UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

[ ]

Preliminary Proxy Statement.

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

[X]

Definitive Proxy Statement.

[ ]

Definitive Additional Materials.

[ ]

Soliciting Material Pursuant to §240.14a-12.

GREENPRO

CAPITAL CORP.

(Name

of Registrant As Specified in Charter)

(Name

of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14c−5(g) and 0−11.

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0−11 (set forth the amount

on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0−1 1(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing.

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

(4)

|

Date

Filed:

|

Greenpro

Capital Corp.

Room

1701-1703, 17/F, The Metropolis Tower

10 Metropolis Drive

Hung Hom, Kowloon, Hong Kong

NOTICE

OF ANNUAL

MEETING

OF STOCKHOLDERS

To

Be Held On June 5, 2020

Dear

Stockholders:

You

are hereby notified that the Annual Meeting of Stockholders of Greenpro Capital Corp., a Nevada corporation (together with its

subsidiaries, the “Company, “we”, “us” or “our”), will be held at 10:00 a.m. on Friday,

June 5, 2020 (local time), at the offices of the Company at Room 1701-1703, 17/F, The Metropolis Tower, 10 Metropolis Drive, Hung

Hom, Kowloon, Hong Kong, for the following purposes:

|

|

1.

|

To

elect our directors. Our Board of Directors intends to present for election the following six nominees: (1) Lee, Chong Kuang,

(2) Loke Che Chan, Gilbert, (3) Chuchottaworn, Srirat, (4) Louis, Ramesh Ruben, (5) Glendening, Brent Lewis and (6) Bringuier,

Christophe Philippe Roland;

|

|

|

|

|

|

|

2.

|

To

ratify the appointment of Weinberg & Company P.A. (“Weinberg”) as our independent registered public accounting

firm for the fiscal year ending December 31, 2020; and

|

|

|

|

|

|

|

3.

|

To

transact such other business as may properly come before the Annual Meeting and any postponement(s) or adjournment(s) thereof.

|

The

foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Our

Board of Directors unanimously recommends that you vote “FOR” each of the nominees to our Board, and “FOR”

Proposal 2.

Our

Board of Directors has fixed the close of business on May 4, 2020 as the record date for the determination of stockholders entitled

to vote at the Annual Meeting, and only holders of record of shares of Common Stock at the close of business on that day will

be entitled to vote. The stock transfer books of the Company will not be closed.

Only

stockholders and guests of the Company may attend and be admitted to the Annual Meeting. If your shares are registered in the

name of a broker, trust, bank or other nominee, you will need to bring a proxy or a letter from that broker, trust, bank or other

nominee or your most recent brokerage account statement that confirms that you are the beneficial owner of those shares.

All

stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to be present at the Annual

Meeting, please fill in, date, sign, and return the enclosed Proxy, which is solicited by management. The Proxy is revocable and

will not affect your vote in person in the event you attend the Annual Meeting.

|

|

By

Order of the Board of Directors of

|

|

|

Greenpro

Capital Corp.

|

|

|

|

|

|

/s/

Lee Chong Kuang

|

|

|

Lee

Chong Kuang

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

May

4, 2020

|

Greenpro

Capital Corp.

Room

1701-1703, 17/F, The Metropolis Tower

10 Metropolis Drive

Hung Hom, Kowloon, Hong Kong

PROXY

STATEMENT

ANNUAL

MEETING OF STOCKHOLDERS

To

Be Held On June 5, 2020

The

enclosed Proxy is solicited by the Board of Directors (the “Board of Directors”) of Greenpro Capital Corp, a Nevada

corporation, for use at our Annual Meeting of Stockholders (the “Meeting”) to be held on Friday, June 5, 2020 at the

offices of the Company at Room 1701-1703, 17/F, The Metropolis Tower, 10 Metropolis Drive, Hung Hom, Kowloon, Hong Kong and any

adjournments thereof. The Board of Directors has set the close of business on May 4, 2020, as the record date (the “Record

Date”) for the determination of stockholders entitled to vote at the Meeting. A stockholder executing and returning a proxy

has the power to revoke it at any time before it is exercised by filing a later-dated proxy with, or other communication to, the

Secretary of the Company or by attending the Meeting and voting in person. It is anticipated that this Proxy Statement will be

mailed to our stockholders on or about May 8, 2020. References to the “Company,” “us,” “we,”

or “our,” refer to Greenpro Capital Corp.

The

Annual Meeting is for the purpose of considering and voting:

|

|

1.

|

To

elect the directors. Our Board of Directors intends to present for election the following six nominees: (1) Lee, Chong Kuang,

(2) Loke Che Chan, Gilbert, (3) Chuchottaworn, Srirat, (4) Louis, Ramesh Ruben, (5) Glendening, Brent Lewis and (6) Bringuier,

Christophe Philippe Roland;

|

|

|

|

|

|

|

2.

|

To

ratify the appointment of Weinberg & Company P.A. (“Weinberg”) as our independent registered public accounting

firm for the fiscal year ending December 31, 2020; and

|

|

|

|

|

|

|

3.

|

To

transact such other business as may properly come before the Annual Meeting and any postponement(s) or adjournment(s) thereof.

|

In

the event that a quorum is not present at the annual meeting, you may also be asked to vote upon a proposal to adjourn or postpone

the annual meeting to solicit additional proxies.

Record

Date

Only

stockholders of record as of the Record Date will be entitled to vote at the Annual Meeting and any adjournments thereof. As of

the Record Date, 54,723,889 shares of our common stock, par value $.0001 per share (“Common Stock”), were issued and

outstanding. The holders of our Common Stock are entitled to one vote per share.

Voting

Rights and Quorum

Each

share of our common stock is entitled to one vote. The presence in person or representation by proxy of holders of a majority

of the shares of our common stock issued and outstanding as of the close of business on the Record Date will constitute a quorum

at the annual meeting. If a share is represented for any purpose at the meeting, it is deemed to be present for the transaction

of all business. Abstentions and broker non-votes are counted as present for the purpose of determining the presence or absence

of a quorum for the transaction of business. In the event that a quorum is not present at the annual meeting, it is expected that

the annual meeting will be adjourned or postponed to solicit additional proxies.

Vote

Required

Proposal

One. Directors are elected by a plurality, and the nominees who receive the most votes will be elected. Proposal One is

considered a “non-routine” matter under NASDAQ Stock Market (“NASDAQ”) rules, and, accordingly, brokerage

firms and nominees do not have the authority to vote their clients’ unvoted shares on Proposal One or to vote their clients’

shares if the clients have not furnished voting instructions within a specified period of time prior to the Annual Meeting. Abstentions

and broker non-votes will not be counted as votes cast and will have no effect on the outcome of the vote on Proposal One.

