0001101302ENTEGRIS INCfalse00011013022025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) February 6, 2025

_______________________________________

Entegris, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-32598 | | 41-1941551 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 129 Concord Road, | Billerica, | MA | | | 01821 |

| (Address of principal executive offices) | | | (Zip Code) |

(978) 436-6500

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

___________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

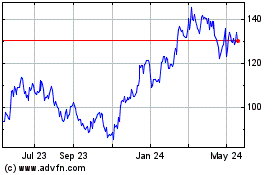

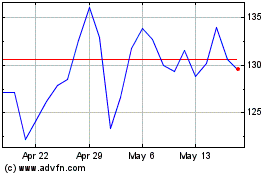

| Common stock, $0.01 par value per share | | ENTG | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 6, 2025, Entegris, Inc. (the "Company") issued a press release to announce results for the fourth quarter of 2024 and will hold a conference call to discuss such results. A copy of this press release and the supplemental slides to which management will refer during the conference call are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

In accordance with General Instructions B.2 of Form 8-K, the information in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. The information set forth herein will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| EXHIBIT INDEX |

Exhibit

No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | | | | | | | | |

| ENTEGRIS, INC. |

| | |

Dated: February 6, 2025 | By: | /s/ Linda LaGorga |

| Name: | Linda LaGorga |

| Title: | Senior Vice President and Chief Financial Officer |

| | | | | | | | | | | | | | |

| | | PRESS RELEASE

Bill Seymour VP of Investor Relations T + 1 952 556 1844 bill.seymour@entegris.com

|

Exhibit 99.1

ENTEGRIS REPORTS RESULTS FOR FOURTH QUARTER OF 2024

•Net sales (as reported) of $850 million, increased 5% from prior year.

•Adjusted net sales (excluding the impact of divestitures) increased 11% from prior year.

•GAAP diluted EPS of $0.67.

•Non-GAAP diluted EPS of $0.84.

BILLERICA, Mass., February 6, 2025 - Entegris, Inc. (NASDAQ: ENTG), today reported its financial results for the Company’s fourth quarter ended December 31, 2024.

Bertrand Loy, Entegris’ President and Chief Executive Officer, said: “We concluded 2024 with strong performance in the fourth quarter, exceeding our guidance for both sales and non-GAAP EPS. For the year, we continued to outperform the market and demonstrated leverage in our model with EBITDA growth that was twice the rate of our sales growth.”

Mr. Loy added: “As we enter 2025, visibility outside of advanced logic and AI-driven applications remains limited and we have yet to see evidence of a significant broad-based semiconductor market rebound. We remain focused on delivering strong market outperformance and profitability, improving free cash flow while continuing to fund critical investments that improve our long-term competitiveness and position us for the industry upturn.”

Mr. Loy concluded: “We are very confident in the strong long-term growth outlook of the semiconductor industry. The industry’s technology roadmaps continue to be opportunity-rich for Entegris, as our customers drive for more complex device architectures and further miniaturization. The resulting process complexity is making our expertise in materials science and materials purity increasingly valuable, positioning us very well for the upcoming technology node transitions, all of which are expected to generate incremental content per wafer opportunities and fuel our market outperformance in the years to come.”

Quarterly Financial Results Summary

(in thousands, except percentages and per share data) | | | | | | | | | | | |

| GAAP Results | Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 |

| Net sales | $849,837 | $812,291 | $807,694 |

| Gross margin - as a % of net sales | 45.6 | % | 42.4 | % | 46.0 | % |

| | | |

| Operating margin - as a % of net sales | 17.6 | % | 12.4 | % | 16.9 | % |

| Net income | $102,243 | $37,977 | $77,582 |

| Diluted earnings per common share | $0.67 | $0.25 | $0.51 |

| | | |

| | | |

| Non-GAAP Results | Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 |

| | | |

| Adjusted gross margin - as a % of net sales | 45.6 | % | 42.4 | % | 46.0 | % |

| Adjusted operating margin - as a % of net sales | 23.5 | % | 20.7 | % | 23.0 | % |

| Adjusted EBITDA - as a % of net sales | 29.2 | % | 26.0 | % | 28.8 | % |

| | | |

| Diluted non-GAAP earnings per common share | $0.84 | $0.65 | $0.77 |

First Quarter Outlook

For the Company’s guidance for the first quarter ending March 29, 2025, the Company expects sales of $775 million to $805 million. The midpoint of this guidance range represents a 7% year-on-year increase, excluding the impact of divestitures. GAAP net income of $58 million to $68 million and diluted earnings per common share is expected to be between $0.38 and

$0.45. On a non-GAAP basis, the Company expects diluted earnings per common share to range from $0.64 to $0.71, reflecting net income on a non-GAAP basis in the range of $97 million to $108 million. The Company also expects adjusted EBITDA of approximately 28.0% to 29.0% of sales.

Segment Results

The Company currently operates in two segments:

Materials Solutions (MS): MS provides materials-based solutions, such as chemical vapor and atomic layer deposition materials, chemical mechanical planarization slurries and pads, ion implantation specialty gases, formulated etch and clean materials, and other specialty materials that enable our customers to achieve better device performance and faster time to yield, while providing for lower total cost of ownership.

Advanced Purity Solutions (APS): APS offers filtration, purification and contamination-control solutions that improve customers’ yield, device reliability and cost by ensuring the purity of critical liquid chemistries and gases and the cleanliness of wafers and other substrates used throughout semiconductor manufacturing processes, the semiconductor ecosystem and other high-technology industries.

Fourth-Quarter Results Conference Call

Entegris will hold a conference call to discuss its results for the fourth quarter on Thursday, February 6, 2025, at 9:00 a.m. Eastern Time. Participants should dial 800-579-2543 or +1 785-424-1789, referencing confirmation ID: ENTGQ424. Participants are asked to dial in 10 minutes prior to the start of the call. For the live webcast and replay of the call, please Click Here.

Management’s slide presentation concerning the results for the fourth quarter will be posted on the Investor Relations section of www.entegris.com.

Entegris, Inc. - page 2 of 15

About Entegris

Entegris is a leading supplier of advanced materials and process solutions for the semiconductor and other high-tech industries. Entegris has approximately 8,000 employees throughout its global operations and is ISO 9001 certified. It has manufacturing, customer service and/or research facilities in the United States, Canada, China, Germany, Israel, Japan, Malaysia, Singapore, South Korea, and Taiwan. Additional information can be found at www.entegris.com.

Non-GAAP Information

The Company’s condensed consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States (GAAP). Adjusted Net Sales, Adjusted EBITDA, Adjusted Gross Profit, Adjusted Segment Profit, Adjusted Operating Income, non-GAAP Net Income, non-GAAP Adjusted Operating Margin and diluted non-GAAP Earnings Per Common Share, together with related measures thereof, are considered “non-GAAP financial measures” under the rules and regulations of the Securities and Exchange Commission. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company provides supplemental non-GAAP financial measures to better understand and manage its business and believes these measures provide investors and analysts additional and meaningful information for the assessment of the Company’s ongoing results. Management also uses these non-GAAP measures to assist in the evaluation of the performance of its business segments and to make operating decisions. Management believes that the Company’s non-GAAP measures help indicate the Company’s baseline performance before certain gains, losses or other charges that may not be indicative of the Company’s business or future outlook, and that non-GAAP measures offer a more consistent view of business performance. The Company believes the non-GAAP measures aid investors’ overall understanding of the Company’s results by providing a higher degree of transparency for such items and providing a level of disclosure that will help investors generally understand how management plans, measures and evaluates the Company’s business performance. Management believes that the inclusion of non-GAAP measures provides greater consistency in its financial reporting and facilitates investors’ understanding of the Company’s historical operating trends by providing an additional basis for comparisons to prior periods. The reconciliations of GAAP net sales to Adjusted Net Sales (excluding divestitures), GAAP gross profit to Adjusted Gross Profit, GAAP segment profit to Adjusted Operating Income, GAAP net income to Adjusted Operating Income and Adjusted EBITDA, GAAP net income and diluted earnings per common share to non-GAAP Net Income and diluted non-GAAP Earnings Per Common Share and GAAP outlook to non-GAAP outlook are included elsewhere in this release.

