false

0000036377

0000036377

2025-02-10

2025-02-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 10, 2025

FIRST

HAWAIIAN, INC.

(Exact Name of Registrant as Specified in Its

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 001-14585 |

|

99-0156159 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

| 999

Bishop St., 29th Floor |

|

|

| Honolulu,

Hawaii |

|

96813 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(808)

525-7000

(Registrant’s Telephone

Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

| Common

Stock, par value $0.01 per share |

|

FHB |

|

NASDAQ

Global Select Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

First Hawaiian, Inc. (the “Company”),

the holding company for First Hawaiian Bank, is furnishing with this Current Report on Form 8-K a copy of an investor presentation

that it intends to use for any investor meetings or related interactions in 2025. A copy of the presentation also will be posted to the

Company’s website (www.fhb.com) in the Investor Relations section.

Pursuant to Regulation FD, the presentation materials

are furnished as Exhibit 99.1. The information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the

Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

| Exhibit No. |

Description |

| |

|

| 99.1 |

Presentation Materials |

| 104 |

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FIRST HAWAIIAN, INC. |

| |

|

|

| Date: February 10, 2025 |

By: |

/s/Robert S. Harrison |

| |

|

Robert S. Harrison |

| |

|

Chairman of the Board, President and Chief Executive Officer |

| |

|

(Principal Executive Officer) |

Exhibit 99.1

0 Investor Presentation February 10, 2025

DISCLAIMER Forward - Looking Statements This presentation contains, and from time - to - time in connection with this presentation our management may make, forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward - looking statements reflect our views at such time with respect to, among other things, future events and our financial performance. These statements are often, but not always , m ade through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “expect,” “continu e,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” “annualized,” and “outlook,” or the negative version of these w ord s or other comparable words or phrases of a future or forward - looking nature. These forward - looking statements are not historical facts an d are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by m ana gement, and any such forward - looking statements are subject to risks, assumptions, estimates and uncertainties that are difficult to pre dict. Actual results may prove to be materially different from the results expressed or implied by the forward - looking statements. Factors th at could cause our actual results to differ materially from those described in the forward - looking statements, including (without limitation) t he domestic and global economic environment and capital market conditions and other risk factors, can be found in our SEC filings, including, bu t not limited to, our most recent Form 10 - K and subsequent Quarterly Reports on Form 10 - Q, which are available on our website (www.fhb.com) and th e SEC’s website (www.sec.gov). Any forward - looking statement speaks only as of the date on which it is made, and we do not underta ke any obligation to update or review any forward - looking statement, whether as a result of new information, future developments or oth erwise, except as required by applicable law. Use of Non - GAAP Financial Measures The information provided herein includes certain non - GAAP financial measures. We believe that these measures provide useful inf ormation about our operating results and enhance the overall understanding of our past performance and future performance. Although t hes e non - GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytic al tools and should not be considered in isolation or as a substitute for analysis of our results or financial condition as reported under GA AP. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assess ing our performance or financial condition. The reconciliation of such measures to the comparable GAAP figures are included in the a ppe ndix of this presentation. Other References to “we,” “us,” “our,” “FHI,” “FHB,” “Company,” and “First Hawaiian” refer to First Hawaiian, Inc. and its consolid ate d subsidiaries. 1

INVESTMENT HIGHLIGHTS 2 Strong, Consistent Financial Performance Leading Position In Attractive Markets Experienced Leadership Team High Quality Balance Sheet Proven Through The Cycle Performance Well - Capitalized With Attractive Dividend 1 2 3 4 5 6

