false

0001621832

0001621832

2025-02-03

2025-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 3, 2025

AQUA METALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

001-37515

|

|

47-1169572

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

|

5370 Kietzke Lane, Suite 201

Reno, Nevada 89511

|

|

(Address of principal executive offices)

|

|

(775) 446-4418

|

|

(Registrant’s telephone number, including area code)

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions.

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14d-2(b)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)of the Act:

|

Title of each class

Common stock: Par value $.001

|

Trading Symbol(s)

AQMS

|

Name of each exchange on which registered

Nasdaq Capital Market

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On February 3, 2025, the Board of Directors (“Board”) of Aqua Metals, Inc. (“Company”), acting upon the recommendation of the Board’s Nominating and Corporate Governance Committee, appointed Steve Henderson and Eric Gangloff to the Board.

Steve Henderson joins Aqua Metals’ Board with over four decades of experience in automotive, specialty chemicals, and manufacturing. Most recently, he served as Executive Vice President at Leggett & Platt, overseeing businesses that accounted for over half of the company’s total revenue and EBITDA. Previously, at Dow Chemical, Henderson led the company’s automotive division and played a key role in advancing battery material innovations, working directly with industry leaders like Tesla, Ford, and Magna.

Eric Gangloff has extensive experience in capital markets, debt financing, and investment management. As the founder of Summit Alternative Investments and Chairman and CEO of AmeriFirst Finance, he has structured and executed complex debt and equity financial transactions across multiple asset classes with counterparties such as Goldman Sachs, Deutsche Bank, First National Bank of Omaha, Bayview Asset Management, Credigy, Fortress Investment Group and many others. His background includes leadership roles in both consumer finance and strategic lending, making him well-equipped to support Aqua Metals' growth and commercialization strategy.

Mr. Gangloff participated in the Company’s December 2024 private placement of secured promissory notes and warrants. Mr. Gangloff purchased a secured note in the original principal amount of $400,000, which accrues interest at the rate of 20% per annum, subject to a payment of a minimum of 12 months interest in the event of prepayment. The entire principal amount evidenced by the Notes plus all accrued and unpaid interest is due on December 31, 2025. The Company’s obligations under the Notes are secured by a first lien on the Company’s strategic metal inventory and a second lien on all other assets of the Company. Mr. Gangloff also received a warrant to purchase 200,000 shares of the Company’s common stock over a five-year period at an exercise price of $1.92 per share.

In February 2023, Aqua Metals entered into a Loan Agreement with Summit Investment Services, LLC, a Nevada limited liability company controlled by Mr. Gangloff, pursuant to which Summit provided the Company with a loan in the amount of $3,000,000. The loan accrues interest at a fixed annual rate of 9.50%. Interest-only payments are due monthly for the first 24 months and the principal and all unpaid interest is due on March 27, 2025. The loan is collateralized by a first priority lien on all assets of the Company, other than the Company’s strategic metal inventory for which Summit holds a second lien.

On February 6, 2025, we issued a press release announcing Mr. Henderson and Mr. Gangloff’s appointment. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are being filed herewith:

|

Exhibits

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AQUA METALS, INC.

|

| |

|

| |

|

|

Dated: February 6, 2025

|

/s/ Judd Merrill

|

| |

Judd Merrill,

|

| |

Chief Financial Officer

|

Exhibit 99.1

Aqua Metals Strengthens Board of Directors to Advance Sustainable Battery Recycling and Critical Minerals Production

Industry Leader Steve Henderson and Finance Expert Eric Gangloff Bring Strategic Expertise to Support Growth

RENO, Nev., February 6, 2025 – Aqua Metals, Inc. (NASDAQ: AQMS), a leader in clean metals recycling, today announced the appointment of Steve Henderson and Eric Gangloff to its Board of Directors. These additions bring deep industry expertise and financial leadership, supporting the Company’s mission to scale its cost leading and low-carbon lithium battery recycling technology and accelerate the development of a domestic critical minerals supply chain.

Strengthening Industry Reach and Commercial Execution

Steve Henderson joins Aqua Metals’ Board with over four decades of experience in automotive, specialty chemicals, and manufacturing. Most recently, he served as Executive Vice President at Leggett & Platt, overseeing businesses that accounted for over half of the company’s total revenue and EBITDA. Previously, at Dow Chemical, Henderson led the company’s automotive division and played a key role in advancing battery material innovations, working directly with industry leaders like Tesla, Ford, and Magna.

“Aqua Metals is building a cleaner, more cost-efficient solution for battery recycling and critical minerals production,” said Steve Cotton, CEO of Aqua Metals. “I look forward to leveraging Steve’s experience and network to help the company establish a strong position in the global battery supply chain ecosystem.”