Cautionary Note on Forward-Looking Statements

This news release contains “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on current management expectations and assumptions only as of the date of this news release. They are not guarantees of future performance and they involve substantial risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. These risks and uncertainties include, but are not limited to, fluctuations in the demand for semiconductors and the overall volume of semiconductor manufacturing; the impact of global economic uncertainty, including volatile financial markets, inflationary pressures and interest rate fluctuations, economic recessions, national debt and bank failures, raw material shortages, supply and labor constraints, and price increases; fluctuations in the Company’s revenues and operating results and their impact on the Company’s stock price; supply chain interruptions and the Company’s dependence on sole, single and limited source suppliers; operational, political and legal risks of the Company’s international operations; the impact of regional and global instabilities, hostilities and geopolitical uncertainty, including, but not limited to, the ongoing conflicts between Ukraine and Russia, and between Israel and Hamas, as well as the global responses thereto; export controls, economic sanctions, and similar restrictions; the concentration and consolidation of the Company’s customer base; the Company’s ability to meet rapid demand shifts; the Company’s ability to continue technological innovation and to introduce new products to meet customers’ rapidly changing requirements; manufacturing and other operational disruptions or delays; IT system failures, network disruptions, and cybersecurity risks; the risks associated with the use and manufacture of hazardous materials; tariffs, additional taxes, and other protectionist measures resulting from international trade disputes, strained international relations, and changes in foreign and national security policy; goodwill impairment; challenges in attracting and retaining qualified personnel; the Company’s ability to protect and enforce intellectual property rights; the Company’s environmental, social, and governance commitments; legal and regulatory risks, including changes in laws and regulations related to the environment, health and safety, accounting standards, and corporate governance, across the jurisdictions in which the Company operates; changes in taxation or adverse tax rulings; the Company’s ability to effectively implement any organizational changes; the ability to obtain government incentives and the possibility that competitors will benefit from government incentives; the amount and

Entegris, Inc. - page 3 of 15

consequences of the Company’s indebtedness, its ability to repay its debt and to obtain future financing, and the Company’s obligations under its current outstanding credit facilities; volatility in the Company’s stock price; the payment of cash dividends and the adoption of future share repurchase programs; challenges associated with a potential change of control; substantial competition; the Company’s ability to identify, complete and integrate acquisitions, joint ventures, divestitures or other similar transactions; the impacts of climate change; and other matters. These risks and uncertainties also include, but are not limited to, the risk factors and additional information described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including under the heading “Risk Factors” in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed on February 15, 2024, and in the Company’s other SEC filings. Except as required under the federal securities laws and the rules and regulations of the SEC, the Company undertakes no obligation to update publicly any forward-looking statements or information contained herein, which speak as of their respective dates.

Entegris, Inc. - page 4 of 15

Entegris, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited) | | | | | | | | | | | | | | |

| | Three months ended |

| | Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 |

| Net sales | $849,837 | $812,291 | $807,694 |

| Cost of sales | 462,582 | 467,611 | 435,869 |

| Gross profit | 387,255 | 344,680 | 371,825 |

| Selling, general and administrative expenses | 109,604 | 144,680 | 108,455 |

| Engineering, research and development expenses | 81,447 | 67,567 | 80,903 |

| Amortization of intangible assets | 46,221 | 50,984 | 46,226 |

| Goodwill impairment | — | 10,432 | — |

| Gain on termination of alliance agreement | — | (30,000) | — |

| Operating income | 149,983 | 101,017 | 136,241 |

| Interest expense, net | 50,524 | 62,101 | 50,419 |

| Other (income) expense, net | (13,029) | 12,058 | (212) |

| Income before income tax expense (benefit) | 112,488 | 26,858 | 86,034 |

| Income tax expense (benefit) | 9,997 | (11,264) | 8,190 |

| Equity in net loss of affiliates | 248 | 145 | 262 |

| Net income | $102,243 | $37,977 | $77,582 |

| | | | |

| | |

| Basic earnings per common share: | $0.68 | $0.25 | $0.51 |

| Diluted earnings per common share: | $0.67 | $0.25 | $0.51 |

| | | |

| Weighted average shares outstanding: | | | |

| Basic | 151,236 | 150,223 | 151,196 |

| Diluted | 151,900 | 151,331 | 151,924 |

Entegris, Inc. - page 5 of 15

Entegris, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited) | | | | | | | | | | | |

| | Twelve months ended |

| | Dec 31, 2024 | Dec 31, 2023 |

| Net sales | $3,241,208 | $3,523,926 |

| Cost of sales | 1,754,489 | 2,026,321 |

| Gross profit | 1,486,719 | 1,497,605 |

| Selling, general and administrative expenses | 446,567 | 576,194 |

| Engineering, research and development expenses | 316,111 | 277,313 |

| Amortization of intangible assets | 190,119 | 214,477 |

| Goodwill impairment | — | 115,217 |

| Gain on termination of alliance agreement | — | (184,754) |

| Operating income | 533,922 | 499,158 |

| Interest expense, net | 207,849 | 301,121 |

| Other expense, net | 4,021 | 25,367 |

| Income before income tax expense (benefit) | 322,052 | 172,670 |

| Income tax expense (benefit) | 28,332 | (8,413) |

| Equity in net loss of affiliates | 933 | 414 |

| Net income | $292,787 | $180,669 |

| | | |

| |

| Basic earnings per common share: | $1.94 | $1.21 |

| Diluted earnings per common share: | $1.93 | $1.20 |

| | | |

| Weighted average shares outstanding: | | |

| Basic | 150,946 | 149,900 |

| Diluted | 151,840 | 150,945 |

Entegris, Inc. - page 6 of 15

Entegris, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited) | | | | | | | | | | | | | | | | | |

| | | Dec 31, 2024 | Dec 31, 2023 |

| ASSETS | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $329,213 | $456,929 |

| Trade accounts and notes receivable, net | 495,312 | 457,052 |

| Inventories, net | | 638,080 | 607,051 |

| Deferred tax charges and refundable income taxes | 39,613 | 63,879 |

| Assets held-for-sale | | | 5,519 | 278,753 |

| Other current assets | 108,567 | 113,663 |

| Total current assets | 1,616,304 | 1,977,327 |

| Property, plant and equipment, net | 1,622,926 | 1,468,043 |

| Right-of-use assets | 83,475 | 80,399 |

| Goodwill | 3,943,571 | 3,945,860 |

| Intangible assets, net | 1,091,746 | 1,281,969 |

| Deferred tax assets and other noncurrent tax assets | 12,463 | 31,432 |

| Other assets | | 24,135 | 27,561 |

| Total assets | | $8,394,620 | $8,812,591 |

| LIABILITIES AND EQUITY | |

| Current liabilities | | | |

| | |

| Accounts payable | | 193,261 | 134,211 |

| Accrued liabilities | | 250,172 | 283,158 |

| Liabilities held-for-sale | | 1,213 | 19,223 |

| Income tax payable | | 80,532 | 77,403 |

| Total current liabilities | 525,178 | 513,995 |

| Long-term debt | 3,981,105 | 4,577,141 |

| Long-term lease liabilities | | 72,159 | 68,986 |

| Other liabilities | | 124,674 | 243,875 |

| Shareholders’ equity | | 3,691,504 | 3,408,594 |

| Total liabilities and equity | $8,394,620 | $8,812,591 |

Entegris, Inc. - page 7 of 15

Entegris, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| Three months ended | Twelve months ended |

| Dec 31, 2024 | Dec 31, 2023 | Dec 31, 2024 | Dec 31, 2023 |

| Operating activities: | | | | |

| Net income | $102,243 | $37,977 | $292,787 | $180,669 |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation | 48,272 | 42,558 | 188,120 | 172,683 |

| Amortization | 46,221 | 50,984 | 190,119 | 214,477 |

| Share-based compensation expense | 15,510 | 8,955 | 65,859 | 61,371 |

| Provision for deferred income taxes | (31,835) | (50,240) | (78,902) | (145,606) |

| Loss on extinguishment of debt | 2,001 | 17,003 | 13,386 | 27,865 |

| Impairment of goodwill | — | 10,432 | — | 115,217 |

| Gain on termination of alliance agreement | — | (30,000) | — | (184,754) |

| (Gain) loss from sale of businesses and held-for-sale assets, net | — | (4,740) | (4,311) | 23,839 |

| Other | 14,852 | 45,398 | 73,647 | 113,232 |

| Changes in operating assets and liabilities, net of effects of acquisitions: | | | | |

| Trade accounts and notes receivable | 3,044 | 903 | (49,031) | 608 |

| Inventories | (7,836) | 39,411 | (76,708) | 102,751 |

| Accounts payable and accrued liabilities | (43,693) | (26,437) | 8,870 | (14,633) |

| Income taxes payable, refundable income taxes and noncurrent taxes payable | 31,597 | 26,597 | 7,889 | (10,177) |

| Other | (4,280) | (10,696) | (4) | (13,066) |

| Net cash provided by operating activities | 176,096 | 158,105 | 631,721 | 644,476 |

| Investing activities: | | | | |

| Acquisition of property and equipment | (107,524) | (128,665) | (315,606) | (456,847) |

| | | | |

| Proceeds, net from sale of businesses | — | 680,674 | 250,789 | 814,960 |

| Proceeds from termination of alliance agreement | — | 21,900 | — | 191,151 |

| Other | (387) | 1,888 | (2,262) | 3,807 |

| Net cash (used in) provided by investing activities | (107,911) | 575,797 | (67,079) | 553,071 |

| Financing activities: | | | | |

| Proceeds from debt | 110,000 | — | 364,537 | 217,449 |

| Payments of debt | (260,000) | (869,725) | (988,311) | (1,473,675) |

| Payments for debt issuance costs | — | — | — | (3,475) |

| Payments for dividends | (15,105) | (15,019) | (60,583) | (60,221) |

| Issuance of common stock | 429 | 5,704 | 14,046 | 35,878 |

| Taxes paid related to net share settlement of equity awards | (688) | (568) | (16,834) | (12,108) |

| | | | |

| | | | |

| Other | (27) | (468) | (1,842) | (1,391) |

| Net cash used in financing activities | (165,391) | (880,076) | (688,987) | (1,297,543) |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (5,653) | 9,083 | (3,371) | (6,514) |

| Decrease in cash, cash equivalents and restricted cash | (102,859) | (137,091) | (127,716) | (106,510) |

| Cash, cash equivalents and restricted cash at beginning of period | 432,072 | 594,020 | 456,929 | 563,439 |

| Cash, cash equivalents and restricted cash at end of period | $329,213 | $456,929 | $329,213 | $456,929 |

