false

0001014763

0001014763

2024-08-05

2024-08-05

0001014763

AIMD:CommonStockParValue0.01PerShareMember

2024-08-05

2024-08-05

0001014763

AIMD:WarrantsToPurchaseCommonStockMember

2024-08-05

2024-08-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 5, 2024

| AINOS,

INC. |

| (Exact

name of registrant as specified in its charter) |

| Texas |

|

001-41461 |

|

75-1974352 |

(State

or other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

8880

Rio San Diego Drive, Ste. 800, San Diego, CA 92108

(858)

869-2986 |

| (Address

and telephone number, including area code, of registrant’s principal executive offices) |

(Former

name or former address if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

AIMD |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

AIMDW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition

On

August 5, 2024, Ainos, Inc. (the “Company”) reported its financial results for the second quarter ended June 30, 2024. A

copy of the press release issued by the Company in this connection is furnished herewith as Exhibit 99.1.

The

information in this Item in this Current Report on Form 8-K and Exhibit 99.1 attached hereto are being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended or the Exchange Act, regardless of any general incorporation language in such filing.

Item

9.01 Financial Statement and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Ainos,

Inc. |

| |

|

|

| Date:

August 5, 2024 |

By: |

/s/

Chun-Hsien Tsai |

| |

Name: |

Chun-Hsien Tsai |

| |

Title: |

Chief Executive Officer |

Exhibit

99.1

Ainos

Reports Second Quarter 2024 Financial Results

Enrolling

first subject for FCGS clinical study marks a solid start in shifting animal health emphasis to drug developments

Robust

financial runway for over 12 months following the prepayment of a senior secured convertible note

SAN

DIEGO, CA / ACCESSWIRE /August 5, 2024 / Ainos, Inc. (NASDAQ:AIMD, AIMDW) (“Ainos”, or the “Company”), a diversified

healthcare company focused on novel AI-powered point-of-care testing (“POCT”) and low-dose interferon therapeutics (“VELDONA®”),

today announced its financial results for the second quarter ended June 30, 2024.

Chun-Hsien

(Eddy) Tsai, Chairman of the Board, President, and Chief Executive Officer of Ainos, commented, “We’ve made meaningful progress

in initiating a clinical study for treating feline chronic gingivostomatitis (“FCGS”). This new animal drug potentially expands

VELDONA®’s market. Our core strategy for this oral low-dose interferon alpha (IFNα) formulation remains focused

on fast-tracking VELDONA® commercialization by identifying optimal opportunities and effectively utilizing our resources.”

“Pets

are becoming increasingly important to families. There is a rapidly growing trend of pet owners prioritizing animal health, and we are

capitalizing on this by initially launching VELDONA® Pet supplements in Taiwan at the end of Q3 2023. Pet dogs and cats

now outnumber children under 14 years old in Taiwan, making it an ideal trial market. Although VELDONA® Pet’s sales

have room for growth, we have gained valuable insights into demand: consumers favor health-enhancing food over standalone supplements

in the current inflationary environment, and our Soothing and Alpha products, which address allergies and gum health respectively, have

been particularly well-received among the five VELDONA® Pet products. These insights will shape our development strategy

as drug becomes our emphasis for animal health market. I see significant market opportunity in FCGS, a cat oral disease with 0.7-10%

estimated prevalence rate, where pet parents are facing few treatment options.”

“VELDONA®

has built a solid foundation in animal health since its 1985 approval for feline leukemia and canine parvovirus from the Texas

Department of Health. Across 28 studies for a range of animal diseases, results have shown systemic benefits across a variety of animal

species and a strong safety profile. A 2022 preclinical study sponsored by Ainos and conducted by the Agricultural Technology Research

Institute in Taiwan indicated VELDONA® efficacy in maintaining immune health in cats and dogs. We are excited to have

enrolled our first subject in July 2024 for the Taiwanese clinical study targeting FCGS, aiming for trial completion by Q1 2025.”

“For

other products in the pipeline, our main priorities for AI Nose include progressing our leading volatile organic compounds (“VOC”)

POCT candidate, Ainos Flora, and jointly developing a VOC sensing platform with our Japanese partners. The Next-Gen Ainos Flora will

advance with implementation of NVIDIA CUDA, and the Company is targeting Q3 for design completion and Q4 for clinical trial kickoff.

Concurrently, we are pushing forward with clinical studies and actively seek out-licensing opportunities for VELDONA®

human drug candidates, including the treatment for oral warts in HIV-seropositive patients, which has obtained Orphan Drug Designation

from the U.S. Food and Drug Administration. We are dedicated to executing our diversified strategy to ensuring our extensive product

portfolio brings swift and positive benefits worldwide, while maximizing long-term value for our shareholders.”

