UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-40301

Infobird

Co., Ltd

(Registrant’s Name)

Room 706, 7/F, Low Block, Grand Millennium Plaza,

181 Queen’s Road Central, Central, Hong Kong

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Entry into a Material Agreement

As disclosed in the current report on Form 6-K filed

on December 6, 2024, Infobird Co., Ltd (the “Company”) entered into an equity acquisition agreement (the “Equity Acquisition

Agreement”) with One One Business Limited.

On December 20, 2024, the transaction contemplated in the Equity Acquisition

Agreement closed. The Company paid $19.8 million in cash and issued a senior convertible note in the principal amount of US$5,953,095

(the “Convertible Note”). The Convertible Note includes an original issue discount of fifteen percent (15%) of the aggregate

principal amount. After closing, the Company has become the legal and beneficial owner of 97% of the issued and outstanding equity of

Pure Tech Global Limited. The Convertible Note bears an interest at a rate of 5% per annum. The Convertible Note will mature and be due

and payable in full on the date that is twenty-four (24) months following the date of the Convertible Note. At the option of the holder,

the Convertible Note shall be convertible into ordinary shares (“Conversion Shares”) of the Company. If the Company exercises

its right to prepay the Convertible Note, the Company shall make payment to the holder of an amount in cash equal to 115% (the “Prepayment

Premium”) multiplied by the then outstanding balance of the Convertible Note being prepaid. Subject to the approval set forth in

the Convertible Note, the holder has the right to convert all or any portion of the outstanding balance into the ordinary shares of the

Company, and the conversion price (the “Conversion Price”) should be calculated with a discount of forty percent (40%) of

the lowest closing price of the last thirty (30) trading days immediately prior to the date of the conversion notice, provided that the

Conversion Price shall not be lower than US$0.4.

The issuances of the Convertible Note was made pursuant

to the exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended. The foregoing descriptions

of the Convertible Note are summaries of the material terms of such agreements, do not purport to be complete and are qualified in their

entirety by reference to the Convertible Note, which are attached hereto as Exhibit 10.1.

Financial Statements and Exhibits.

Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

INFOBIRD CO., LTD |

| |

|

|

| Date: December 20, 2024 |

By: |

/s/ Yiting

Song |

| |

Name: |

Yiting Song |

| |

Title: |

Chief Financial Officer |

3

EXHIBIT 10.1

Convertible

Promissory Note

THIS CONVERTIBLE

PROMISSORY NOTE HAS BEEN ACQUIRED FOR INVESTMENT AND HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (THE “ACT”),

AS AMENDED, OR UNDER ANY OTHER APPLICABLE SECURITIES LAWS, OR QUALIFIED UNDER ANY STATE SECURITIES LAWS. THIS CONVERTIBLE PROMISSORY NOTE

MAY NOT BE SOLD OR TRANSFERRED IN THE ABSENCE OF SUCH REGISTRATION OR QUALIFICATION OR AN EXEMPTION THEREFROM UNDER THE ACT, UNDER ANY

OTHER APPLICABLE SECURITIES LAWS AND ANY APPLICABLE STATE SECURITIES LAWS.

FOR VALUE RECEIVED, Lender

promises to pay US$5,953,095 to Borrower (Lender and Borrower identified on the listed signature page) totally in serial transactions,

and Borrower agrees to undertake any interest, fees, charges, and late fees accrued hereunder. This Convertible Promissory Note (“Note”)

is issued and made effective as of the date (the “Effective Date”) pursuant to that certain Equity Acquisition Agreement

dated December 6, 2024, as the same may be amended from time to time, by and between Lender and Borrower . Certain capitalized terms used

herein are defined in Attachment 1 attached hereto and incorporated herein by this reference.

The Note carries an OID of fifteen

percent (15%) of the aggregate principal amount.

1. Interest Rate. Interest shall accrue at

a rate of 5% simple return per annum on the Outstanding Amount under this Note for the period commencing on and from the Issuance

Date until the Outstanding Amount (including any Default Interest) is fully repaid or redeemed under Section 7 (the “Final

Repayment Date”). Interest shall be due and payable on each anniversary of the Issuance Date and on the Final Repayment Date, and

shall be calculated based on a 365-day year for the actual number of days elapsed.