$359 $365 $357 $355 $353 $380 $387 $380 $395 $365 $310 $353 $336 $307 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 1.40% 1.47% 0.89% 1.00% 0.87% 0.94% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 STRONG, CONSISTENT FINANCIAL PERFORMANCE 3 Source: Public filings and S&P Global Capital IQ, as of 05 - Feb - 2025 Note: Financial data as of 31 - Dec - 2024. $10 – $50 bn banks at 31 - Dec - 2023; excluding merger targets, constituted based on publicly available information as of 07 - Feb - 2024. (1) Pre - Tax, Pre - Provision Earnings, ROATA (Return On Average Tangible Assets) and ROATCE (Return On Average Tangible Common Equity) are non - GAAP financial measures. A reconciliation to the comparable FHB GAAP measures is provided in the appendix. 12.1% 10.9% 20.0% 14.7% 9.5% 10.2% 4.0% 8.0% 12.0% 16.0% 20.0% 24.0% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Pre - Tax, Pre - Provision Earnings ($mm) (1) ROATA (1) Stable Earnings Drivers ROATCE (1) Year Ended December 31 Consistent PTPP Earnings Consistent History of Strong Profitability First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets Year Ended December 31 ▪ Dominant loan and deposit positions in attractive markets ▪ Consistent underwriting standards with proven performance through the credit cycle ▪ Demonstrated history of disciplined expense management Year Ended December 31

NALs / Loans (6) 61.6% 57.5% FHB Peer Median 14.7% 10.2% FHB Peer Median LEADING POSITION IN AN ATTRACTIVE MARKET 4 Branch Presence Financial Overview – 12/31/2024 ($ billions) Source: Public filings and S&P Global Capital IQ as of 05 - Feb - 2025 Note: Financial data as of 31 - Dec - 2024. Market data as of 31 - Dec - 2024. (1) $10 – $50 bn banks at 31 - Dec - 2023; excluding merger targets, constituted based on publicly available information as of 07 - Feb - 2024 . (2) ROATA (Return On Average Tangible Assets) and ROATCE (Return on Average Tangible Common Equity) are non - GAAP financial measures. A reconciliation to the comparable FHB GAAP measures is provided in the appendix. (3) Dividend yield based on dividend paid in 2024 and closing market price as of 05 - Feb - 2025. (4) Deposit market share based on FDIC data as of 30 - Jun - 2024. (5) Full - year ending December 31, 2024 (6) As of 31 - Dec - 2024 Company Highlights x Oldest and largest Hawaii - based bank x Full - service community bank with complete suite of products & services x Largest combined deposit base in Hawaii, Guam and Saipan (4) x Largest Hawaii - based lender x $22.2 bn assets under administration as of Dec 31, 2024 x Proven through the cycle and outstanding operating performance Efficiency Ratio (5) ROATCE (2,5) Dividend Yield (3) Maui Kahoolawe Lanai Oahu Kauai Niihau Honolulu Hawaii Island Molokai 0.14% 0.52% FHB Peer Median $ 14.4 Loans $ 3.5 Market Cap $ 20.3 Deposits $ 23.8 Assets Guam Saipan (1) (1) (1) (1) 165 bps 228 bps FHB Peer Median Cost of Deposits (5) (1) 1.0% 0.9% FHB Peer Median ROATA (2,5) (1) 48 branches 3.7% 2.8% FHB Peer Median (1)

HAWAII BANKING MARKET DOMINATED BY LOCAL BANKS 5 The top 4 banks account for ~93% of deposits (2) Sources: FDIC, SEC and company filings. Company filings and public information used for peers where available, otherwise reg ula tory data used. Note: Financial data as of 31 - Dec - 2024. (1) ROATCE (return on average tangible common equity) and ROATA (return on average tangible assets) are non - GAAP financial measures. Reconciliations to the comparable FHB GAAP measures are provided in the appendix. (2) Deposit market share based on FDIC data as of 30 - Jun - 2024 27 35 50 48 Branches 721 939 1,865 1,997 FTEs 7.5 9.3 23.6 23.8 Assets ($bn) 5.3 6.1 14.1 14.4 Loans ($bn) 6.6 8.1 20.6 20.3 Deposits ($bn) 10.3% 2.5% 11.1% 14.7% 2024 ROATCE (1) 0.72% 0.13% 0.64% 1.00% 2024 ROATA (1) Loan Portfolio Deposit Portfolio $6.6 $8.1 $19.2 $18.3 Balance ($bn) Hawaii Deposits 2 11.7 % 14.4% 34.1% 32.5% Share Commercial Commercial RE Residential RE Consumer & Other Transaction Accounts Savings / MMDA Time Deposits 10% 16% 37% 29% 9% 12% 31% 33% 15% 5 % 10% 27% 48% 10% 10% 11% 31% 35% 13% 16% 34% 50% 15% 45% 40% 50% 38% 12% 16% 49% 35% 8% HELOC