Christopher

Lee, Chief Financial Officer of Ainos, commented, “We had some deferred revenues from product sales in the quarter. We have continued

to be capital efficient, as demonstrated by our prudent management of operating expenses, excluding depreciation, amortization, and stock-based

compensation. Our financial position was further enhanced with the successful raising of US$9 million in a convertible note financing

in May 2024 from an existing shareholder. We extend our sincere gratitude for their unwavering support. After prepaying a senior secured

convertible note in August 2024, we believe we maintain a financial runway for more than 12 months. Our strategically careful financial

management and strong investor backing position us well for creating continuous value creation for all stakeholders.”

Second

Quarter 2024 Financial Results

Revenues

Revenues

were nominal in the second quarter of 2024, nil compared to US$28,555 in the same period of 2023. This decline reflects the Company’s

cessation of sales of its COVID-19 antigen rapid test kits after a strategic pivot shift and exchange rate fluctuations.

Cost

of Revenues

Cost

of revenues was US$25,373 in the second quarter of 2024, compared to US$55,817 in the same period of 2023. The decrease was primarily

attributable to the decline in sales volume.

Gross

Profit

In

the second quarter of 2024, gross profit was negative US$25,373, narrowing from negative US$27,262 in the second quarter of 2023, due

to lower sales volumes of the Company’s newly launched products and reduced cost of revenues.

Total

Operating Expenses

Total

operating expenses were US$3,023,636 in the second quarter of 2024, compared to US$2,289,336 in the same period of 2023. The change was

mainly attributable to increased expenses associated with co-research for technology, product and staffing expenditures, and increases

in share-based compensation and professional expenses.

Operating

expenses, excluding depreciation, amortization expenses, and share-based compensation, were US$1,408,190 in the second quarter of 2024,

compared to US$957,882 in the second quarter of 2023.

R&D

expenses increased to US$1,978,756 in the second quarter of 2024 from US$1,671,187 in the same period of 2023. The increase was primarily

due to increased expenses associated with co-research for technology and product, as well as staffing expenditures. Share-based compensation

expenses and depreciation and amortization expenses in the second quarter of 2024 were US$1,276,777, compared with US$1,210,429 in the

second quarter of 2023. Excluding these non-cash expenses, R&D expenses increased to US$ 701,979 from US$460,758 over the same period.

SG&A

expenses increased to US$1,044,880 in the second quarter of 2024 from US$618,149 in the same period of 2023. Share-based compensation

expenses and depreciation and amortization expenses in the second quarters of 2024 and 2023 were US$338,669 and US$121,025, respectively.

Excluding these non-cash expenses, SG&A expenses increased to US$706,211 from US$497,124 over the same period.

Net

Loss

Net

loss attributable to common stock shareholders was US$3,195,022 in the second quarter of 2024, compared to US$2,349,727 in the same period

of 2023.

Balance

Sheet

As

of June 30, 2024, the Company had cash and cash equivalents of US$8,014,098, compared to US$1,885,628 as of December 31, 2023.

Recent

Business Developments

On

July 23, 2024, the Company announced that it has enrolled the first subject for its Taiwanese clinical study of VELDONA®-based

animal drug in treating FCGS. This clinical trial aims to complete the enrollment of 30 subjects by the end-2024 with the trial report

to be finalized in Q1 2025.

On

June 14, 2024, the Company announced critical progress in the clinical trials of its revolutionary “Ainos Flora” VOC POCT

device that is based upon its transformative AI Nose technology. Ainos Flora has been in clinical trials at four major medical centers

in Taiwan, successfully tested 75 clinical cases with meaningful insights. The Next-Gen Ainos Flora will advance with implementation

of NVIDIA CUDA, and the Company is targeting Q3 for design completion and Q4 for clinical trial kickoff.

On

May 15, 2024, the Company announced the initiation of a clinical study for a new potential VELDONA®-based drug treating

pet disease. The study is aimed at evaluating the clinical efficacy of low-dose oral interferons in the treatment of FCGS, a serious

and painful chronic oral disease characterized by inflammation or abnormal proliferation in the oral cavity. The clinical trials are

expected to run for approximately ten months, from May 24, 2024 to March 31, 2025.

About

Ainos, Inc.

Headquartered

in San Diego, California, Ainos is a diversified healthcare company focused on novel AI-powered point-of-care testing (POCT) and VELDONA

low-dose interferon therapeutics. The Company’s clinical-stage product pipeline includes VELDONA human and animal oral therapeutics,

human orphan drugs, and telehealth-friendly POCT solutions powered by its AI Nose technology platform.

The

name “Ainos” is a combination of “AI” and “Nose” to reflect the Company’s commitment to empowering

individuals to manage their health more effectively with next-generation AI-driven POCT solutions. To learn more, visit https://www.ainos.com.