Entegris, Inc. - page 8 of 15

Entegris, Inc. and Subsidiaries

Segment Information

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended | Twelve months ended |

| Net sales | Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 | Dec 31, 2024 | Dec 31, 2023 |

| Materials Solutions | $361,079 | $364,965 | $346,634 | $1,400,082 | $1,689,467 |

| Advanced Purity Solutions | 491,193 | 449,779 | 463,131 | 1,850,199 | 1,846,596 |

| | | | | |

| Inter-segment elimination | (2,435) | (2,453) | (2,071) | (9,073) | (12,137) |

| Total net sales | $849,837 | $812,291 | $807,694 | $3,241,208 | $3,523,926 |

| | | | | |

| | | | | | | | | | | | | | | | | |

| Three months ended | Twelve months ended |

| Segment profit | Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 | Dec 31, 2024 | Dec 31, 2023 |

| Materials Solutions | $77,122 | $53,204 | $71,706 | $286,220 | $296,375 |

| Advanced Purity Solutions | 134,966 | 118,021 | 127,315 | 496,131 | 531,448 |

| | | | | |

| Total segment profit | 212,088 | 171,225 | 199,021 | 782,351 | 827,823 |

| Amortization of intangibles | (46,221) | (50,984) | (46,226) | (190,119) | (214,477) |

| Unallocated expenses | (15,884) | (19,224) | (16,554) | (58,310) | (114,188) |

| Total operating income | $149,983 | $101,017 | $136,241 | $533,922 | $499,158 |

Entegris, Inc. - page 9 of 15

Entegris, Inc. and Subsidiaries

Reconciliation of GAAP Gross Profit to Adjusted Gross Profit

(In thousands)

| | | | | | | | | | | | | | | | | |

| Three months ended | Twelve months ended |

| Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 | Dec 31, 2024 | Dec 31, 2023 |

| Net sales | $849,837 | $812,291 | $807,694 | $3,241,208 | $3,523,926 |

| Gross profit-GAAP | $387,255 | $344,680 | $371,825 | $1,486,719 | $1,497,605 |

| Adjustments to gross profit: | | | | | |

Restructuring costs 1 | 429 | 28 | — | 429 | 8,194 |

| | | | | |

| Adjusted gross profit | $387,684 | $344,708 | $371,825 | $1,487,148 | $1,505,799 |

| | | | | |

| Gross margin - as a % of net sales | 45.6 | % | 42.4 | % | 46.0 | % | 45.9 | % | 42.5 | % |

| Adjusted gross margin - as a % of net sales | 45.6 | % | 42.4 | % | 46.0 | % | 45.9 | % | 42.7 | % |

| | | | | |

1 Restructuring charges resulting from cost saving initiatives.

Entegris, Inc. - page 10 of 15

Entegris, Inc. and Subsidiaries

Reconciliation of GAAP Segment Profit to Adjusted Operating Income

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| Three months ended | Twelve months ended | |

| Adjusted segment profit | Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 | Dec 31, 2024 | Dec 31, 2023 | |

| MS segment profit | $77,122 | $53,204 | $71,706 | $286,220 | $296,375 | |

Restructuring costs 1 | 1,154 | | 1,635 | — | 1,154 | 9,261 | |

(Gain) loss on sale of businesses and held-for-sale assets, net 2 | — | | (4,740) | | — | (4,311) | 23,839 | |

Goodwill impairment 3 | — | 10,432 | — | — | 115,217 | |

Gain on termination of alliance agreement 4 | — | (30,000) | — | — | (184,754) | |

Impairment on long-lived assets 5 | — | 30,464 | — | 12,967 | 30,464 | |

| | | | | | |

| MS adjusted segment profit | $78,276 | $60,995 | $71,706 | $296,030 | $290,402 | |

| | | | | | |

| APS segment profit | $134,966 | $118,021 | $127,315 | $496,131 | $531,448 | |

Restructuring costs 1 | 2,121 | | 278 | | — | | 2,121 | | 5,009 | | |

| | | | | | |

| APS adjusted segment profit | $137,087 | $118,299 | $127,315 | $498,252 | $536,457 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Unallocated general and administrative expenses | $15,884 | $19,224 | $16,554 | $58,310 | $114,188 | |

| Less: unallocated deal and integration costs | — | | (7,810) | | (426) | | (3,368) | | (56,526) | | |

Less: unallocated restructuring costs 1 | (655) | (388) | — | (655) | (475) | |

Less: unallocated acquired tax equalization asset reduction 6 | — | — | (2,959) | (2,959) | — | |

| Adjusted unallocated general and administrative expenses | $15,229 | $11,026 | $13,169 | $51,328 | $57,187 | |

| | | | | | |

| Total adjusted segment profit | $215,363 | $179,294 | $199,021 | $794,282 | $826,859 | |

| | | | | | |

| Less: adjusted unallocated general and administrative expenses | (15,229) | (11,026) | (13,169) | (51,328) | (57,187) | |

| Total adjusted operating income | $200,134 | $168,268 | $185,852 | $742,954 | $769,672 | |

1 Restructuring charges resulting from cost saving initiatives.

2 (Gain) loss from the sale of certain businesses and held-for-sale assets, net.

3 Non-cash impairment charges associated with goodwill.

4 Gain on the termination of the alliance agreement with MacDermid Enthone.

5 Impairment of long-lived assets.

6 Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition.

Entegris, Inc. - page 11 of 15

Entegris, Inc. and Subsidiaries

Reconciliation of GAAP Net Income to Adjusted Operating Income and Adjusted EBITDA

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended | Twelve months ended |

| Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 | Dec 31, 2024 | Dec 31, 2023 |

| Net sales | $849,837 | $812,291 | $807,694 | $3,241,208 | $3,523,926 |

| Net income | $102,243 | $37,977 | $77,582 | $292,787 | $180,669 |

| Net income - as a % of net sales | 12.0 | % | 4.7 | % | 9.6 | % | 9.0 | % | 5.1 | % |

| Adjustments to net income: | | | | | |

| Equity in net loss of affiliates | 248 | 145 | 262 | 933 | 414 |

| Income tax expense (benefit) | 9,997 | (11,264) | 8,190 | 28,332 | (8,413) |

| Interest expense, net | 50,524 | 62,101 | 50,419 | 207,849 | 301,121 |

| Other (income) expense, net | (13,029) | 12,058 | (212) | 4,021 | 25,367 |

| GAAP - Operating income | 149,983 | 101,017 | 136,241 | 533,922 | 499,158 |

| Operating margin - as a % of net sales | 17.6 | % | 12.4 | % | 16.9 | % | 16.5 | % | 14.2 | % |

Goodwill impairment 1 | — | 10,432 | — | — | 115,217 |

Deal and transaction costs 2 | — | — | — | — | 3,001 |

| Integration costs: | | | | | |

Professional fees 3 | — | 4,582 | 287 | 2,574 | 36,650 |

Severance costs 4 | — | (395) | 139 | 794 | 1,478 |

Retention costs 5 | — | — | — | — | 1,687 |

Other costs 6 | — | 3,623 | — | — | 13,710 |

Restructuring costs 7 | 3,930 | 2,301 | — | 3,930 | 14,745 |

Acquired tax equalization asset reduction 8 | — | — | 2,959 | 2,959 | — |

(Gain) loss on sale of businesses and held-for-sale assets, net 9 | — | (4,740) | — | (4,311) | 23,839 |

Gain on termination of alliance agreement 10 | — | (30,000) | — | — | (184,754) |

Impairment of long-lived assets 11 | — | 30,464 | — | 12,967 | 30,464 |

Amortization of intangible assets 12 | 46,221 | 50,984 | 46,226 | 190,119 | 214,477 |

| Adjusted operating income | 200,134 | 168,268 | 185,852 | 742,954 | 769,672 |

| Adjusted operating margin - as a % of net sales | 23.5 | % | 20.7 | % | 23.0 | % | 22.9 | % | 21.8 | % |

| Depreciation | 48,272 | 42,558 | 47,098 | 188,120 | 172,683 |

| Adjusted EBITDA | $248,406 | $210,826 | $232,950 | $931,074 | $942,355 |

| Adjusted EBITDA - as a % of net sales | 29.2 | % | 26.0 | % | 28.8 | % | 28.7 | % | 26.7 | % |

1 Non-cash impairment charges associated with goodwill of our Electronic Chemicals and a small, industrial specialty chemicals businesses.

