Strengthens Leadership with Appointments to

Executive Team and Boards

Publishes Landmark Peer-Reviewed Article,

Validating Technology

Ongoing Clinical and Regulatory Progress for

the HeartBeam AIMIGo™ VECG Device

Management to Host Webcast and Conference Call

Today At 4:30 p.m. ET

HeartBeam, Inc. (NASDAQ: BEAT), a cardiac technology

company that has developed the first and only credit card-size

3D-vector electrocardiogram (VECG) platform for patient use at

home, allowing for the creation of rich data for AI, has reported

its financial and operational results for the third quarter ended

September 30, 2023.

Third Quarter and Subsequent 2023 Operational

Highlights

- Announced the publication, in Journal of American College of

Cardiology (“JACC”): Advances of a foundational study demonstrating

the ability of HeartBeam’s VECG technology platform to detect the

presence of coronary artery occlusions.

- Appointed Richa Gujarati as Senior Vice President, Product;

Pooja Chatterjee as Vice President, Clinical; and Deborah Castillo,

PhD, as Vice President of Regulatory Affairs, significantly

bolstering the senior management team.

- Appointed Michael R. Jaff, DO, a renowned vascular physician

and researcher bringing a wealth of clinical and industry

experience to the Board of Directors.

- Expanded its Scientific Advisory Board (SAB) to include several

leading cardiologists: Charles L. Brown III, MD; Tony Das, MD;

Robert Harrington, MD; Campbell Rogers, MD; and Niraj Varma, MD,

Ph.D.

- Made steady progress toward key AIMIGo™ VECG Device Clinical

and Regulatory Milestones.

- Received and responded to questions from FDA on the initial

AIMIGo 510(k) submission, which is focused on the system

hardware.

- Held a pre-submission meeting with FDA on the second AIMIGo

510(k) submission, which is focused on the algorithms that

synthesize a 12L ECG from the AIMIGo device. This application will

be submitted after the initial clearance that is focusing on AIMIGo

hardware. The emphasis of the pre-submission meeting was on the

design of the clinical study that will demonstrate the performance

of our synthesized 12L ECG in relation to standard 12L ECGs.

- The US Patent and Trademark Office granted a third patent for

the 12-Lead Extended Wear Patch for detecting heart attacks and

complex cardiac arrythmias.

- Cash and cash equivalents totaled approximately $19.2 million

as of September 30, 2023, enabling the Company to execute on

upcoming clinical and regulatory milestones. Projected cash runway

goes into 2025.

Management Commentary

“During the third quarter of 2023 we significantly enhanced the

HeartBeam team, continued to make steady progress toward upcoming

clinical and regulatory milestones, and validated the potential of

our VECG technology platform,” said Branislav Vajdic, PhD, Chief

Executive Officer and Founder of HeartBeam. “Having respected

industry executives in place is the cornerstone to successful

clinical development and commercialization of our ambulatory VECG

products, and we were privileged to welcome several experienced

leaders in the last several months. Taken together, we believe that

these new appointments, along with our full team’s collective

expertise, vision, and dedication, will enable the timely delivery

of our ambulatory VECG products to market, which are our key future

value drivers.

“We also strengthened our Board with the appointment of

respected industry executive Michael R. Jaff, DO, Chief Medical

Officer and Vice President of Clinical Affairs, Technology and

Innovation of the Peripheral Interventions division at Boston

Scientific Corporation. Most recently we added five distinguished

physicians to our Scientific Advisory Board, who will provide

expertise in interventional cardiology, electrophysiology, clinical

research, and new technologies.

“We recently announced the publication in JACC: Advances, of a

landmark peer-reviewed study based on our novel VECG technology.

This is an excellent validation of the technology and underscores

its unique design benefits. The study demonstrates the potential

for an easy-to-use patient-held device to be employed in the

detection of heart attacks at home and deliver comparable results

to that available from a 12-lead electrocardiogram (12L ECG) in a

medical facility. By personalizing AIMIGo, combining the novel VECG

approach with a system that incorporates a patient’s baseline

signal, our technology was shown to detect coronary occlusions with

an accuracy of almost 40% better than a 12L ECG when no baseline is

readily available.

