CytomX Therapeutics, Inc. (Nasdaq: CTMX), a leader in the field of

masked, conditionally activated biologics, today announced 2024

financial results and provided a business update.

“Throughout 2024 we continued to advance and

prioritize our multi-modality clinical pipeline with disciplined

capital allocation. Entering 2025, our top strategic priority is

the clinical development of our lead program, CX-2051, in advanced

colorectal cancer. CX-2051 is a masked EpCAM-targeting ADC armed

with a topoisomerase-1 payload, specifically designed to address

profound unmet need in CRC. EpCAM is highly expressed in more than

90 percent of colorectal cancers and we believe our PROBODY

platform offers a unique strategy to unlock the tremendous

potential of this previously undruggable target,” said Sean

McCarthy, D.Phil., chief executive officer and chairman of

CytomX.

Dr. McCarthy continued, “We are encouraged by

our progress to date in the first in human evaluation of CX-2051,

having successfully escalated to doses predicted to be in the

biologically active range. We believe CX-2051 is behaving as

designed, and we look forward to sharing preliminary clinical data

and future plans for CX-2051 in the coming months. We are

optimistic about the potential for CX-2051 in colorectal cancer,

and also in many other solid tumor types that express EpCAM and

where major unmet needs remain to be addressed.”

Pipeline Program Updates:

CX-2051 (EpCAM PROBODY Topo-1

ADC)

- CX-2051 has been

prioritized as Company’s lead clinical program with an initial

focus in advanced metastatic CRC. The Phase 1 study of CX-2051 was

initiated in April of 2024 and is focused on advanced metastatic

CRC, one of many tumor types where there is high expression of

EpCAM. CX-2051 contains a next generation topoisomerase-1 payload

(CAMP59) and a cleavable payload-antibody linker licensed from

AbbVie (formerly Immunogen).

- EpCAM (Epithelial

Cell Adhesion Molecule) is a highly expressed tumor antigen that

has been previously undruggable with systemically administered

agents due to expression on normal tissues. CX-2051 is designed to

open a therapeutic window for this high potential target and

deliver meaningful anti-cancer activity in solid tumors, including

CRC. CRC remains an area of high unmet medical need, especially in

the late-line setting, where outcomes from currently approved

standard of care remain extremely poor, with objective response

rates in the low-single digit percentages and approximately two to

four months of progression free survival1.

- The CX-2051 study

is currently enrolling patients with advanced CRC who have

generally received three or more prior lines of systemic therapy in

the metastatic setting. Enrolled patients are not being

pre-selected for EpCAM expression or for disease characteristics

such as KRAS mutational status or liver

metastases.

- In Phase 1 dose

escalation to date, CX-2051 has demonstrated a favorable

tolerability profile and doses predicted to be therapeutically

active, based on preclinical modeling, have been attained.

- The CX-2051 Phase 1

study is ongoing and is evaluating the seventh dose level.

- Initial Phase 1a

data in CRC are expected to be presented in the first half of

2025.

CX-801 (PROBODY Interferon-alpha

2b)

- Phase 1 dose

escalation continues with a focused early development strategy in

metastatic melanoma and with the goal of initiating combination

therapy with CX-801 and KEYTRUDA® in 2025.

- The Phase 1 study

is currently in the fourth monotherapy dose escalation cohort where

the dose of CX-801 exceeds the approved dose of the unmasked

peginterferon alfa-2b (SYLATRON™)2.

- Initial Phase 1a

translational and biomarker data in advanced melanoma is expected

in the second half of 2025.

KEYTRUDA® is a registered trademark of Merck Sharp & Dohme

LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ, USA

CX-904 (EGFR-CD3 PROBODY

TCE)

- Based on CX-904

clinical observations to-date as well as CytomX pipeline

priorities, CytomX and Amgen have jointly decided to not further

develop CX-904.