1.53% 2.52% 5.13% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q Hawaii Banks U.S. Banks Fed Funds 5.25% HAWAII BANKS HAVE A SIGNIFICANT DEPOSIT ADVANTAGE 6 Source: S&P Global and the Federal Reserve website. (1) Deposit beta is defined as the change in deposit costs as a percentage of the change in Fed Funds over a particular period. D ep osit cost uses starting point (2Q04) to peak (3Q07); one quarter lag. (2) Includes First Hawaiian, Bank of Hawaii, American Savings, Central Pacific, Territorial Bancorp, Hawaii National. 3Q24 cost o f deposits based on publicly available information as of 3 - Feb - 2025. Line represents average of data set. (3) Includes all U.S. bank holding companies excluding Hawaii - based banks. 3Q24 cost of deposits based on publicly available inform ation as of 3 - Feb - 2025. Line represents average of data set. Hawaii banks experience more favorable deposit behavior across all rate cycles; Hawaii banks experienced a deposit beta ( ¹ ) of ~36% vs. ~45% for broader U.S. banks during the last rising rate cycle 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 (2) (3) 99bps Funding Advantage ~110bps Funding Advantage

$9.1 $9.4 $10.2 $10.5 $12.2 $12.9 $13.6 $14.7 $16.1 $16.8 $17.6 $17.2 $16.4 $19.2 $21.8 $21.7 $21.3 $20.3 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 Demand 34% Money Market 20% Savings 27% Time 15% SOLID, LOW - COST CORE DEPOSIT BASE Strong brand, deep ties to the community and a leading market share position have driven an attractive, low - cost deposit base As of December 31 Deposit Portfolio Composition Consistent Deposit Growth ($bn) Best - in - Class Cost of Deposits 0.87 % 1.92 % 1.65 % 1.69 % 2.94 % 2.28 % – % 0.50 % 1.00 % 1.50 % 2.00 % 2.50 % 3.00 % 3.50 % '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets Year Ended December 31 Source: Public filings and S&P Global Capital IQ, as of 05 - Feb - 2025 Note: Financial data as of 31 - Dec - 2024. $10 – $50 bn banks at 31 - Dec - 2023; excluding merger targets, constituted based on publicly available information as of 07 - Feb - 2024 . Public Savings 3% Reduced Public Time Deposits by $1.5 bn in 2018 and 2019 Public Time 1% Deposits Well - Balanced Between Retail and Commercial 7 10.0 9.5 0.8 Retail Commercial Public ($ billions) 12/31/24 12/31/24

$6.5 $7.9 $8.0 $8.3 $8.3 $9.0 $9.5 $10.0 $10.7 $11.5 $12.3 $13.1 $13.2 $13.3 $13.0 $14.1 $14.4 $14.4 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 24 HIGH - QUALITY, BALANCED LOAN PORTFOLIO Steady through the cycle organic loan growth and balanced loan portfolio 8 Well - positioned to serve clients during the financial crisis Loans: $14.4 bn 71% 67% 65% 62% 59% 69% 80% 76% 70% 69% 67% 68% 70% 70% 69% 79% 78% 84% Loans / Deposits As of December 31, Balanced Loan Portfolio (as of 12/31/24) Steady Loan Growth ($bn) Note: Financial data as of 31 - Dec - 2024 ▪ Largest Hawaii - based lender ▪ Balanced Portfolio ▪ 56% Commercial, 44% Consumer ▪ 76 % Hawaii/Guam/Saipan, 24% Mainland ▪ Commercial ▪ Hawaii’s leading commercial bank with experienced lending team. ▪ 57 % Hawaii/Guam/Saipan, 43% Mainland ▪ $ 1,502 mm Shared National Credit portfolio ▪ Participating in SNC lending for over 20 years ▪ 26 % Hawaii - based, 74% Mainland ▪ Leading SBA lender Hawaii ▪ SBA Lender of the Year (Category 1) 2017, 2018, 2021 , 2022, and 2024 ▪ Leveraged SBA experience to quickly launch PPP program ▪ Originated over 10k PPP loans for over $1.4bn in principal balances in 2020 and 2021 ▪ Consumer ▪ Primarily a Prime and Super Prime lender ▪ ~90% of portfolio collateralized ▪ Financing consumer auto loans for over 40 years C&I $2,247 mm 16% CRE $4,464 31% Construction $918 mm 6% Leasing $435 mm 3% Residential $4,168 mm 29% Home Equity $1,152 mm 8% Consumer Auto $613 mm 4% Credit Card $331 mm 2% Other Consumer $80 mm 1% Loan Portfolio Highlights (as of 12/31/24) $585 mm PPP loans repaid in 2021 Note: Percentages shown may not total to 100% due to rounding