“We are pleased with the ongoing advancement toward several

clinical and regulatory milestones for the HeartBeam AIMIGo VECG

device, including active discussions with FDA that are progressing

well. The product and regulatory efforts include first obtaining an

FDA 510(k) clearance for the HeartBeam AIMIGo VECG device. We

submitted this application to the FDA in May 2023. This will be

followed by a second FDA application on the system’s ability to

synthesize a 12L ECG. We continue to expect the product will be

ready for limited market release during the second half of

2024.

“We ended the third quarter of 2023 with approximately $19.2

million in cash and cash equivalents, and believe we are in a

strong position as we carefully manage spending to extend our

runway. Earlier in the year we closed a $26.5 million in common

stock-only financing, which we believe will fund our operations

into early 2025. We look forward to providing updates on our

progress in the months ahead,” concluded Dr. Vajdic.

Third Quarter 2023 Financial Results

Research and development expenses for the third quarter of 2023

were $1.6 million, compared to $1.6 million for the third quarter

of 2022.

General and administrative expenses for the third quarter of

2023 were $2.1 million compared to $2.0 million for the third

quarter of 2022.

Net loss for the third quarter of 2023 was $3.5 million,

compared to a net loss of $3.6 million for the third quarter of

2022.

Cash and cash equivalents totaled approximately $19.2 million as

of September 30, 2023, compared to $3.6 million of Cash and cash

equivalents as of December 31, 2022. In May 2023, the Company

completed the sale of Common Stock with gross proceeds of $26.5

million. Net cash used in operations was approximately $2.1 million

this quarter.

Third Quarter 2023 Results Conference Call

HeartBeam CEO and Founder Branislav Vajdic, PhD, President

Robert Eno, and CFO Richard Brounstein will host the conference

call, followed by a question-and-answer period. The conference call

will be accompanied by a presentation, which can be viewed during

the webcast or accessed via the investor relations section of the

Company’s website here.

To access the call, please use the following information:

Date:

Tuesday, November 14, 2023

Time:

4:30 p.m. Eastern time (1:30 p.m. Pacific

time)

Dial-in:

1-877-704-4453

International Dial-in:

1-201-389-0920

Conference Code:

13741784

Webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1637601&tp_key=06cb7fdae7

A telephone replay will be available approximately two hours

after the call and will run through February 14, 2023, by dialing

1-844-512-2921 from the U.S., or 1-412-317-6671 from international

locations, and entering replay pin number: 13741784. The replay can

also be viewed through the webcast link above and the presentation

utilized during the call will be available in the company’s

investor relations section here.

About HeartBeam, Inc.

HeartBeam, Inc. (NASDAQ: BEAT) is a cardiac technology company

that has developed the first and only 3D-vector ECG platform

intended for patient use at home. By applying a suite of

proprietary algorithms to simplify vector electrocardiography

(VECG), the HeartBeam platform enables patients and their

clinicians to assess their cardiac symptoms quickly and easily, so

care can be expedited, if required. HeartBeam AIMIGo™ is the first

and only credit card-sized 12-lead output ECG device coupled with a

smart phone app and cloud-based diagnostic software system to

facilitate remote evaluation of cardiac symptoms. By collecting 3D

signals of the heart’s electrical activity, HeartBeam AIMIGo has

the potential to provide unparalleled data for the development of

AI algorithms. HeartBeam AIMIGo has not yet been cleared by the US

Food and Drug Administration (FDA) for marketing in the USA or

other geographies. For more information, visit HeartBeam.com.

Forward-Looking Statements

All statements in this release that are not based on historical

fact are "forward-looking statements." While management has based

any forward-looking statements included in this release on its

current expectations, the information on which such expectations

were based may change. Forward-looking statements involve inherent

risks and uncertainties which could cause actual results to differ

materially from those in the forward-looking statements, as a

result of various factors including those risks and uncertainties

described in the Risk Factors and in Management’s Discussion and

Analysis of Financial Condition and Results of Operations sections

of our in our Forms 10-K, 10-Q and other reports filed with the SEC

and available at www.sec.gov. We urge you to consider those risks

and uncertainties in evaluating our forward-looking statements. We

caution readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date made.

Except as otherwise required by the federal securities laws, we

disclaim any obligation or undertaking to publicly release any

updates or revisions to any forward-looking statement contained

herein (or elsewhere) to reflect any change in our expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statement is based.

HEARTBEAM, INC.

