0000744218 False 0000744218 2025-02-27 2025-02-27 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

_______________________________

Celldex Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 000-15006 | 13-3191702 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

Perryville III Building, 53 Frontage Road, Suite 220

Hampton, New Jersey 08827

(Address of Principal Executive Offices) (Zip Code)

(908) 200-7500

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.001 | CLDX | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 27, 2025, Celldex Therapeutics, Inc. (the "Company") issued a press release announcing its financial results for the fourth quarter and year ended 2024. The full text of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information in this Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Celldex Therapeutics, Inc. |

| | | |

| | | |

| Date: February 27, 2025 | By: | /s/ Sam Martin |

| | | Sam Martin |

| | | Senior Vice President and

Chief Financial Officer |

| | | |

EXHIBIT 99.1

Celldex Reports Fourth Quarter and Year End 2024 Financial Results and Provides Corporate Update

- Enrollment ongoing in Phase 3 barzolvolimab CSU studies; Phase 3 program in CIndU under development

- Phase 2 barzolvolimab EOE study fully accrued; Phase 2 study initiated in atopic dermatitis; enrollment ongoing in Phase 2 PN study

- Celldex’s first bispecific for inflammatory diseases, CDX-622, Phase 1 study initiated

- Multiple important data read outs anticipated in 2025

HAMPTON, N.J., Feb. 27, 2025 (GLOBE NEWSWIRE) -- Celldex Therapeutics, Inc. (NASDAQ:CLDX) today reported financial results for the fourth quarter and year ended December 31, 2024 and provided a corporate update.

"In 2024, Celldex set a new bar for efficacy in chronic urticarias—presenting best-in-disease data across both our Phase 2 studies in CSU and CIndU,” said Anthony Marucci, Co-founder, President and Chief Executive Officer of Celldex Therapeutics. “Our Phase 3 studies in CSU have been met with great enthusiasm from the global medical community and are actively enrolling patients around the world. We look forward to building on this momentum later this year when we initiate our Phase 3 program in CIndU.”

“We closed 2024 with the initiation of two new programs—advancing barzolvolimab into its fifth indication, atopic dermatitis, and expanding our leadership in mast cell science with the introduction of our first inflammatory bispecific candidate into the clinic, CDX-622, which targets stem cell factor and TSLP,” added Mr. Marucci. “We expect 2025 will be a year of continued execution across our robust pipeline supported by important data from our barzolvolimab Phase 2 studies in CSU, CIndU and EOE and our CDX-622 Phase 1 study in healthy volunteers. We’re excited to continue this work and share our progress over the course of the year.”

Recent Program Highlights

Barzolvolimab - KIT Inhibitor Program

Barzolvolimab is a humanized monoclonal antibody developed by Celldex that binds the KIT receptor with high specificity and potently inhibits its activity. The KIT receptor tyrosine kinase is expressed in a variety of cells, including mast cells, which mediate inflammatory responses such as hypersensitivity and allergic reactions. KIT signaling controls the differentiation, tissue recruitment, survival and activity of mast cells.

Chronic Urticarias

Phase 3 Development

- A global Phase 3 program in chronic spontaneous urticaria (CSU) consisting of two Phase 3 trials (EMBARQ-CSU1 and EMBARQ-CSU2) was initiated in July and enrollment is ongoing. The studies are designed to establish the efficacy and safety of barzolvolimab in adult patients with CSU who remain symptomatic despite H1 antihistamine treatment and also include patients who remain symptomatic after treatment with biologics. EMBARQ-CSU1 and EMBARQ-CSU2 will enroll approximately 915 patients each across 40 countries and 500 sites.

- The Company is currently planning a global Phase 3 program in chronic inducible urticaria (CIndU), which is expected to initiate in 2025.

Phase 2 Development

- Barzolvolimab met all primary and secondary endpoints at 12 weeks across the Company’s Phase 2 studies in CSU and CIndU. Results were highly statistically significant and clinically meaningful.