2. Payments. All payments of each transaction

under this Note shall be paid in lawful money of the United States of America to the Holder, made by wire transfer of immediately available

funds to the bank account designated by the Holder in a written notice delivered to the Company.

3. Maturity

Date. The Outstanding Amount under this Note shall, subject to the provisions for redemption

and conversion hereof, as applicable, mature and be due and payable in full on the date that is twenty-four (24) months following

the date of this Note, or such later date as the Holder and the Company may mutually in writing agree (the “Maturity Date”).

The Principal Amount may not be prepaid, in whole or in part, prior to the Maturity Date without the written consent of the Holder.

4. Ranking.

Unless fully converted, this Note constitutes direct, unconditional and unsubordinated obligations of the Company. This Note ranks (i) senior

in right of payment to any of the Company’s future indebtedness that is expressly subordinated in right of payment to this Note,

(ii) pari passu with the claims of all of the Company’s other unsecured and unsubordinated creditors, except for

obligations mandatorily preferred by law applying to individuals or companies generally.

5. Conversion.

Rights of

Conversion

(i) At the option

of the Holder of each transaction, this Note shall be convertible into Ordinary Shares (“Conversion Shares”) of the Company

on the terms and conditions set forth in this Section 5 (the “Right of Conversion”).

(ii) Subject

to the terms and conditions set forth in this Section 5, at any time between the Issuance Date and 11:59 p.m. US time on the Business

Day immediately preceding the Maturity Date (or if Section 5(a)(iii) applies, the Final Repayment Date) (the “Conversion

Period”), the Holder shall be entitled to convert all or any portion of the then Outstanding Amount into Ordinary Shares of

the Company based on the Conversion Price described in Section 5(b) below, provided that the Ordinary Shares shall bear a restrictive

legend as set forth in Section 2.2 of the Agreement and that the Holder may not transfer such Conversion Shares except pursuant to an

effective registration Statement covering the resale of such shares, or pursuant to an exemption from registration requirement under the

Securities Act. The Holder may exercise the Right of Conversion once or more during the Conversion Period.

(iii) Notwithstanding sub-clause (ii) above,

if this Note is not fully repaid in accordance with Sections 1 and 3 or redeemed on the Maturity Date, the Right of Conversion will revive

and will continue to be exercisable up to, and including, the Final Repayment Date.

(iv) Notwithstanding the foregoing, so long as Borrower

has not received a Conversion Notice as set forth in Exhibit D from Lender where the applicable Conversion Shares have not yet been delivered

and so long as no Event of Default (as defined below) has occurred and is continuing, then Borrower shall have the right, exercisable

on not less than ten (10) Trading Days prior written notice to Lender to prepay the Outstanding Balance of this Note, in part or in full.

Any notice of prepayment hereunder (an “Optional Prepayment Notice”) shall be delivered to Lender at its registered

address and shall state: (A) that Borrower is exercising its right to prepay this Note, and (B) the date of prepayment, which shall be

not less than ten (10) Trading Days from the date of the Optional Prepayment Notice. On the date fixed for prepayment (the “Optional

Prepayment Date”), Borrower shall make payment of the Optional Prepayment Amount (as defined below) to or upon the order of

Lender as may be specified by Lender in writing to Borrower.

(v) If Borrower exercises its right to prepay this

Note, Borrower shall make payment to Lender of an amount in cash equal to 115% (the “Prepayment Premium”) multiplied

by the then Outstanding Balance of this Note being prepaid (the “Optional Prepayment Amount”). In the event Borrower

delivers the Optional Prepayment Amount to Lender prior to the Optional Prepayment Date or without delivering an Optional Prepayment Notice

to Lender as set forth herein without Lender’s prior written consent, the Optional Prepayment Amount shall not be deemed to have

been paid to Lender until the Optional Prepayment Date. In the event Borrower delivers an Optional Prepayment Notice, Lender shall be

entitled to exercise its conversion rights set forth herein during such ten (10) Trading Day period. In the event Borrower delivers the

Optional Prepayment Amount without an Optional Prepayment Notice, then the Optional Prepayment Date will be deemed to be the date that

is ten (10) Trading Days from the date that the Optional Prepayment Amount was delivered to Lender and Lender shall be entitled to exercise

its conversion rights set forth herein during such ten (10) Trading Day period. In addition, if Borrower delivers an Optional Prepayment

Notice and fails to pay the Optional Prepayment Amount due to Lender within two (2) Trading Days following the Optional Prepayment Date,

Borrower shall forever forfeit its right to prepay this Note.