Proposal

Two. To be approved, the ratification of Weinberg & Company LLP, as the Company’s independent accountants must

receive the affirmative vote of the majority of the shares of Common Stock present in person or by proxy and cast at the Annual

Meeting. Proposal Two is considered a “routine” matter under NASDAQ rules, and, accordingly, brokerage firms and nominees

have the authority to vote their clients’ unvoted shares on Proposal Two as well as to vote their clients’ shares

where the clients have not furnished voting instructions within a specified period of time prior to the Annual Meeting. Abstentions

and broker non-votes will not be counted as votes cast and will have no effect on the outcome of the vote on Proposal Two.

A

properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted

with respect to the director or directors indicated, and will have the same effect as a vote cast against such director. With

respect to the other proposals, a properly executed proxy marked “ABSTAIN,” although counted for purposes of determining

whether there is a quorum, will not be voted. Accordingly, an abstention will have the same effect as a vote cast against a proposal.

Under Nevada law, a broker non-vote will be treated as not being voted and will have the same effect as a vote cast against a

proposal.

A

“broker non-vote” occurs when a broker, bank, or other holder of record holding shares for a beneficial owner does

not vote on a particular proposal because that holder (i) has not received instructions from the beneficial owner and (ii) does

not have discretionary voting power for that particular item.

If

you are a beneficial owner and you do not give instructions to your broker, bank, or other holder of record, such holder of record

will be entitled to vote the shares with respect to “routine” items but will not be permitted to vote the shares with

respect to “non-routine” items (those shares are treated as “broker non-votes”). If you are a beneficial

owner, your broker, bank, or other holder of record has discretion to vote your shares on the proposals to ratify the appointment

of Weinberg as our independent registered public accounting firm if the holder of record does not receive voting instructions

from you. However, such holder of record may not vote your shares on the election of directors without your voting instructions

on those proposal. Accordingly, without your voting instructions on those proposals, a broker non-vote will occur. We encourage

you to provide instructions to your bank, brokerage firm, or other nominee by voting your proxy. This action ensures that your

shares will be voted in accordance with your wishes at the annual meeting.

Voting

and Revocation of Proxies

After

carefully reading and considering the information contained in this proxy statement, you may attend the annual meeting and vote

your shares in person, by telephone or over the Internet. You may also grant your proxy to vote by returning a signed, dated and

marked proxy card, by telephone or over the Internet.

Unless

you specify to the contrary, all of your shares represented by valid proxies will be voted

|

|

●

|

“FOR”

all director nominees; and

|

|

|

|

|

|

|

●

|

“FOR”

the appointment of Weinberg as our independent registered public accounting firm;

|

The

persons you name as proxies may propose and vote for one or more adjournments or postponements of the annual meeting, including

adjournments or postponements to permit further solicitations of proxies. Such proxy holders may also vote in its discretion on

any other matters that properly come before the annual meeting.

Until

exercised at the annual meeting, you can revoke your proxy and change your vote in any of the following ways:

|

|

●

|

by

delivering written notification to us at our principal executive offices at Room 1701-1703, 17/F, The Metropolis Tower, 10

Metropolis Drive, Hung Hom, Kowloon, Hong Kong, Attention: Corporate Secretary;

|

|

|

|

|

|

|

●

|

by

changing your vote or revoking your proxy by telephone or over the Internet;

|

|

|

|

|

|

|

●

|

if

you hold shares in your name, by attending the annual meeting and voting in person (your attendance at the meeting will not,

by itself, revoke your proxy; you must vote in person at the meeting);

|

|

|

|

|

|

|

●

|

if

you have instructed a broker or bank to vote your shares, by following the directions received from your broker or bank to

change those instructions; or

|

|

|

|

|

|

|

●

|

if

you hold shares in street name with your broker or by a nominee, by obtaining a legal proxy from the institution that holds

your shares, attending the annual meeting and voting in person (your attendance at the meeting will not, by itself, revoke

your proxy; you must vote in person at the meeting).

|

If

you decide to vote by completing, signing, dating and returning a proxy card, you should retain a copy of the voter control number

found on the proxy card in the event that you decide later to change or revoke your proxy.

Solicitation

of Proxies

The

accompanying proxy is being solicited by our Board of Directors. The entire cost of soliciting proxies will be borne by the Company.

The costs of solicitation will include the costs of supplying necessary additional copies of the solicitation materials to beneficial

owners of shares held of record by brokers, dealers, banks, trustees, and their nominees, including the reasonable expenses of

such record holders for completing the mailing of such materials to such beneficial owners. Solicitation of proxies may also include

solicitation by telephone, fax, electronic mail, or personal solicitations by directors, officers, or employees of the Company.

No additional compensation will be paid for any such services.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

The

following table sets forth, as of May 4, 2020, certain information concerning the beneficial ownership of our common stock by

(i) each stockholder known by us to own beneficially five percent or more of our outstanding common stock or series a common stock;

(ii) each director; (iii) each named executive officer; and (iv) all of our executive officers and directors as a group, and their

percentage ownership and voting power.

The

information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the

rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these

rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote

or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to

own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within

sixty (60) days through the conversion or exercise of any convertible security, warrant, option, or other right. More than one

(1) person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person

as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number

of shares as to which such person has the right to acquire voting or investment power within sixty (60) days, by the sum of the

number of shares outstanding as of such date. Consequently, the denominator used for calculating such percentage may be different

for each beneficial owner. Except as otherwise indicated below and under applicable community property laws, we believe that the

beneficial owners of our common stock listed below have sole voting and investment power with respect to the shares shown.

|

Name of Beneficial Owner(1)

|

|

Number of

Shares Beneficially

Owned(2)

|

|

|

Percentage of

Shares Beneficially

Owned(2)

|

|

|

|

|

|

|

|

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lee Chong Kuang(3)

President, Chief Executive Officer and Director

|

|

|

19,046,987

|

|

|

|

34.81

|

%

|

|

|

|

|

|

|

|

|

|

|

Loke Che Chan Gilbert

Chief Financial Officer and Director

|

|

|

17,385,838

|

|

|

|

31.77

|

%

|

|

|

|

|

|

|

|

|

|

|

Chuchottaworn Srirat

Independent Director

|

|

|

1,221,500

|

|

|

|

2.23

|

%

|

|

|

|

|

|

|

|

|

|

|

Louis Ramesh Ruben

Independent Director

|

|

|

4,000

|

|

|

|

*

|

%

|

|

|

|

|

|

|

|

|

|

|

Glendening Brent Lewis

Independent Director

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

Bringuier Christophe Philippe Roland

Independent Director

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

All officers and directors as a group (6 persons named above)

|

|

|

37,658,325

|

|

|

|

68.81

|

%

|

|

|

|

|

|

|

|

|

|

|

|

5% or More Beneficial Owners

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Greenpro Talents Ltd (4)

|

|

|

4,984,469

|

|

|

|

9.11

|

%

|

*

Less than 1%

(1)

Except as otherwise set forth below, the address of each beneficial owner is Room 1701-1703, 17/F, The Metropolis Tower, 10

Metropolis Drive, Hung Hom, Kowloon, Hong Kong.

