ALX Oncology Reports Third Quarter 2024 Financial Results and Provides Corporate Update

November 07 2024 - 3:00PM

ALX Oncology Holdings Inc., (“ALX Oncology” or “the Company”)

(Nasdaq: ALXO), a clinical-stage biotechnology company advancing

therapies that boost the immune system to treat cancer in new ways

and extend patients’ lives, today reported financial results for

the third quarter ended September 30, 2024, and provided a

corporate update.

“We made substantial clinical progress during the third quarter,

most notably announcing topline data from our ASPEN-06 Phase 2

trial in which our lead candidate evorpacept became the first and

only CD47-blocking agent to show a durable clinical benefit and a

well-tolerated safety profile in a prospective randomized clinical

trial,” said Jason Lettmann, Chief Executive Officer of ALX

Oncology. “These results provided further validation for

evorpacept’s novel mechanism of action and our robust evorpacept

clinical program. We anticipate achieving several additional

clinical milestones in the near-term that could advance evorpacept

towards being a best-in-class, combinable therapeutic across a wide

range of cancer types.”

Third Quarter 2024 Highlights and Recent

Developments

- Reported topline data results in July from the multi-center,

international ASPEN-06 Phase 2 clinical trial (NCT05002127)

evaluating evorpacept in combination with HERCEPTIN® (trastuzumab),

CYRAMZA® (ramucirumab) and paclitaxel (Evo-TRP) against

trastuzumab, CYRAMZA (ramucirumab) and paclitaxel (TRP) for the

treatment of patients with HER2-positive gastric/gastroesophageal

junction (GEJ) cancer, where all patients had received an anti-HER2

agent in prior lines of therapy.

- Evorpacept improved tumor response in patients with

HER2-positive gastric/GEJ cancer, becoming the first CD47 blocker

to show promising and durable response with a well-tolerated safety

profile in a prospective randomized study.

- Evo-TRP achieved a confirmed overall response rate (ORR) of

40.3% compared to 26.6% for the TRP control arm and demonstrated a

median duration of response of 15.7 months compared to 7.6 months

in the intent to treat population (ITT) (N=127). The primary

analysis of the ITT compared Evo-TRP to an assumed RP control ORR

of 30% Secondary endpoints of PFS and OS were immature at the time

of analysis.

- Evo-TRP combination showed the greatest response with an ORR of

54.8% compared to 23.1% in the TRP control arm in a pre-specified

population of patients with fresh HER2-positive biopsies

(n=48).

- In September, commenced patient dosing to investigate

evorpacept plus SARCLISA® (isatuximab-irfc) and dexamethasone in

patients with relapsed or refractory multiple myeloma (RRMM) in the

Sanofi-partnered arm of the randomized UMBRELLA phase 1/2 clinical

study.

- Sanofi is conducting the two-part multicenter, randomized,

open-label, controlled, parallel-group study (NCT04643002) to

evaluate the safety, efficacy, pharmacokinetics and biomarker data

of evorpacept in combination with SARCLISA and dexamethasone in

patients with RRMM.

- Part 1 is evaluating the dosing of evorpacept in combination

with standard doses of SARCLISA and dexamethasone to identify a

recommended evorpacept dose.

- Part 2 is investigating the efficacy and safety of this

three-drug combination in an expanded population of patients with

RRMM.

- In August, enhanced the leadership team by appointing Alan

Sandler, M.D. to Board of Directors, a distinguished leader in

oncology and drug development with over 30 years of experience

across industry and academia.

- Dr. Sandler’s industry background includes serving as Executive

Vice President, Chief Medical Officer at Mirati Therapeutics, prior

to its acquisition by Bristol Myers Squibb. Before joining Mirati,

he served as President, Global Head of Development in Oncology at

Zai Lab, and prior to that, he was the Senior Vice President and

Global Head, Product Development of Oncology Solid Tumors at

Genentech, a member of the Roche Group.

- Presented at the 2024 Cantor Fitzgerald Global Healthcare

Conference in New York City in September.

- Participated in fireside chat with Analyst, Li Watsek and

conducted investor meetings.