6. Lender Optional Conversion.

(i) Conversion Shares. Lender has the right

at any time after effective date until the Outstanding Balance has been paid in full, at its election, to convert (“Conversion”)

all or any portion of the Outstanding Balance of each transaction into fully paid and non-assessable Ordinary Shares, par value $0.00001

(the “Ordinary Shares”), of Borrower (“Conversion Shares”) as per the following conversion formula:

the number of Conversion Shares equals the amount being converted (the “Conversion Amount”) divided by the Conversion

Price;

(ii) Conversion Price. Subject to the approval

set forth in this Note, Lender has the right to convert all or any portion of the Outstanding Balance into ordinary shares of each transaction,

and the Conversion price should be calculated with a discount of forty percent (40%) of the lowest closing price of the last thirty (30)

trading days immediately prior to the date of the Conversion Notice.

(iii) Conversion Price Floor. At any time,

both Lender and Borrower hereto each agree and acknowledge that the floor price of the conversion shall not be lower than US $0.4.

(iv) Title of Conversion Shares. After conversion,

the title of the shares shall be held by the Lender or any Person appointed by the Lender.

7. Trigger Events and Remedies.

(i) Trigger Events. The following are

trigger events under this Note (each, a “Trigger Event”): (a) Borrower fails to pay any principal, interest, fees,

charges, or any other amount when due and payable hereunder; (b) Borrower fails to deliver any Conversion Shares in accordance with the

terms hereof; (c) a receiver, trustee or other similar official shall be appointed over Borrower or a material part of its assets and

such appointment shall remain uncontested for twenty (20) days or shall not be dismissed or discharged within sixty (60) days; (d) Borrower

becomes insolvent or generally fails to pay, or admits in writing its inability to pay, its debts as they become due, subject to applicable

grace periods, if any; (e) Borrower makes a general

assignment for the benefit of creditors; (f) Borrower files a petition for relief

under any bankruptcy, insolvency or similar law (domestic or foreign); (g) an involuntary bankruptcy proceeding is commenced or filed

against Borrower, which is not cured within sixty (60) calendar days; (h) any representation, warranty or other statement made or furnished

by or on behalf of Borrower or any pledgor, trustor, or guarantor of this Note to Lender herein, in any Transaction Document, or otherwise

in connection with the issuance of this Note is false, incorrect, incomplete or misleading in any material respect when made or furnished;

(i) the occurrence of a Fundamental Transaction without prior written consent of the holder of 50% or more of the Outstanding Amount,

which shall not be unreasonably withheld; (j) Borrower effectuates a reverse split of its Ordinary Shares without twenty (20) Trading

Days prior written notice to Lender other than a reverse split of its Ordinary Shares to maintain compliance with the minimum bid price

requirements of the Principal Market; (k) any money judgment, writ or similar process is entered or filed against Borrower or any subsidiary

of Borrower or any of its property or other assets for more than $1,000,000.00, and shall remain unvacated, unbonded or unstayed for a

period of twenty (20) calendar days unless otherwise consented to by Lender; (l) Borrower fails to maintain the Share Reserve (as defined

in the Securities Purchase Agreement); or (m) Borrower, any affiliate of Borrower, or any pledgor, trustor, or guarantor of this Note

breaches any covenant or other term or condition contained in any Other Agreements in any material respect. Notwithstanding the foregoing,

the occurrence of any event specified in Sections 7(i) above shall not be considered a Trigger Event if such event is cured within ten

(10) Trading Days of the occurrence thereof.