2 Deal and transaction costs associated with the CMC Materials acquisition and completed divestitures.

3 Represents professional and vendor fees recorded in connection with services provided by consultants, accountants, lawyers and other third-party service providers to assist us in integrating CMC Materials into our operations. These fees arise outside of the ordinary course of our continuing operations.

4 Represents severance charges related to the integration of the CMC Materials acquisition.

5 Represents retention charges related directly to the CMC Materials acquisition and completed divestitures, and are not part of our normal, recurring cash operating expenses.

6 Represents other employee-related costs and other costs incurred relating to the CMC Materials acquisition and the completed divestitures. These costs arise outside of the ordinary course of our continuing operations.

7 Restructuring charges resulting from cost saving initiatives.

8 Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition.

9 (Gain) loss from the sale of certain businesses and held-for-sale assets, net.

10 Gain on termination of the alliance agreement with MacDermid Enthone.

11 Impairment of long-lived assets.

12 Non-cash amortization expense associated with intangibles acquired in acquisitions.

Entegris, Inc. - page 12 of 15

Entegris, Inc. and Subsidiaries

Reconciliation of GAAP Net Income and Diluted Earnings per Common Share to Non-GAAP Net Income and Diluted Non-GAAP Earnings per Common Share

(In thousands, except per share data) (Unaudited) | | | | | | | | | | | | | | | | | |

| Three months ended | Twelve months ended |

| Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 | Dec 31, 2024 | Dec 31, 2023 |

| GAAP net income | $102,243 | $37,977 | $77,582 | $292,787 | $180,669 |

| Adjustments to net income: | | | | | |

Goodwill impairment 1 | — | 10,432 | — | — | 115,217 |

Deal and transaction costs 2 | — | — | — | — | 3,001 |

| Integration costs: | | | | | |

Professional fees 3 | — | 4,582 | 287 | 2,574 | 36,650 |

Severance costs 4 | — | (395) | 139 | 794 | 1,478 |

Retention costs 5 | — | — | — | — | 1,687 |

Other costs 6 | — | 3,623 | — | — | 13,710 |

Restructuring costs 7 | 3,930 | 2,301 | — | 3,930 | 14,745 |

Patent infringement settlement gain, net 8 | (20,033) | — | — | (20,033) | — |

Acquired tax equalization asset reduction 9 | — | — | 2,959 | 2,959 | — |

Loss on extinguishment of debt and modification 10 | 2,001 | 17,003 | — | 14,348 | 29,896 |

(Gain) loss on sale of businesses and held-for-sale assets, net 11 | — | (4,740) | — | (4,311) | 23,839 |

Gain on termination of alliance agreement 12 | — | (30,000) | — | — | (184,754) |

Infineum termination fee, net 13 | — | — | — | — | (10,877) |

Impairment of long-lived assets 14 | — | 30,464 | — | 12,967 | 30,464 |

Amortization of intangible assets 15 | 46,221 | 50,984 | 46,226 | 190,119 | 214,477 |

Tax effect of adjustments to net income and discrete tax items16 | (6,837) | (24,288) | (9,611) | (40,146) | (71,284) |

| Non-GAAP net income | $127,525 | $97,943 | $117,582 | $455,988 | $398,918 |

| | | | | |

| Diluted earnings per common share | $0.67 | $0.25 | $0.51 | $1.93 | $1.20 |

| Effect of adjustments to net income | $0.17 | $0.40 | $0.26 | $1.07 | $1.45 |

| Diluted non-GAAP earnings per common share | $0.84 | $0.65 | $0.77 | $3.00 | $2.64 |

| | | | | |

| Diluted weighted averages shares outstanding | 151,900 | 151,331 | 151,924 | 151,840 | 150,945 |

| | | | | |

| | | | | |

1 Non-cash impairment charges associated with goodwill of our Electronic Chemicals and a small, industrial specialty chemicals businesses.

2 Deal and transaction costs associated with the CMC Materials acquisition and completed divestitures.

3 Represents professional and vendor fees recorded in connection with services provided by consultants, accountants, lawyers and other third-party service providers to assist us in integrating CMC Materials into our operations.

4 Represents severance charges related to the integration of the CMC Materials acquisition.

5 Represents retention charges related directly to the CMC Materials acquisition and completed divestitures, and are not part of our normal, recurring cash operating expenses.

6 Represents other employee related costs and other costs incurred relating to the CMC Materials acquisition and the completed divestitures. These costs arise outside of the ordinary course of our continuing operations.

7 Restructuring charges resulting from cost saving initiatives.

8 During the fourth quarter of 2024, the Company settled a patent infringement litigation and received net proceeds of $20.0 million.

9 Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition.

10 Loss on extinguishment of debt and modification of our Existing Credit Agreement.

11 (Gain) loss from the sale of certain businesses and held-for-sale assets, net.

12 Gain on termination of the alliance agreement with MacDermid Enthone.

13 Non-recurring gain from the termination fee with Infineum.

14 Impairment of long-lived assets.

15 Non-cash amortization expense associated with intangibles acquired in acquisitions.

16 The tax effect of pre-tax adjustments to net income was calculated using the applicable marginal tax rate for each respective year.

Entegris, Inc. - page 13 of 15

Entegris, Inc. and Subsidiaries

Reconciliation of Reported Net Sales to Adjusted Net Sales (excluding divestitures) Non-GAAP

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | Twelve months ended |

| | | Dec 31, 2024 | Dec 31, 2023 | Sep 28, 2024 | | | Dec 31, 2024 | Dec 31, 2023 |

| Net sales | | | $849,837 | $812,291 | $807,694 | | | $3,241,208 | $3,523,926 |

Less: divestitures 1 | | | — | | (46,844) | | — | | | | (33,907) | | (458,357) | |

| Adjusted net sales (excluding divestitures) Non-GAAP | | | $849,837 | $765,447 | $807,694 | | | $3,207,301 | $3,065,569 |

1 Adjusted for the impact of net sales from divestitures.

Entegris, Inc. - page 14 of 15

Entegris, Inc. and Subsidiaries

Reconciliation of GAAP Outlook to Non-GAAP Outlook *

(In millions, except per share data)

(Unaudited)

| | | | | |

| First Quarter Outlook |

| Reconciliation GAAP Operating Margin to non-GAAP Operating Margin and Adjusted EBITDA Margin | March 29, 2025 |

| Net sales | $775 - $805 |

| GAAP - Operating income | $116 - $134 |

| Operating margin - as a % of net sales | 15.0% - 16.7% |

| |

| Restructuring costs | 2 | |

| Amortization of intangible assets | 46 | |

| Adjusted operating income | $165 - $182 |

| Adjusted operating margin - as a % of net sales | 21.2% - 22.6% |

| Depreciation | 53 | |

| Adjusted EBITDA | $217 - $233 |

| Adjusted EBITDA - as a % of net sales | 28.0% - 29.0% |

| | | | | |

| First Quarter Outlook |

| Reconciliation GAAP net income to non-GAAP net income | March 29, 2025 |

| GAAP net income | $58 - $68 |

| Adjustments to net income: | |

| |

| Restructuring costs | 2 | |

| Amortization of intangible assets | 46 | |

| |

| Income tax effect | (9) | |

| Non-GAAP net income | $97 - $108 |

| |

| |

| |

| | | | | |

| First Quarter Outlook |

| Reconciliation GAAP diluted earnings per share to non-GAAP diluted earnings per share | March 29, 2025 |

| Diluted earnings per common share | $0.38 - $0.45 |

| Adjustments to earnings per share: | |

| |

| Restructuring costs | 0.01 | |

| Amortization of intangible assets | 0.30 | |

| |

| Income tax effect | (0.06) | |

| Diluted non-GAAP earnings per common share | $0.64 - $0.71 |

| |

| *As a result of displaying amounts in millions, rounding differences may exist in the tables. | |