Upcoming Clinical Milestones for

Evorpacept’s Development Pipeline

- Breast Cancer – Results from a Phase 1b/2 combination trial

evaluating evorpacept in combination with Jazz Pharmaceuticals’

zanidatamab in HER2-positive and HER2-low metastatic breast cancer

will be presented at a poster spotlight presentation at the San

Antonio Breast Cancer Symposium on December 12, 2024

- Gastric/GEJ Cancer – Updated results of ASPEN-06 Phase 2

clinical trial (1H 2025)

- Head and Neck Squamous Cell Carcinoma – Topline results from a

Phase 2 randomized clinical trial of ASPEN-03 with KEYTRUDA®

(pembrolizumab) (1H 2025)

- Head and Neck Squamous Cell Carcinoma – Topline results from a

Phase 2 randomized clinical trial of ASPEN-04 with KEYTRUDA and

chemotherapy (1H 2025)

- Urothelial Cancer – Updated results from a Phase 1 clinical

trial of ASPEN-07 in combination with PADCEV® (enfortumab vedotin)

(1H 2025)

- Gastric/GEJ Cancer – Initiation of Phase 3 registrational

randomized clinical trial for evorpacept (mid-2025)

- Breast Cancer – Topline results from a Phase 1b I-SPY TRIAL

with ENHERTU® (fam-trastuzumab deruxtecan-nxki) (2H 2025)

Third Quarter 2024 Financial Results:

- Cash, Cash Equivalents and Investments: Cash,

cash equivalents and investments as of September 30, 2024, were

$162.6 million. The Company believes its cash, cash equivalents and

investments, which includes the proceeds from sales under its

at-the-market (“ATM”) offering in the first half of 2024 are

sufficient to fund planned operations well into Q1 2026.

- Research and Development (“R&D”) Expenses:

R&D expenses consist primarily of pre-clinical, clinical and

manufacturing expenses related to the development of the Company’s

current lead product candidate, evorpacept, and R&D

employee-related expenses. These expenses for the three months

ended September 30, 2024, were $26.5 million, compared to $45.8

million for the prior-year period. R&D expenses decreased by

$19.3 million during the three months ended September 30, 2024,

compared to the three months ended September 30, 2023. Lower

expense was primarily attributable to a decrease of $22.2 million

in clinical and development costs primarily due to manufacturing of

clinical trial materials to support active clinical trials for our

lead product candidate, evorpacept, slightly offset by increased

preclinical costs for development of new targets, an increase in

personnel and related costs, and an increase in stock-based

compensation expense.

- General and Administrative (“G&A”)

Expenses: G&A expenses consist primarily of

administrative employee-related expenses, legal and other

professional fees, patent filing and maintenance fees, and

insurance. These expenses for the three months ended September 30,

2024, were $6.1 million, compared to $7.5 million for the prior

year period. G&A expenses decreased by $1.4 million during the

three months ended September 30, 2024, compared to the three months

ended September 30, 2023. The decrease was primarily attributable

to lower stock-based compensation expense and lower accounting

consulting costs.

- Net loss: GAAP net loss was $30.7 million for

the three months ended September 30, 2024, or ($0.58) per basic and

diluted share, as compared to a GAAP net loss of $51.0 million for

the three months ended September 30, 2023, or ($1.24) per basic and

diluted share. Non-GAAP net loss was $23.7 million for the three

months ended September 30, 2024, as compared to a non-GAAP net loss

of $44.0 million for the three months ended September 30, 2023. A

reconciliation of GAAP to non-GAAP financial results can be found

at the end of this news release.

About ALX Oncology

ALX Oncology (Nasdaq: ALXO) is a clinical-stage biotechnology

company advancing therapies that boost the immune system to treat

cancer in new ways and extend patients’ lives. ALX Oncology’s lead

therapeutic candidate, evorpacept, has demonstrated potential to

serve as a cornerstone therapy upon which the future of

immuno-oncology can be built. Evorpacept is currently being

evaluated across multiple ongoing clinical trials in a wide range

of cancer indications. More information is available at

www.alxoncology.com and on LinkedIn @ALX Oncology.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. Forward-looking

statements include statements regarding future results of

operations and financial position, business strategy, product

candidates, planned preclinical studies and clinical trials,

results of clinical trials, research and development costs,

regulatory approvals, timing and likelihood of success, plans and

objects of management for future operations, as well as statements

regarding industry trends. Such forward-looking statements are

based on ALX Oncology’s beliefs and assumptions and on information

currently available to it on the date of this press release.

Forward-looking statements may involve known and unknown risks,

uncertainties and other factors that may cause ALX Oncology’s

actual results, performance or achievements to be materially

different from those expressed or implied by the forward-looking

statements. These and other risks are described more fully in ALX

Oncology’s filings with the Securities and Exchange Commission

(“SEC”), including ALX Oncology’s Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and other documents ALX Oncology

files with the SEC from time to time. Except to the extent required

by law, ALX Oncology undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made.