0.21% 0.10% 0.10% 0.16% 0.00% 0.50% 1.00% 1.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 PROVEN, CONSISTENT, AND CONSERVATIVE CREDIT RISK MANAGEMENT Strong through the cycle credit performance driven by conservative approach to credit risk management 9 Year Ended December 31 0.16% 0.19% 0.41% 0.52% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 As of December 31 1.43% 1.11% 1.16% 1.18% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 71.4x 7.8x 3.2x 2.3x '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 As of December 31 As of December 31 First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets Source: Public filings and SNL Financial, available as of 05 - Feb - 2025 Note: Financial data as of 31 - Dec - 2024. $10 – $50 bn banks at 31 - Dec - 2023; excluding merger targets, constituted based on publicly available information as of 07 - Feb - 2024 . NCOs / Average Loans NPAs + 90s / Loans + OREO Reserves / Loans Reserves / Non - Accrual Loans 75.0x 20.0x 10.0x

$9.1 $20.3 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 Source: Public filings and S&P Global Capital IQ as of 05 - Feb - 2025 Note: Financial data as of 31 - Dec - 2024. $10 – $50 bn banks at 31 - Dec - 2023; excluding merger targets, constituted based on publicly available information as of 07 - Feb - 2024 . (1) ROATCE (Return on Average Tangible Common Equity) is a non - GAAP financial measure. A reconciliation to the comparable FHB G AAP measure is provided in the appendix. 12.1% 14.7% 9.5% 10.2% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 PROVEN THROUGH THE CYCLE PERFORMANCE 10 Through the Cycle Credit Performer Strong Profitability Consistent Deposit Growth ($ bn ) Steady, Balanced Loan Growth ($ bn ) $6.5 $14.4 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 NPAs + 90s / Loans + OREO ROATCE (1) First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets 0.16% 0.19% 0.41% 0.52% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 As of December 31 As of December 31 Year Ended December 31 As of December 31

WELL - CAPITALIZED WITH AN ATTRACTIVE DIVIDEND 11 Source: Public filings and S&P Global Capital IQ as of 05 - Feb - 2025 Note: Financial data as of 31 - Dec - 2024. $10 – $50 bn banks at 31 - Dec - 2023; excluding merger targets, constituted based on publicly available information as of 07 - Feb - 2024 . (1) Dividends and share repurchases are subject to approval of FHI’s board of directors, future capital needs and regulatory appr ov als. (2) Dividend yield (MRQ) based on Q4 2024 dividends annualized and market data as of 31 - Dec - 2024. Robust Capital Position (As of 12/31/24) Attractive Dividend Yield (1)(2) Capital Management Approach 12.8 % 12.9 % 0.5 % 1.2 % 2.0 % 14.0% 15.4% FHI Public U.S. Banks with $10-$50bn of Assets Tier 2 NCT1 CET 1 10.4% 9.1% Tier 1 Leverage ▪ Retain sufficient earnings to support loan growth and maintain strong capital levels ▪ Return excess capital through dividends and share repurchases ▪ Maintained quarterly dividend at $0.26/share in 2024 ▪ Repurchased 1.5mm shares for $40mm in 2024 ▪ Repurchase authorization for up to $100mm of common stock during 2025 3.7% 2.8% First Hawaiian, Inc. Public U.S. Banks with $10-$50bn of Assets