(ii) Trigger Event Remedies. At any

time following the occurrence of any Trigger Event, Lender may, at its option, increase the Outstanding Balance by applying the Default

Interest (as defined below) (subject to the limitation set forth below).

8. Defaults. At any time following the occurrence

of a Trigger Event, Lender may, at its option, send written notice to Borrower demanding that Borrower cure the Trigger Event within five

(5) Trading Days. If Borrower fails to cure the Trigger Event within the required five (5) Trading Day cure period, the Trigger Event

will automatically become an event of default hereunder (each, an “Event of Default”).

Default Remedies. At any time and from

time to time following the occurrence of any Event of Default, Lender may accelerate this Note by written notice to Borrower, with the

Outstanding Balance becoming immediately due and payable in cash applying the Default Interest. Notwithstanding the foregoing, upon the

occurrence of any Trigger Event described in clauses (c), (d), (e), (f) or (g) of Section 7, an Event of Default will be deemed to have

occurred and the Outstanding Balance as of the date of such Trigger Event shall become immediately and automatically due and payable in

cash applying the Default Interest, subject to any applicable cure period as set forth under this Section 7, without any written notice

required by Lender for the Trigger Event to become an Event of Default. At any time following the occurrence of any Event of Default,

upon written notice given by Lender to Borrower, interest shall accrue on the Outstanding Balance beginning on the date the applicable

Event of

Default occurred at an interest rate equal to the lesser of twenty-two percent (22%) per annum or the maximum rate permitted

under applicable law (“Default Interest”). For the avoidance of doubt, Lender may continue making Conversions at any

time following a Trigger Event or an Event of Default until such time as the Outstanding Balance is paid in full. In connection with acceleration

described herein, Lender need not provide, and Borrower hereby waives, any presentment, demand, protest or other notice of any kind, and

Lender may immediately but subject to any applicable cure period as set forth under this Section 7, enforce any and all of its rights

and remedies hereunder and all other remedies available to it under applicable law. Such acceleration may be rescinded and annulled by

Lender at any time prior to payment hereunder and Lender shall have all rights as a holder of the Note until such time, if any, as Lender

receives full payment. No such rescission or annulment shall affect any subsequent Event of Default or impair any right consequent thereon.

Nothing herein shall limit Lender’s right to pursue any other remedies available to it at law or in equity including, without limitation,

a decree of specific performance and/or injunctive relief with respect to Borrower’s failure to timely deliver Conversion Shares

upon Conversion of the Note as required pursuant to the terms hereof.

9. Unconditional Obligation; No Offset. Borrower

acknowledges that this Note is an unconditional, valid, binding and enforceable obligation of Borrower not subject to offset, deduction

or counterclaim of any kind. Borrower hereby waives any rights of offset it now has or may have hereafter against Lender, its successors

and assigns, and agrees to make the payments or Conversions called for herein in accordance with the terms of this Note.

10. Waiver. No waiver of any provision of this

Note shall be effective unless it is in the form of a writing signed by the party granting the waiver. No waiver of any provision or consent

to any prohibited action shall constitute a waiver of any other provision or consent to any other prohibited action, whether or not similar.

No waiver or consent shall constitute a continuing waiver or consent or commit a party to provide a waiver or consent in the future except

to the extent specifically set forth in writing.

11. Conversion Delays. If Borrower fails to

deliver Conversion Shares in accordance with the timeframe stated in this Note, Lender may at any time prior to receiving the applicable

Conversion Shares rescind in whole or in part such Conversion, with a corresponding increase to the Outstanding Balance (any returned

amount will tack back to the Purchase Price Date for purposes of determining the holding period under Rule 144). In addition, for each

Conversion, in the event that Conversion Shares are not delivered by the Delivery Date, a late fee equal to 2% of the applicable Conversion

Share Value rounded to the nearest multiple of $100.00 but with a floor of $500.00 per day (but in any event the cumulative amount of

such late fees for each Conversion shall not exceed 200% of the applicable Conversion Share Value) will be assessed for each day after

the Delivery Date until Conversion Share delivery is made; and such late fee will be added to the Outstanding Balance (such fees, the

“Conversion Delay Late Fees”).