- 52 week data from the Phase 2 study in CSU (n=208) were presented in a late breaking oral presentation at the EADV Congress 2024. A deepening of response was observed over the 52 week treatment period and barzolvolimab demonstrated the highest rate of complete response observed in a well controlled study in CSU with 71% of patients (150 mg Q4W) achieving a complete response at Week 52. Importantly, barzolvolimab was also well tolerated through 52 weeks. The Company anticipates presenting 76 week data (52 weeks of treatment; 24 weeks of follow up post treatment) from the study in 2025.

- 12 week primary endpoint data from the Phase 2 study in CIndU (n=196) were presented in a late breaking oral presentation at the ACAAI Annual Scientific Meeting 2024. Barzolvolimab is the first drug to demonstrate clinical benefit in patients with chronic inducible urticaria in a large, randomized, placebo-controlled study. Up to 53.1% of patients with cold urticaria (ColdU) and 57.6% of patients with symptomatic dermographism (SD) treated with barzolvolimab experienced a complete response (per provocation test) compared to placebo rates of only 12.5% (p=0.0011) in ColdU and 3.2% (p<0.0001) in SD—the primary endpoint of the study. Secondary and exploratory endpoints were highly supportive of the primary endpoint. Patients on study continued to receive barzolvolimab or placebo for up 20 weeks and are being followed for an additional 24 weeks. The study also includes an Open Label Extension. The Company anticipates presenting data through week 44 in 2025 (20 weeks of treatment; 24 weeks of follow up post treatment; patients with returning symptoms can enter open label extension during follow up period).

Additional Indications

- A Phase 2 study in eosinophilic esophagitis (EoE) is fully accrued. This randomized, double-blind, placebo-controlled, parallel group study is evaluating the efficacy and safety profile of barzolvolimab in patients with active EoE. Data from this study is expected in 2025.

- Enrollment continues in the Phase 2 study in prurigo nodularis (PN). This randomized, double-blind, placebo-controlled, parallel group study is evaluating the efficacy and safety profile of barzolvolimab in approximately 120 patients with moderate to severe PN who had inadequate response to prescription topical medications, or for whom topical medications are medically inadvisable, including patients who received prior biologics.

- A Phase 2 study in atopic dermatitis (AD) was initiated in December 2024 and enrollment is ongoing. This randomized, double-blind, placebo-controlled, parallel group study is evaluating the efficacy and safety profile of barzolvolimab in approximately 120 patients with moderate to severe AD.

Bispecific Antibody Platform

CDX-622 – Bispecific SCF & TSLP

CDX-622 targets two complementary pathways that drive chronic inflammation, potently neutralizing the alarmin thymic stromal lymphopoietin (TSLP) and depleting mast cells via stem cell factor (SCF) starvation. Combined neutralization of SCF and TSLP with CDX-622 is expected to simultaneously reduce tissue mast cells and inhibit Type 2 inflammatory responses to potentially offer enhanced therapeutic benefit in inflammatory and fibrotic disorders.

- A Phase 1 study in healthy volunteers was initiated in November 2024 and enrollment is ongoing. This two-part randomized, double-blind, placebo-controlled, Phase 1 dose escalation study is designed to assess the safety, pharmacokinetics, and pharmacodynamics of single ascending doses (Part 1) and multiple ascending doses (Part 2) of CDX-622 in up to 56 healthy participants. The pharmacodynamic biomarkers from blood and skin will be highly informative on the ability of CDX-622 to engage and neutralize SCF and TSLP.

Fourth Quarter and Twelve Months 2024 Financial Highlights and 2025 Guidance

Cash Position: Cash, cash equivalents and marketable securities as of December 31, 2024 were $725.3 million compared to $756.0 million as of September 30, 2024. The decrease was primarily driven by fourth quarter cash used in operating activities of $32.5 million. At December 31, 2024, Celldex had 66.4 million shares outstanding.

Revenues: Total revenue was $1.2 million in the fourth quarter of 2024 and $7.0 million for the year ended December 31, 2024, compared to $4.1 million and $6.9 million for the comparable periods in 2023. The decrease in revenue for the fourth quarter of 2024, as compared to the fourth quarter of 2023, was primarily due to a decrease in services performed under our manufacturing and research and development agreements with Rockefeller University.