(2)

Based on 54,723,889 shares of common stock outstanding as of May 4, 2020, together with securities exercisable or convertible

into shares of common stock within 60 days of May 4, 2020. Beneficial ownership is determined in accordance with the rules of

the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of

common stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible

stock, warrants or other securities that are currently exercisable or convertible or that will become exercisable or convertible

within 60 days of May 4, 2020, are deemed to be beneficially owned by the person holding such securities for the purpose of computing

the number of shares beneficially owned and percentage of ownership of such person, but are not treated as outstanding for the

purpose of computing the percentage ownership of any other person.

(3)

Represents 17,385,837 shares held directly by Mr. Lee Chong Kuang and 1,661,150 shares held by his spouse Yap Pei Ling.

(4)

Greenpro Talents Limited is wholly owned by Greenpro International Foundation. The address for Greenpro International Foundation

is Delta Tower Building, 14th Floor, “Via Espana” one hundred twenty two (122), Panama City, Republic of Panama. Tan

Inn Shen, Au Pak Lun Patrick and Sirichotepong Rateewan have shared voting and dispositive power over the shares.

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

Our

Board of Directors has approved the persons named below as nominees for election to our Board of Directors. All nominees presently

serve as directors. Proxies will be voted for the election as directors for the ensuing year of the persons named below (or if

for any reason unavailable, of such substitutes as our Board of Directors may designate). Our Board of Directors has no reason

to believe that any of the nominees will be unavailable to serve.

|

Nominee

Name

|

|

Age

|

|

Positions

and Offices

|

|

|

|

|

|

|

|

Lee,

Chong Kuang

|

|

46

|

|

President,

Chief Executive Officer, Director

|

|

Loke,

Che Chan Gilbert

|

|

65

|

|

Chief

Financial Officer, Secretary, Treasurer, Chairman of the Board

|

|

Chuchottaworn,

Srirat(1)

|

|

51

|

|

Director

|

|

Louis,

Ramesh Ruben(1)(2)(3)

|

|

42

|

|

Director

|

|

Glendening,

Brent Lewis(1)(2)(3)

|

|

65

|

|

Director

|

|

Bringuier,

Christophe Philippe Roland (1)(2)

|

|

42

|

|

Director

|

|

(1)

|

Member

of the Audit Committee.

|

|

(2)

|

Member

of the Compensation Committee.

|

|

(3)

|

Member

of the Nominating and Corporate Governance Committee.

|

Lee,

Chong Kuang, age 46, has served as our Chief Executive Officer, President and Director since July 19, 2013. During the

period of July 19, 2013 to June 5, 2019, he served as Chairman of the Board. From 2003 until January 2015, Mr. Lee served as a

director of Asia UBS Global Ltd, a Hong Kong company, which he founded in 2003. He served as director, Chief Financial Officer

and Treasurer of Odenza Corp. from February 4, 2013 to April 29, 2016. He also served as the Chief Financial Officer and director

of Moxian Corporation from October 2012 until December 2014. Mr. Lee served as director of Greenpro Talents Ltd. from November

16, 2015 to June 6, 2017. Mr. Lee served as director of GC Investment Management Limited, which is the investment manager of Greenpro

Asia Strategic SPC, since April 6, 2016. From 1997 to 2000, Mr. Lee worked at K. Y. Ho & Co, Chartered Accountants. He began

his professional career with Siva Tan & Co., a Chartered Accountant firm in Malaysia in 1995 where he remained until 1997.

As a qualified member of the ACCA and Malaysia Institute of Accountants, Mr. Lee earned his professional qualification from the

Hong Kong Institute of Certified Public Accountants and extended his professional services covering accounting, tax, corporate

structuring planning with special focus in cross-border client nature, in addition to his accounting software businesses. Mr.

Lee established the Cross-Border Business Association (CBBA) – a NGO (Non-Government Organization) established under Hong

Kong Society Act - to provide information and professional advice in Cross Border Business for its investment members. For the

Cross-Border Investment especially in the mining resources companies which are growing fast since 2011, Mr. Lee continues to support

its clients by using cloud platform to strengthen its clientele through the use of technology advancement and models such as SaaS,

PaaS, etc., for accounting and management solution purposes. Mr. Lee brings to the Board of Directors his business leadership,

corporate strategy and accounting and financial expertise.

Loke,

Che Chan Gilbert, age 65, has served as our Chief Financial Officer, Treasurer and Director since inception on July 19,

2013. Effective from June 6, 2019, he serves as Chairman of the Board. Mr. Loke has extensive knowledge in accounting and has

been an accountant for more than 35 years. He was trained and qualified with UHY (formerly known as Hacker Young), Chartered Accountants,

one of the large accounting firms based in London, England between 1981 and 1988. His extensive experience in auditing, accounting,

taxation, SOX compliance and corporate listing has prompted him to specialize in corporate advisory, risk management and internal

controls serving those small medium-sized enterprises. From September 1999 until June 2013, Mr. Loke served as an adjunct lecturer

in ACCA P3 Business Analysis at HKU SPACE (HKU School of Professional and Continuing Education), which is an extension of the

University of Hong Kong and provides professional and continuing education. Mr. Loke worked as an independent, non-executive director

of ZMay Holdings Limited, a public company listed on the Hong Kong Stock Exchange from January 2008 to July 2008 and as Chief

Financial Officer for Asia Properties Inc. from May 31, 2011 to March 28, 2012 and Sino Bioenergy Inc., with both companies listed

on the OTC Markets in the US, from 2011 to 2012. Mr. Loke has served as the Chief Executive Officer and a director of Greenpro

Resources Corporation since October 16, 2012. He has also served the Chief Executive Officer and a director of Moxian Corporation

from October 2012 until December 2014. Mr. Loke served as an independent director of Odenza Corp. from February 2013 to May 2015.