12 APPENDIX

FULL SUITE OF PRODUCTS AND SERVICES 13 • Largest commercial lender in Hawaii • 63 commercial bankers (2) • Relationship - based lending • Primary focus on Hawaii, additional focus on California • C&I, leases, auto dealer flooring, CRE, and C&D • Strong relationships with proven local real estate developers • $22.5 bn (2) of AUA and 34 financial advisors (2) • Personal services include financial planning, insurance, trust, estate, and private banking • Institutional services include investment management, retirement plan administration, and custody • Mutual funds provided by Bishop Street Capital Management • 32.5% deposit market share in Hawaii (1) • Retail deposit products offered through branch, online, mobile, and direct channels • Commercial deposits, treasury and cash management products • Hawaii state and municipal relationships Commercial Lending Wealth Management Deposits • Services provided to individuals and small to mid - sized businesses • Full - service branches, online and mobile channels • Exclusively in - footprint focus • First mortgages, home equity, indirect auto financing, and other consumer loans Consumer Lending • Leading credit card issuer among Hawaii banks • Approximately 157,000 accounts with more than $2.5bn annual spend (2) • Consumer, small businesses, and commercial cards • Issuer of M asterCard Credit Cards • Largest merchant processor in Hawaii • Spans Hawaii, Guam and Saipan • Over 3,400 terminals processed ~38.4 mm transactions in 2024 • Relationships with all major U.S. card companies and select foreign cards Merchant Processing First Hawaiian is a full - service community bank focused on building relationships with our customers (1) Source: FDIC as of 30 - Jun - 2024 (2) As of 31 - Dec - 2024

HAWAII IS AN ATTRACTIVE MARKET WITH STRONG ECONOMIC FUNDAMENTALS 14 • Attractive destination for domestic and international travelers • Attractive alternative for travelers concerned about international travel • Well - developed visitor industry infrastructure • High quality medical care • Strategically important • Headquarters of US Indo - Pacific Command and regional component commands: Army, Navy, Air Force, Marines • Estimated total defense spending in Hawaii in FY22: $8.8bn (3) • Defense spending was approximately 8.9% of state GDP in FY22 (3) • Over 48.5k Active Duty and Reserve personnel stationed in Hawaii and 20k civilian employees (FY22) (3) Government 19% Real Estate 21% Residential RE 23% Other 12% Transportation & Warehousing 5% Entertainment 12% Professiona l 9 % Construction 6% Retail Trade 7 % Healthcare & Education 8% Hawaii GDP by Industry (2023) (1) Visitor spending is ~19% of Hawaii GDP (2) (1) US Bureau of Economic Analysis (2) Based on $20.8bn of 2023 visitor spending according to Hawaii Department of Business, Economic Development and Tourism. Fundamental Strengths (3) defenseeconomy.hawaii.gov

GAAP TO NON - GAAP RECONCILIATIONS Return on average tangible assets, return on average tangible stockholders’ equity, tangible book value per share, tangible stockholders’ equity to tangible assets and pre - tax, pre - provision earnings are non - GAAP financial measures. We compute our return on average tangible assets as the ratio of net income to average tangible assets, which is calculated by subtracting (and thereby effectively excluding) amounts related to the effect of goodwill from our average total assets. We compute our return on average tangible stockholders’ equity as the ratio of net income to average tangible stockholders’ equity, which is calculated by subtracting (and thereby effectively excluding) amounts related to the effect of goodwill from our average total stockholders’ equity. We compute our tangible book value per share as the ratio of tangible stockholders’ equity to outstanding shares. Tangible stockholders’ equity is calculated by subtracting (and thereby effectively excluding) amounts related to the effect of goodwill from our total stockholders’ equity. We compute our tangible stockholders’ equity to tangible assets as the ratio of tangible stockholders’ equity to tangible assets, each of which we calculate by subtracting (and thereby effectively excluding) the value of our goodwill. Pre - tax, pre - provision earnings are calculated by subtracting (and thereby effectively excluding) the provision for credit losses from our income before provision for income taxes. We believe that these measurements are useful for investors, regulators, management and others to evaluate financial performance and capital adequacy relative to other financial institutions. Although these non - GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results or financial condition as reported under GAAP. Investors should consider our performance and capital adequacy as reported under GAAP and all other relevant information when assessing our performance and capital adequacy. The following tables provide a reconciliation of these non - GAAP financial measures with their most directly comparable GAAP measures. 15