R&D Expenses: Research and development (R&D) expenses were $46.9 million in the fourth quarter of 2024 and $163.6 million for the year ended December 31, 2024, compared to $30.4 million and $118.0 million for the comparable periods in 2023. The increase in R&D expenses was primarily due to an increase in barzolvolimab clinical trial and personnel expenses, partially offset by a decrease in barzolvolimab contract manufacturing expenses.

G&A Expenses: General and administrative (G&A) expenses were $10.3 million in the fourth quarter of 2024 and $38.5 million for the year ended December 31, 2024, compared to $8.8 million and $30.9 million for the comparable periods in 2023. The increase in G&A expenses was primarily due to an increase in stock-based compensation and barzolvolimab commercial planning expenses.

Litigation Settlement Related Loss: During the fourth quarter of 2023, the Company announced positive topline results from its Phase 2 clinical trial of barzolvolimab in patients with moderate to severe CSU, satisfying the “Successful Completion” of a Phase 2 clinical trial of barzolvolimab milestone pursuant to the Company’s settlement agreement with SRS. During the fourth quarter of 2023, we paid the $12.5 million milestone in cash and recorded a litigation settlement related loss of $12.5 million.

Net Loss: Net loss was $47.1 million, or ($0.71) per share, for the fourth quarter of 2024, and $157.9 million, or ($2.45) per share, for the year ended December 31, 2024, compared to a net loss of $43.3 million, or ($0.83) per share, for the fourth quarter of 2023, and $141.4 million, or ($2.92) per share, for the year ended December 31, 2023.

Financial Guidance: Celldex believes that the cash, cash equivalents and marketable securities at December 31, 2024 are sufficient to meet estimated working capital requirements and fund current planned operations through 2027.

About Celldex Therapeutics, Inc.

Celldex is a clinical stage biotechnology company leading the science at the intersection of mast cell biology and the development of transformative therapeutics for patients. Our pipeline includes antibody-based therapeutics which have the ability to engage the human immune system and/or directly affect critical pathways to improve the lives of patients with severe inflammatory, allergic, autoimmune and other devastating diseases. Visit www.celldex.com.

Forward Looking Statement

This release contains "forward-looking statements" made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are typically preceded by words such as "believes," "expects," "anticipates," "intends," "will," "may," "should," or similar expressions. These forward-looking statements reflect management's current knowledge, assumptions, judgment and expectations regarding future performance or events. Although management believes that the expectations reflected in such statements are reasonable, they give no assurance that such expectations will prove to be correct or that those goals will be achieved, and you should be aware that actual results could differ materially from those contained in the forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, our ability to successfully complete research and further development and commercialization of Company drug candidates, including barzolvolimab (also referred to as CDX-0159), in current or future indications; the uncertainties inherent in clinical testing and accruing patients for clinical trials; our limited experience in bringing programs through Phase 3 clinical trials; our ability to manage and successfully complete multiple clinical trials and the research and development efforts for our multiple products at varying stages of development; the availability, cost, delivery and quality of clinical materials produced by our own manufacturing facility or supplied by contract manufacturers, who may be our sole source of supply; the timing, cost and uncertainty of obtaining regulatory approvals; the failure of the market for the Company's programs to continue to develop; our ability to protect the Company's intellectual property; the loss of any executive officers or key personnel or consultants; competition; changes in the regulatory landscape or the imposition of regulations that affect the Company's products; our ability to continue to obtain capital to meet our long-term liquidity needs on acceptable terms, or at all, including the additional capital which will be necessary to complete the clinical trials that we have initiated or plan to initiate; and other factors listed under "Risk Factors" in our annual report on Form 10-K and quarterly reports on Form 10-Q.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this release. We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Company Contact