He has also served as the Chief Financial Officer, Secretary, Treasurer, and a director of CGN Nanotech, Inc. from September 4,

2014 to September 28, 2016.

Mr.

Loke served as director of Greenpro Talents Ltd. from November 16, 2015 to June 6, 2017. Mr. Loke served as director of GC Investment

Management Limited, which is the investment manager of Greenpro Asia Strategic SPC, since April 6, 2016. Mr. Loke earned his degree

of MBA from Bulacan State University, Philippines, and earned his professional accountancy qualifications from the ACCA, AIA and

HKICPA. He also earned other professional qualifications from the HKICS, ICSA as Chartered Secretary, FPAM - Malaysia as Certified

Financial Planner, ATIHK as tax adviser in Hong Kong and CWM Institute as Chartered Wealth Manager in Hong Kong. Mr. Loke brings

to the Board of Directors accounting and financial expertise and business leadership.

Chuchottaworn,

Srirat, age 51, joined us as an Independent Director on October 18, 2015. Ms. Chuchottaworn has more than 20 years in

the IT and consulting business. In 1997, she became an SAP consultant for finance and controlling (FI/CO) and held a certificate

of FI/CO. In 2004, she found I AM Group and has been the group director since then. She is an experienced project manager and

holds multiple SAP certifications. She earned a Bachelor’s in Engineering Degree from the King Monkut’s Institute

of Technology Ladkrabang and Master of Science in Information Technology from the Chulalongkorn University. Ms. Chuchottaworn

brings to the Board of Directors business leadership and experience and familiarity with conducting business in Thailand.

Louis,

Ramesh Ruben, age 42, joined us as an Independent Director of the Company on May 8, 2019. Mr. Louis is a Chartered Accountant

of the Malaysian Institute of Accountants (MIA), a fellow member of Association of Chartered Certified Accountants (FCCA), a chartered

member of the Institute of Internal Auditors, as well as a Certified Financial Planner. Mr. Louis has over 20 years of experience

in accounting, auditing and risk management ranging from large public listed companies to multinational corporations, government

agencies as well as SME’s in a spectrum of industries including plantation, property development, manufacturing, trading,

IT, shipping, retailing, etc. He started his career at Arthur Andersen from December 1996 to 1997, and subsequently moved to BDO

from April 2000 to 2004 and from 2005 to 2006, respectively. He also has experience in corporate finance with Southern Investment

Bank Berhad for a year from 2004 to 2005. Mr. Louis has hands-on experience on other corporate exercises such as due diligence,

IPO’s, issuance of bonds, corporate & debt restructuring and investigative audit. His training and advisory experience

includes topics on Internal & Statutory Auditing, Public Sector/Government Audits, Value-for-Money Audits, ISQC 1, Risk Management&

Internal Controls, Review and Assurance Engagements such as Financial Due Diligence, Forecasts & Projections, Forensic &

Fraud Accounting/Auditing, as well as practical application of International Financial Reporting Standards (“IFRS”),

Reporting Standards for SMEs (MPERS/PERS) and public sector accounting (MPSAS). He has facilitated training and provided advisory

for public accountants across Asia Pacific, multinationals and public sector institutions. Mr. Louis is a certified trainer by

the Human Resource Development Fund (HRDF), Ministry of Human Resources Malaysia. Mr. Louis brings to the Board of Directors extensive

experience in mergers and acquisitions, risk management, strategic planning, and financial oversight and reporting.

Glendening,

Brent Lewis, age 65, joined us as an Independent Director of the Company on October 1, 2019. Mr. Glendening, a U.S. citizen,

is a global technology executive with over 25 years of experience in international management and strategic IT leadership driving

business results and strategic programs. Since September 2018, he has served as the managing director of Brent Glendening &

Associates LLC, a company that provides senior IT leadership development and support services in strategic planning, strategic

supplier negotiations and business analytics / artificial intelligence (AI) development. From March 2017 to August 2018, he served

as vice president of supply chain solutions of Halo BI LLC, a company that provides business analytics solutions with an emphasis

in supply planning and utilizing AI to improve supply chain planning. In this role, Mr. Glendening was the chief architect for

all business analytics solutions development. From April 2010 to February 2017, he served as vice president of information technology

of The Carlstar Group LLC, a worldwide leader of specialty tires and wheels for the off-road enthusiast market. Mr. Glendening

has expertise in global business harmonization, consolidation and restructuring. During his career, in addition to the positions

disclosed above, Mr. Glendening has held senior technology management positions in various other notable companies, such as director

of management information services of ADT Security Systems, Inc., executive vice president and chief information officer of Schindler

Holding AG, Switzerland (SCHN: SWX), president of Schindler Informatik AG and vice president and international chief information

officer of Whirlpool Corporation (NYSE: WHR). Mr. Glendening was awarded the Top 10 Chief Information Officer by Computerworld

in Switzerland 2005. Mr. Glendening brings to the Board of Directors significant senior executive leadership experience, as well

as relevant experience in information technology, AI and business process improvement.

Bringuier,

Christophe Philippe Roland, age 42, joined us as an Independent Director of the Company on October 16, 2019. Mr. Bringuier,

a French citizen, is currently living and working in Hong Kong. He has over 15 years of international exposure in France, India,

PRC and Hong Kong. Mr. Bringuier has held various managerial positions in different industries such as banking, energy, direct

marketing, watchmaking and financial services since 2001. Since 2018, he has served as the business transformation specialist

of Equiom Group (HK) Limited, a company that provides end-to-end wealth protection and business support services to private clients,

corporate clients and funds. Mr. Bringuier established his own consulting company in 2016, Itaque Consulting in Hong Kong, providing

consulting services for business transformation, leadership and communication skill training and coaching courses for senior executives

in various industries. From 2011 to 2016, he served as senior operations manager of Intertrust Group (HK) Limited, a company that

delivers high-quality, tailored corporate, fund, capital market and private wealth services to its clients. In this role, Mr.

Bringuier was in charge of internal audit, risk management and operational transformation processes. From 2007 to 2011, he served

as project and marketing manager of Montrichard Watch Company Limited in Shenzhen, PRC, a watchmaking company with production

plants in PRC and Switzerland, and offices in Europe, Asia and USA. Mr. Bringuier has expertise in process improvement, stakeholder

management and project management in a complex, multicultural or cross-functional environment. Mr. Bringuier brings to the Board

of Directors extensive knowledge and experience in talent development, executive coaching, business transformation and international

operations.

