0001888654false00018886542024-11-202024-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 20, 2024 |

5E ADVANCED MATERIALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41279 |

87-3426517 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9329 Mariposa Road, Suite 210 |

|

Hesperia, California |

|

92344 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (442) 221-0225 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.01 par value per share |

|

FEAM |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

On November 21, 2024, 5E Advanced Materials, Inc. (the “Company”) issued a press release providing certain financial, operational and other updates for the quarter ended September 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 20, 2024, the Company received written notice (the “Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that the Company was not in compliance with the minimum stockholders’ equity requirement set forth in Nasdaq Listing Rule 5450(b)(1), which requires companies listed on the Nasdaq Global Select Market to maintain a minimum of $10,000,000 in stockholders’ equity for continued listing (the “Stockholders’ Equity Rule”). The Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024 reported stockholders’ equity of $2,094,000 as of September 30, 2024.

The Notice has no immediate effect on the listing of the common stock, which continues to trade on the Nasdaq Global Select Market under the symbol “FEAM”.

In accordance with Nasdaq Listing Rule 5810(c)(2)(A), the Company has been provided 45 calendar days, or until January 6, 2025, to submit a plan to regain compliance (the “Compliance Plan”). If the Compliance Plan is accepted, Nasdaq may grant an extension of up to 180 calendar days from the date of the Notice to evidence compliance. If Nasdaq does not accept the Compliance Plan, the Company will have the opportunity to appeal that decision to a Nasdaq Hearings Panel.

The Company intends to submit the Compliance Plan on or before January 6, 2025. However, there can be no assurance that or that Nasdaq will grant the Company any extension of time to regain compliance with the Stockholders’ Equity Rule or that the Company will regain compliance with the Stockholders’ Equity Requirement or otherwise maintain compliance with any of the other listing requirements.

As previously reported in the Company’s Current Report on Form 8-K filed September 16, 2024, on September 12, 2024, the Company received written notice from Nasdaq notifying the Company that, for the preceding 30 consecutive business days, the closing bid price of the Company’s common stock had closed below the $1.00 per share minimum bid price requirement for continued inclusion on The Nasdaq Global Select Market pursuant to Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Price Requirement”). The Company was provided an initial period of 180 calendar days, or until March 11, 2025 to regain compliance with the Minimum Bid Price Requirement.

Item 7.01 Regulation FD Disclosure.

On November 21, 2024, in connection with the conference call, the Company made available a presentation, a copy of which is furnished as Exhibit 99.2 to this Current Report and incorporated herein by reference. The presentation is also available on the Investors section of the Company’s website at www.5eadvancedmaterials.com.

The information furnished in this Current Report (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this Current Report regarding our business strategy, plans, goal, and objectives are forward-looking statements, including without limitation statements regarding the Company’s intent or ability to regain compliance with any applicable Nasdaq listing requirements. When used in this Current Report, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “seek,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: the substantial doubt regarding our ability to continue as a going concern; our need for substantial additional financing to continue as a going concern and advance our development and operations; the significant net operating losses incurred since our inception and anticipation of the same net operating losses for the foreseeable future; the de-listing of our securities from Nasdaq, which could limit investors’ ability to transact in our securities, subject us to additional trading restrictions and substantially

increase the number of shares issuable upon conversion of our outstanding convertible notes; our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our inability to successfully operate the smaller-scale Boron Facility or complete further technical and economic studies may impact the 5E Boron Americas (Fort Cady) Complex (the “Project”); our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; risks and uncertainties relating to the development of the Project; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the expected benefits from certain reduced spending measures; and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission (the “SEC”) from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. These risks are not exhaustive and the information in this Current Report may be subject to additional risks. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this Current Report.