Sarah Cavanaugh

Senior Vice President, Corporate Affairs & Administration

(508) 864-8337

scavanaugh@celldex.com

Patrick Till

Meru Advisors

(484) 788-8560

ptill@meruadvisors.com

| CELLDEX THERAPEUTICS, INC. | |

| (In thousands, except per share amounts) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | Three Months | | Year | |

| Consolidated Statements of Operations Data | | Ended December 31, | | Ended December 31, | |

| | | | 2024 | | 2023 | | 2024 | | 2023 | |

| | | | (Unaudited) | | | | | |

| Revenues: | | | | | | | | | |

| Product development and licensing agreements | | $ | 8 | | | $ | 259 | | | $ | 13 | | | $ | 278 | | |

| Contracts and grants | | | 1,167 | | | | 3,873 | | | | 7,007 | | | | 6,605 | | |

| | | | | | | | | | | |

| Total revenues | | | 1,175 | | | | 4,132 | | | | 7,020 | | | | 6,883 | | |

| | | | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Research and development | | | 46,939 | | | | 30,427 | | | | 163,550 | | | | 118,011 | | |

| General and administrative | | | 10,263 | | | | 8,832 | | | | 38,548 | | | | 30,914 | | |

| Litigation settlement related loss | | | - | | | | 12,500 | | | | - | | | | 12,500 | | |

| | | | | | | | | | | |

| Total operating expenses | | | 57,202 | | | | 51,759 | | | | 202,098 | | | | 161,425 | | |

| | | | | | | | | | | |

| Operating loss | | | (56,027 | ) | | | (47,627 | ) | | | (195,078 | ) | | | (154,542 | ) | |

| | | | | | | | | | | |

| Investment and other income, net | | | 8,935 | | | | 4,321 | | | | 37,215 | | | | 13,113 | | |

| | | | | | | | | | | |

| Net loss | | $ | (47,092 | ) | | $ | (43,306 | ) | | $ | (157,863 | ) | | $ | (141,429 | ) | |

| | | | | | | | | | | |

| Basic and diluted net loss per common share | | $ | (0.71 | ) | | $ | (0.83 | ) | | $ | (2.45 | ) | | $ | (2.92 | ) | |

| | | | | | | | | | | |

| Shares used in calculating basic and diluted net loss per share | | | 66,353 | | | | 52,028 | | | | 64,395 | | | | 48,449 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Condensed Consolidated Balance Sheet Data | | | | | | December 31, | | December 31, | |

| | | | | | | | 2024 | | 2023 | |

| | | | | | | | | | | |

| Assets | | | | | | | | | |

| Cash, cash equivalents and marketable securities | | | | | | $ | 725,281 | | | $ | 423,598 | | |

| Other current assets | | | | | | | 21,878 | | | | 8,095 | | |

| Property and equipment, net | | | | | | | 4,346 | | | | 4,060 | | |

| Intangible and other assets, net | | | | | | | 40,835 | | | | 29,874 | | |

| | Total assets | | | | | | $ | 792,340 | | | $ | 465,627 | | |

| | | | | | | | | | | |

| Liabilities and stockholders' equity | | | | | | | | | |

| Current liabilities | | | | | | $ | 39,501 | | | $ | 31,125 | | |

| Long-term liabilities | | | | | | | 5,834 | | | | 5,331 | | |

| Stockholders' equity | | | | | | | 747,005 | | | | 429,171 | | |

| | Total liabilities and stockholders' equity | | | | | | $ | 792,340 | | | $ | 465,627 | | |

| | | | | | | | | | | |

v3.25.0.1

Cover

|

Feb. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2025

|

| Entity File Number |

000-15006

|

| Entity Registrant Name |

Celldex Therapeutics, Inc.

|

| Entity Central Index Key |

0000744218

|

| Entity Tax Identification Number |

13-3191702

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Perryville III Building, 53 Frontage Road, Suite 220

|

| Entity Address, City or Town |

Hampton

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08827

|

| City Area Code |

908

|

| Local Phone Number |

200-7500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $.001

|

| Trading Symbol |

CLDX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

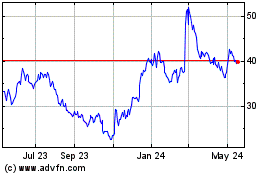

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From Mar 2024 to Mar 2025