CORPORATE

GOVERNANCE

Director

Independence

The

Board of Directors has reviewed the independence of our directors, applying the NASDAQ independence standards. Based on this review,

the Board of Directors determined that each of Chuchottaworn Srirat, Louis Ramesh Ruben, Glendening Brent Lewis, and Bringuier

Christophe Philippe Roland, are independent within the meaning of the NASDAQ rules. In making this determination, our Board of

Directors considered the relationships that each of these non-employee directors has with us and all other facts and circumstances

our Board of Directors deemed relevant in determining their independence. As required under applicable NASDAQ rules, we anticipate

that our independent directors will meet on a regular basis as often as necessary to fulfill their responsibilities, including

at least annually in executive session without the presence of non-independent directors and management.

Board

Meetings

During

calendar year 2019, our Board held six (6) meetings and acted by written consent five (5) times. Each director attended all Board

meetings and applicable committee meetings held during calendar year 2019. The work of the Company’s directors is performed

not only at meetings of the Board, but also by consideration of the Company’s business through the review of documents and

in numerous communications among Board members and others.

Director

Attendance at Annual Meeting

We

have not yet developed a policy regarding director attendance at annual meetings of the stockholders. We expect all of our directors

to attend our 2020 Annual Stockholders Meeting,

Committees

of Our Board

Audit

Committee

Our

Audit Committee was established on March 23, 2016 and is currently comprised of our independent directors: Mr. Louis Ramesh Ruben

(Chairman), Ms. Chuchottaworn Srirat, Mr. Glendening Brent Lewis and Mr. Bringuier Christophe Philippe Roland. Mr. Louis is Chair

of the Audit Committee and he qualifies as the Audit Committee financial expert as defined in Item 407(d)(5) of Regulation S-K

promulgated under the Securities Act. The Audit Committee held ten (10) meetings during 2019, four (4) of the meetings were held

after each quarter end or year end with our external auditor for discussing any significant financial reporting or audit issues

before filing Form 10-Qs or Form 10-K, the remaining six (6) meetings were discussing about the progress of our internal controls

system.

According

to its charter, the Audit Committee consists of at least three members, each of whom shall be a non-employee director who has

been determined by the Board to meet the independence requirements of NASDAQ, and also Rule 10A-3(b)(1) of the SEC, subject to

the exemptions provided in Rule 10A-3(c). A copy of the Audit Committee Charter is available on our website at http://www.greenprocapital.com.

The Audit Committee Charter describes the primary functions of the Audit Committee, including the following:

|

|

●

|

Oversee

the Company’s accounting and financial reporting processes;

|

|

|

|

|

|

|

●

|

Oversee

audits of the Company’s financial statements;

|

|

|

|

|

|

|

●

|

Discuss

policies with respect to risk assessment and risk management, and discuss the Company’s major financial risk exposures

and the steps management has taken to monitor and control such exposures;

|

|

|

|

|

|

|

●

|

Review

and discuss with management the Company’s audited financial statements and review with management and the Company’s

independent registered public accounting firm the Company’s financial statements prior to the filing with the SEC of

any report containing such financial statements.

|

|

|

|

|

|

|

●

|

Recommend

to the board that the Company’s audited financial statements be included in its annual report on Form 10-K for the last

fiscal year;

|

|

|

●

|

Meet

separately, periodically, with management, with the Company’s internal auditors (or other personnel responsible for

the internal audit function) and with the Company’s independent registered public accounting firm;

|

|

|

|

|

|

|

●

|

Be

directly responsible for the appointment, compensation, retention and oversight of the work of any independent registered

public accounting firm engaged to prepare or issue an audit report for the Company;

|

|

|

|

|

|

|

●

|

Take,

or recommend that the board take, appropriate action to oversee and ensure the independence of the Company’s independent

registered public accounting firm; and

|

|

|

|

|

|

|

●

|

Review

major changes to the Company’s auditing and accounting principles and practices as suggested by the Company’s

independent registered public accounting firm, internal auditors or management.

|

Audit

Committee Report

The

Audit Committee has reviewed and discussed the audited financial statements with management. The Audit Committee has discussed

with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended and

adopted by the Public Company Accounting Oversight Board in Rule 3200T. It has received the written disclosures and the letter

from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding

the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the

independent accountant the independent accountant’s independence. Based upon the foregoing review and discussions, the Audit

Committee recommended to the Board that the audited consolidated financial statements be included in the company’s Annual

Report on Form 10-K for the year ended December 31, 2019. Our Annual Report on Form 10-K was filed with the SEC on March 30, 2020.

Submitted

by members of the Audit Committee:

Louis

Ramesh Ruben (Chairman)

Chuchottaworn

Srirat

Glendening

Brent Lewis

Bringuier

Christophe Philippe Roland

Compensation

Committee

Our

Compensation Committee was established on March 17, 2017 and currently consists of Mr. Louis Ramesh Ruben, Mr. Glendening Brent

Lewis and Mr. Bringuier Christophe Philippe Roland. Mr. Louis serves as chairman of the Compensation Committee. The Compensation

Committee did not hold any meeting or act by written consent during 2019. The Compensation Committee will be responsible for,

among other matters:

|

|

●

|

reviewing

and approving, or recommending to the Board of Directors to approve the compensation of our CEO and other executive officers

and directors reviewing key employee compensation goals, policies, plans and programs;

|

|

|

|

|

|

|

●

|

administering

incentive and equity-based compensation;

|

|

|

|

|

|

|

●

|

reviewing

and approving employment agreements and other similar arrangements between us and our executive officers; and

|

|

|

|

|

|

|

●

|

appointing

and overseeing any compensation consultants or advisors.

|

Corporate

Governance and Nominating Committee

Our

Corporate Governance and Nominating Committee was established on March 17, 2017 and currently consists of Mr. Glendening Brent

Lewis and Mr. Louis Ramesh Ruben. Mr. Glendening serves as chairman of the Corporate Governance and Nominating Committee. The

Corporate Governance and Nominating Committee did not meet in person at any time during 2019, but did act by written consent on

one occasion. The Corporate Governance and Nominating Committee will be responsible for, among other matters:

|

|

●

|

selecting

or recommending for selection candidates for directorships;

|

|

|

|

|

|

|

●

|

evaluating

the independence of directors and director nominees;

|

|

|

|

|

|

|

●

|

reviewing

and making recommendations regarding the structure and composition of our board and the board committees;

|

|

|

|

|

|

|

●

|

developing

and recommending to the board corporate governance principles and practices;

|

|

|

|

|

|

|

●

|

reviewing

and monitoring the Company’s Code of Business Conduct and Ethics; and

|

|

|

|

|

|

|

●

|

overseeing

the evaluation of the Company’s management.