### END ###

Entegris, Inc. - page 15 of 15

Earnings Summary February 6, 2025 Fourth Quarter 2024 Exhibit 99.2

This news release contains “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on current management expectations and assumptions only as of the date of this news release. They are not guarantees of future performance and they involve substantial risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. These risks and uncertainties include, but are not limited to, fluctuations in the demand for semiconductors and the overall volume of semiconductor manufacturing; the impact of global economic uncertainty, including volatile financial markets, inflationary pressures and interest rate fluctuations, economic recessions, national debt and bank failures, raw material shortages, supply and labor constraints, and price increases; fluctuations in the Company’s revenues and operating results and their impact on the Company’s stock price; supply chain interruptions and the Company’s dependence on sole, single and limited source suppliers; operational, political and legal risks of the Company’s international operations; the impact of regional and global instabilities, hostilities and geopolitical uncertainty, including, but not limited to, the ongoing conflicts between Ukraine and Russia, and between Israel and Hamas, as well as the global responses thereto; export controls, economic sanctions, and similar restrictions; the concentration and consolidation of the Company’s customer base; the Company’s ability to meet rapid demand shifts; the Company’s ability to continue technological innovation and to introduce new products to meet customers’ rapidly changing requirements; manufacturing and other operational disruptions or delays; IT system failures, network disruptions, and cybersecurity risks; the risks associated with the use and manufacture of hazardous materials; tariffs, additional taxes, and other protectionist measures resulting from international trade disputes, strained international relations, and changes in foreign and national security policy; goodwill impairment; challenges in attracting and retaining qualified personnel; the Company’s ability to protect and enforce intellectual property rights; the Company’s environmental, social, and governance commitments; legal and regulatory risks, including changes in laws and regulations related to the environment, health and safety, accounting standards, and corporate governance, across the jurisdictions in which the Company operates; changes in taxation or adverse tax rulings; the Company’s ability to effectively implement any organizational changes; the ability to obtain government incentives and the possibility that competitors will benefit from government incentives; the amount and consequences of the Company’s indebtedness, its ability to repay its debt and to obtain future financing, and the Company’s obligations under its current outstanding credit facilities; volatility in the Company’s stock price; the payment of cash dividends and the adoption of future share repurchase programs; challenges associated with a potential change of control; substantial competition; the Company’s ability to identify, complete and integrate acquisitions, joint ventures, divestitures or other similar transactions; the impacts of climate change; and other matters. These risks and uncertainties also include, but are not limited to, the risk factors and additional information described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including under the heading “Risk Factors” in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed on February 15, 2024, and in the Company’s other SEC filings. Except as required under the federal securities laws and the rules and regulations of the SEC, the Company undertakes no obligation to update publicly any forward-looking statements or information contained herein, which speak as of their respective dates. This presentation contains references to "Adjusted Net Sales ", “Adjusted EBITDA,” “Adjusted EBITDA – as a % of Net Sales,” “Adjusted Operating Income,” “Adjusted Operating Margin,” “Adjusted Gross Profit,” “Adjusted Gross Margin – as a % of Net Sales,” “Adjusted Segment Profit,” “Adjusted Segment Profit Margin,” “Non-GAAP Operating Expenses,” “Non-GAAP Tax Rate,” “Non-GAAP Net Income,” “Diluted Non-GAAP Earnings per Common Share,” “Free Cash Flow,” and other measures that are not presented in accordance GAAP. The non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures but should instead be read in conjunction with the GAAP financial measures. Further information with respect to and reconciliations of such measures to the most directly comparable GAAP measure can be found attached to this presentation. 2 Safe Harbor

3 $ in millions, except per share data 4Q24 4Q23 3Q24 4Q24 over 4Q23 4Q24 over 3Q24 Net Sales $849.8 $812.3 $807.7 4.6% 5.2% Gross Margin 45.6% 42.4% 46.0% Operating Expenses $237.3 $243.7 $235.6 (2.6%) 0.7% Operating Income $150.0 $101.0 $136.2 48.5% 10.1% Operating Margin 17.6% 12.4% 16.9% Tax Rate 8.9% (41.9%) 9.5% Net Income $102.2 $38.0 $77.6 168.9% 31.7% Diluted Earnings Per Common Share $0.67 $0.25 $0.51 168.0% 31.4% Summary – Consolidated Statement of Operations GAAP

4 $ in millions, except per share data 4Q24 4Q23 3Q24 4Q24 over 4Q23 4Q24 over 3Q24 Net Sales $849.8 $812.3 $807.7 4.6% 5.2% Adjusted Gross Margin – as a % of Net Sales 45.6% 42.4% 46.0% Non-GAAP Operating Expenses2 $187.5 $176.4 $186.0 6.3% 0.8% Adjusted Operating Income $200.1 $168.3 $185.9 18.9% 7.6% Adjusted Operating Margin 23.5% 20.7% 23.0% Non-GAAP Tax Rate3 11.6% 11.7% 13.1% Non-GAAP Net Income4 $127.5 $97.9 $117.6 30.2% 8.4% Diluted Non-GAAP Earnings Per Common Share $0.84 $0.65 $0.77 29.2% 9.1% Adjusted EBITDA $248.4 $210.8 $233.0 17.8% 6.6% Adjusted EBITDA – as a % of Net Sales 29.2% 26.0% 28.8% Summary – Consolidated Statement of Operations Non-GAAP1 1.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. 2.Excludes amortization expense, deal and transaction costs, integration costs, goodwill impairment, restructuring costs, impairment of long-lived assets, acquired tax equalization asset reduction and loss (gain) on sale of certain businesses and held-for-sale assets. 3.Reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 4. Excludes the items noted in footnotes 2 and 3, interest expense, net, Infineum termination fee, loss on extinguishment of debt and modification of our Existing Credit Agreement, acquired tax equalization asset reduction, patent infringement settlement gain, net and the tax effect of non-GAAP adjustments. As a result of displaying amounts in millions, rounding differences may exist in the tables.

5 $ in millions 4Q24 4Q23 3Q24 4Q24 over 4Q23 4Q24 over 3Q24 Adjusted Net Sales $849.8 $765.4 $807.7 11.0% 5.2% Adjusted Gross Margin % 45.6% 43.4% 46.0% Non-GAAP Operating Expenses $187.5 $174.0 $186.0 7.8% 0.8% Adjusted Operating Income $200.1 $157.9 $185.9 26.7% 7.6% Adjusted Operating Margin 23.5% 20.6% 23.0% Adjusted EBITDA $248.4 $200.4 $233.0 24.0% 6.6% Adjusted EBITDA Margin 29.2% 26.2% 28.8% Summary – Consolidated Statement of Operations (excluding divestitures)1,2 Non-GAAP 1.Excludes the impact of divestitures of the Electronic Chemicals ("EC"), QED, and the Pipeline and Industrial Materials ("PIM") businesses and termination of alliance agreement with MacDermid Enthone. 2.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. As a result of displaying amounts in millions, rounding differences may exist in the tables. . Excluding Divestitures

6 $ in millions, except per share data Year ended December 31, 2024 Year ended December 31, 2023 Year-over-Year Net Revenue $3,241.2 $3,523.9 (8.0%) Gross Margin 45.9% 42.5% Operating Expenses $952.8 $998.4 (4.6%) Operating Income $533.9 $499.2 7.0% Operating Margin 16.5% 14.2% Tax Rate 8.8% (4.9%) Net Income $292.8 $180.7 62.0% Diluted Earnings Per Common Share $1.93 $1.20 60.8% Summary – Consolidated Statement of Operations GAAP

7 $ in millions, except per share data Year ended December 31, 2024 Year ended December 31, 2023 Year-over-Year Net Sales $3,241.2 $3,523.9 (8.0%) Adjusted Gross Margin 45.9% 42.7% Non-GAAP Operating Expenses2 $744.2 $736.1 1.1% Adjusted Operating Income $743.0 $769.7 (3.5%) Adjusted Operating Margin 22.9% 21.8% Non-GAAP Tax Rate3 13.0% 13.6% Non-GAAP Net Income4 $456.0 $398.9 14.3% Diluted Non-GAAP Earnings Per Common Share $3.00 $2.64 13.6% Summary – Consolidated Statement of Operations Non-GAAP1 1.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. 2.Excludes amortization expense, deal and transaction costs, integration costs, goodwill impairment, restructuring costs, impairment of long-lived assets, acquired tax equalization asset reduction and loss (gain) on sale of certain businesses and held-for-sale assets. 3.Reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 4. Excludes the items noted in footnotes 2 and 3, interest expense, net, Infineum termination fee, loss on extinguishment of debt and modification of our Existing Credit Agreement, acquired tax equalization asset reduction, patent infringement settlement gain, net and the tax effect of non-GAAP adjustments. As a result of displaying amounts in millions, rounding differences may exist in the tables. 7

8 $ in millions, except per share data Year ended December 31, 2024 Year ended December 31, 2023 Year-over-Year Net Sales $3,207.3 $3,065.6 4.6% Adjusted Gross Margin 46.0% 45.3% Non-GAAP Operating Expenses $742.3 $715.2 3.8% Adjusted Operating Income $732.6 $674.7 8.6% Adjusted Operating Margin 22.8% 22.0% Adjusted EBITDA $920.7 $840.0 9.6% Adjusted EBITDA Margin 28.7% 27.4% Summary – Consolidated Statement of Operations (excluding divestitures)1,2 Non-GAAP 1.Excludes the impact of divestitures of the EC, QED, and PIM businesses and termination of alliance agreement with MacDermid Enthone. 2.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. As a result of displaying amounts in millions, rounding differences may exist in the tables. Excluding Divestitures 8