GAAP TO NON - GAAP RECONCILIATION - ANNUAL 16 Note: Totals may not sum due to rounding. As of and for the Twelve Months Ended December 31, 2019 2020 2021 2022 2023 2024 (Dollars in millions, except per share data) $ 284.4 $ 185.8 $ 265.7 $ 265.7 $ 235.0 $ 230.1 Net Income $ 2,609.4 $2,698.9 $ 2,708.4 $ 2,321.6 $ 2,346.7 $ 2,557.2 Average Total Stockholders’ Equity 995.5 995.5 995.5 995.5 995.5 995.5 Less: Average Goodwill $ 1,613.9 $1,703.4 $ 1,712.9 $ 1,362.1 $ 1,351.2 $ 1,561.7 Average Tangible Stockholders’ Equity $ 2,640.3 $ 2,744.1 $ 2,656.9 $ 2,269.0 $ 2,486.1 $ 2,617.5 Total Stockholders’ Equity 995.5 995.5 995.5 995.5 995.5 995.5 Less: Goodwill $ 1,644.8 $1,748.6 $1,661.4 $ 1,273.5 $1,490.6 $1,662.0 Tangible Stockholders’ Equity $ 20,325.7 $ 21,869.1 $ 24,426.3 $ 24,964.4 $ 24,625.4 $ 23,996.7 Average Total Assets 995.5 995.5 995.5 995.5 995.5 995.5 Less: Average Goodwill $ 19,330.2 $ 20,873.6 $ 23,430.8 $ 23,968.9 $ 23,630.0 $ 23,001.2 Average Tangible Assets $ 20,166.7 $ 22,662.8 $ 24,992.4 $ 24,577.2 $ 24,926.5 $ 23,828.2 Total Assets 995.5 995.5 995.5 995.5 995.5 995.5 Less: Goodwill $ 19,171.2 $ 21,667.3 $ 23,996.9 $ 23,581.7 $ 23,931.0 $ 22,832.7 Tangible Assets 10.90% 6.88% 9.81% 11.44% 10.01% 9.00% Return on Average Total Stockholders’ Equity 17.62% 10.91% 15.51% 20.03% 17.39% 14.74% Return on Average Tangible Stockholders’ Equity (non - GAAP) 1.40% 0.85% 1.09% 1.06% 0.95% 0.96% Return on Average Total Assets 1.47% 0.89% 1.13% 1.11% 0.99% 1.00% Return on Average Tangible Assets (non - GAAP) $ 381.7 $ 243.7 $ 349.0 $ 351.2 $ 309.2 $ 292.6 Income Before Provision for Income Taxes 13.8 121.7 (39.0) 1.4 26.6 14.8 Provision For Credit Losses $ 395.5 $ 365.4 $ 310.0 $ 352.6 $ 335.8 $ 307.4 Pre - Tax, Pre - Provision Earnings (Non - GAAP)