|

Identifying

and Evaluating Nominees

In

considering candidates for membership on the Board of Directors, the Corporate Governance and Nominating Committee will take into

consideration the needs of the Board of Directors and the candidate’s qualifications. The Corporate Governance and Nominating

Committee will request such information as:

|

|

●

|

The

name and address of the proposed candidate;

|

|

|

|

|

|

|

●

|

The

proposed candidates resume or a listing of his or her qualifications to be a director of the Company;

|

|

|

|

|

|

|

●

|

A

description of any relationship that could affect such person’s qualifying as an independent director, including identifying

all other public company board and committee memberships;

|

|

|

|

|

|

|

●

|

A

confirmation of such person’s willingness to serve as a director if selected by the Board of Directors; and

|

|

|

|

|

|

|

●

|

Any

information about the proposed candidate that would, under the federal proxy rules, be required to be included in the Company’s

proxy statement if such person were a nominee.

|

Once

a person has been identified by the Corporate Governance and Nominating Committee as a potential candidate, the Corporate Governance

and Nominating Committee may collect and review publicly available information regarding the person to assess whether the person

should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors

and the Corporate Governance and Nominating Committee believes that the candidate has the potential to be a good candidate, the

Corporate Governance and Nominating Committee would seek to gather information from or about the candidate, including through

one or more interviews as appropriate and review his or her accomplishments and qualifications generally, including in light of

any other candidates that the Corporate Governance and Nominating Committee may be considering. The Corporate Governance and Nominating

Committee’s evaluation process does not vary based on whether the candidate is recommended by a shareholder.

The

Corporate Governance and Nominating Committee will, from time to time, seek to identify potential candidates for director nominees

and will consider potential candidates proposed by the Board of Directors and by management of the Company. There is no specific

board diversity policy in place presently.

Communications

with Our Board

Stockholders

and interested parties who wish to contact our Board, a committee thereof, the presiding non-management director of executive

sessions or any individual director are invited to do so by writing to:

Board

of Directors of Greenpro Capital Corp.

c/o

Corporate Secretary

Room

1701-1703, 17/F, The Metropolis Tower

10

Metropolis Drive

Hung

Hom, Kowloon, Hong Kong

All

communications will be forwarded to our Board of Directors, the specified committee or the specified individual director, as appropriate.

Board

Leadership Structure and Role in Risk Oversight

Mr.

Loke Che Chan Gilbert holds the positions of chief financial officer and chairman of the Board of Directors of the Company. The

board believes that Mr. Loke’s services as both chief financial officer and chairman of the board is in the best interest

of the Company and its shareholders. Mr. Loke possesses detailed and in-depth knowledge of the issues, opportunities and challenges

facing the Company in its business and is thus best positioned to develop agendas that ensure that the Board’s time and

attention are focused on the most critical matters relating to the business of the Company. His combined role enables decisive

leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly

and consistently to the Company’s shareholders, employees and customers.

The

Board of Directors has not designated a lead director. Given the limited number of directors comprising the Board of Directors,

the independent directors call and plan their executive sessions collaboratively and, between meetings of the Board of Directors,

communicate with management and one another directly. Under these circumstances, the directors believe designating a lead director

to take on responsibility for functions in which they all currently participate might detract from rather than enhance performance

of their responsibilities as directors.

Management

is responsible for assessing and managing risk, subject to oversight by the Board of Directors. The Board of Directors oversees

our risk management policies and risk appetite, including operational risks and risks relating to our business strategy and transactions.

Various committees of the board assist the board in this oversight responsibility in their respective areas of expertise.

|

|

●

|

The

Audit Committee assists the board with the oversight of our financial reporting, independent auditors and internal controls.

It is charged with identifying any flaws in business management and recommending remedies, detecting fraud risks and implementing

anti-fraud measures. The audit committee further discusses our policies with respect to risk assessment and management with

respect to financial reporting.

|

|

|

|

|

|

|

●

|

The

Compensation Committee oversees compensation, retention, succession and other human resources-related issues and risks.

|

|

|

|

|

|

|

●

|

The

Corporate Governance and Nominating Committee overviews risks relating to our governance policies and initiatives.

|

Family

Relationships

There

are no family relationships between any of our directors or executive officers.

Involvement

in Certain Legal Proceedings

No

executive officer or director is a party in a legal proceeding adverse to us or any of our subsidiaries or has a material interest

adverse to us or any of our subsidiaries.

No

executive officer or director has been involved in the last ten years in any of the following:

|

|

●

|

Any

bankruptcy petition filed by or against any business or property of such person, or of which such person was a general partner

or executive officer either at the time of the bankruptcy or within two years prior to that time;

|

|

|

●

|

Any

conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other

minor offenses);

|

|

|

|

|

|

|

●

|

Being

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities

or banking activities;

|

|

|

|

|

|

|

●

|

Being

found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have

violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

|

|

|

|

|

|

|

●

|

Being

the subject of or a party to any judicial or administrative order, judgment, decree or finding, not subsequently reversed,

suspended or vacated relating to an alleged violation of any federal or state securities or commodities law or regulation,

or any law or regulation respecting financial institutions or insurance companies, including but not limited to, a temporary

or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist

order, or removal or prohibition order, or any law or regulation prohibiting mail, fraud, wire fraud or fraud in connection

with any business entity; or

|

|

|

|

|

|

|

●

|

Being

the subject of or a party to any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory

organization (as defined in Section 3(a)(26) of the Exchange Act, any registered entity (as defined in Section 1(a)(29) of

the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority

over its members or persons associated with a member.

|

Certain

Relationships and Related Transactions

Except

as set forth below, we have not been a party to any transaction since January 1, 2018, in which the amount involved in the transaction

exceeded or will exceed the lesser of $120,000 or one percent of the average of our total assets as at the year-end for the last

two completed fiscal years, and to which any of our directors, executive officers or beneficial holders of more than 5% of our

capital stock, or any immediate family member of, or person sharing the household with, any of these individuals, had or will

have a direct or indirect material interest.

Our

policy is that a contract or transaction either between the Company and a director, or between a director and another company

in which he is financially interested is not necessarily void or void-able if the relationship or interest is disclosed or known

to the Board of Directors and the Board of Directors is entitled to vote on the issue.

Transactions

with certain companies which Greenpro Venture Capital Limited owns certain percentage of their company shares and companies that

we have determined that we can significantly influence based on our common business relationships.

Related

party transactions amounted to $1,977,186 in service revenue for the year ended December 31, 2019 and $420,730 in service revenue

for the year ended December 31, 2018.