Follow

Ainos on X, formerly known as Twitter, (@AinosInc) and LinkedIn to stay up-to-date.

Safe

Harbor Statements

Certain

statements in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking

statements. Forward-looking statements can be identified by the use of words such as “anticipate,” “believe,”

“estimate,” “approximate,” “expect,” “intend,” “plan,” “predict,”

“project,” “target,” “future,” “likely,” “strategy,” “foresee,”

“may,” “guidance,” “potential,” “outlook,” “forecast,” “should,”

“will” or other similar words or phrases. Similarly, statements that describe the Company’s objectives, plans or goals

are, or may be, forward-looking statements. Forward-looking statements are based only on the Company’s current beliefs, expectations,

and assumptions. Forward-looking statements are subject to inherent uncertainties, risks, and changes in circumstances that are difficult

to predict and many of which are outside of the Company’s control. The Company’s actual results may differ materially from

those indicated in the forward-looking statements.

Important

factors that could cause the Company’s actual results to differ materially from the projections, forecasts, estimates and expectations

discussed in this press release include, among others, the cost of production and sales potential of the products announced in this press

release; the Company’s dependence on projected revenues from the sale of current or future products ; the Company’s limited

cash and history of losses; the Company’s ability to achieve profitability; the Company’s ability to raise additional capital

to continue the Company’s product development; the ability to accurately predict the future operating results of the Company; the

ability to advance Ainos’ current or future product candidates through clinical trials, obtain marketing approval and ultimately

commercialize any product candidates the Company develops; the ability to obtain and maintain regulatory approval of Ainos’ product

candidates; delays in completing the development and commercialization of the Company’s current and future product candidates,

which could result in increased costs to the Company, delay or limit the ability to generate revenue and adversely affect the business,

financial condition, results of operations and prospects of the Company; intense competition and rapidly advancing technology in the

Company’s industry that may outpace its technology; customer demand for the products and services the Company develops; the accuracy

of third-party market research data, the impact of competitive or alternative products, technologies and pricing; disruption in research

and development facilities; lawsuits and other claims by third parties or investigations by various regulatory agencies governing the

Company’s operations; potential cybersecurity attacks; increased requirements and costs related to cybersecurity; the Company’s

ability to realize the benefits of third party licensing agreements; the Company’s ability to obtain and maintain intellectual

property protection for Ainos product candidates; compliance with applicable laws, regulations and tariffs; continued listing on and

compliance with the applicable regulations of the Nasdaq Capital Market; and the Company’s success in managing growth. A more complete

description of these risk factors and others is included in the “Risk Factors” section of Ainos’ Annual Report on Form

10-K for the year ended December 31, 2023, and other public filings with the U.S. Securities and Exchange Commission (“SEC”),

many of which risks are beyond the Company’s control. In addition to the risks described above and in the Company’s filings

with the SEC, other unknown or unpredictable factors also could cause actual results to differ materially from the projections, forecasts,

estimates and expectations discussed in this press release.

The

forward-looking statements made in this press release are expressly qualified in their entirety by the foregoing cautionary statements.

Any forward-looking statements contained in this press release represent Ainos’ views only as of today and should not be relied

upon as representing its views as of any subsequent date. Ainos undertakes no obligation to, and expressly disclaims any such obligation

to, publicly update or revise any forward-looking statement to reflect changed assumptions, the occurrence of anticipated or unanticipated

events or changes to the future results over time or otherwise, except as required by law.

Investor

Relations Contact

Feifei

Shen

Email:

IR@ainos.com

Ainos,

Inc.

Condensed

Balance Sheets

(Unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 8,014,098 | | |

$ | 1,885,628 | |

| Accounts receivable | |

| 9 | | |

| 455 | |

| Inventory, net | |

| 166,322 | | |

| 167,593 | |

| Other current asset | |

| 291,166 | | |

| 419,521 | |

| Total current assets | |

| 8,471,595 | | |

| 2,473,197 | |

| Intangible assets, net | |

| 26,028,058 | | |

| 28,283,208 | |

| Property and equipment, net | |

| 691,100 | | |

| 876,572 | |

| Other assets | |

| 348,634 | | |

| 208,827 | |

| Total assets | |

$ | 35,539,387 | | |

$ | 31,841,804 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Contract liabilities | |