Condensed Balance Sheets

(Unaudited)

(In thousands, except share

data)

September 30,

2023

December 31,

2022

Assets

Current Assets:

Cash and cash equivalents

$

19,184

$

3,594

Prepaid expenses and other current

assets

295

445

Total Current Assets

$

19,479

$

4,039

Property and equipment, net

144

—

Other assets

25

—

Total Assets

$

19,648

$

4,039

Liabilities and Stockholders’

Equity

Current Liabilities:

Accounts payable and accrued expenses

(includes related party $2)

1,019

1,665

Total Liabilities

1,019

1,665

Commitments

Stockholders’ Equity

Preferred stock - $0.0001 par value;

10,000,000 authorized; 0 shares outstanding at September 30, 2023

and December 31, 2022

—

—

Common stock - $0.0001 par value;

100,000,000 shares authorized; 26,325,282 and 8,009,743 shares

issued and outstanding at September 30, 2023 and December 31,

2022

3

1

Additional paid in capital

51,572

24,559

Accumulated deficit

(32,946

)

(22,186

)

Total Stockholders’ Equity

$

18,629

$

2,374

Total Liabilities and Stockholders’

Equity

$

19,648

$

4,039

HEARTBEAM, INC.

Condensed Statements of

Operations (Unaudited)

(In thousands, except share

and per share data)

Three months ended September

30,

Nine months ended September

30,

2023

2022

2023

2022

Operating Expenses:

General and administrative

$

2,114

$

2,048

$

6,417

$

5,256

Research and development

1,623

1,562

4,788

4,036

Total operating expenses

3,737

3,610

11,205

9,292

Loss from operations

(3,737

)

(3,610

)

(11,205

)

(9,292

)

Other Income

Interest income

267

28

445

39

Other Income

—

3

—

3

Total other income

267

31

445

42

Loss before provision for income taxes

(3,470

)

(3,579

)

(10,760

)

(9,250

)

Income tax provision

—

—

—

—

Net Loss

$

(3,470

)

$

(3,579

)

$

(10,760

)

$

(9,250

)

Net loss per share, basic and diluted

$

(0.13

)

$

(0.44

)

$

(0.59

)

$

(1.14

)

Weighted average common shares

outstanding, basic and diluted

26,449,168

8,147,024

18,252,654

8,107,359

HEARTBEAM, INC.

Condensed Statements of Cash

Flows (Unaudited)

(In thousands)

Nine Months ended September

30,

2023

2022

Cash Flows From Operating

Activities

Net loss

$

(10,760

)

$

(9,250

)

Adjustments to reconcile net loss to net

cash used in operating activities

Stock-based compensation expense

2,021

774

Changes in operating assets and

liabilities:

Prepaid expenses and other current

assets

150

683

Accounts payable and accrued expenses

(646

)

800

Net cash used in operating

activities

(9,235

)

(6,993

)

Cash Flows From Investing

Activities

Purchase of property and equipment

(144

)

—

Net cash used in investing

activities

(144

)

—

Cash Flows From Financing

Activities

Proceeds from sale of equity, net of

issuance costs

24,764

348

Proceeds from exercise of stock

options

214

2

Proceeds from exercise of warrants

16

—

Net cash provided by financing

activities

24,994

350

Net increase (decrease) in cash and

restricted cash

15,615

(6,643

)

Cash, cash equivalents and restricted

cash - beginning of period

3,594

13,192

Cash, cash equivalents and restricted

cash - at end of period

$

19,209

$

6,549

Supplemental Disclosures of Cash Flow

Information:

Taxes paid

$

—

$

—

Interest paid

—

—

Supplemental Disclosures of Non-cash

Flow Information:

Issuance of common stock and warrants to

settle accrued expenses

—

456

Reconciliation of cash, cash

equivalents and restricted cash:

Cash and cash equivalents

19,184

6,549

Restricted cash (included in other

assets)

25

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114221434/en/

Investor Relations Contact: Chris Tyson Executive Vice

President MZ North America Direct: 949-491-8235 BEAT@mzgroup.us

www.mzgroup.us

Media Contact: media@heartbeam.com

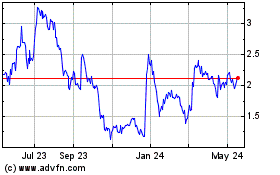

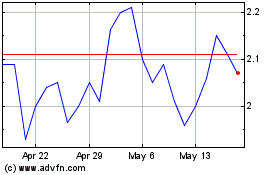

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Oct 2024 to Nov 2024

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Nov 2023 to Nov 2024