Our

related parties are mainly those companies in which Greenpro Venture Capital Limited or Greenpro Resources Limited owns a certain

percentage of the shares of such companies, or those companies that the Company can exercise significant influence over them in

making financial and operating policy decisions. Some of the related parties are either controlled by or under common control

of Mr. Loke Che Chan, Gilbert or Mr. Lee Chong Kuang, the director of the Company and the other entity. One of the related parties

is controlled by Ms. Chen Yanhong, the director of one of our subsidiaries. All of these related party transactions are generally

transacted at an arm’s-length basis at the current market value in the normal course of business.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act requires our executive officers and directors, and persons who own more than 10% of our common

stock, to file reports regarding ownership of, and transactions in, our securities with the Securities and Exchange Commission

and to provide us with copies of those filings. Based solely on our review of the copies of such forms furnished to us and written

representations by our officers and directors regarding their compliance with applicable reporting requirements under Section

16(a) of the Exchange Act, we believe that all Section 16(a) filing requirements for our executive officers, directors and 10%

stockholders were met during the year ended December 31, 2019.

EXECUTIVE

COMPENSATION

Summary

Compensation Table

Set

forth below is information regarding the compensation paid during the year ended December 31, 2019 and 2018 to our principal executive

officer and principal financial officer, who are collectively referred to as “named executive officers” elsewhere

in this proxy statement.

|

Name and Principal Position

|

|

Year

|

|

|

Salary ($)

|

|

|

|

|

|

Total ($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lee Chong Kuang

|

|

|

2019

|

|

|

|

169,000

|

|

|

|

26,000

|

|

|

|

193,000

|

|

|

Chief Executive Officer and President

|

|

|

2018

|

|

|

|

169,000

|

|

|

|

26,000

|

|

|

|

193,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loke Che Chan Gilbert

|

|

|

2019

|

|

|

|

169,000

|

|

|

|

26,000

|

|

|

|

193,000

|

|

|

Chief Financial Officer, Treasurer and Secretary

|

|

|

2018

|

|

|

|

169,000

|

|

|

|

26,000

|

|

|

|

193,000

|

|

Employment

Agreements

Each

of Loke Che Chan Gilbert, our Chief Financial Officer, Treasurer and Secretary, and director, and Mr. Lee Chong Kuang, our Chief

Executive Officer, entered into employment agreements with us on July 28, 2017, effective as of September 1, 2017, and will expire

on August 31, 2020.

Under

the terms of the agreements, each of Messrs. Loke and Lee will receive a monthly salary equal to $13,000, and a monthly housing

allowance of $2,000, both which may also be payable in Hong Kong Dollars.

Messrs.

Loke and Lee are entitled to reimbursement for reasonable travel and other out-of-pocket expenses incurred in connection with

their services on our behalf. The employment agreements also contain normal and customary terms relating to confidentiality, indemnification,

non-solicitation and ownership of intellectual property.

Outstanding

Equity Awards At Fiscal Year-End

None.

Director

Compensation

During

our fiscal year ended December 31, 2018, we provided $500 per month as compensation to our independent directors who were also

the members of audit committee, including Mr. Hee Chee Keong, Mr. Shum Albert and Ms. Chuchottaworn Srirat (started from December

1, 2018). During 2019, we provided monthly compensation to our independent directors, including Mr. Hee Chee Keong for $500 (up

to May 8, 2019), Mr. Shum Albert for $500 (up to September 30, 2019), Ms. Chuchottaworn Srirat for $500, Mr. Louis Ramesh Ruben

for $1,200 (started from May 8, 2019), Mr. Glendening Brent Lewis for $750 (started from October 1, 2019) and Mr. Bringuier Christophe

Philippe Roland for $500 (started from October 16, 2019). All the independent directors are also members of our audit committee.

We

currently have no plan for compensating our executive directors for their services in their capacity as directors, although we

may elect to issue stock options or provide cash compensation to such persons from time to time in the future. However, we are

compensating the independent directors who serve on the board. These independent directors are entitled to the reimbursement for

reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of our Board of Directors.

Our Board of Directors may award special remuneration to any director undertaking any special services on our behalf other than

services ordinarily required of a director.

Our

Board of Directors unanimously recommends that you vote “FOR” all of the nominees listed above.

PROPOSAL

NO. 2

RATIFICATION

OF SELECTION OF AUDITORS

The

Board of Directors has appointed Weinberg & Company P.A. (“Weinberg”) to audit our consolidated financial statements

for the fiscal year ending December 31, 2019. Weinberg has served as our independent registered public accounting firm since December

2017. We do not expect representatives of Weinberg to be present at our annual meeting of the shareholders.

We

are not required to submit the selection of our independent registered public accounting firm for stockholder approval. If the

stockholders do not ratify the selection of Weinberg as our independent auditors for the fiscal year ending December 31, 2020,

our Board of Directors will evaluate what would be in the best interests of the Company and our stockholders and consider whether

to select new independent auditors for the current fiscal year or whether to wait until the completion of the audit for the current

fiscal year before changing independent auditors.

Audit

Fees

The

following table sets forth the aggregate fees billed to the Company by its independent registered public accounting firms for

the fiscal years ended December 31, 2019 and 2018. The accounting fees and services charged by Weinberg for 2019 and 2018 are

shown separately in the following two tables.

|

ACCOUNTING FEES AND SERVICES

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

Audit fees

|

|

$

|

130,000

|

|

|

$

|

130,000

|

|

|

Audit-related fees

|

|

|

-

|

|

|

|

-

|

|

|

Tax fees

|

|

$

|

-

|

|

|

$

|

-

|

|

|

All other fees

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

130,000

|

|

|

$

|

130,000

|

|

The

category of “Audit fees” includes fees for our annual audit, quarterly reviews and services rendered in connection

with regulatory filings with the SEC, such as the issuance of comfort letters and consents.

The

category of “Audit-related fees” includes employee benefit plan audits, internal control reviews and accounting consultation.

The

category of “Tax services” includes tax compliance, tax advice, tax planning.

The

category of “All other fees” generally includes advisory services related to accounting rules and regulations.

The

policies and procedures contained in the Audit Committee Charter provide that the Committee must pre-approve the audit services,

audit-related services and non-audit services provided by the independent auditor and the provision for such services by Weinberg

were compatible with the maintenance of the firm’s independence in the conduct of its audits.

Pre-approval

Policies and Procedures

Consistent

with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation

and overseeing the work of the independent auditor. Our Audit Committee has adopted certain pre-approval policies and procedures

which were filed as Exhibit 99.2 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 filed with the

SEC on March 30, 2020.