For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K for the fiscal year ended June 30, 2024, filed on September 9, 2024. Additional risks are also disclosed by the Company in its filings with the SEC throughout the year, including its Form 10-K, Form 10-Qs and Form 8-Ks, as well as in its filings with the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, the Company expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, the Company undertakes no obligation to comment on third party analyses or statements regarding the Company’s actual or expected financial or operating results or its securities.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

5E Advanced Materials, Inc. |

|

|

|

|

Date: |

November 21, 2024 |

By: |

/s/ Paul Weibel |

|

|

|

Paul Weibel

Chief Executive Officer |

Exhibit 99.1

5E ADVANCED MATERIALS PROVIDES SHAREHOLDER UPDATE CALL HIGHLIGHTING BY-PRODUCT DECISION AND FIRST COMMERCIAL DELIVERY OF BORIC ACID

Company unveils strategic decision to progress forward with calcium chloride as optimal by-product to reduce CAPEX, reports positive operational progress on its small-scale facility production and plant operations, commercial developments, and capital funding

HESPERIA, CA., November 21, 2024 (GLOBE NEWSWIRE) - 5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) (“5E” or the “Company”), a boron and lithium company with U.S. government Critical Infrastructure designation for its 5E Boron Americas (Fort Cady) Complex, today provides a shareholder update and review of the first quarter ended September 30, 2024.

HIGHLIGHTS

•5E has assessed and scoped its commercial phase design package to include calcium chloride production, which we anticipate will reduce Phase 1 commercial CAPEX by approximately 15% and improve project rates of return;

•5E’s commercial progress is advancing with momentum as the Company has delivered its first full truckload shipment of boric acid super sacks to a U.S. customer;

•The Company’s expanded cost optimization initiative has further streamlined operations, and is estimated to yield approximately $2.2 million in operating expense improvement for calendar year 2025;

•The Company’s small-scale boron facility has achieved its optimized steady-state production rate of 1 short ton per day of boric acid, a level which is designed to meet volumetric needs for expanded customer qualification, testing needs for our commercial strategy, and minimize liquidity impact;

•Operational process improvements have yielded improved product quality and consistency, with production now consistently exceeding desired customer specifications; and

•The Company’s capital funding strategy has been advanced with the receipt of a letter-of-intent from the Export-Import Bank of the United States (“EXIM”) for the potential creation of a facility to backstop up to $285 million in project debt financing, subject to EXIM’s final approval.

“Over the last three months, 5E has made significant progress across the most critical elements of our strategy and go-forward plan as we advance our 5E Boron Americas project (the “Project”) towards commercial scale production,” said Paul Weibel, Chief Executive Officer of 5E Advanced Materials. “We’ve made the critical strategic decision to pursue calcium chloride as our byproduct and have now begun incorporating this decision into our commercial basis of design. We believe that the pursuit of calcium chloride for our by-production alongside boric acid has the potential to ultimately yield a significant decrease in our CAPEX needed for our commercial scale development, to meaningfully improve the Project’s rate of return, and to further embed long-term shareholder value creation to the Project.”

Weibel continued “Our commercial strategy is advancing with momentum, and we recently met a key milestone in our timeline through the delivery of our first truckload of boric acid super sacks to a U.S. customer. We recently added two seasoned borates sales and marketing professionals which have already helped 5E make important advancements in translating customer engagement to initial off-take discussions, and we’re currently in process of negotiating contracts for 25-to-50% of our initial boric acid production in commercial Phase 1, with a line of sight towards securing tonnage of boric acid in the coming months that will go towards Phase 2. Additionally, we’ve expanded the geographic reach of commercial program to the APAC region, with coverage over more than 80% of the global borates demand as we look to high-grade the margin profile of our commercial scale production through targeted industry segmentation.”

Weibel concluded, “We’ve aligned and optimized our plant-level production rates and overall operations and production processes, which has resulted in operating cost reductions and an improvement in the quality and consistency of our boric acid production. 5E is working to accelerate across its operational and commercial strategy playbook, and we remain on path to complete an optimal design with pre-feed engineering work and progress our Project and development towards production of boric acid at commercial scale. Our commercial strategy execution has gained encouraging momentum as we’ve advanced customer offtake discussions and recently delivered our first shipment of boric acid to a customer. We will remain diligent with a keen focus on operational and commercial execution to help support our long-term funding strategy. We have a clear roadmap ahead of us in the next twelve months, and we look forward to delivering on our Project’s value enhancing catalysts as we complete pre-feed engineering and prepare the Project for commercial scale development and production in the coming year.”