12. Governing Law;Venue. This Note shall be

construed and enforced in accordance with, and all questions concerning the construction, validity, interpretation and performance of

this Note shall be governed by, the internal laws of Cayman Islands.

13. Arbitration of Disputes. In case of any

disputes, friendly negotiations should be made by both parties. If the disputes is unsolved, each Party could apply for arbitration in

Hong Kong International Arbitration Center (HKIAC) in accordance with and subject to the Rules of HKIAC for the final judgement. The award

should be binding and respected by both Parties.

14. Cancellation. After repayment or conversion

of the entire Outstanding Balance, this Note shall be deemed paid in full, shall automatically be deemed canceled, and shall not be reissued.

15. Amendments. The prior written consent of

both parties hereto shall be required for any change or amendment to this Note.

16. Assignments. Borrower may not assign this

Note without the prior written consent of Lender. Any Ordinary Shares issued upon conversion of this Note may be offered, sold, assigned

or transferred by Lender without the consent of Borrower. This Note may be offered, sold, assigned or transferred by Lender without the

consent of Borrower.

17. Notices. Whenever notice is required to

be given under this Note, unless otherwise provided herein, such notice shall be given in accordance with the subsection of the Securities

Purchase Agreement titled “Notices.”

18. Liquidated Damages. Lender and Borrower

agree that in the event Borrower fails to comply with any of the terms or provisions of this Note, Lender’s damages would be uncertain

and difficult (if not impossible) to accurately estimate because of the parties’ inability to predict future interest rates, future

share prices, future trading volumes and other relevant factors. Accordingly, Lender and Borrower agree that any fees, balance adjustments,

Default Interest or other charges assessed under this Note are not penalties but instead are intended by the parties to be, and shall

be deemed, liquidated damages (under Lender’s and Borrower’s expectations that any such liquidated damages will tack back

to the Purchase Price Date for purposes of determining the holding period under Rule 144). Therefore, no additional penalty claims, lost

profits or liquidated damages shall be claimed in excess of agreed liquidated damage amounts under this Note.

19. Severability. If any part of this Note

is construed to be in violation of any law, such part shall be modified to achieve the objective of Borrower and Lender to the fullest

extent permitted by law and the balance of this Note shall remain in full force and effect.

IN WITNESS WHEREOF, the

undersigned Investor and Company have caused this Agreement to be duly executed as of the date first above written.

| |

INFOBIRD CO., LTD |

| |

|

| |

By: |

/s/

Yiting Song |

| |

Name: |

Yiting Song |

| |

Title: |

Chief Financial Officer |

IN WITNESS WHEREOF, the

undersigned Investor and Company have caused this Agreement to be duly executed as of the date first above written.

| |

One One Business Limited |

| |

|

| |

By: |

/s/ Iris Wan |

| |

Name: |

Iris Wan |

| |

Title: |

Director |

ATTACHMENT 1

DEFINITIONS and INTERPRETATIONS

For purposes of this Note, the

following terms shall have the following meanings:

“Note” shall

have the meaning ascribed to it in the Preamble.

“Price Floor” shall

have the meaning given to it under Clause 6 (iii) of this Agreement.

“Conversion Share Value”

means the product of the number of Conversion Shares deliverable pursuant to any Conversion Notice multiplied by the Closing Trade Price

of the Ordinary Shares on the Delivery Date for such Conversion.

“DTC” means

the Depository Trust Company or any successor thereto.

“Trigger Event”

means any Trigger Event occurring under Sections 7.

“Other Agreements”

means, collectively, (a) all existing and future agreements and instruments between, among or by Borrower (or an affiliate), on the one

hand, and Lender (or an affiliate), on the other hand, and (b) any financing agreement or a material agreement that affects Borrower’s

ongoing business operations.

“Outstanding Balance”

means as of any date of determination, the Purchase Price, as reduced or increased, as the case may be, pursuant to the terms hereof for

payment, Conversion, offset, or otherwise, plus the OID, plus the Transaction Expense Amount, accrued but unpaid interest, collection

and enforcements costs (including attorneys’ fees) incurred by Lender, transfer, stamp, issuance and similar taxes and fees related

to Conversions, and any other fees or charges (including without limitation Conversion Delay Late Fees) incurred under this Note.