Our

Board of Directors unanimously recommends that you vote “FOR” the proposal to ratify the appointment of Weinberg as

our independent registered public accounting firm for the fiscal year ending December 31, 2020.

STOCKHOLDER

PROPOSALS

Stockholder

proposals intended to be included in the proxy statement for the next annual meeting must be received by Company by January 9,

2021. The persons authorized by the form of proxy to be sent in connection with the solicitation of proxies on behalf of Company’s

Board of Directors for next year’s annual meeting will vote in their discretion as to any matter of which Company has not

received notice by March 24, 2021. The form and substance of these proposals must satisfy the requirements established by the

Company’s Bylaws and the SEC, and the timing for the submission of any such proposals may be subject to change as a result

of changes in SEC rules and regulations.

DELIVERY

OF PROXY MATERIALS

Our

annual report to stockholders for the fiscal year ended December 31, 2019, including audited financial statements, accompanies

this Proxy Statement. Copies of our Annual Report on Form 10-K for fiscal 2019 are available from the Company without charge upon

written request of a stockholder. Copies of these materials are also available online through the Securities and Exchange Commission

at www.sec.gov. The Company may satisfy SEC rules regarding delivery of proxy statements and annual reports by delivering

a single proxy statement and annual report to an address shared by two or more Company stockholders. This delivery method can

result in meaningful cost savings for the Company. In order to take advantage of this opportunity, the Company may deliver only

one proxy statement and annual report to multiple stockholders who share an address, unless contrary instructions are received

prior to the mailing date. Similarly, if you share an address with another stockholder and have received multiple copies of our

proxy materials, you may write or call us at the address and phone number below to request delivery of a single copy of these

materials in the future. We undertake to deliver promptly upon written or oral request a separate copy of the proxy statement

and/or annual report, as requested, to a stockholder at a shared address to which a single copy of these documents was delivered.

If you hold stock as a record stockholder and prefer to receive separate copies of a proxy statement or annual report either now

or in the future, please contact the Company’s Secretary at Room 1701-1703, 17/F, The Metropolis Tower, 10 Metropolis Drive,

Hung Hom, Kowloon, Hong Kong or by telephone at +(852) 3111-7718. If your stock is held through a brokerage firm or bank and you

prefer to receive separate copies of a proxy statement or annual report either now or in the future, please contact your brokerage

firm or bank.

FORWARD-LOOKING

STATEMENTS

This

Proxy Statement may contain certain “forward-looking” statements (as that term is defined in the Private Securities

Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing

our expectations or beliefs regarding our company. These forward- looking statements include, but are not limited to, statements

regarding our business, anticipated financial or operational results and objectives. For this purpose, any statements contained

herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality

of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,”

“intend,” “could,” “estimate,” “might,” or “continue” or the negative

or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by

their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ

materially depending on a variety of important factors, including factors discussed in this and other filings of ours with the

SEC.

AVAILABLE

INFORMATION

The

Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and, in accordance therewith,

files reports and other information with the Securities and Exchange Commission (the “SEC”). The SEC maintains an

Internet site that contains reports, proxy and information statements and other information regarding the Company and other registrants

that file electronically with the SEC at http://www.sec.gov.

The

Company’s common stock is listed on The Nasdaq Capital Market and trades under the symbol “GRNQ”.

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

PROXY

FOR THE ANNUAL MEETING OF STOCKHOLDERS OF

GREENPRO CAPITAL CORP.

TO BE HELD ON JUNE 5, 2020

Unless

otherwise specified, this proxy will be voted FOR Proposals 1 and 2.

The Board of Directors recommends a vote FOR

Proposals 1 and 2.

|

[ ]

|

FOR

all nominees listed below (except

as marked to the contrary below)

|

|

[ ]

|

WITHHOLD

AUTHORITY to vote for

all nominees listed below

|

|

1)

Lee, Chong Kuang

2)

Loke Che Chan Gilbert

3)

Chuchottaworn, Srirat

4)

Louis, Ramesh Ruben

5)

Glendening, Brent Lewis

6)

Bringuier, Christophe Philippe Roland

|

INSTRUCTION:

To withhold authority to vote for any nominee, write the nominee’s name in the space provided below.

|

|

|

|

2.

|

RATIFICATION

OF INDEPENDENT ACCOUNTANTS

|

|

[ ]

|

FOR

|

[ ]

|

|

AGAINST

|

[ ]

|

ABSTAIN

|

Please

sign exactly as your name appears below. When shares are held by joint tenants, each should sign. When signing as attorney, executor,

administrator, trustee, guardian, corporate officer, or partner, please give full title as such.

Date:

__________, 2020

|

|

|

|

|

|

|

Signature

|

|

|

|

|

|

|

|

|

|

|

|

Signature

if held jointly

|

PLEASE

MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

Greenpro

Capital Corp.

Annual

Meeting of Stockholders

JUNE

5, 2020

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

To

Be Held on June 5, 2020

The

undersigned, hereby appoints Lee Chong Kuang, Chief Executive Officer, with full power of substitution, as proxy to represent

and vote all shares of Common Stock, par value $0.0001 per share, of Greenpro Capital Corp. (the “Company”), which

the undersigned will be entitled to vote if personally present at the Annual Meeting of the Stockholders of the Company to be

held on June 5, 2020, at 10:00 a. m. local time the offices of Room 1701-1703, 17/F, The Metropolis Tower, 10 Metropolis Drive,

Hung Hom, Kowloon, Hong Kong, upon matters set forth in the Notice of Annual Meeting of Stockholders and Proxy Statement, a copy

of which has been received by the undersigned. Each share of Common Stock is entitled to one vote. The proxies are further authorized

to vote, in their discretion, upon such other business as may properly come before the meeting.

This

proxy, when properly executed, will be voted as directed. If no direction is made, the proxy shall be voted FOR the election

of the listed nominees as directors and FOR the ratification of Weinberg & Company P.A. (“Weinberg”) as

our independent registered public accounting firm for the fiscal year ending December 31, 2020 and, in the case of other matters

that legally come before the meeting, as said proxy(s) may deem advisable.

Please

check here if you plan to attend the Annual Meeting of Stockholders on June 5, 2020 at 10:00 a.m. (Local Time). [ ]

(Continued

and to be signed on Reverse Side)

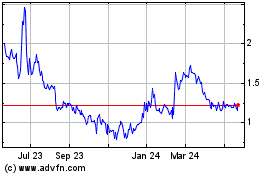

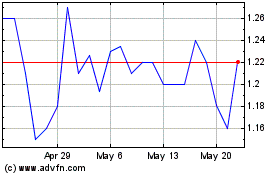

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Feb 2024 to Feb 2025