|

|

Amortization of premiums and accretion of discounts on marketable

securities, net |

|

(3,121 |

) |

|

|

487 |

|

|

Change in fair value of embedded derivatives |

|

1,360 |

|

|

|

- |

|

|

Amortization of right-of-use asset |

|

123 |

|

|

|

137 |

|

|

Non-cash research and development expense |

|

739 |

|

|

|

- |

|

|

Realized gain on marketable securities |

|

(11 |

) |

|

|

- |

|

|

Non-cash interest expense |

|

145 |

|

|

|

- |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Prepaid expenses and other current assets |

|

(369 |

) |

|

|

1,700 |

|

|

Other assets |

|

(70 |

) |

|

|

(137 |

) |

|

Accounts payable |

|

(261 |

) |

|

|

552 |

|

|

Accrued clinical trial expenses |

|

1,670 |

|

|

|

2,570 |

|

|

Accrued expenses and other current liabilities |

|

2,989 |

|

|

|

(562 |

) |

|

Finance lease liability |

|

17 |

|

|

|

- |

|

|

Operating lease liability |

|

(110 |

) |

|

|

(137 |

) |

| Net cash

used in operating activities |

|

(43,064 |

) |

|

|

(35,153 |

) |

| Cash

flows from investing activities |

|

|

|

| Purchases of

marketable securities |

|

(250,634 |

) |

|

|

(41,514 |

) |

| Proceeds

from maturities and sales of marketable securities |

|

78,981 |

|

|

|

80,860 |

|

| Proceeds

from sale of property and equipment |

|

3 |

|

|

|

- |

|

| Purchases of

property and equipment |

|

(21 |

) |

|

|

(161 |

) |

| Net cash

provided by (used in) investing activities |

|

(171,671 |

) |

|

|

39,185 |

|

| Cash

flows from financing activities |

|

|

|

| Proceeds

from issuance of common stock, net of issuance costs |

|

121,904 |

|

|

|

3,792 |

|

| Proceeds

from term loan |

|

30,000 |

|

|

|

- |

|

| Payments for

financing costs |

|

(476 |

) |

|

|

- |

|

| Proceeds

from exercise of stock options |

|

325 |

|

|

|

115 |

|

| Net cash

provided by financing activities |

|

151,753 |

|

|

|

3,907 |

|

| Net

change in cash and cash equivalents and restricted cash |

|

(62,982 |

) |

|

|

7,939 |

|

| Cash and

cash equivalents and restricted cash at the beginning of the

period |

|

130,101 |

|

|

|

122,162 |

|

| Cash and

cash equivalents and restricted cash at the end of the period |

$ |

67,119 |

|

|

$ |

130,101 |

|

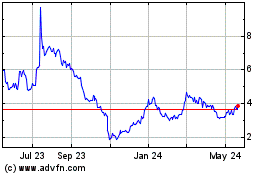

Acumen Pharmaceuticals (NASDAQ:ABOS)

Historical Stock Chart

From Feb 2025 to Mar 2025

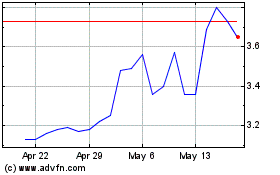

Acumen Pharmaceuticals (NASDAQ:ABOS)

Historical Stock Chart

From Mar 2024 to Mar 2025