Conference Call Information

Interested parties can access the live webcast of the conference call at 5:00 p.m. EST today on the Company’s website at https://investors.5eadvancedmaterials.com/events-presentations, or for participants that prefer to dial in by phone, dial in using toll-free number +1 (877) 545-0320 with Participant Access Code 702160. International call participants are instructed to use toll-free number +1 (973) 528-0002. Please log in or dial in at least 10 minutes prior to the start time to ensure a connection. An archived version of the webcast will be accessible for 1 year following the call at https://investors.5eadvancedmaterials.com/ in the Investor Relations – Events and Presentations section of the website.

About 5E Advanced Materials, Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) is focused on becoming a vertically integrated global leader and supplier of specialty boron and advanced boron derivative materials, complemented by lithium co-product production. The Company’s mission is to become a supplier of these critical materials to industries addressing global decarbonization, food and domestic security. Boron and lithium products will target applications in the fields of electric transportation, clean energy infrastructure, such as solar and wind power, fertilizers, and domestic security. The business strategy and objectives are to develop capabilities ranging from upstream extraction and product sales of boric acid, lithium carbonate and potentially other co-products, to downstream boron advanced material processing and development. The business is based on the company’s large domestic boron and lithium resource, which is located in Southern California and designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency.

Forward Looking Statements and Disclosure

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this press release regarding the Company’s business strategy, plans, goals, and objectives; our expectation of future results; future operational initiatives, costs and cost savings; production capacity; capital expenditures, the anticipated benefits of pursuing calcium chloride for by-production; anticipated capital funding, market dynamics; and other items, are forward-looking statements. When used in this press release, the words “believe,” “project,” “expect,” “forecast,” “anticipate,” “estimate,” “intend,” “seek,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to continue as a going concern and to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady Project, including our ability to timely and successfully complete our proposed Commercial Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the implementation of and expected benefits from certain reduced spending measures; the delisting of our securities from Nasdaq, which could limit investors’ ability to transact in our securities, subject us to additional trading restrictions and substantially increase the number of shares issuable upon conversion of our outstanding convertible notes; and other risks and uncertainties set forth in our Annual Report on Form 10-K (“Form 10-K”) filed with the U.S. Securities and Exchange Commission (“SEC”) on September 9, 2024, as updated in other filings with the SEC from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. These risks are not exhaustive and the information in this press release may be subject to additional risks. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this press release.

For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K and subsequent filings with the SEC, as well as in its filings with the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, 5E expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, 5E undertakes no obligation to comment on third party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

For further information contact:

Nathan Skown or Joseph Caminiti

Alpha IR Group

FEAM@alpha-ir.com

Ph: +1 (312) 445-2870

Reshoring the United States Boron Supply Chain November 21, 2024 : FEAM : 5EA Fiscal 2025: First Quarter Update Call Exhibit 99.2