9 1. Excludes the impact of divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. 2. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. As a result of displaying amounts in millions, rounding differences may exist in the tables. . Sales increase ex. divestitures (YOY and SEQ) was driven primarily by CMP consumables, advanced deposition materials and etching chemistries. Segment profit margin (adjusted) increase (SEQ) was driven by operating expense leverage. $ in millions 4Q24 4Q23 3Q24 4Q24 over 4Q23 4Q24 over 3Q24 Net Sales $361.1 $365.0 $346.6 (1.1%) 4.2% Adjusted Net Sales (ex. divestitures)1 $361.1 $318.1 $346.6 13.5% 4.2% Segment Profit $77.1 $53.2 $71.7 44.9% 7.5% Segment Profit Margin 21.4% 14.6% 20.7% Adj. Segment Profit2 $78.3 $61.0 $71.7 28.4% 9.2% Adj. Segment Profit (ex. divestitures)1 $78.3 $50.6 $71.7 54.7% 9.2% Adj. Segment Profit Margin2 21.7% 16.7% 20.7% Adj. Segment Profit Margin (ex. divestitures)1 21.7% 15.9% 20.7% Materials Solutions (MS) 4Q24 Highlights

10 1.During the three months ended December 31, 2024, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). The following prior year information has been recast to reflect this realignment. 2.See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. As a result of displaying amounts in millions, rounding differences may exist in the tables. Advanced Purity Solutions (APS)1 $ in millions 4Q24 4Q23 3Q24 4Q24 over 4Q23 4Q24 over 3Q24 Net Sales $491.2 $449.8 $463.1 9.2% 6.1% Segment Profit $135.0 $118.0 $127.3 14.4% 6.0% Segment Profit Margin 27.5% 26.2% 27.5% Adj. Segment Profit2 $137.1 $118.3 $127.3 15.9% 7.7% Adj. Segment Profit Margin2 27.9% 26.3% 27.5% 4Q24 Highlights Sales increase (YOY) was driven by fluid handling, wafer handling and gas purification. Sales increase (SEQ) was driven by growth in liquid and gas filters; and dispense pumps used in advanced packaging applications. Segment profit margin (adjusted) increase (SEQ) was primarily driven by volume leverage.

11 $ in millions 4Q24 4Q23 3Q24 $ Amount % Total $ Amount % Total $ Amount % Total Cash and Cash Equivalents $329.2 3.9% $456.9 5.2% $432.1 5.1% Accounts Receivable, Net $495.3 5.9% $457.1 5.2% $503.2 5.9% Inventories, Net $638.1 7.6% $607.1 6.9% $643.0 7.6% Net PP&E $1,622.9 19.3% $1,468.0 16.7% $1,542.4 18.2% Total Assets $8,394.6 $8,812.6 $8,472.8 Accounts Payable $193.3 2.3% $134.2 1.5% $174.2 2.1% Other Current Liabilities $331.9 4.0% $379.8 4.3% $347.5 4.1% Long-Term Debt, Including Current Portion $3,981.1 47.4% $4,577.1 51.9% $4,125.7 48.7% Total Liabilities $4,703.1 56.0% $5,404.0 61.3% $4,880.2 57.6% Total Shareholders’ Equity $3,691.5 44.0% $3,408.6 38.7% $3,592.5 42.4% Summary – Balance Sheet Items As a result of displaying amounts in millions, rounding differences may exist in the tables.

12 $ in millions 4Q24 4Q23 FY2024 FY2023 Beginning Cash Balance $432.1 $594.0 $456.9 $563.4 Cash provided by operating activities 176.1 158.1 631.7 644.5 Capital expenditures (107.5) (128.7) (315.6) (456.8) Net payments on debt (150.0) (869.7) (623.8) (1,256.2) Proceeds from sale of businesses — 680.7 250.8 815.0 Payments for dividends (15.1) (15.0) (60.6) (60.2) Proceeds from termination of alliance agreement — 21.9 — 191.2 Other investing activities (0.4) 1.9 (2.3) 3.8 Other financing activities (0.3) 4.6 (4.5) 18.8 Effect of exchange rates (5.7) 9.1 (3.4) (6.5) Ending Cash Balance $329.2 $456.9 $329.2 $456.9 Free Cash Flow1 $68.6 $29.4 $316.1 $187.6 Cash Flows 1. Equals cash from operations less capital expenditures. As a result of displaying amounts in millions, rounding differences may exist in the tables.

13 GAAP $ in millions, except per share data 1Q25 Guidance 4Q24 Actual 3Q24 Actual Net Sales $775 - $805 $849.8 $807.7 Operating Expenses $236 - $240 $237.3 $235.6 Net Income $58 - $68 $102.2 $77.6 Diluted Earnings per Common Share $0.38 - $0.45 $0.67 $0.51 Operating Margin 15.0% - 16.7% 17.6% 16.9% Non-GAAP $ in millions, except per share data 1Q25 Guidance 4Q24 Actual 3Q24 Actual Net Sales $775 - $805 $849.8 $807.7 Non-GAAP Operating Expenses1 $188 - $192 $187.5 $186.0 Non-GAAP Net Income1 $97 - $108 $127.5 $117.6 Diluted non-GAAP Earnings per Common Share1 $0.64 - $0.71 $0.84 $0.77 Adjusted EBITDA Margin 28.0% - 29.0% 29.2% 28.8% Outlook 1. See GAAP to non-GAAP reconciliation tables in the appendix of this presentation. As a result of displaying amounts in millions, rounding differences may exist in the tables.

Entegris®, the Entegris Rings Design®, and other product names are trademarks of Entegris, Inc. as listed on entegris.com/trademarks. All product names, logos, and company names are trademarks or registered trademarks of their respective owners. Use of them does not imply any affiliation, sponsorship, or endorsement by the trademark owner. ©2020 Entegris, Inc. All rights reserved. 14

Appendix 15

16 $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Net Sales $922.4 $901.0 $888.2 $812.3 $3,523.9 $771.0 $812.7 $807.7 $849.8 $3,241.2 Adjusted Gross Margin % 44.3% 42.6% 41.4% 42.4% 42.7% 45.6% 46.2% 46.0% 45.6% 45.9% Non-GAAP Operating Expenses $204.3 $183.2 $172.1 $176.4 $736.1 $173.7 $196.9 $186.0 $187.5 $744.2 Adjusted Operating Income $204.8 $200.9 $195.7 $168.3 $769.7 $178.1 $178.9 $185.9 $200.1 $743.0 Adjusted Operating Margin 22.2% 22.3% 22.0% 20.7% 21.8% 23.1% 22.0% 23.0% 23.5% 22.9% Adjusted EBITDA $251.5 $244.6 $235.3 $210.8 $942.4 $223.4 $226.3 $233.0 $248.4 $931.1 Adjusted EBITDA Margin 27.3% 27.2% 26.5% 26.0% 26.7% 29.0% 27.8% 28.8% 29.2% 28.7% Consolidated (as reported) Summary Financials Non-GAAP As a result of displaying amounts in millions, rounding differences may exist in the tables.

17 $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Adjusted Net Sales $778.4 $765.8 $756.0 $765.4 $3,065.6 $737.1 $812.7 $807.7 $849.8 $3,207.3 Adjusted Gross Margin % 48.3% 45.6% 44.0% 43.4% 45.3% 46.1% 46.2% 46.0% 45.6% 46.0% Non-GAAP Operating Expenses $198.0 $177.1 $166.0 $174.0 $715.2 $171.8 $196.9 $186.0 $187.5 $742.3 Adjusted Operating Income $178.0 $172.4 $166.4 $157.9 $674.7 $167.7 $178.9 $185.9 $200.1 $732.6 Adjusted Operating Margin 22.9% 22.5% 22.0% 20.6% 22.0% 22.8% 22.0% 23.0% 23.5% 22.8% Adjusted EBITDA $218.4 $215.0 $206.2 $200.4 $840.0 $213.1 $226.3 $233.0 $248.4 $920.7 Adjusted EBITDA Margin 28.1% 28.1% 27.3% 26.2% 27.4% 28.9% 27.9% 28.8% 29.2% 28.7% Consolidated (excluding divestitures)1 Summary Financials Non-GAAP 1.Excludes the impact of divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. As a result of displaying amounts in millions, rounding differences may exist in the tables. Excluding Divestitures

18 Segment (as reported) Financials Non-GAAP1 $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Sales: MS $448.3 $440.6 $435.5 $365.0 $1,689.5 $350.0 $342.3 $346.6 $361.1 $1,400.1 APS $476.9 $463.6 $456.3 $449.8 $1,846.6 $423.4 $472.5 $463.1 $491.2 $1,850.2 Inter-segment elimination $(2.9) $(3.2) $(3.6) $(2.5) $(12.1) $(2.4) $(2.2) $(2.1) $(2.4) $(9.1) Total Sales $922.4 $901.0 $888.2 $812.3 $3,523.9 $771.0 $812.7 $807.7 $849.8 $3,241.2 Adjusted Segment Profit: MS $80.1 $75.9 $73.4 $61.0 $290.4 $75.2 $70.8 $71.7 $78.3 $296.0 APS $148.2 $136.5 $133.5 $118.3 $536.5 $111.2 $122.7 $127.3 $137.1 $498.3 Adjusted Segment Profit Margin: MS 17.9% 17.2% 16.8% 16.7% 17.2% 21.5% 20.7% 20.7% 21.7% 21.1% APS 31.1% 29.4% 29.3% 26.3% 29.1% 26.3% 26.0% 27.5% 27.9% 26.9% 1. During the three months ended December 31, 2024, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). The following prior year information has been recast to reflect this realignment. As a result of displaying amounts in millions, rounding differences may exist in the tables.

