Current Report Filing (8-k)

July 24 2020 - 3:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported):

July

24, 2020

Commission

File Number 001-38308

Greenpro

Capital Corp.

(Exact

name of registrant issuer as specified in its charter)

|

Nevada

|

|

98-1146821

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification No.)

|

Room

1701-1703, 17/F.,

The

Metropolis Tower,

10

Metropolis Drive, Hung Hom,

Hong

Kong

(Address

of principal executive offices, including zip code)

Registrant’s

phone number, including area code (852) 3111 -7718

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange on Which Registered

|

|

Common

Stock, $0.0001 par value

|

|

GRNQ

|

|

NASDAQ

Capital Market

|

Item

1.02. Termination of a Material Definitive Agreement.

As

previously disclosed on a Current Report on Form 8-K filed on June 19, 2020 by Greenpro Capital Corp. (the “Company”),

the Company entered into a loan agreement (the “Loan Agreement”) dated June 15, 2020 with an institutional investor

(the “Lender”) pursuant to which the Company will issue in a private placement a five (5) year convertible promissory

note (the “Note”) in the principal amount of $5 million. Pursuant to the Loan Agreement, the Company will pay a coupon

equal to 3% annually. At the maturity date, the Lender may (i) demand repayment of the unpaid principal and interest under the

loan, or (ii) subject to the Company’s consent, elect to convert the unpaid principal and interest under the loan into restricted

shares of the Company’s common stock. The conversion price will be based on the average of the closing price of the common

stock of the Company as agreed upon between the Lender and the Company on the date of conversion. The Company intends to use the

proceeds of the loan for commercial expansion and business development.

On

July 24, 2020, the Company and the Lender mutually agreed to terminate the Loan Agreement. No penalties or fees were incurred

by either party in connection with the termination.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

GREENPRO

CAPITAL CORP.

|

|

|

|

|

|

Date:

July 24, 2020

|

By:

|

/s/

Lee Chong Kuang

|

|

|

Title:

|

President

and Chief Executive Officer

|

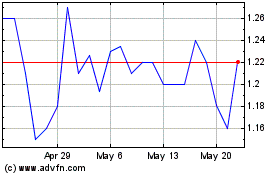

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

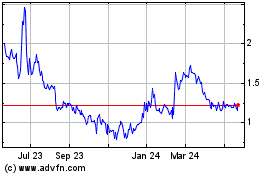

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Feb 2024 to Feb 2025