“Purchase Price Date”

means the date the Purchase Price for this Note is delivered by Lender to Borrower.

“Headings” Headings

are included for convenience only and shall not affect the construction of any provision of this Agreement.

“Writing”

References to “writing” and “written” include any mode of reproducing words in a legible and non-transitory form

including emails and faxes.

”Fundamental Transaction”

means that (a) (i) Borrower or any of its subsidiaries shall, directly or indirectly, in one or more related transactions, consolidate

or merge with or into (whether or not Borrower or any of its subsidiaries is the surviving corporation) any other person or entity, or

(ii) Borrower or any of its subsidiaries shall, directly or indirectly, in one or more related transactions, sell, lease, license,

assign, transfer, convey or otherwise dispose of all or substantially all of its respective properties or assets to any other person or

entity, or (iii) Borrower or any of its subsidiaries shall, directly or indirectly, in one or more related transactions, allow any

other person or entity to make a purchase, tender or exchange offer that is accepted by the holders of more than 50% of the outstanding

shares of voting stock of Borrower (not including any shares of voting stock of Borrower held by the person or persons making or party

to, or associated or affiliated with the persons or entities making or party to, such purchase, tender or exchange offer), or (iv) Borrower

or any of its subsidiaries shall, directly or indirectly, in one or more related transactions, consummate a stock or share purchase agreement

or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with

any other person or entity whereby such other person or entity acquires more than 50% of the outstanding shares of voting stock of Borrower

(not including any shares of voting stock of Borrower held by the other persons or entities making or party to, or associated or affiliated

with the other persons or entities making or party to, such stock or share purchase agreement or other business combination), or (v) Borrower

or any of its subsidiaries shall, directly or indirectly, in one or more related transactions, reorganize, recapitalize or reclassify

the ADSs, other than an increase in the number of authorized shares of Borrower’s ADSs, or (b) any “person” or

“group” directly or indirectly, acquiring 50% of the aggregate ordinary voting power represented by issued and outstanding

voting stock of Borrower.

EXHIBIT D

Date:

INFOBIRD CO., LTD

Attn:

CONVERSION NOTICE

The above-captioned Lender hereby gives notice to

INFOBIRD CO., LTD, (the “Borrower”), pursuant to that certain Convertible Promissory Note made by Borrower in

favor of Lender (the “Note”), that Lender elects to convert the portion of the Note balance set forth below into fully

paid and non-assessable Ordinary Shares of Borrower as of the date of conversion specified below. Said conversion shall be based on the

Conversion Price set forth below. In the event of a conflict between this Conversion Notice and the Note, the Note shall govern, or, in

the alternative, at the election of Lender in its sole discretion, Lender may provide a new form of Conversion Notice to conform to the

Note. Capitalized terms used in this notice without definition shall have the meanings given to them in the Note.

| |

A. |

Date

of Conversion: ____________ |

| |

B. |

Conversion #: ____________ |

| |

C. |

Conversion Amount: __________ |

| |

D. |

Conversion Price: _______________ |

| |

E. |

Conversion Shares: _______________

(C divided by D) |

| |

F. |

Remaining Outstanding Balance

of Note: ____________* |

Please transfer the Conversion Shares electronically (via DWAC) to the following account:

To the extent the Conversion Shares

are not able to be delivered to Lender electronically via the DWAC system, deliver all such certificated shares to Lender via reputable

overnight courier after receipt of this Conversion Notice (by facsimile transmission or otherwise) to:

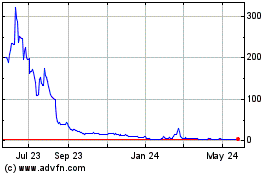

Infobird (NASDAQ:IFBD)

Historical Stock Chart

From Dec 2024 to Jan 2025

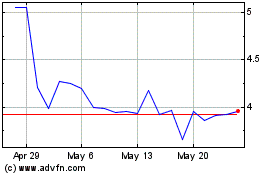

Infobird (NASDAQ:IFBD)

Historical Stock Chart

From Jan 2024 to Jan 2025