Expanding Financial and Investment Expertise

Eric Gangloff has extensive experience in capital markets, debt financing, and investment management. As the founder of Summit Alternative Investments and Chairman and CEO of AmeriFirst Finance, he has structured and executed complex debt and equity financial transactions across multiple asset classes with counterparties such as Goldman Sachs, Deutsche Bank, First National Bank of Omaha, Bayview Asset Management, Credigy, Fortress Investment Group and many others. His background includes leadership roles in both consumer finance and strategic lending, making him well-equipped to support Aqua Metals' growth and commercialization strategy.

“Eric’s expertise in structuring financing solutions will be a major asset as Aqua Metals moves toward commercial-scale operations,” said Steve Cotton, CEO of Aqua Metals. “His ability to connect financial strategy with operational execution will also help us accelerate our plans and drive long-term value for our stakeholders.”

Scaling Clean Battery Recycling for the Future

These appointments come at a critical time as Aqua Metals strives to scale its AquaRefining™ process aiming to provide an economically profitable, environmentally sustainable and domestically sourced supply of lithium, nickel, and cobalt—key materials for electric vehicles and energy storage.

The Company’s technology eliminates the need for polluting smelting processes and significantly improves economics by recycling chemicals in a closed-loop process vs high-cost, one-time-use chemicals and undesirable waste streams. AquaRefining™ provides a low-cost, low-carbon, closed-loop recycling solution to reduce reliance on foreign supply chains. Henderson’s deep industry connections and Gangloff’s financial expertise are expected to support Aqua Metals’ efforts to expand commercial partnerships, secure financing, and accelerate the buildout of its Sierra ARC facility.

About Aqua Metals

Aqua Metals, Inc. (NASDAQ: AQMS) is reinventing metals recycling with its patented AquaRefining™ technology. The Company is pioneering a sustainable recycling solution for materials strategic to energy storage and electric vehicle manufacturing supply chains. AquaRefining™ is a low-emissions, closed-loop recycling technology that replaces polluting furnaces and hazardous chemicals with electricity-powered electroplating to recover valuable metals and materials from spent batteries with higher purity, lower emissions, and minimal waste. Aqua Metals is based in Reno, NV and operates the first sustainable lithium battery recycling facility at the Company’s Innovation Center in the Tahoe-Reno Industrial Center. To learn more, please visit www.aquametals.com.

Aqua Metals Social Media

Aqua Metals has used, and intends to continue using, its investor relations website (https://ir.aquametals.com), in addition to its Twitter, Threads, LinkedIn and YouTube accounts at https://twitter.com/AquaMetalsInc (@AquaMetalsInc), https://www.threads.net/@aquametalsinc (@aquametalsinc), https://www.linkedin.com/company/aqua-metals-limited and https://www.youtube.com/@AquaMetals respectively, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Safe Harbor

This press release contains forward-looking statements concerning Aqua Metals, Inc. Forward-looking statements include, but are not limited to, our plans, objectives, expectations and intentions and other statements that contain words such as "expects," "contemplates," "anticipates," "plans," "intends," "believes", "estimates", "potential" and variations of such words or similar expressions that convey the uncertainty of future events or outcomes, or that do not relate to historical matters. Those forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially, including, but not limited to those risks disclosed in the section "Risk Factors" included in our Annual Report on Form 10-K filed on March 28, 2024. Aqua Metals cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake and specifically disclaims any obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur, except as required by law.

Contact Information

Investor Relations

Bob Meyers & Rob Fink

FNK IR

646-878-9204

aqms@fnkir.com

Media

David Regan

Aqua Metals

415-336-3553

david.regan@aquametals.com

v3.25.0.1

Document And Entity Information

|

Feb. 03, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

AQUA METALS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 03, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37515

|

| Entity, Tax Identification Number |

47-1169572

|

| Entity, Address, Address Line One |

5370 Kietzke Lane, Suite 201

|

| Entity, Address, City or Town |

Reno

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89511

|

| City Area Code |

775

|

| Local Phone Number |

446-4418

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

AQMS

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001621832

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

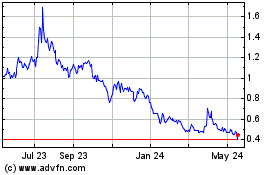

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Jan 2025 to Feb 2025

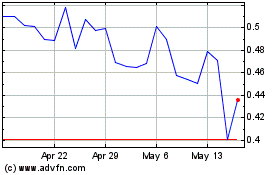

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Feb 2024 to Feb 2025