Lenders One Unites Members and Providers to Help Drive Profitability and Celebrate 25 Years of Success

March 03 2025 - 12:00PM

Lenders One® Cooperative (“L1” or “Lenders One”), a national

alliance of independent mortgage bankers, banks and credit unions

(collectively “members”), managed by a subsidiary of Altisource

Portfolio Solutions S.A. (“Altisource” or the “Company”) (NASDAQ:

ASPS), welcomes members and providers to the L1 Summit, its annual

conference at the Hilton Cancun in Cancun, Mexico. During the

three-day event, Lenders One members will celebrate the

Cooperative’s 25th anniversary, attend keynotes with industry

leading speakers, participate in education sessions, and experience

one-of-a-kind networking events.

Since its March 2024 Summit, L1 added 39 new members, enhanced

its direct solution offerings, and added preferred vendors to

support Lenders One’s 25-year mission to help its members increase

profitability by growing revenue, reducing costs, and improving

decision making. The addition of these new members amid the current

mortgage origination environment is a testament to the Lenders One

team and value proposition.

Lenders One offers its members a variety of direct solutions,

capital markets and national programs products and services to help

its members better compete and increase their profitability.

Lenders One direct solutions include credit, flood, fraud,

insurance, verifications, fulfillment services, quality control,

title and escrow, valuations and vendor management. More recently,

Lenders One launched and refined some of its direct solutions to

enhance the value proposition for its members:

- L1 Credit and Verifications. L1

Credit, a full-service credit reporting agency, is regularly

evolving and adding new products to its already robust offerings.

This year the following solutions were made available to members:

- ScoreNavigator®:

ScoreNavigator provides loan officers with access to a detailed

analysis of a borrower’s credit health to help streamline the

mortgage qualification process by identifying viable candidates for

mortgage approval.

- L1 Verification of Assets: Powered by

FinLocker®, a financial fitness platform built on open-banking

innovation, L1 Verification of Assets (L1 VOA) offers lenders a

robust platform to order asset and payroll verification data and

reports to accelerate their lending processes.

- L1 Flood. L1 Flood

offers flood zone determinations that can help protect member

clients by helping them comply with the National Flood Insurance

Program (NFIP). L1 Flood is now powered by ServiceLink®, part

of the Fidelity National Financial® family of companies and the

nation’s premier provider of tech-enabled mortgage services.

ServiceLink’s comprehensive suite of flood products and services

includes flood certifications, custom data and delivery solutions,

life-of-loan-tracking, portfolio review, Home Mortgage Disclosure

Act (HMDA) reporting information and more. The solution also

features ServiceLink’s exclusive CertMap®, a high-quality map

showing a subject property’s proximity to Federal Emergency

Management Agency (FEMA) flood zones with aerial images.

- L1 Insurance. Piloted

in 2024, L1 Insurance is an innovative homeowner insurance solution

that provides borrowers with multiple competitive quotes for the

insurance coverage required to close their mortgage transaction.

This solution is available through a collaboration between

CastleLine® Risk and Insurance Services, a wholly owned subsidiary

of Altisource, and VIU by HUB, an omnichannel insurance brokerage

platform backed by one of the largest personal insurance brokers,

HUB International. Members can help their borrowers quickly get

multiple competitive homeowners insurance quotes for homes located

across the U.S. L1 Insurance integrates seamlessly with major loan

origination systems to share borrower and property information with

a team of licensed insurance agents, who can quickly obtain quotes

for insurance.

In addition to its direct solutions, Lenders One has a suite of

Capital Market and National Program solutions to help the members

better compete. These Capital Markets and National Programs

offerings include over 90 vendors and solutions providers which

support all facets of the mortgage business. Since the last Summit,

Lenders One has added 8 new Preferred Providers to its National

Programs platform:

-

Blend: Blend is a leading digital origination

platform that streamlines the mortgage process for banks,

credit unions, and IMBs. By automating complex and manual

processes with intelligent workflows, Blend boosts

efficiency, reduces costs, and enhances the borrower

and loan officer experience for lenders.