| ALX ONCOLOGY

HOLDINGS INC.Condensed Consolidated Statements of

Operations(unaudited)(in thousands, except share and per share

amounts) |

| |

| |

Three Months

Ended |

|

|

Nine Months

Ended |

|

| |

September 30, |

|

|

September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

26,471 |

|

|

$ |

45,766 |

|

|

$ |

92,841 |

|

|

$ |

100,011 |

|

|

General and administrative |

|

6,096 |

|

|

|

7,509 |

|

|

|

19,013 |

|

|

|

22,244 |

|

|

Total operating expenses |

|

32,567 |

|

|

|

53,275 |

|

|

|

111,854 |

|

|

|

122,255 |

|

| Loss from operations |

|

(32,567 |

) |

|

|

(53,275 |

) |

|

|

(111,854 |

) |

|

|

(122,255 |

) |

|

Interest income |

|

2,303 |

|

|

|

2,677 |

|

|

|

7,488 |

|

|

|

7,654 |

|

|

Interest expense |

|

(446 |

) |

|

|

(391 |

) |

|

|

(1,302 |

) |

|

|

(1,150 |

) |

|

Other (expense) income, net |

|

3 |

|

|

|

(1 |

) |

|

|

(19 |

) |

|

|

418 |

|

| Net loss |

$ |

(30,707 |

) |

|

$ |

(50,990 |

) |

|

$ |

(105,687 |

) |

|

$ |

(115,333 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.58 |

) |

|

$ |

(1.24 |

) |

|

$ |

(2.05 |

) |

|

$ |

(2.82 |

) |

| Weighted-average shares of common

stock used to compute net loss per shares, basic and diluted |

|

52,693,878 |

|

|

|

41,147,938 |

|

|

|

51,544,501 |

|

|

|

40,963,015 |

|

| Condensed

Consolidated Balance Sheet Data(in thousands) |

| |

| |

September 30, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

|

Cash, cash equivalents and investments |

$ |

162,610 |

|

|

$ |

218,147 |

|

| Total assets |

$ |

185,715 |

|

|

$ |

242,553 |

|

| Total liabilities |

$ |

48,908 |

|

|

$ |

52,841 |

|

| Accumulated deficit |

$ |

(591,959 |

) |

|

$ |

(486,272 |

) |

| Total stockholders’ equity |

$ |

136,807 |

|

|

$ |

189,712 |

|

| GAAP to

Non-GAAP Reconciliation(unaudited)(in thousands) |

| |

| |

Three Months

Ended |

|

|

Nine Months

Ended |

|

| |

September 30, |

|

|

September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

GAAP net loss, as reported |

$ |

(30,707 |

) |

|

$ |

(50,990 |

) |

|

$ |

(105,687 |

) |

|

$ |

(115,333 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

6,952 |

|

|

|

6,964 |

|

|

|

21,235 |

|

|

|

19,552 |

|

|

Accretion of term loan discount and issuance costs |

|

66 |

|

|

|

63 |

|

|

|

196 |

|

|

|

186 |

|

|

Total adjustments |

|

7,018 |

|

|

|

7,027 |

|

|

|

21,431 |

|

|

|

19,738 |

|

| Non-GAAP net loss |

$ |

(23,689 |

) |

|

$ |

(43,963 |

) |

|

$ |

(84,256 |

) |

|

$ |

(95,595 |

) |

Use of Non-GAAP Financial Measures

We supplement our consolidated financial statements presented on

a GAAP basis by providing additional measures which may be

considered “non-GAAP” financial measures under applicable SEC

rules. We believe that the disclosure of these non-GAAP financial

measures provides our investors with additional information that

reflects the amounts and financial basis upon which our management

assesses and operates our business. These non-GAAP financial

measures are not in accordance with generally accepted accounting

principles and should not be viewed in isolation or as a substitute

for reported, or GAAP, net loss, and are not a substitute for, or

superior to, measures of financial performance performed in

conformity with GAAP.

“Non-GAAP net loss” is not based on any standardized methodology

prescribed by GAAP and represents GAAP net loss adjusted to exclude

stock-based compensation expense and accretion of term loan

discount and issuance costs. Non-GAAP financial measures used by

ALX Oncology may be calculated differently from, and therefore may

not be comparable to, non-GAAP measures used by other

companies.

Company Contact: Caitlyn Doherty, Manager, Corporate Communications, ALX Oncology, cdoherty@alxoncology.com, (650) 466-7125

Investor Contact: Malini Chatterjee, Ph.D., Blueprint Life Science Group, mchatterjee@bplifescience.com, (917) 330-4269

Media Contact: Audra Friis, Sam Brown, Inc., audrafriis@sambrown.com, (917) 519-9577

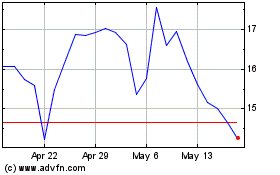

ALX Oncology (NASDAQ:ALXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

ALX Oncology (NASDAQ:ALXO)

Historical Stock Chart

From Dec 2023 to Dec 2024