Corporate and Financial:

-

Organization: In January 2025, CytomX announced a

reduction of organizational headcount by approximately 40 percent

in order to direct capital resources primarily to CX-2051 and

create additional flexibility in its cost structure. Headcount

reductions primarily impact areas supporting non-partnered early

research and general and administrative functions and are expected

to be completed by the end of the first quarter of 2025.

-

Financial: Cost reductions realized from the

January 2025 restructuring combined with focused clinical

development priorities are expected to extend cash runway into the

second quarter of 2026. CytomX ended 2024 with $100.6 million of

cash, cash equivalents and investments.

- Research

collaborations:

- New milestone

achieved in Astellas T-cell engager collaboration: In February

2025, Astellas advanced the second program to GLP toxicology

studies, triggering a $5 million milestone payment to CytomX.

- Multiple drug

discovery programs continue across our research collaborations with

a focus on T-cell engagers. CytomX has research collaborations with

Bristol Myers Squibb, Amgen, Astellas, Regeneron, and Moderna.

__________________________________1 Lonsurf®,

Fruzaqla®, Stivarga® package inserts.2 SYLATRON Prescribing

Information

Full Year 2024 Financial

Results:

Cash, cash equivalents and investments totaled

$100.6 million as of December 31, 2024, compared to $174.5 million

as of December 31, 2023.

Total revenue was $138.1 million for the year

ended December 31, 2024, compared to $101.2 million in 2023. The

increase in revenue was driven primarily by a higher percentage of

completion for research programs in the Bristol Myers Squibb

collaboration as well as the collaborations with Moderna, Astellas,

and Regeneron.

In 2024, CytomX remained focused on controlling

costs and efficiently progressing its pipeline programs. Total

operating expense in 2024 was $113.1 million compared to $107.7

million in 2023, an increase of $5.4 million. The increase in

operating expenses was primarily due to a $5.0 million milestone

payment to AbbVie (formerly ImmunoGen) as a result of dosing the

first patient for CX-2051 in Phase 1 based upon the ImmunoGen 2019

License Agreement.

Research and development expenses increased by

$5.7 million during the year ended December 31, 2024, to $83.4

million compared to $77.7 million in 2023. The $5.0 million

milestone payment to AbbVie for dosing of the first patient in the

CX-2051 Phase 1 study was recorded in 2024 as a research and

development expense and was the primary driver of increased

research and development spend in 2024 compared to 2023.

General and administrative expenses were essentially flat in

2024 compared to 2023, decreasing by $0.3 million to $29.7 million

for the year ended December 31, 2024.

About CytomX

TherapeuticsCytomX is a clinical-stage, oncology-focused

biopharmaceutical company focused on developing novel conditionally

activated, masked biologics designed to be localized to the tumor

microenvironment. By pioneering a novel pipeline of localized

biologics, powered by its PROBODY® therapeutic platform, CytomX’s

vision is to create safer, more effective therapies for the

treatment of cancer. CytomX’s robust and differentiated pipeline

comprises therapeutic candidates across multiple treatment

modalities including antibody-drug conjugates (“ADCs”), T-cell

engagers, and immune modulators such as cytokines. CytomX’s

clinical-stage pipeline includes CX-2051, CX-904 and CX-801.

CX-2051 is a masked, conditionally activated ADC directed toward

epithelial cell adhesion molecule (EpCAM), armed with a

topoisomerase-1 inhibitor payload. CX-2051 has potential

applicability across multiple EpCAM-expressing epithelial cancers,

including CRC, and was discovered in collaboration with ImmunoGen,

now part of AbbVie. CX-904 is a masked, conditionally activated

T-cell-engaging bispecific antibody targeting the epidermal growth

factor receptor (EGFR) on tumor cells and the CD3 receptor on T

cells. CX-904 is partnered with Amgen in a global co-development

alliance. CX-801 is a masked interferon alpha-2b PROBODY® cytokine

with broad potential applicability in traditionally immuno-oncology

sensitive as well as insensitive (cold) tumors. CytomX has

established strategic collaborations with multiple leaders in

oncology, including Amgen, Astellas, Bristol Myers Squibb,

Regeneron and Moderna. For more information about CytomX and how it

is working to make conditionally activated treatments the new

standard-of-care in the fight against cancer,

visit www.cytomx.com and follow us

on LinkedIn and X

(formerly Twitter).