$ | 106,502 | | |

$ | 112,555 | |

| Convertible notes payable | |

| 3,000,000 | | |

| - | |

| Senior secured convertible notes measured at fair value - Current | |

| 1,585,761 | | |

| - | |

| Other notes payable, related party | |

| 312,000 | | |

| 42,000 | |

| Accrued expenses and others current liabilities | |

| 738,936 | | |

| 1,182,283 | |

| Total current liabilities | |

| 5,743,199 | | |

| 1,336,838 | |

| Senior secured convertible notes measured at fair value | |

| - | | |

| 2,651,556 | |

| Convertible notes payable - noncurrent | |

| 9,000,000 | | |

| 3,000,000 | |

| Other notes payable, related party – noncurrent | |

| - | | |

| 270,000 | |

| Other long-term liabilities | |

| 83,912 | | |

| 135,829 | |

| Total liabilities | |

| 14,827,111 | | |

| 7,394,223 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value; 50,000,000 shares authorized; none issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.01 par value; 300,000,000 shares authorized as of June 30, 2024 and December 31, 2023, 7,388,674 and 4,677,787 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 73,887 | | |

| 46,778 | |

| Common stock to be issued, 270 shares and 162,337 shares as of June 30, 2024 and December 31, 2023, respectively | |

| 3 | | |

| 1,623 | |

| Additional paid-in capital | |

| 65,414,761 | | |

| 62,555,808 | |

| Accumulated deficit | |

| (44,395,987 | ) | |

| (37,886,155 | ) |

| Accumulated other comprehensive loss - translation adjustment | |

| (380,388 | ) | |

| (270,473 | ) |

| Total stockholders’ equity | |

| 20,712,276 | | |

| 24,447,581 | |

| Total liabilities and stockholders’ equity | |

$ | 35,539,387 | | |

$ | 31,841,804 | |

Ainos,

Inc.

Condensed

Statements of Operations

(Unaudited)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | - | | |

$ | 28,555 | | |

$ | 20,729 | | |

$ | 77,719 | |

| Cost of revenues | |

| (25,373 | ) | |

| (55,817 | ) | |

| (52,127 | ) | |

| (156,665 | ) |

| Gross loss | |

| (25,373 | ) | |

| (27,262 | ) | |

| (31,398 | ) | |

| (78,946 | ) |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| 1,978,756 | | |

| 1,671,187 | | |

| 4,063,404 | | |

| 3,370,070 | |

| Selling, general and administrative expenses | |

| 1,044,880 | | |

| 618,149 | | |

| 2,074,298 | | |

| 1,380,614 | |

| Total operating expenses | |

| 3,023,636 | | |

| 2,289,336 | | |

| 6,137,702 | | |

| 4,750,684 | |

| Loss from operations | |

| (3,049,009 | ) | |

| (2,316,598 | ) | |

| (6,169,100 | ) | |

| (4,829,630 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating (expenses) income, net: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (118,759 | ) | |

| (40,311 | ) | |

| (167,455 | ) | |

| (49,585 | ) |

| Issuance cost of senior secured convertible note measured at fair value | |

| - | | |

| - | | |

| (138,992 | ) | |

| - | |

| Fair value change for senior secured convertible note | |

| (66,844 | ) | |

| - | | |

| (98,412 | ) | |

| - | |

| Other income, net | |

| 39,590 | | |

| 7,182 | | |

| 64,127 | | |

| 9,013 | |

| Total non-operating expenses, net | |

| (146,013 | ) | |

| (33,129 | ) | |

| (340,732 | ) | |

| (40,572 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before income taxes | |

| (3,195,022 | ) | |

| (2,349,727 | ) | |

| (6,509,832 | ) | |

| (4,870,202 | ) |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss | |

$ | (3,195,022 | ) | |

$ | (2,349,727 | ) | |

$ | (6,509,832 | ) | |

$ | (4,870,202 | ) |

v3.24.2.u1

Cover

|

Aug. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 05, 2024

|

| Entity File Number |

001-41461

|

| Entity Registrant Name |

AINOS,

INC.

|

| Entity Central Index Key |

0001014763

|

| Entity Tax Identification Number |

75-1974352

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

8880

Rio San Diego Drive

|

| Entity Address, Address Line Two |

Ste. 800

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92108

|

| City Area Code |

(858)

|

| Local Phone Number |

869-2986

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.01 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

AIMD

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants

to purchase Common Stock

|

| Trading Symbol |

AIMDW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AIMD_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AIMD_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

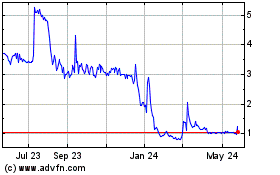

Ainos (NASDAQ:AIMD)

Historical Stock Chart

From Nov 2024 to Dec 2024

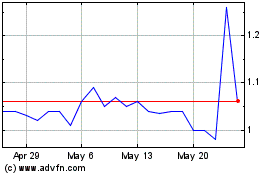

Ainos (NASDAQ:AIMD)

Historical Stock Chart

From Dec 2023 to Dec 2024