GAAP TO NON - GAAP RECONCILIATION - ANNUAL (CONTINUED) 17 Note: Totals may not sum due to rounding. As of and for the Twelve Months Ended December 31, 2011 2012 2013 2014 2015 2016 2017 2018 (Dollars in millions, except per share data) $ 199.7 $ 211.1 $ 214.5 $ 216.7 $ 213.8 $ 230.2 $ 183.7 $ 264.4 Net Income $ 2,640.6 $ 2,664.2 $ 2,667.4 $ 2,698.4 $ 2,735.8 $ 2,568.2 $ 2,538.3 $ 2,457.8 Average Total Stockholders’ Equity 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Less: Average Goodwill $ 1,645.1 $ 1,668.7 $ 1,672.0 $ 1,702.9 $ 1,740.3 $ 1,572.7 $ 1,542.8 $ 1,462.3 Average Tangible Stockholders’ Equity $ 2,677.4 $ 2,654.2 $ 2,651.1 $ 2,675.0 $ 2,736.9 $ 2,476.5 $ 2,532.6 $ 2,524.8 Total Stockholders’ Equity 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Less: Goodwill $ 1,681.9 $ 1,658.7 $ 1,655.6 $ 1,679.5 $ 1,741.4 $ 1,481.0 $ 1,537.1 $ 1,529.3 Tangible Stockholders’ Equity $ 15,246.8 $ 16,085.7 $ 16,653.6 $ 17,493.2 $ 18,785.7 $ 19,334.7 $ 19,942.8 $ 20,247.1 Average Total Assets 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Less: Average Goodwill $ 14,251.3 $ 15,090.2 $ 15,658.1 $ 16,497.7 $ 17,790.2 $ 18,339.2 $ 18,947.3 $ 19,251.6 Average Tangible Assets $ 15,839.4 $ 16,646.7 $ 17,118.8 $ 18,133.7 $ 19,352.7 $ 19,661.8 $ 20,549.5 $ 20,695.7 Total Assets 995.5 995.5 995.5 995.5 995.5 995.5 995.5 995.5 Less: Goodwill $ 14,843.9 $ 15,651.2 $ 16,123.3 $ 17,138.2 $ 18,357.2 $ 18,666.3 $ 19,554.0 $ 19,700.2 Tangible Assets 7.56% 7.92% 8.04% 8.03% 7.81% 8.96% 7.24% 10.76% Return on Average Total Stockholders’ Equity 12.14% 12.65% 12.83% 12.72% 12.28% 14.64% 11.91% 18.08% Return on Average Tangible Stockholders’ Equity (non - GAAP) 1.31% 1.31% 1.29% 1.24% 1.14% 1.19% 0.92% 1.31% Return on Average Total Assets 1.40% 1.40% 1.37% 1.31% 1.20% 1.26% 0.97% 1.37% Return on Average Tangible Assets (non - GAAP) $ 316.4 $ 329.8 $ 344.5 $ 344.2 $ 343.2 $ 371.8 $ 368.4 $ 358.2 Income Before Provision for Income Taxes 42.1 34.9 12.2 11.1 9.9 8.6 18.5 22.2 Provision For Credit Losses $ 358.5 $ 364.7 $ 356.7 $ 355.3 $ 353.1 $ 380.4 $ 386.9 $ 380.4 Pre - Tax, Pre - Provision Earnings (Non - GAAP)

v3.25.0.1

Cover

|

Feb. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 10, 2025

|

| Entity File Number |

001-14585

|

| Entity Registrant Name |

FIRST

HAWAIIAN, INC.

|

| Entity Central Index Key |

0000036377

|

| Entity Tax Identification Number |

99-0156159

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

999

Bishop St.

|

| Entity Address, Address Line Two |

29th Floor

|

| Entity Address, City or Town |

Honolulu

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96813

|

| City Area Code |

808

|

| Local Phone Number |

525-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

FHB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

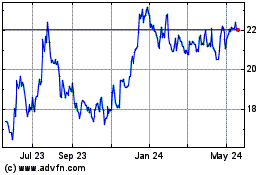

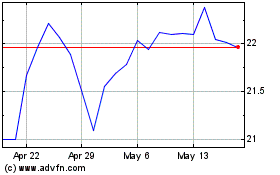

First Hawaiian (NASDAQ:FHB)

Historical Stock Chart

From Jan 2025 to Feb 2025

First Hawaiian (NASDAQ:FHB)

Historical Stock Chart

From Feb 2024 to Feb 2025