- Blue

Sage: Blue Sage is a leading provider of cutting-edge,

fully cloud-based digital lending platforms for the mortgage

industry, offering end-to-end functionality from origination to

servicing. With a focus on innovation and client value, our

API-driven workflow automation ensures maximum efficiency across

all channels, delivering a superior experience for every

borrower.

-

Bonzo: Bonzo is a modern CRM and conversation

platform that simplifies client acquisition, conversion, and

retention. Bonzo streamlines customer engagement for mortgage

professionals by automating tasks and enabling efficient client

communication via video, voice, and text—all within an intuitive

platform that fosters authentic relationships while saving

time.

-

CarShield™: CarShield auto service contract

solutions help shield borrowers from some of the high costs of

automobile repairs. CarShield offers a wide range of flexible

vehicle service plans.

-

Credible: Credible is an online marketplace that

enables consumers to compare prequalified personal loan offers from

multiple lenders without affecting their credit scores. Credible

partners with leading lenders, providing personal loan options for

various use cases, including debt consolidation and home

improvement.

-

HomeSafe: HomeSafe, part of the CarShield suite of

products, provides new and existing homeowners with peace of mind

by providing safeguards from certain unexpected home system and

appliance breakdowns. This solution fosters sustainable

homeownership with predictable premiums and service fees,

potentially alleviating some of the financial burdens of unexpected

high-cost home repairs.

-

MMI: MMI is a leading mortgage and real estate

intelligence platform, integrating MMI Data Center, MonitorBase,

and Bonzo to connect data, automation, and engagement.

Professionals can track high-intent borrowers, monitor top agents,

and launch automated campaigns—maximizing opportunities with

predictive insights and seamless follow-up.

-

NFTYDoor: NFTYDoor, a division of Homebridge®,

offers lenders and banks a white-label, automated “HELOC in a box”

solution for their borrowers, typically providing borrowers with

cash in days, not weeks or months. Lenders can power their HELOC

business by teaming with NFTYDoor as either a broker or

correspondent.

“We’re excited to welcome our newest 39 members to the

Cooperative and pleased to gather with the member community to

celebrate the Cooperative’s 25th anniversary at our Annual Summit

in Cancun,” said Justin Demola, CMB, President, Lenders One.

“This is a special milestone, and it is gratifying to see our

member community recognize the value that Lenders One brings to

their business. We remain committed to the mission of helping all

members maximize revenue, reduce costs, and improve decision

making, and will continue to launch new initiatives and solutions

to help their business compete.”

About Lenders One Cooperative

Lenders One (LendersOne.com) was established in 2000 as a

national alliance of independent mortgage bankers, banks, credit

unions and is dedicated to helping its members improve their

profitability by reducing costs, maximizing revenue and sharing

best practices. Lenders One members originated approximately $372

billion of mortgages during 2023, collectively ranking as the

largest retail mortgage entity in the U.S. Lenders One is managed

by a subsidiary of Altisource Portfolio Solutions S.A. (NASDAQ:

ASPS).

About Altisource®

Altisource Portfolio Solutions S.A. (NASDAQ: ASPS) is an

integrated service provider and marketplace for the real estate and

mortgage industries. Combining operational excellence with a suite

of innovative services and technologies, Altisource helps solve the

demands of the ever-changing markets we serve. Additional

information is available at altisource.com.

| Investor

Contact:Michelle D. EstermanChief Financial

Officer770-612-7007Michelle.Esterman@altisource.com |

Press Contact:Justin Demola, CMBPresident, Lenders

One770-956-5809Justin.Demola@lendersone.com |

Source: Altisource Portfolio Solutions S.A.

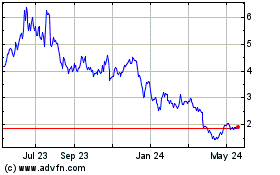

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Feb 2025 to Mar 2025

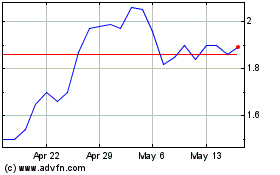

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Mar 2024 to Mar 2025