Aligos Therapeutics Announces $105 Million Private Placement Financing

February 12 2025 - 6:00AM

Aligos Therapeutics, Inc. (Nasdaq: ALGS, “Aligos”, “Company”), a

clinical stage biotechnology company focused on improving patient

outcomes through best-in-class therapies for liver and viral

diseases, today announced that it has entered into a securities

purchase agreement for a private placement that is expected to

result in gross proceeds of approximately $105 million, before

deducting placement agents’ fees and other expenses.

The private placement is being led by a life sciences dedicated

investment firm with participation from other new and existing

institutional investors.

Aligos currently expects to use the net proceeds from the

private placement, together with its existing cash, cash

equivalents and investments, to fund the continued advancement of

ALG-000184 into a Phase 2 clinical study in subjects with chronic

hepatitis B virus infection (CHB) and for other general corporate

purposes.

Aligos believes its cash, cash equivalents and investments,

including the expected net proceeds from the private placement,

will provide sufficient funding of planned operations into the

second half of 2026.

In the private placement, Aligos is selling 2,103,307 shares of

common stock, consisting of 1,427,000 shares of voting common stock

and 676,307 shares of non-voting common stock, pre-funded warrants

to purchase up to 1,922,511 shares of voting common stock, and

accompanying warrants to purchase up to 2,012,909 shares of voting

common stock at a combined price per share of common stock and

accompanying warrant of $26.0825 and a combined price per

pre-funded warrant and accompanying warrant of $26.0824. Each

pre-funded warrant will have a nominal exercise price of $0.0001

per share of voting common stock, will be immediately exercisable

and will be exercisable until exercised in full. The accompanying

warrants will have an exercise price of $26.02 per share of common

stock, will be immediately exercisable and will expire on February

13, 2032. The private placement is expected to close on February

13, 2025 subject to the satisfaction of customary closing

conditions.

Jefferies and Piper Sandler are acting as placement agents for

the private placement. H.C. Wainwright & Co. is acting as

financial advisor in connection with the transaction.

The securities sold in this private placement have not been

registered under the Securities Act of 1933, as amended, or

applicable state securities laws, and may not be offered or sold in

the United States except pursuant to an effective registration

statement or an applicable exemption from the registration

requirements. Aligos granted registration rights to the purchasers

in private placements, and has agreed to file a registration

statement with the Securities and Exchange Commission registering

the resale of the shares of common stock issued in the private

placement, the shares of common stock issuable upon exercise of the

pre-funded warrants issued in the private placement and the shares

of common stock issuable upon exercise of the accompanying warrants

issued in the private placement.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities described herein,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction.

About Aligos

Aligos Therapeutics, Inc. (NASDAQ: ALGS) is a clinical stage

biopharmaceutical company founded with the mission to improve

patient outcomes by developing best-in-class therapies for the

treatment of liver and viral diseases. Aligos applies its science

driven approach and deep R&D expertise to advance its

purpose-built pipeline of therapeutics for diseases with high unmet

medical need such as chronic hepatitis B virus infection (CHB),

metabolic dysfunction-associated steatohepatitis (MASH), and

coronaviruses.

For more information, please visit www.aligos.com or follow us

on LinkedIn or X.

Forward-Looking Statement

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. Any statements in this press release that are not historical

facts may be considered “forward-looking statements,” including

without limitation, statements related to the sufficiency of

funding of planned operations, the expected use of proceeds of the

financing, the timing and expectation of the closing of the private

placement. Forward-looking statements are typically, but not

always, identified by the use of words such as “may,” “will,”

“would,” “believe,” “intend,” “plan,” “anticipate,” “estimate,”

“expect,” and other similar terminology indicating future results.

Such forward looking statements are subject to substantial risks

and uncertainties that could cause our development programs, future

results, performance, or achievements to differ materially from

those anticipated in the forward-looking statements. Such risks and

uncertainties include, without limitation, the risks and

uncertainties associated with market conditions and the

satisfaction of customary closing conditions related to the

proposed financing, risks and uncertainties inherent in the drug

development process, including Aligos’ clinical stage of

development, the process of designing and conducting clinical

trials and the regulatory approval processes. For a further

description of the risks and uncertainties that could cause actual

results to differ from those anticipated in these forward-looking

statements, as well as risks relating to the business of Aligos in

general, see Aligos’ Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on November 6, 2024 and its

future periodic reports to be filed or submitted with the

Securities and Exchange Commission. Except as required by law,

Aligos undertakes no obligation to update any forward-looking

statements to reflect new information, events or circumstances, or

to reflect the occurrence of unanticipated events.

Aligos Therapeutics

ContactJordyn TaraziVice President, Investor

Relations & Corporate Communications+1 (650)

910-0427jtarazi@aligos.com

Aligos Therapeutics (NASDAQ:ALGS)

Historical Stock Chart

From Feb 2025 to Mar 2025

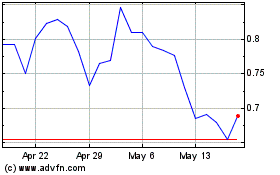

Aligos Therapeutics (NASDAQ:ALGS)

Historical Stock Chart

From Mar 2024 to Mar 2025