Disclaimer FORWARD-LOOKING STATEMENTS The information in this presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this presentation regarding our business strategy, plans, goals, and objectives; our expectation of future results; future operational initiatives, costs and cost savings; production capacity; capital expenditures, the anticipated benefits of pursuing calcium chloride for by-production; anticipated capital funding, market dynamics; and other items are forward-looking statements. When used in this presentation, the words “believe,” “project,” “expect,” “forecast,” “anticipate,” “estimate,” “intend,” ”seek,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on 5E’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to continue as a going concern and to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady Project, including our ability to timely and successfully complete our proposed Commercial Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the implementation of and expected benefits from certain reduced spending measures; the delisting of our securities from Nasdaq, which could limit investors’ ability to transact in our securities, subject us to additional trading restrictions and substantially increase the number of shares issuable upon conversion of our outstanding convertible notes, and other risks and uncertainties set forth in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission ("SEC") on September 9, 2024, as updated in other filings with the SEC from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. These risks are not exhaustive and the information in this presentation may be subject to additional risks. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation. Except as otherwise required by applicable law, we disclaim any duty to update and do not intend to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. MARKET AND INDUSTRY DATA This presentation has been prepared by 5E and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although 5E believes these third-party sources are reliable as of their respective dates for the purposes used herein, neither we nor any of our affiliates, directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy or completeness of such information. Although we believe the sources are reliable, we have not independently verified the accuracy or completeness of data from such sources. Some data is also based on 5E’s good faith estimates, which are derived from our review of internal sources as well as the third-party sources described above. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only there can be no assurance that such conditions will actually occur or result in positive returns. CAUTIONARY NOTE REGARDING RESERVES Unless otherwise indicated, all mineral resource estimates included in this presentation have been prepared in accordance with and are based on the relevant definitions set forth in the SEC’s Mining Disclosure Rules and Regulation S-K 1300 (each as defined below). Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 under the Exchange Act (“SEC Industry Guide 7”). In accordance with the SEC’s Final Rule 13-10570, Modernization of Property Disclosure for Mining Registrant, the SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules (the “Mining Disclosure Rules”) under sub-part 1300 of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”) (“Regulation S-K 1300”). Regulation S-K 1300 replaces the historical property disclosure requirements included in SEC Industry Guide 7. Regulation S-K 1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) - based classification system for mineral resources and mineral reserves and accordingly, under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, and require SEC-registered mining companies to disclose in their SEC filings specified information concerning their mineral resources, in addition to mineral reserves. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. The SEC Mining Disclosure Rules more closely align SEC disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, referred to as the “JORC Code.” While the SEC now recognizes “Measured Mineral Resources,” “Indicated Mineral Resources” and “Inferred Mineral Resources” under the SEC Mining Disclosure Rules, investors should not assume that any part or all the mineral deposits in these categories will be converted into a higher category of mineral resources or into mineral reserves. For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s filings with the SEC. Additionally, 5E undertakes no obligation to comment on third-party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

Welcome Today’s speakers: Paul Weibel CHIEF EXECUTIVE OFFICER Rod MacLaine VP, ENGINEERING & CONSTRUCTION Mark Zamek VP, COMMERCIAL PRODUCTS Today’s Agenda: Small Scale Boron Facility Operations Update Advancing Byproducts Timeline: Key Mile Markers for Next Twelve Months Commercial Update Funding Strategy & Next Steps

Byproduct to focus on Calcium Chloride Pursuing calcium chloride byproduct pathway Advancing potential off-taking partnerships Factored into commercial basis for design in FEL-2 First truckload sale and delivery of Boric Acid Recently delivered 22 super sacks for customer testing Advanced and improved plant-level operations Achieved steady-state production rate of 1 ton/day Removal of calcium and metal salts as production levels increase Production process improvement - observable results Multi-step approaches to improve production processes Consistently exceeding customer specs, with improved product quality and purity Further streamlining of Opex Aligned plant operations with cost fixed/variable considerations; strategic Reduction in Force Expected to yield $2.2M in Opex savings in CY’25 Operational Update – Project Progress SSBF State of the Union Optimized Boric Acid production rates; meeting volume needs while minimizing liquidity impact Operational process improvement led to improved product quality and consistency Streamlined organization and operations to reduce Opex Finalized byproduct decision - simplified commercial design to include calcium chloride

Recent and Ongoing Process Improvements De-bottlenecked production processes through re-designing and improvement to SSBF’s conveyor systems Increasing purity and yield on Boric Acid through better optimization of boric acid belt feeder rates Achieving continuous distillation through re-programming of crystallization unit Optimized process flow and truncated sulfur rates (<100ppm) through installation of new belt filter spray nozzles New acid spray bar and nozzles in belt wash area Boric Acid Operations – Process Improvements Yielding Results First super sacks of Boric Acid being prepared for customer shipments

Recent Update – Calcium Chloride Byproduct Analysis Consideration Technical Risk Operational Ease Logistics Commercial Economics Calcium Chloride Rationale & Relative Attributes Achieving 38% solution is low technical risk; less complex process with bench testing complete; offtake specifications confirmed Expected to simplify process to focus on Boric Acid; reduces necessary OPEX and headcount; and improved safety considerations Less raw materials to procure; comparable quantities of deliveries to gypsum Local market demand for 90k production; higher margin profile; potential offtake parties and necessary specs are known and established Anticipated ~15% CAPEX reduction aligns with near-term priorities and improved IRR due to lower capital outlay, lower maintenance capital needs