19 Segment (excluding divestitures)1,2 Financials Non-GAAP $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Adjusted Sales: MS $304.3 $305.4 $303.3 $318.1 $1,231.1 $316.1 $342.3 $346.6 $361.1 $1,366.2 APS $476.9 $463.6 $456.3 $449.8 $1,846.6 $423.4 $472.5 $463.1 $491.2 $1,850.2 Inter-segment elimination $(2.9) $(3.2) $(3.6) $(2.5) $(12.1) $(2.4) $(2.2) $(2.1) $(2.4) $(9.1) Total Sales $778.4 $765.8 $756.0 $765.4 $3,065.6 $737.1 $812.7 $807.7 $849.8 $3,207.4 Adjusted Segment Profit: MS $53.3 $47.4 $44.1 $50.6 $195.4 $64.9 $70.8 $71.7 $78.3 $285.8 APS $148.2 $136.5 $133.5 $118.3 $536.5 $111.2 $122.7 $127.3 $137.1 $498.3 Adjusted Segment Profit Margin: MS 17.5% 15.5% 14.5% 15.9% 15.9% 20.5% 20.7% 20.7% 21.7% 20.9% APS 31.1% 29.4% 29.3% 26.3% 29.1% 26.3% 26.0% 27.5% 27.9% 26.9% 1.Excludes the impact of divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. 2.During the three months ended December 31, 2024, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). The following prior year information has been recast to reflect this realignment. As a result of displaying amounts in millions, rounding differences may exist in the tables. Excluding Divestitures

20 $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Net sales $922.4 $901.0 $888.2 $812.3 $3,523.9 $771.0 $812.7 $807.7 $849.8 $3,241.2 Divestitures 2 (144.0) (135.2) (132.2) (46.8) (458.4) (33.9) — — — (33.9) Adjusted net sales Non-GAAP $778.4 $765.8 $756.0 $765.4 $3,065.6 $737.1 $812.7 $807.7 $849.8 $3,207.3 Reconciliation of Net Sales (as reported) to Adjusted Net Sales Non-GAAP (excluding divestitures)1 Reconciliation of Adjusted Gross Profit (as reported) to Adjusted (excluding divestitures)1 Gross Profit Non-GAAP $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Net sales $922.4 $901.0 $888.2 $812.3 $3,523.9 $771.0 $812.7 $807.7 $849.8 $3,241.2 Adjusted net sales Non-GAAP 3 $778.4 $765.8 $756.0 $765.4 $3,065.6 $737.1 $812.7 $807.7 $849.8 $3,207.3 Gross profit - GAAP 401.7 384.2 367.1 344.7 1,497.6 351.8 375.8 371.8 387.3 1,486.7 Adjustments to gross profit: Restructuring costs 4 7.4 — 0.8 — 8.2 — — — 0.4 0.4 Adjusted Gross Profit $409.1 $384.2 $367.9 $344.7 $1,505.8 $351.8 $375.8 $371.8 $387.7 $1,487.1 Divestitures 5 (33.0) (34.6) (35.5) (12.8) (116.0) (12.3) — — — (12.3) Adjusted (excluding divestitures)1 gross profit $376.0 $349.5 $332.3 $331.9 $1,389.8 $339.5 $375.8 $371.8 $387.7 $1,474.8 Gross margin - as a % of net sales 43.5 % 42.6 % 41.3 % 42.4 % 42.5 % 45.6 % 46.2 % 46.0 % 45.6 % 45.9 % Adjusted gross margin - as a % of net sales 44.3 % 42.6 % 41.4 % 42.4 % 42.7 % 45.6 % 46.2 % 46.0 % 45.6 % 45.9 % Adjusted (excluding divestitures)1 gross margin - as a % of adjusted net sales 48.3 % 45.6 % 44.0 % 43.4 % 45.3 % 46.1 % 46.2 % 46.0 % 45.6 % 46.0 % 1.Excludes the impact of divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. 2.Adjusted for the full year impact of Net Sales from divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. 3. See Reconciliation of Net Sales to Adjusted Net Sales Comparable Non-GAAP within. 4.Restructuring charges resulting from cost-saving initiatives. 5. Adjusted for the full year impact of gross profit from divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. As a result of displaying amounts in millions, rounding differences may exist in the tables.

21 Reconciliation of GAAP Operating Expenses (as reported) to Operating Expenses (excluding divestitures)1 Non-GAAP $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 GAAP Operating Expenses $388.2 $116.6 $250.0 $243.7 $998.4 $234.2 $ 245.7 $ 235.6 $ 237.3 $ 952.8 Adjustments to operating expenses: Goodwill impairment 1 88.9 — 15.9 10.4 115.2 — — — — — Deal and transaction costs 2 3.0 — — — 3.0 — — — — — Integration costs: Professional fees 3 12.0 13.3 6.8 4.6 36.7 2.1 0.1 0.3 — 2.6 Severance costs 4 1.4 1.0 (0.5) (0.4) 1.5 0.1 0.6 0.1 — 0.8 Retention costs 5 1.3 0.4 — — 1.7 — — — — — Other costs 6 2.3 3.8 4.0 3.6 13.7 — — — — — Restructuring costs 7 3.9 — 0.4 2.3 6.6 — — — 3.5 3.5 Acquired tax equalization asset reduction 8 — — — — — — — 3.0 — 3.0 Loss (gain) from sale of businesses and held-for- sale assets, net 9 13.6 14.9 — (4.7) 23.8 (4.9) 0.5 — — (4.3) Impairment of long-lived assets 10 — — — 30.5 30.5 13.0 — — — 13.0 Amortization of intangible assets 11 57.6 54.7 51.2 51.0 214.5 50.2 47.5 46.2 46.2 190.1 Gain on termination of alliance agreement 12 — (154.8) — (30.0) (184.8) — — — — — Non-GAAP operating expenses $204.3 $183.2 $172.1 $176.4 $736.1 $173.7 $196.9 $186.0 $187.5 $744.2 Divestitures 13 (6.2) (6.1) (6.2) (2.4) (21.0) (1.9) — — — (1.9) Operating Expenses (excluding divestitures)1 Non-GAAP $198.0 $177.1 $166.0 $174.0 $715.2 $171.8 $196.9 $186.0 $187.5 $742.3 1.Non-cash impairment charges associated with goodwill of our Electronic Chemicals and a small, industrial specialty chemicals businesses. 2.Non-recurring deal and transaction costs associated with the CMC Materials acquisition and completed divestitures. 3.Represents professional and vendor fees recorded in connection with services provided by consultants, accountants, lawyers and other third-party service providers to assist us in integrating CMC Materials into our operations. 4. Represent severance charges related to the integration of the CMC Materials acquisition. 5.Represents retention charges related directly to the CMC Materials acquisition and completed divestitures, and are not part of our normal, recurring cash operating expenses. 6.Represents other employee-related costs and other costs incurred relating to the CMC Materials acquisition and completed divestitures. These costs arise outside of the ordinary course of our continuing operations. 7. Restructuring charges resulting from cost-saving initiatives. 8.Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition. 9.Non-recurring net loss (gain) from the sale of certain businesses and held-for-sale assets. 10. Impairment of long-lived assets. 11.Non-cash amortization expense associated with intangibles acquired in acquisitions. 12. Gain on termination of the alliance agreement with MacDermid Enthone. 13. Adjusted for the full year impact of operating expenses from divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. As a result of displaying amounts in millions, rounding differences may exist in the tables.