CytomX Therapeutics Forward-Looking

StatementsThis press release includes forward-looking

statements. Such forward-looking statements involve known and

unknown risks, uncertainties and other important factors that are

difficult to predict, may be beyond our control, and may cause the

actual results, performance, or achievements to be materially

different from any future results, performance or achievements

expressed or implied in such statements, including those related to

the future potential of partnerships or collaboration agreements

and projected cash runway. Accordingly, you should not rely on any

of these forward-looking statements, including those relating to

the potential benefits, safety and efficacy or progress of CytomX’s

or any of its collaborative partners’ product candidates, including

CX-2051 and CX-801, the potential benefits or applications of

CytomX’s PROBODY® therapeutic platform, CytomX’s or its

collaborative partners’ ability to develop and advance product

candidates into and successfully complete clinical trials,

including the ongoing and planned clinical trials of CX-2051 and

CX-801 and the timing of initial and ongoing data availability for

our clinical trials, including CX-2051, CX-904 and CX-801, and

other development milestones. Risks and uncertainties that

contribute to the uncertain nature of the forward-looking

statements include: the unproven nature of CytomX’s novel PROBODY®

therapeutic technology; uncertainties around the Company’s ability

to raise sufficient funds to carry out its planned research and

development; CytomX’s clinical trial product candidates are in the

initial stages of clinical development and its other product

candidates are currently in preclinical development, and the

process by which preclinical and clinical development could

potentially lead to an approved product is long and subject to

significant risks and uncertainties, including the possibility that

the results of preclinical research and early clinical trials,

including initial CX-2051 and CX-801 results, may not be predictive

of future results; the possibility that CytomX’s clinical trials

will not be successful; the possibility that current preclinical

research may not result in additional product candidates; CytomX’s

dependence on the success of CX-2051 and CX-801; CytomX’s reliance

on third parties for the manufacture of the Company’s product

candidates; possible regulatory developments in the United States

and foreign countries; and the risk that we may incur higher costs

than expected for research and development or unexpected costs and

expenses or may not obtain expected savings from our announced

restructuring. Additional applicable risks and uncertainties

include those relating to our preclinical research and development,

clinical development, and other risks identified under the heading

"Risk Factors" included in CytomX’s Quarterly Report on Form 10-K

filed with the SEC on March 6, 2025. The forward-looking statements

contained in this press release are based on information currently

available to CytomX and speak only as of the date on which they are

made. CytomX does not undertake and specifically disclaims any

obligation to update any forward-looking statements, whether as a

result of any new information, future events, changed circumstances

or otherwise.

PROBODY is a U.S. registered trademark of CytomX

Therapeutics, Inc. All other trademarks are the properties of their

respective owners.

Company Contact:Chris OgdenSVP,

Chief Financial Officercogden@cytomx.com

Investor Contact:Precision AQ

(formerly Stern Investor Relations)Stephanie

AscherStephanie.Ascher@precisionaq.com

Media Contact:Redhouse

CommunicationsTeri Dahlmanteri@redhousecomms.com

|

CYTOMX THERAPEUTICS, INC.STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (LOSS)(in