FID 12-Month Roadmap and Timeline Expectations Phase One of Commercial Engineering: Underway Evaluated project management system, charter, strategy, risk register, and execution plan Committed to scope, optimize, and reduce Capex by incorporating Calcium Chloride into our basis of design Anticipating capital estimate from EPC contractor no later than Spring of 2025 FEL-3 / FEED Engineering: Up-Next Following the refresh of our technical report following reception of capital estimate Leads to stage-gate to FEL-3, also known as FEED engineering FEED engineering is expected to be a 7-to-8-month process Final Investment Decision: Target December ‘25 Based on FEED engineering results and updated IRR estimates Supported by ongoing diligence work evaluating byproduct optionality and production optimization FID anticipated to be made in late calendar year 2025

Commercial Update – Driving Momentum Ahead of FEL-2 4. De-risk Financing Options: Contracted volumes increase funding options and flexibility Improve “invest-ability” Strengthen 5E’s position in global debt & equity capital markets 2. Market Segmentation 90K tons volume = greater optionality across high-margin / low cost-to-serve customers Strategy aimed to place volumes in targeted industries & geographies to maximize value 3. Expanding 5E’s Commercial Reach Added sales & marketing leaders with real, global industry and customer relationships Expanded commercial focus to APAC region: ~60% of global demand, with strong ASPs and margin profiles; toehold into BA specialties I. Negotiating Offtaking & HOAs: In-process or finalizing contracts for 25-50% of initial 90k tonnage in Commercial Phase 1 Targeting having tonnage committed to customers for Phase II in Spring CY’25 Strategic Focus Areas Commercial development and customer negotiations advancing quickly

Seeking Federal Funding Support DOD DOE EXIM Non-Dilutive Financing CURRENT STATE OF AFFAIRS Department of Defense Multiple applications for funding already in progress Funding focused on increasing current production, as well as boron derivative products Export-Import Bank Letter of Support to backstop all project debt finance for 5E to procure in the private sector Department of Energy AMMTO Funding Application in evaluation to fund work to increase lithium extraction rates at the 5E Boron Americans Complex Department of Defense Defense Production Act, DPA Title III NDAA Funding Bill Export Import Bank Credit Facility to backstop private project finance through US Treasury Department of Energy ATVM / Loan Program Office GOV’T FUNDING SOURCES Received LOI for up to $285M in potential loan support

Appendix

ELECTRIC �VEHICLES FOOD �SECURITY DOMESTIC �SECURITY GREEN �ENERGY Investment Tesis Initial mine life of 31 years containing 7.9M tons of boric acid1 Small-scale facility – Delivering on-spec product to customers Commercial production fully permitted (90ktpa) with phase expansion plans LOI received from US EXIM Bank to support development, significantly de-risking finance Expressions of interest received from customers for 100% of 90ktpa production Simplified by-product strategy reducing OPEX and CAPEX Globally, largest known (colemanite) boron deposit outside of Turkey Regulation S-K 1300 Initial Assessment Report with a revised report date of February 2, 2024 (using 2% cut off grade) prepared by Qualified Person. Figures presented reflect total estimated measured, indicated and inferred resources combined.

Thank you

v3.24.3

Document And Entity Information

|

Nov. 20, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 20, 2024

|

| Entity Registrant Name |

5E ADVANCED MATERIALS, INC.

|

| Entity Central Index Key |

0001888654

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-41279

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

87-3426517

|

| Entity Address, Address Line One |

9329 Mariposa Road, Suite 210

|

| Entity Address, City or Town |

Hesperia

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92344

|

| City Area Code |

(442)

|

| Local Phone Number |

221-0225

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

true

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

FEAM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

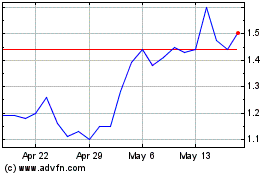

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Dec 2023 to Dec 2024