22 Reconciliation of GAAP Net Income to Adjusted Operating Income and Adjusted EBITDA $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Net sales $922.4 $901.0 $888.2 $812.3 $3,523.9 $771.0 $812.7 $807.7 $849.8 $3,241.2 Net (loss) Income ($88.2) $197.6 $33.2 $38.0 $180.7 $45.3 $67.7 $77.6 $102.2 $292.8 Net (loss) income - as a % of net sales (9.6%) 21.9% 3.7% 4.7% 5.1% 5.9% 8.3% 9.6% 12.0% 9.0% Adjustments to net (loss) income: Income tax expense (benefit) 21.5 (16.5) (2.1) (11.3) (8.4) 3.5 6.7 8.2 10.0 0.9 Interest expense, net 84.8 78.6 75.6 62.1 301.1 54.4 52.5 50.4 50.5 28.3 Other (income) expense, net (4.7) 7.7 10.2 12.1 25.4 14.3 3.0 (0.2) (13.0) 207.8 Equity in net loss of affiliates — 0.1 0.1 0.1 0.4 0.2 0.2 0.3 0.2 4.0 GAAP - Operating income $13.5 $267.6 $117.1 $101.0 $499.2 $117.6 $130.1 $136.2 $150.0 $533.9 Operating margin - as a % of net sales 1.5 % 29.7 % 13.2 % 12.4 % 14.2 % 15.3 % 16.0 % 16.9 % 17.6 % 16.5 % Goodwill impairment 1 88.9 — 15.9 10.4 115.2 — — — — — Deal and transaction costs 2 3.0 — — — 3.0 — — — — — Integration costs: Professional fees 3 12.0 13.3 6.8 4.6 36.7 2.1 0.1 0.3 — 2.6 Severance costs 4 1.4 1.0 (0.5) (0.4) 1.5 0.1 0.6 0.1 — 0.8 Retention costs 5 1.3 0.4 — — 1.7 — — — — — Other costs 6 2.3 3.8 4.0 3.6 13.7 — — — — — Restructuring costs 7 11.2 — 1.2 2.4 14.8 — — — 3.9 3.9 Acquired tax equalization asset reduction 8 — — — — — — — 3.0 — 3.0 Loss (gain) from sale of businesses and held-for-sale assets, net 9 13.6 14.9 — (4.7) 23.8 (4.8) 0.5 — — (4.3) Impairment of long-lived assets 10 — — — 30.5 30.5 13.0 — — — 13.0 Amortization of intangible assets 11 57.6 54.7 51.2 51.0 214.5 50.2 47.5 46.2 46.2 190.1 Gain on termination of alliance agreement 12 — (154.8) — (30.0) (184.8) — — — — — Adjusted operating income $204.8 $200.9 $195.7 $168.3 $769.7 $178.1 $178.9 $185.9 $200.1 $743.0 Adjusted operating margin - as a % of net sales 22.2 % 22.3 % 22.0 % 20.7 % 21.8 % 23.1 % 22.0 % 23.0 % 23.5 % 22.9 % Depreciation 46.8 43.7 39.6 42.6 172.7 45.3 47.4 47.1 48.3 188.1 Adjusted EBITDA $251.5 $244.6 $235.3 $210.8 $942.4 $223.4 $226.3 $233.0 $248.4 $931.1 Adjusted EBITDA - as a % of net sales 27.3 % 27.2 % 26.5 % 26.0 % 26.7 % 29.0 % 27.8 % 28.8 % 29.2 % 28.7 % 1.Non-cash impairment charges associated with goodwill of our Electronic Chemicals and a small, industrial specialty chemicals businesses. 2.Non-recurring deal and transaction costs associated with the CMC Materials acquisition and completed divestitures. 3.Represents professional and vendor fees recorded in connection with services provided by consultants, accountants, lawyers and other third-party service providers to assist us in integrating CMC Materials into our operations. 4. Represent severance charges related to the integration of the CMC Materials acquisition. 5.Represents retention charges related directly to the CMC Materials acquisition and completed divestitures, and are not part of our normal, recurring cash operating expenses. 6. Represents other employee-related costs and other costs incurred relating to the CMC Materials acquisition and completed divestitures. These costs arise outside of the ordinary course of our continuing operations. 7. Restructuring charges resulting from cost-saving initiatives 8.Represents an asset reduction of an acquired tax equalization asset from the CMC Materials acquisition. 9.Non-recurring net loss (gain) from the sale of certain businesses and held-for-sale assets. 10. Impairment of long-lived assets. 11.Non-cash amortization expense associated with intangibles acquired in acquisitions. 12.Gain on termination of the alliance agreement with MacDermid Enthone. As a result of displaying amounts in millions, rounding differences may exist in the tables.

23 $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Adjusted (excluding divestitures)1 Net Sales 2 $778.4 $765.8 $756.0 $765.4 $3,065.6 $737.1 $812.7 $807.7 $849.8 $3,207.3 Adjusted Operating Income 3 204.8 200.9 195.7 168.3 769.7 178.1 178.9 185.9 200.1 743.0 Divestitures 4 (26.8) (28.5) (29.3) (10.4) (95.0) (10.4) — — — (10.4) Adjusted (excluding divestitures)1 Operating Income $178.0 $172.4 $166.4 $157.9 $674.7 $167.7 178.9 185.9 200.1 732.6 Adjusted (excluding divestitures)1 Operating Income - as a % of net sales 22.9% 22.5% 22.0% 20.6% 22.0% 22.8% 22.0% 23.0% 23.5% 22.8% Reconciliation of Adjusted Operating Income (as reported) to Adjusted Operating Income (excluding divestitures)1 Non-GAAP Reconciliation of Adjusted EBITDA (as reported) to Adjusted EBITDA (excluding divestitures)1 Non-GAAP $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Adjusted (excluding divestitures)1 Net Sales2 $778.4 $765.8 $756.0 $765.4 $3,065.6 $737.1 $812.7 $807.7 $849.8 $3,207.3 Adjusted EBITDA 251.5 244.6 235.3 210.8 942.4 223.4 226.3 233.0 248.4 931.1 Divestitures 5 (33.2) (29.6) (29.2) (10.4) (102.4) (10.4) — — — (10.4) Adjusted (excluding divestitures)1 EBITDA $218.4 $215.0 $206.2 $200.4 $840.0 $213.1 $226.3 $233.0 $248.4 $920.7 Adjusted (excluding divestitures)1 EBITDA - as a % of net sales 28.1% 28.1% 27.3% 26.2% 27.4% 28.9% 27.8% 28.8% 29.2% 28.7% 1.Excludes the impact of divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. 2. See Reconciliation of Net Sales to Adjusted Net Sales Comparable Non-GAAP within. 3. See Reconciliation of GAAP Net Income to Adjusted Operating Income within. 4. Adjusted for the full year impact of operating income from divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. 5. Adjusted for the full year impact of EBITDA from divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. As a result of displaying amounts in millions, rounding differences may exist in the tables.

24 $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 Net Sales: MS Segment Net Sales $448.3 $440.6 $435.5 $365.0 $1,689.5 $350.0 $342.3 $346.6 $361.1 $1,400.1 Adjusted (excluding divestitures)1 Net Sales (144.0) (135.2) (132.2) (46.8) (458.4) (33.9) — — — (33.9) MS Segment (excluding divestitures)1 Adjusted Net Sales $304.3 $305.4 $303.3 $318.1 $1,231.1 $316.1 $342.3 $346.6 $361.1 $1,366.2 Reconciliation of MS Segment Sales (as reported) to MS Segment Sales (excluding divestitures)1,2 Non-GAAP Reconciliation of MS Segment Profit (as reported) to Adjusted MS Segment Profit (excluding divestitures)1,2 Non-GAAP $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 MS segment (loss) profit ($29.5) $215.7 $57.0 $53.2 $296.4 $67.1 $70.3 $71.7 $77.1 $286.2 Restructuring costs 3 7.1 — 0.5 1.6 9.2 — — — 1.2 1.2 Loss (gain) from the sale of businesses and held- for-sale assets, net 4 13.6 14.9 — (4.7) 23.8 (4.8) 0.5 — — (4.3) Goodwill impairment 5 88.9 — 15.9 10.4 115.2 — — — — — Gain on termination of alliance agreement 6 — (154.8) — (30.0) (184.8) — — — — — Impairment of long-lived assets 7 — — — 30.5 30.5 13.0 — — — 13.0 MS adjusted segment profit $80.1 $75.9 $73.4 $61.0 $290.4 $75.2 $70.8 $71.7 $78.3 $296.0 Divestitures 8 (26.8) (28.5) (29.3) (10.4) (95.0) (10.4) — — — (10.4) Adjusted MS Segment Profit (excluding divestitures)1 $53.3 $47.4 $44.0 $50.6 $195.4 $64.9 $70.8 $71.7 $78.3 $285.6 1.Excludes the impact of divestitures of the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. 2. During the three months ended December 31, 2024, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). The following prior year information has been recast to reflect this realignment. 3. Restructuring charges resulting from cost-saving initiatives. 4.Non-recurring loss from the sale of certain business and asset held-for-sale assets, net. 5.Non-cash impairment charges associated with goodwill. 6. Gain on termination of the alliance agreement with MacDermid Enthone. 7.Impairment of long-lived assets. 8. Adjusted for the full year impact of segment profit from divestitures of the the EC, QED, and PIM businesses and termination of the alliance agreement with MacDermid Enthone. As a result of displaying amounts in millions, rounding differences may exist in the tables.

25 Reconciliation of APS Segment Profit to Adjusted APS Segment Profit Non-GAAP 1 $ in millions 1Q23 2Q23 3Q23 4Q23 FY2023 1Q24 2Q24 3Q24 4Q24 FY2024 APS segment profit $144.2 $136.5 $132.8 $118.0 $531.4 $111.2 $122.7 $127.3 $135.0 $496.1 Restructuring costs 2 4.0 — 0.7 0.3 5.0 — — — 2.1 2.1 APS adjusted segment profit $148.2 $136.5 $133.5 $118.3 $536.5 $111.2 $122.7 $127.3 $137.1 $498.3 1.During the three months ended December 31, 2024, the Company realigned its financial reporting structure reflecting management and organizational changes. The Company will report its financial performance based on two reportable segments: Materials Solutions (MS) and Advanced Purity Solutions (APS). The following prior year information has been recast to reflect this realignment. 2. Restructuring charges resulting from cost-saving initiatives As a result of displaying amounts in millions, rounding differences may exist in the tables.