Follows Recommendation from Institutional

Shareholder Services (“ISS”) That Shareholders Vote FOR the

Proposed Transaction

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) (the

“Company” or “Consolidated”), a top 10 fiber provider in the U.S.,

today announced that a leading independent proxy advisory firm,

Glass Lewis & Co. (“Glass Lewis”), has joined Institutional

Shareholder Services (“ISS”) in recommending that Consolidated

shareholders vote “FOR” the proposed acquisition of the Company by

affiliates of Searchlight Capital Partners, L.P. (“Searchlight”)

and British Columbia Investment Management Corporation (“BCI”) (the

“Proposed Transaction”).

The Company’s special meeting of shareholders (the “Special

Meeting”) to vote on the Proposed Transaction is scheduled to be

held on January 31, 2024. Shareholders of record as of December 13,

2023, are entitled to vote at the Special Meeting. Consolidated

urges its shareholders to vote “FOR” the Proposed Transaction

today.

Consolidated issued the following statement regarding the Glass

Lewis recommendation to vote FOR the Proposed Transaction:

“Glass Lewis joining ISS in its support of

the Proposed Transaction underscores the financially compelling and

certain value that this transaction delivers to our shareholders.

Following its extensive and thorough review, the Board believes

this transaction is critical for Consolidated’s future and

represents the best risk-adjusted outcome for shareholders.”

In recommending that Company shareholders vote FOR the Proposed

Transaction, Glass Lewis stated1:

- “We also acknowledge that several of the Company’s peers have

seen significant declines in their share price during the period

following the announcement of the Consortium’s initial offer. In

this context, while optimistic shareholders may believe the

long-term upside of seeing out the fiber investment outweighs the

Consortium’s offer, we ultimately believe the certain and immediate

value and liquidity offered in the sale is sufficiently attractive

to warrant shareholder support, in the absence of any adverse

future developments.”

- “[We] concur with the board’s view that the Company’s near-term

standalone share price would likely fall if the transaction is not

approved.”

- “…we do not believe there is sufficient evidence to suggest

that the risk-adjusted value and premiums offered by the all-cash

consideration are unreasonable. We believe the Advisor’s fairness

opinion provides a basis to suggest that the Company is generally

being valued within a reasonable range, and that our supplementary

review offers more evidence that the valuation of the Company on a

forward multiples basis is not inconsistent with peers.”

_______________________

1 Permission to use quotations from Glass Lewis was neither

sought nor obtained.

Shareholders with questions or who require assistance voting

their shares should contact Consolidated’s proxy solicitor, Morrow

Sodali. Shareholders may call toll-free: (800) 662-5200 or +1 (203)

658-9400 (international) or email CNSL@info.morrowsodali.com.

Advisors

Rothschild & Co is acting as financial advisor to the

special committee and Cravath, Swaine & Moore LLP is acting as

its legal counsel. Latham & Watkins LLP is providing legal

counsel to Consolidated Communications.

About Consolidated Communications

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) is

dedicated to moving people, businesses and communities forward by

delivering the most reliable fiber communications solutions.

Consumers, businesses and wireless and wireline carriers depend on

Consolidated for a wide range of high-speed internet, data, phone,

security, cloud and wholesale carrier solutions. With a network

spanning nearly 60,000 fiber route miles, Consolidated is a top 10

U.S. fiber provider, turning technology into solutions that are

backed by exceptional customer support.

Forward-Looking

Statements

Certain statements in this communication are forward-looking

statements and are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements reflect, among other things, the

Company’s current expectations, plans, strategies and anticipated

financial results.

There are a number of risks, uncertainties and conditions that

may cause the Company’s actual results to differ materially from

those expressed or implied by these forward-looking statements,

including: (i) the risk that the Proposed Transaction may not be

completed in a timely manner or at all; (ii) the failure to

receive, on a timely basis or otherwise, the required approvals of

the Proposed Transaction by the Company’s stockholders; (iii) the

possibility that any or all of the various conditions to the

consummation of the Proposed Transaction may not be satisfied or

waived, including the failure to receive any required regulatory

approvals from any applicable governmental entities (or any

conditions, limitations or restrictions placed on such approvals);

(iv) the possibility that competing offers or acquisition proposals

for the Company will be made; (v) the occurrence of any event,

change or other circumstance that could give rise to the

termination of the definitive transaction agreement relating to the

Proposed Transaction, including in circumstances which would

require the Company to pay a termination fee; (vi) the effect of

the announcement or pendency of the Proposed Transaction on the

Company’s ability to attract, motivate or retain key executives and

employees, its ability to maintain relationships with its

customers, suppliers and other business counterparties, or its

operating results and business generally; (vii) risks related to

the Proposed Transaction diverting management’s attention from the

Company’s ongoing business operations; (viii) the amount of costs,

fees and expenses related to the Proposed Transaction; (ix) the

risk that the Company’s stock price may decline significantly if

the Proposed Transaction is not consummated; (x) the risk of

shareholder litigation in connection with the Proposed Transaction,

including resulting expense or delay; and (xi) (A) the risk factors

described in Part I, Item 1A of Risk Factors in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2022 and

(B) the other risk factors identified from time to time in the

Company’s other filings with the SEC. Filings with the SEC are

available on the SEC’s website at http://www.sec.gov.

Many of these circumstances are beyond the Company’s ability to

control or predict. These forward-looking statements necessarily

involve assumptions on the Company's part. These forward-looking

statements generally are identified by the words “believe,”

“expect,” “anticipate,” “intend,” “plan,” “should,” “may,” “will,”

“would” or similar expressions. All forward-looking statements

attributable to the Company or persons acting on the Company’s

behalf are expressly qualified in their entirety by the cautionary

statements that appear throughout this communication. Furthermore,

undue reliance should not be placed on forward-looking statements,

which are based on the information currently available to the

Company and speak only as of the date they are made. The Company

disclaims any intention or obligation to update or revise publicly

any forward-looking statements.

Additional Information and Where to Find

It

This communication may be deemed to be solicitation material in

respect of the Proposed Transaction. The Special Meeting will be

held on January 31, 2024 at 9:00 A.M. Central Time, at which

meeting the stockholders of the Company will be asked to consider

and vote on a proposal to adopt the merger agreement and approve

the Proposed Transaction. In connection with the Proposed

Transaction, the Company filed relevant materials with the SEC,

including the Proxy Statement. The Company commenced mailing the

Proxy Statement and a proxy card to each stockholder of the Company

entitled to vote at the Special Meeting on December 18, 2023. In

addition, the Company and certain affiliates of the Company jointly

filed an amended transaction statement on Schedule 13e-3 (the

“Schedule 13e-3”). INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE

URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING

THE PROXY STATEMENT AND THE SCHEDULE 13E-3, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT THE COMPANY, SEARCHLIGHT AND BCI AND

THE PROPOSED TRANSACTION. Investors and stockholders of the Company

are able to obtain these documents free of charge from the SEC’s

website at www.sec.gov, or free of charge from the Company by

directing a request to the Company at 2116 South 17th Street,

Mattoon, IL 61938, Attention: Investor Relations or at tel: +1

(844) 909-2675.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240122494259/en/

Philip Kranz, Investor Relations +1 217-238-8480

Philip.kranz@consolidated.com

Jennifer Spaude, Media Relations +1 507-386-3765

Jennifer.spaude@consolidated.com

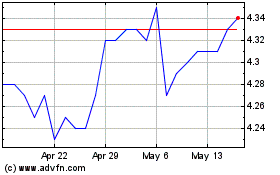

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Feb 2024 to Feb 2025