thousands, except share and per share data) |

| |

| |

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

$ |

138,103 |

|

|

$ |

101,214 |

|

| Operating expenses: |

|

|

|

|

Research and development |

|

83,382 |

|

|

|

77,680 |

|

|

General and administrative |

|

29,726 |

|

|

|

30,018 |

|

|

Total operating expenses |

|

113,108 |

|

|

|

107,698 |

|

| Income (loss) from

operations |

|

24,995 |

|

|

|

(6,484 |

) |

|

Interest income |

|

7,136 |

|

|

|

9,837 |

|

|

Other income (expense), net |

|

(38 |

) |

|

|

(30 |

) |

| Income before income taxes |

|

32,093 |

|

|

|

3,323 |

|

|

Provision for income taxes |

|

224 |

|

|

|

3,892 |

|

| Net income (loss) |

|

31,869 |

|

|

|

(569 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

Unrealized gain (loss) on available-for-sale investments, net of

tax |

|

(68 |

) |

|

|

85 |

|

| Total comprehensive income

(loss) |

$ |

31,801 |

|

|

$ |

(484 |

) |

| Net income (loss) per share: |

|

|

|

|

Basic |

$ |

0.38 |

|

|

$ |

(0.01 |

) |

|

Diluted |

$ |

0.38 |

|

|

$ |

(0.01 |

) |

| Shares used to compute net income

(loss) per share |

|

|

|

|

Basic |

|

84,439,303 |

|

|

|

73,808,237 |

|

|

Diluted |

|

84,745,116 |

|

|

|

73,808,237 |

|

|

CYTOMX THERAPEUTICS, INC.BALANCE

SHEETS(in thousands) |

| |

| |

December 31, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

38,052 |

|

|

$ |

17,171 |

|

|

Short-term investments |

|

62,571 |

|

|

|

157,338 |

|

|

Accounts receivable |

|

3,103 |

|

|

|

3,432 |

|

|

Prepaid expenses and other current assets |

|

3,579 |

|

|

|

4,995 |

|

| Total current assets |

|

107,305 |

|

|

|

182,936 |

|

| Property and equipment, net |

|

2,467 |

|

|

|

3,958 |

|

| Intangible assets, net |

|

583 |

|

|

|

729 |

|

| Goodwill |

|

949 |

|

|

|

949 |

|

| Restricted cash |

|

1,027 |

|

|

|

917 |

|

| Operating lease right-of-use

asset |

|

8,136 |

|

|

|

12,220 |

|

| Other assets |

|

66 |

|

|

|

83 |

|

| Total assets |

$ |

120,533 |

|

|

$ |

201,792 |

|

| Liabilities and

Stockholders' Deficit |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,088 |

|

|

$ |

1,458 |

|

|

Accrued liabilities |

|

12,338 |

|

|

|

17,599 |

|

|

Operating lease liabilities - short term |

|

5,145 |

|

|

|

4,589 |

|

|

Deferred revenues, current portion |

|

67,201 |

|

|

|

132,267 |

|

| Total current liabilities |

|

85,772 |

|

|

|

155,913 |

|

| Deferred revenue, net of current

portion |

|

26,862 |

|

|

|

80,048 |

|

| Operating lease liabilities -

long term |

|

4,240 |

|

|

|

9,385 |

|

| Other long-term liabilities |

|

4,115 |

|

|

|

3,893 |

|

| Total liabilities |

|

120,989 |

|

|

|

249,239 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' deficit |

|

|

|

|

Convertible preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

691,095 |

|

|

|

675,905 |

|

|

Accumulated other comprehensive income |

|

27 |

|

|

|

95 |

|

|

Accumulated deficit |

|

(691,579 |

) |

|

|

(723,448 |

) |

| Total stockholders' deficit |

|

(456 |

) |

|

|

(47,447 |

) |

| Total liabilities and

stockholders' deficit |

$ |

120,533 |

|

|

$ |

201,792 |

|

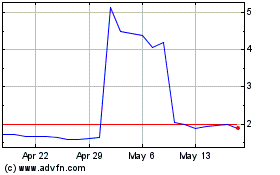

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Feb 2025 to Mar 2025

CytomX Therapeutics (NASDAQ:CTMX)

Historical Stock Chart

From Mar 2024 to Mar 2025